Example of an Expense Report: A Guide for Small Business Owners

Learn how to create an expense report with this example and guide. Understand the purpose of an expense report and how it can help your small business stay organized.

As a small business owner, keeping track of your expenses is crucial to the success of your company. One way to do this is by creating an expense report. An expense report is a document that outlines all of the expenses incurred by an individual or company during a specific period. In this article, we’ll provide you with an example of an expense report and a guide on how to create one for your small business.

Purpose of an Expense Report

An expense report is a tool that allows you to track your business expenses. This includes everything from office supplies to travel expenses. By keeping an accurate record of your expenses, you can:

- Monitor your spending: Tracking your expenses allows you to see where your money is going and identify areas where you can cut back.

- Ensure accuracy: An expense report provides a detailed record of all your expenses, which can help you avoid errors and discrepancies.

- Claim tax deductions: If you’re self-employed, an accurate expense report can help you claim tax deductions for business expenses.

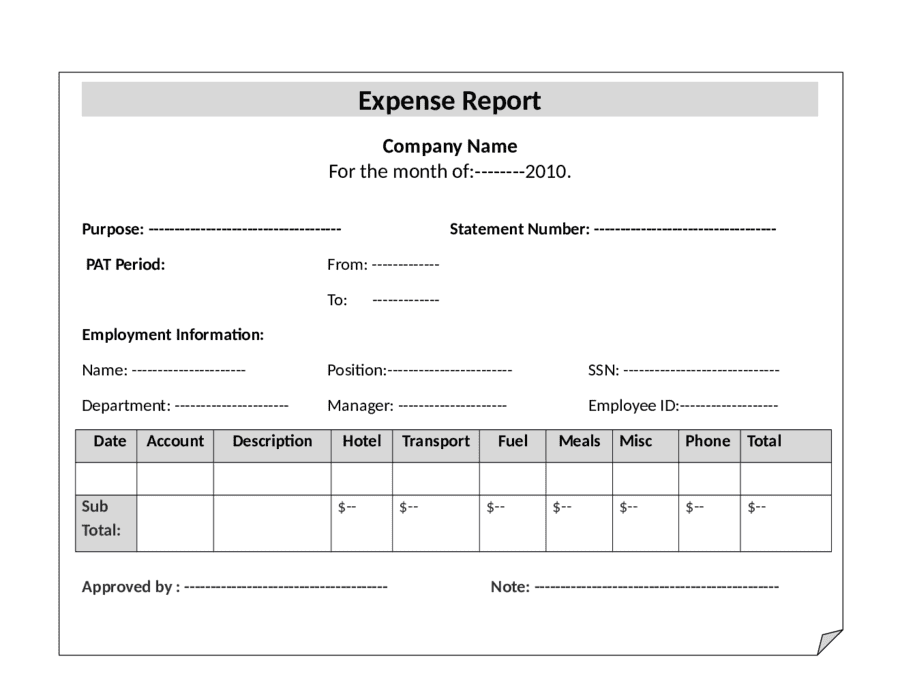

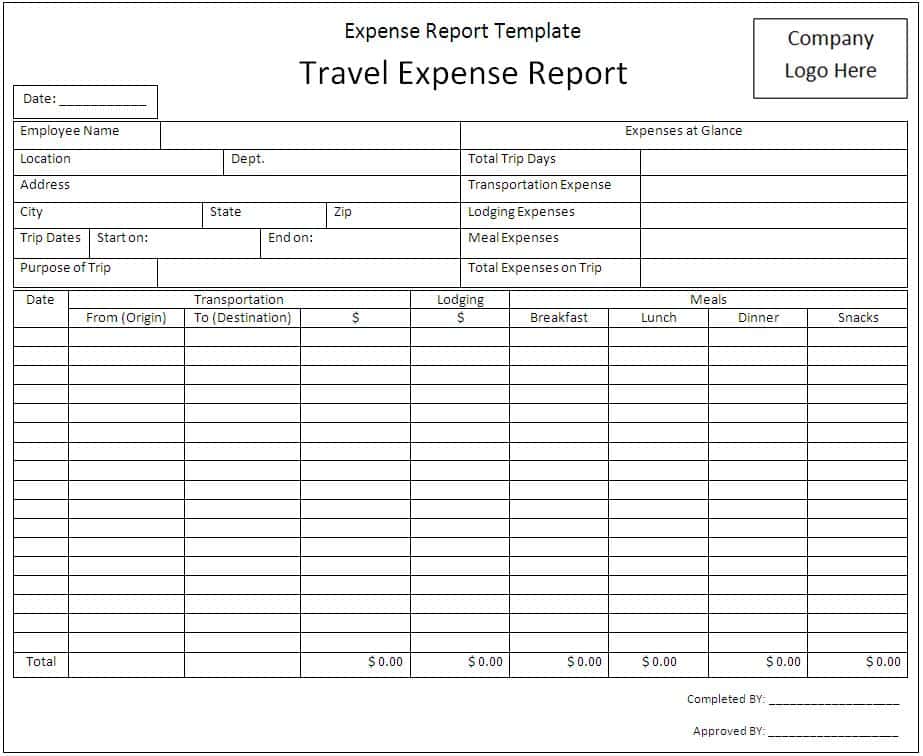

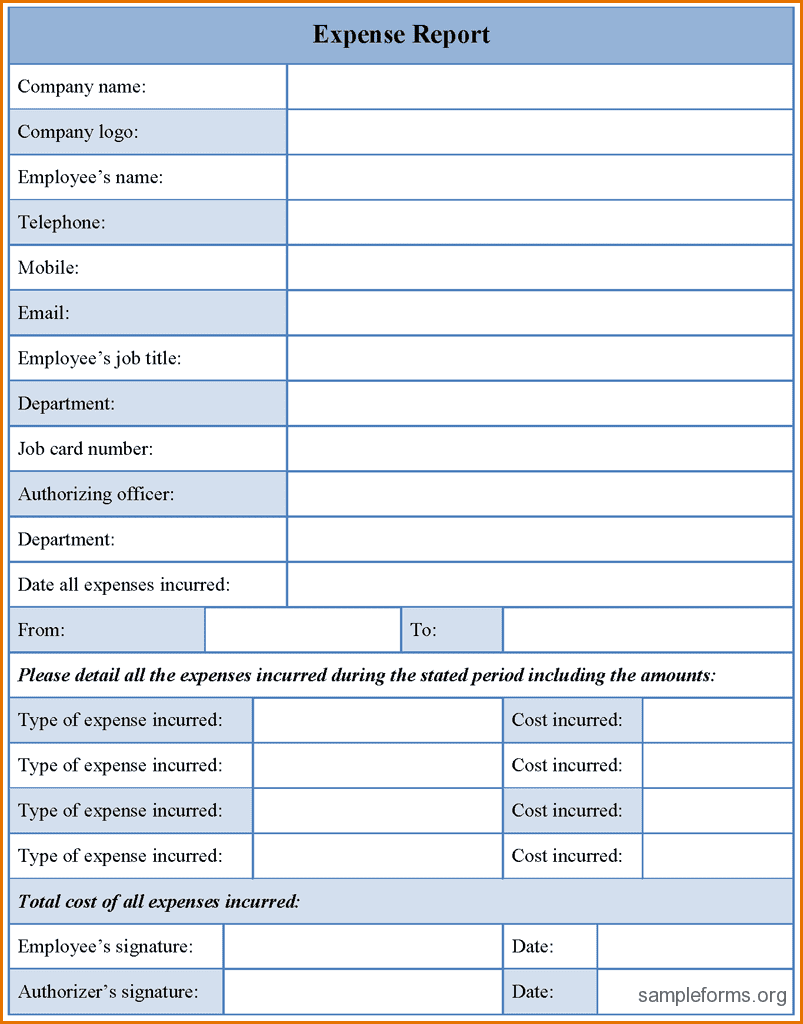

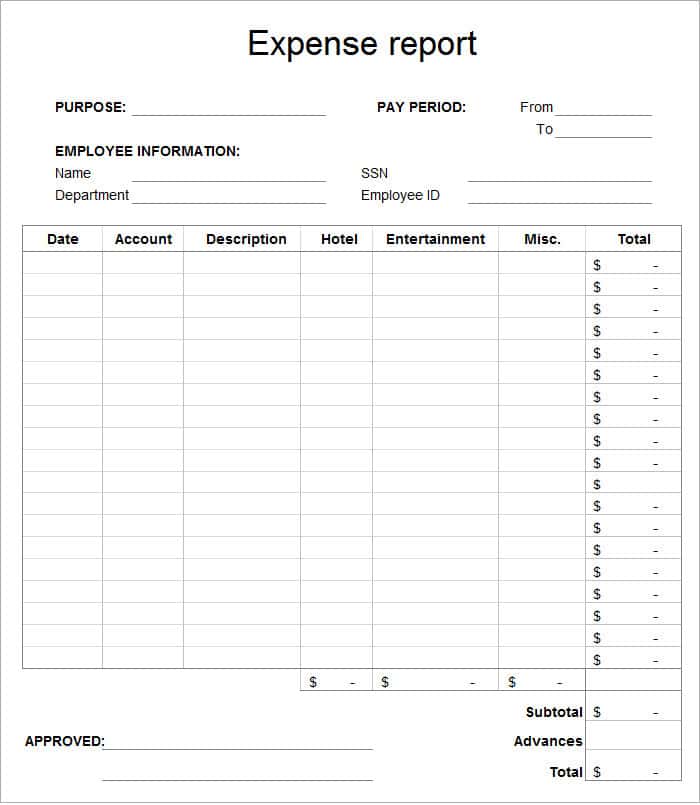

Example of an Expense Report

Here’s an example of an expense report that you can use as a guide when creating your own:

Expense Report for the Month of March 2023

| Date | Description | Amount |

|---|---|---|

| 03/01/23 | Office Supplies | $50.00 |

| 03/03/23 | Business Lunch with Client | $75.00 |

| 03/05/23 | Travel Expenses for Conference | $500.00 |

| 03/10/23 | Advertising Expenses | $150.00 |

| 03/12/23 | Internet and Phone Expenses | $100.00 |

| 03/15/23 | Hotel Expenses for Conference | $750.00 |

| 03/20/23 | Printing and Stationery | $25.00 |

| 03/25/23 | Gas and Mileage | $75.00 |

| 03/30/23 | Miscellaneous Expenses | $50.00 |

Total Expenses: $1,825.00

Creating Your Own Expense Report

Now that you have an example of an expense report, here’s how you can create your own:

- Choose a time period: Decide on the time period for your expense report, such as a week or a month.

- Gather your receipts: Collect all the receipts for your business expenses during the chosen time period.

- Categorize your expenses: Sort your expenses into categories, such as office supplies, travel expenses, and advertising expenses.

- Create a table: Use a table or spreadsheet to organize your expenses. Include the date, description of the expense, and the amount.

- Total your expenses: Add up all the expenses in each category to get the total amount spent.

- Review and submit: Review your expense report for accuracy and completeness. Submit it to your supervisor or accountant for approval.

Tips for Creating an Accurate Expense Report

Creating an accurate expense report is essential to ensure that you can claim all the tax deductions available to your business. Here are a few tips to help you create an accurate expense report:

- Keep track of all your receipts: Keep all the receipts for your business expenses, as these will serve as proof of the expenses claimed in your report.

- Categorize your expenses: Categorize your expenses into different categories, such as office supplies, travel expenses, and advertising expenses, to make it easier to track your spending.

- Use a spreadsheet or online tool: Use a spreadsheet or online tool to organize your expenses and make it easier to total up your spending.

- Be specific: Provide specific details for each expense, such as the date, location, and purpose of the expense.

- Be timely: Submit your expense report on time to ensure that your expenses are claimed in the appropriate tax year.

Conclusion

Creating an expense report is an essential part of running a small business. By tracking your expenses, you can identify areas where you can cut back and claim tax deductions for business expenses. Use the example of an expense report and the guide provided in this article to create your own expense report and stay organized.