Streamline your business travel expenses with a business travel expenses template that provides a comprehensive and organized system to keep track of expenses and optimize your travel budget.

As a business traveler, keeping track of expenses can be a daunting task. With so many receipts and invoices to manage, it’s easy to overlook important details, which can result in overspending or inaccurate reimbursement. However, with the right tools and techniques, it’s possible to streamline the process and avoid the stress and confusion that often comes with managing travel expenses.

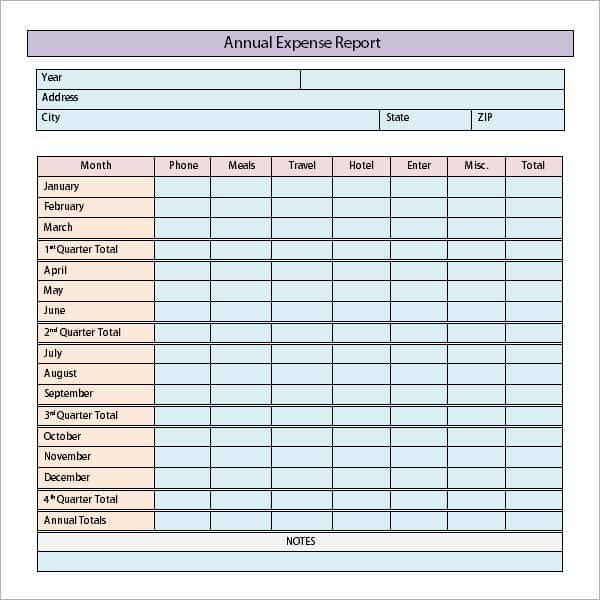

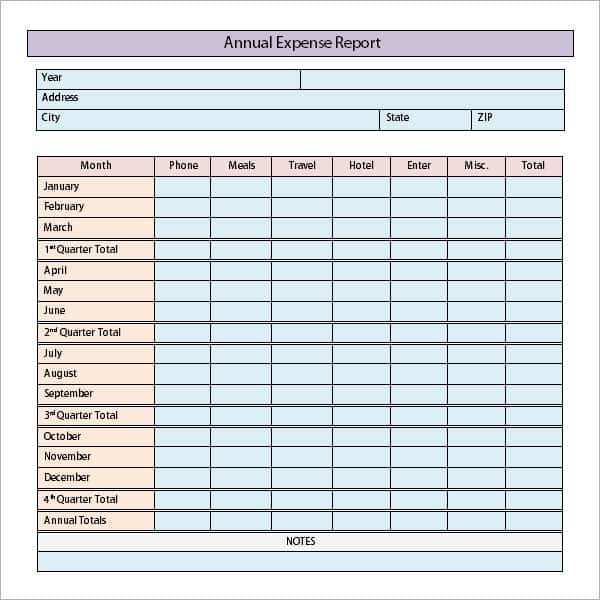

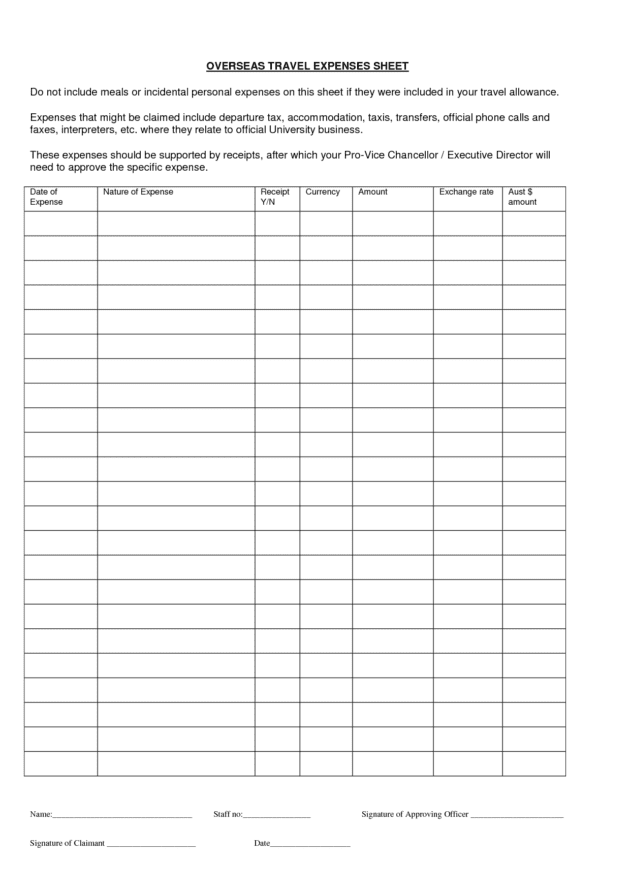

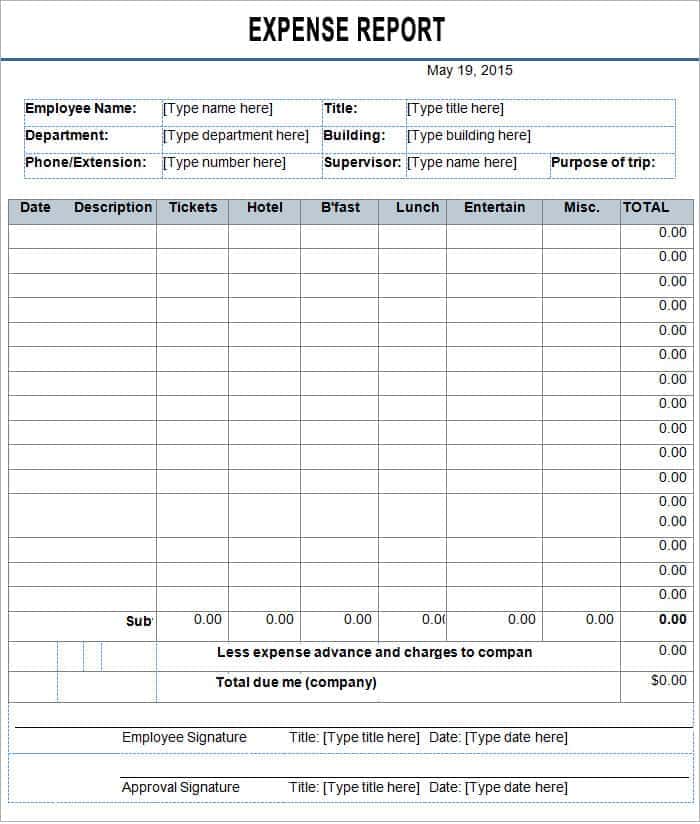

One of the most effective ways to simplify your business travel expenses is to use a comprehensive template that provides a clear and organized system for tracking expenses. A business travel expenses template is a pre-designed spreadsheet or document that allows you to enter your expenses in a structured format, making it easy to monitor your spending and ensure that everything is accounted for.

Here are some key benefits of using a business travel expenses template:

- Organization

A template allows you to categorize expenses and keep them organized in a logical manner, making it easier to identify which expenses belong to which category and avoid any potential mistakes. - Time-saving

With a template, you can quickly input your expenses without having to create a new document each time, saving you time and effort in the long run. - Accuracy

A well-designed template includes all the necessary fields to ensure that your expenses are accurately recorded, including date, description, amount, and payment method. - Budget optimization

By tracking your expenses with a template, you can identify areas where you’re overspending and adjust your budget accordingly to maximize your resources.

When choosing a business travel expenses template, look for one that meets your specific needs and includes all the necessary fields to accurately track your expenses. Some templates may also include features such as automatic currency conversion, built-in calculators, or options to upload receipts and invoices, which can further streamline the process.

In addition to using a template, here are some other tips for managing your business travel expenses effectively:

- Keep all receipts and invoices

Make sure to keep all receipts and invoices, no matter how small, to ensure that all expenses are accounted for. - Use a credit card

Using a credit card can make it easier to track your expenses and avoid overspending, as you can view your statements online and receive alerts when you’re approaching your limit. - Be proactive

Don’t wait until the end of your trip to start tracking expenses. Make it a habit to input your expenses on a daily basis to avoid any potential mistakes or oversights.

- Keep a log

In addition to a template, keeping a log of your expenses can help you stay organized and avoid any potential discrepancies when it comes time to submit your expenses for reimbursement. - Understand your company’s policy

Make sure you understand your company’s policy on travel expenses, including what is and isn’t allowed, and any limits or restrictions on spending. - Communicate with your manager

If you have any questions or concerns about your expenses or the reimbursement process, don’t hesitate to communicate with your manager or the appropriate department to ensure everything is handled properly.

Overall, using a business travel expenses template is an essential tool for simplifying the process of tracking expenses and optimizing your budget. By staying organized, proactive, and informed about your company’s policy, you can ensure that your business travel is not only successful, but also cost-effective and stress-free.

At Pruneyardinn.com, we understand the importance of effective travel management for businesses. That’s why we offer a range of amenities and services to ensure that our guests have everything they need for a productive and enjoyable trip. From complimentary high-speed Wi-Fi to a business center and meeting rooms, we’re committed to providing a seamless and stress-free experience for all of our guests. So why not book your stay with us today and experience the best in business travel?

In conclusion, managing business travel expenses can be a complex and time-consuming task, but with the right tools and techniques, it’s possible to streamline the process and avoid the stress and confusion that often comes with it. By using a comprehensive business travel expenses template and following these tips, you can stay organized, optimize your budget, and focus on the purpose of your trip.