A well-designed sample travel expense policy can help organizations streamline their travel expense process and save costs. Learn more about the benefits of implementing a travel expense policy for your organization.

As businesses expand and become more global, employees are required to travel frequently for work purposes. While work travel can be exciting and rewarding, it can also be expensive, and managing travel expenses can be a challenge for organizations. A well-designed sample travel expense policy can help organizations streamline their travel expense process and save costs.

What is a Travel Expense Policy?

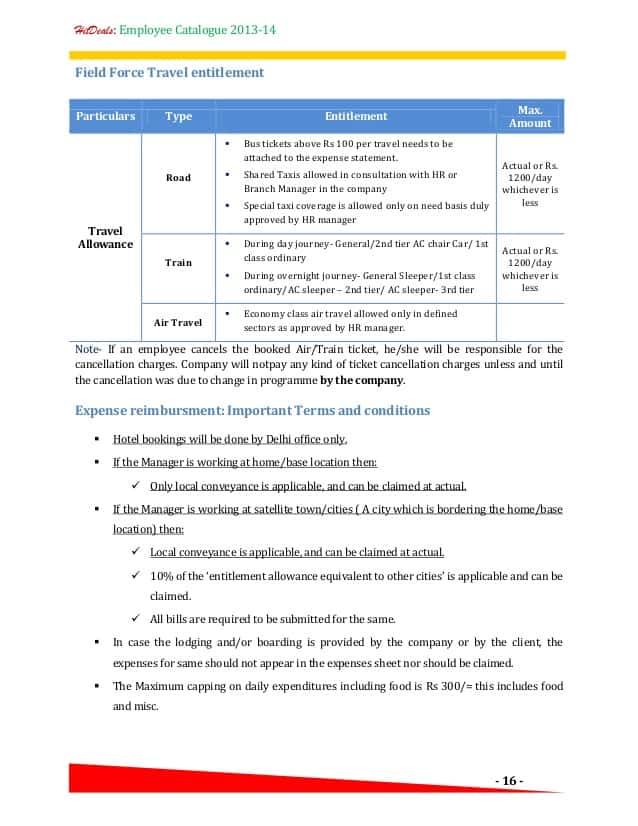

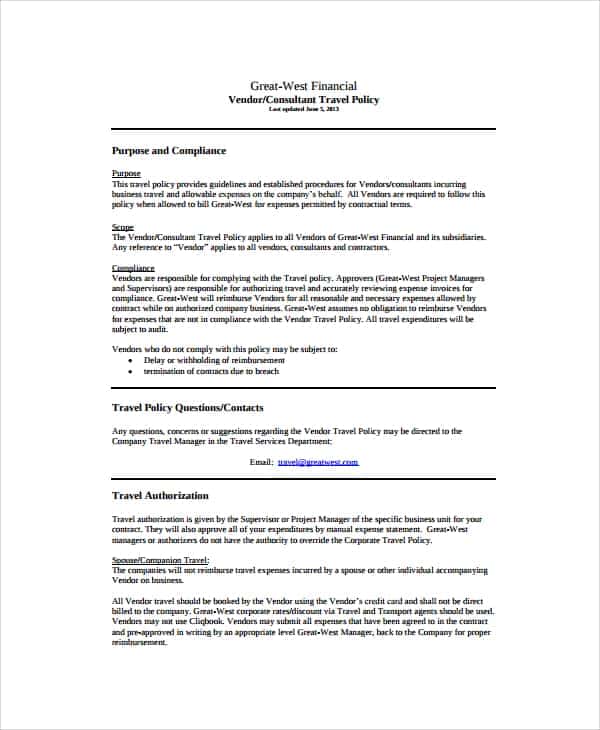

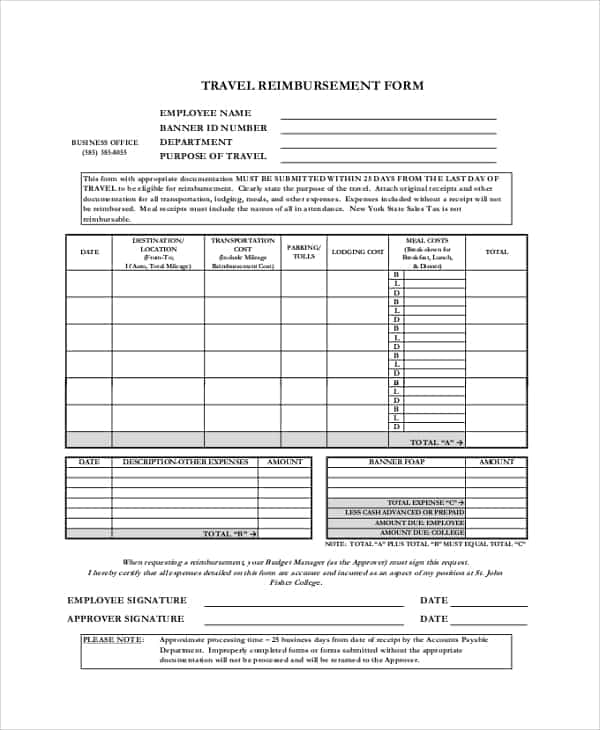

A travel expense policy is a set of guidelines that an organization creates to regulate the expenses incurred by employees during business travel. It defines the rules and procedures for travel expenses, such as transportation, accommodation, meals, and other incidental expenses. The policy outlines the limits on how much an employee can spend on various categories of expenses, which receipts need to be submitted, and what expenses will be reimbursed.

Benefits of Having a Travel Expense Policy

A well-designed travel expense policy can benefit organizations in several ways. Here are some of the key benefits of implementing a travel expense policy:

- Standardization of Expenses

With a travel expense policy in place, employees know exactly what expenses are allowed and what expenses are not. It ensures that employees are reimbursed only for the expenses that are deemed appropriate and necessary. - Cost Savings

A travel expense policy can help organizations save costs by controlling expenses. It enables organizations to set reasonable limits on expenses and avoid unnecessary spending. - Compliance with Regulations

A travel expense policy ensures that the organization is compliant with regulations related to travel expenses. It can help to avoid legal issues by ensuring that employees are reimbursed only for expenses that comply with regulations. - Improved Efficiency

A travel expense policy can help to streamline the travel expense process by reducing the time and effort required to manage expenses. It can also improve the speed of reimbursement, which can lead to better employee satisfaction.

How to Create a Travel Expense Policy?

Creating a travel expense policy can be a daunting task, but it is essential for organizations that have employees who travel frequently. Here are some key steps to create a travel expense policy:

- Define the Objectives

The first step is to define the objectives of the travel expense policy. This includes determining the types of expenses that will be covered, the limits on expenses, and the reimbursement process. - Consult with Employees

It is essential to involve employees in the development of the travel expense policy. This ensures that the policy is relevant, practical, and easy to follow. - Set Limits on Expenses

Set reasonable limits on expenses, such as daily allowances for meals, accommodation, and transportation. - Define the Reimbursement Process

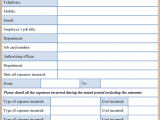

Define the process for submitting and approving travel expenses. This includes the documentation required, such as receipts and expense reports. - Communicate the Policy

Once the travel expense policy is created, communicate it to all employees. It is essential to ensure that everyone understands the policy and knows how to comply with it.

Conclusion

A well-designed travel expense policy is essential for organizations that have employees who travel frequently for work purposes. It can help to standardize expenses, save costs, comply with regulations, and improve efficiency. When creating a travel expense policy, it is important to involve employees, set reasonable limits on expenses, and define the reimbursement process. With a well-designed travel expense policy in place, organizations can ensure that employees are reimbursed for appropriate and necessary expenses, while avoiding unnecessary spending.

In addition to these steps, it is also important to periodically review and update the travel expense policy to ensure that it remains relevant and effective. This can help to adapt to changes in regulations, travel trends, and the needs of the organization.

It is worth noting that creating a travel expense policy can be time-consuming, but the benefits of having a well-designed policy can be significant. It can help to save costs, improve compliance, and streamline the travel expense process.

In conclusion, a sample travel expense policy is an essential tool for organizations that have employees who travel frequently for work purposes. It can help to standardize expenses, save costs, comply with regulations, and improve efficiency. By following the steps outlined above, organizations can create a travel expense policy that is relevant, practical, and easy to follow.