Welcome to the gateway of financial empowerment! In this article, we will embark on a journey to demystify the realm of budgeting and financial management, with our focus firmly set on the indispensable tool – the Financial Expenses Worksheet. As we navigate through the ins and outs of this worksheet, you’ll discover how it can be your compass to financial stability.

Understanding the Financial Expenses Worksheet

The Financial Expenses Worksheet is more than just a spreadsheet; it’s your personal financial GPS. This dynamic tool empowers you to track, categorize, and analyze your expenditures, offering valuable insights into your spending habits.

Organizing Your Finances

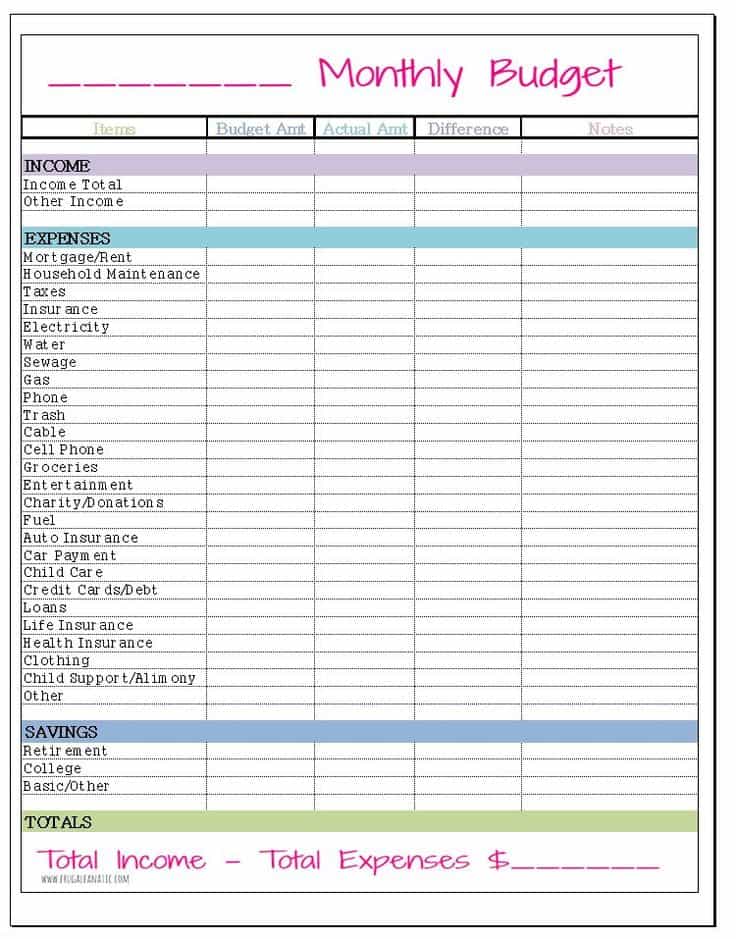

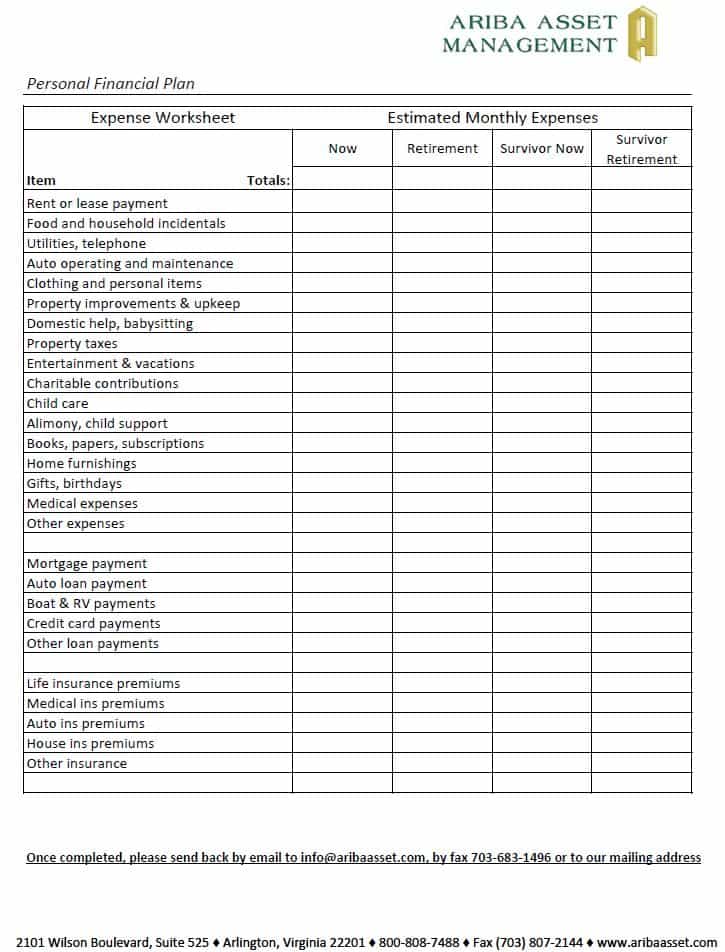

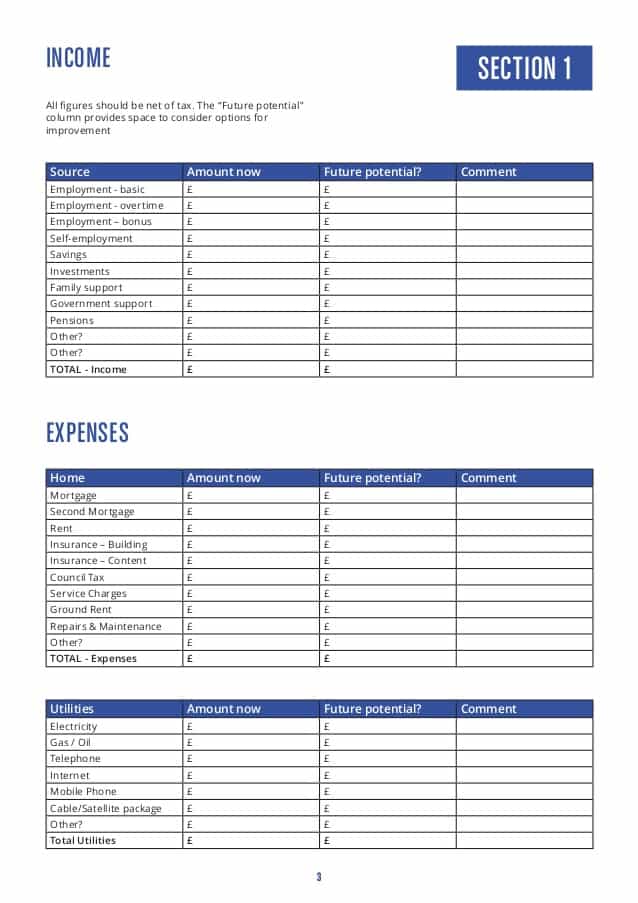

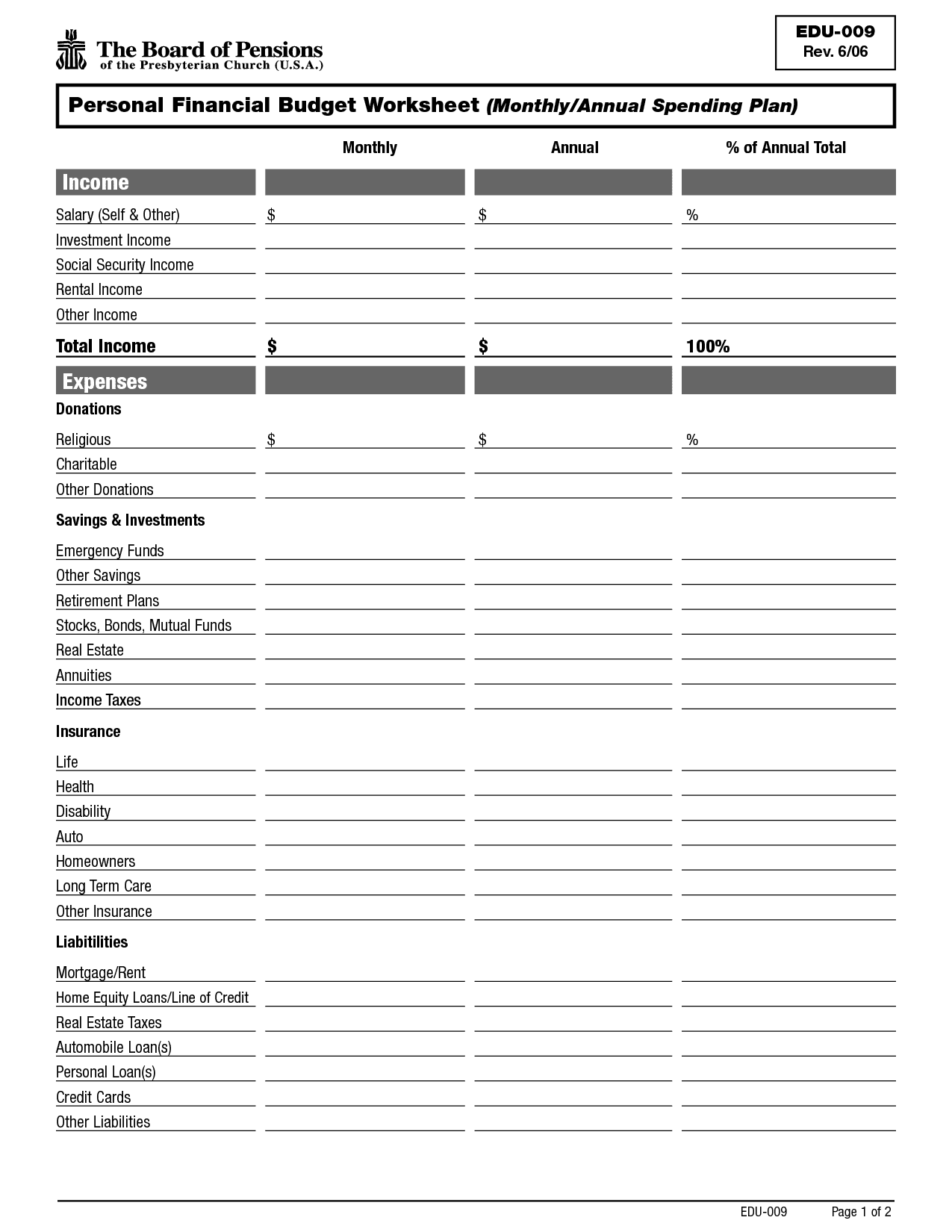

With the Financial Expenses Worksheet, chaos turns into order. Create categories for your expenses, such as housing, utilities, groceries, entertainment, and more. Assigning each expense to a specific category provides a clear snapshot of where your money is going, allowing you to identify areas where adjustments may be needed.

Tracking Daily Expenses

Ever wondered where those extra dollars disappear to? The Financial Expenses Worksheet helps you keep a vigilant eye on your daily spending. Record even the smallest expenses – that daily coffee or the occasional snack. Small leaks can sink ships, and understanding your daily habits is the first step toward plugging those financial leaks.

Setting Realistic Budgets

Budgeting becomes a breeze with the Financial Expenses Worksheet. Analyze your income versus expenses, set realistic spending limits, and allocate funds for savings and investments. This proactive approach ensures that your financial ship sails smoothly, avoiding stormy seas of debt and overspending.

Visualizing Financial Goals

One of the standout features of the Financial Expenses Worksheet is its ability to transform numbers into visual representations. Graphs and charts showcase your spending patterns, making it easy to identify trends and set achievable financial goals. Witnessing your progress visually can be a powerful motivator on your journey to financial success.

Emergency Fund Planning

Life is unpredictable, and financial emergencies can strike when least expected. The Financial Expenses Worksheet aids in planning and building your emergency fund. Allocate a percentage of your income to this fund, providing a financial safety net for unexpected expenses.

Tips for Optimizing Your Financial Expenses Worksheet Experience:

- Consistent Updates

Regularly update your Financial Expenses Worksheet to ensure accurate and up-to-date financial insights. - Review and Reflect

Take time each month to review your spending patterns, celebrating successes and identifying areas for improvement. - Adaptability

Customize your worksheet to suit your unique financial goals and lifestyle. - Educational Resources

Explore online resources and financial literature to enhance your understanding of budgeting and financial planning.

Embracing Financial Freedom: Beyond the Numbers

As you embark on this journey armed with your Financial Expenses Worksheet, remember that it’s not just about crunching numbers; it’s about cultivating a mindset of financial consciousness. Let’s explore some additional strategies to enhance your financial prowess.

- Mindful Spending Habits

The Financial Expenses Worksheet is a mirror reflecting your spending habits. Use it to foster mindfulness about your purchases. Ask yourself, “Is this expense aligned with my financial goals?” This awareness can be a game-changer in curbing impulsive spending and redirecting funds towards your priorities. - Debt Repayment Strategy

Tackling debt is a critical aspect of financial well-being. Your worksheet serves as a strategic ally in this battle. Identify high-interest debts, create a repayment plan, and allocate extra funds accordingly. Witnessing the reduction of debt on your worksheet can be a source of motivation and encouragement. - Income Diversification

The Financial Expenses Worksheet is not only about tracking expenses; it’s about optimizing your income streams. Explore opportunities for income diversification, whether through side hustles, investments, or passive income. Use the worksheet to monitor the impact of these endeavors on your overall financial health. - Savings Goals and Investments

Elevate your financial game by incorporating savings goals and investments into your worksheet. Define short-term and long-term objectives, whether it’s a dream vacation, a down payment on a house, or retirement. Allocate funds systematically, and watch your financial dreams materialize. - Periodic Financial Check-ins

Regularly schedule financial check-ins with your worksheet. Assess your progress, update goals, and adapt your strategy as needed. Life is dynamic, and so should be your financial plan. Embrace change, learn from experiences, and let your worksheet evolve with you. - Celebrate Financial Milestones

Achieving financial milestones is a cause for celebration. Whether it’s paying off a credit card, reaching a savings goal, or successfully sticking to your budget, acknowledge your achievements. Positive reinforcement fuels motivation, making the journey to financial freedom enjoyable. - Educational Empowerment

The Financial Expenses Worksheet is not just a tool; it’s a teacher. Embrace the opportunity to educate yourself continuously about personal finance. Stay informed about market trends, investment strategies, and financial planning. Knowledge is your greatest asset on the road to financial success.

Conclusion

Congratulations on taking the first step towards financial empowerment by delving into the world of the Financial Expenses Worksheet. As you navigate through this tool, remember that financial freedom is a journey, not a destination. Use the insights gained from your worksheet to make informed decisions, shape your financial future, and sail towards a life of financial well-being. Your journey starts here – with the Financial Expenses Worksheet as your trusted companion.