Tax filing can be a daunting task, especially when it comes to organizing your expenses. Learn how a tax template for expenses can simplify the process and save you time.

Are you dreading the upcoming tax season? Filing taxes can be overwhelming, especially when you have to sort through a pile of receipts and invoices to calculate your expenses. Fortunately, there is a solution that can make this process a lot easier: a tax template for expenses.

What is a tax template for expenses?

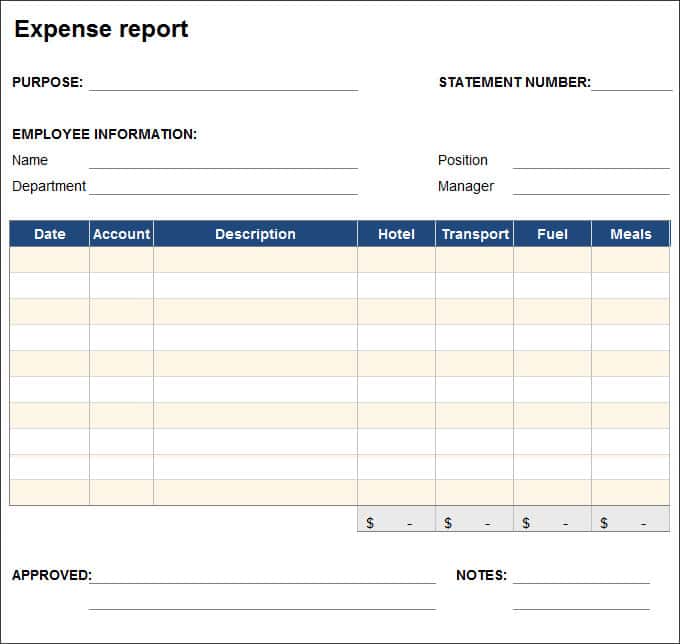

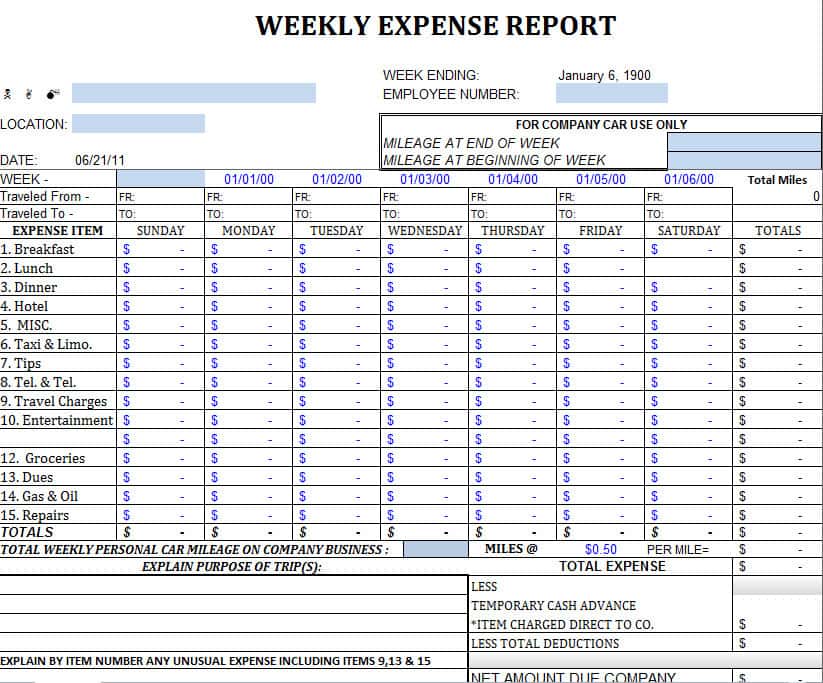

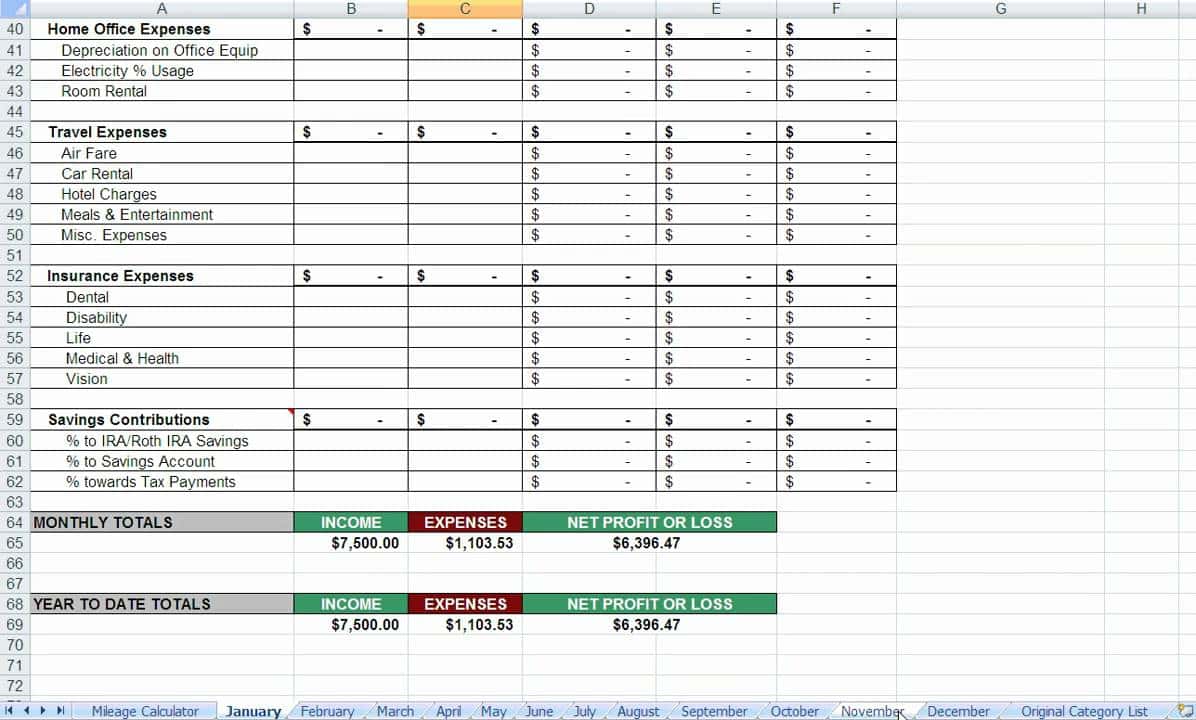

A tax template for expenses is a pre-formatted spreadsheet that you can use to organize your business expenses. It typically includes columns for date, description, category, amount, and tax information. By using a template, you can keep track of your expenses throughout the year and have all the information you need at tax time.

Benefits of using a tax template for expenses

Saves time

One of the biggest benefits of using a tax template for expenses is that it saves time. Instead of scrambling to organize your expenses at tax time, you can simply input your data into the template throughout the year. This can save you hours of work and stress when it’s time to file.

Reduces errors

Another advantage of using a tax template for expenses is that it reduces the risk of errors. When you manually calculate your expenses, it’s easy to make mistakes. However, when you use a template, the calculations are done automatically, reducing the chance of errors.

Ensures compliance

Using a tax template for expenses can also ensure compliance with tax laws. By tracking your expenses in a consistent and organized manner, you can easily provide documentation if the IRS requests it. This can help you avoid penalties and fines.

How to use a tax template for expenses

Using a tax template for expenses is easy. You can find templates online or create your own using a spreadsheet program like Excel or Google Sheets. Once you have a template, simply input your expenses as they occur. Be sure to include the date, description, category, amount, and any tax information that applies.

At tax time, you can use the information in your template to complete your tax return. You can also use the template to generate reports that show your expenses by category or month. This can provide valuable insights into your spending habits and help you identify areas where you can cut costs.

Where to find tax templates for expenses

There are many places where you can find tax templates for expenses online. A quick search on Google or a visit to a website like Pruneyardinn.com can lead you to a variety of templates that are available for free or for a small fee. You can also create your own template using a spreadsheet program like Excel or Google Sheets.

When choosing a template, it’s important to consider your specific needs. Some templates are designed for specific industries, while others are more general. Look for a template that includes all the fields you need and is easy to use.

Tips for using a tax template for expenses

To get the most out of your tax template for expenses, there are a few tips you should keep in mind:

- Be consistent

Make sure to use the same categories and formatting for each expense. This will make it easier to sort and analyze your data. - Keep receipts and invoices

Even if you’re using a template, it’s important to keep your receipts and invoices in case you need to provide documentation to the IRS. - Update regularly

To ensure your template is accurate, make sure to update it regularly. Don’t let your expenses pile up and try to input them all at once. - Back up your data

It’s a good idea to save a backup copy of your template in case your computer crashes or you lose your data for any reason.

Final thoughts

Filing taxes can be a time-consuming and stressful task, but it doesn’t have to be. By using a tax template for expenses, you can simplify the process and save yourself time and stress. Whether you’re a business owner or a freelancer, a tax template can help you stay organized, reduce errors, and ensure compliance with tax laws. So why not give it a try and see how much easier tax season can be?