In the intricate realm of taxes, understanding the nitty-gritty details can make a significant difference in how you manage your finances. The Income Tax Worksheet is a powerful tool that allows you to navigate through the labyrinth of tax calculations, ensuring you’re making the most out of your financial situation. Let’s embark on a journey to unravel the mysteries behind the Income Tax Worksheet and equip ourselves with the knowledge to optimize our tax returns.

What is an Income Tax Worksheet?

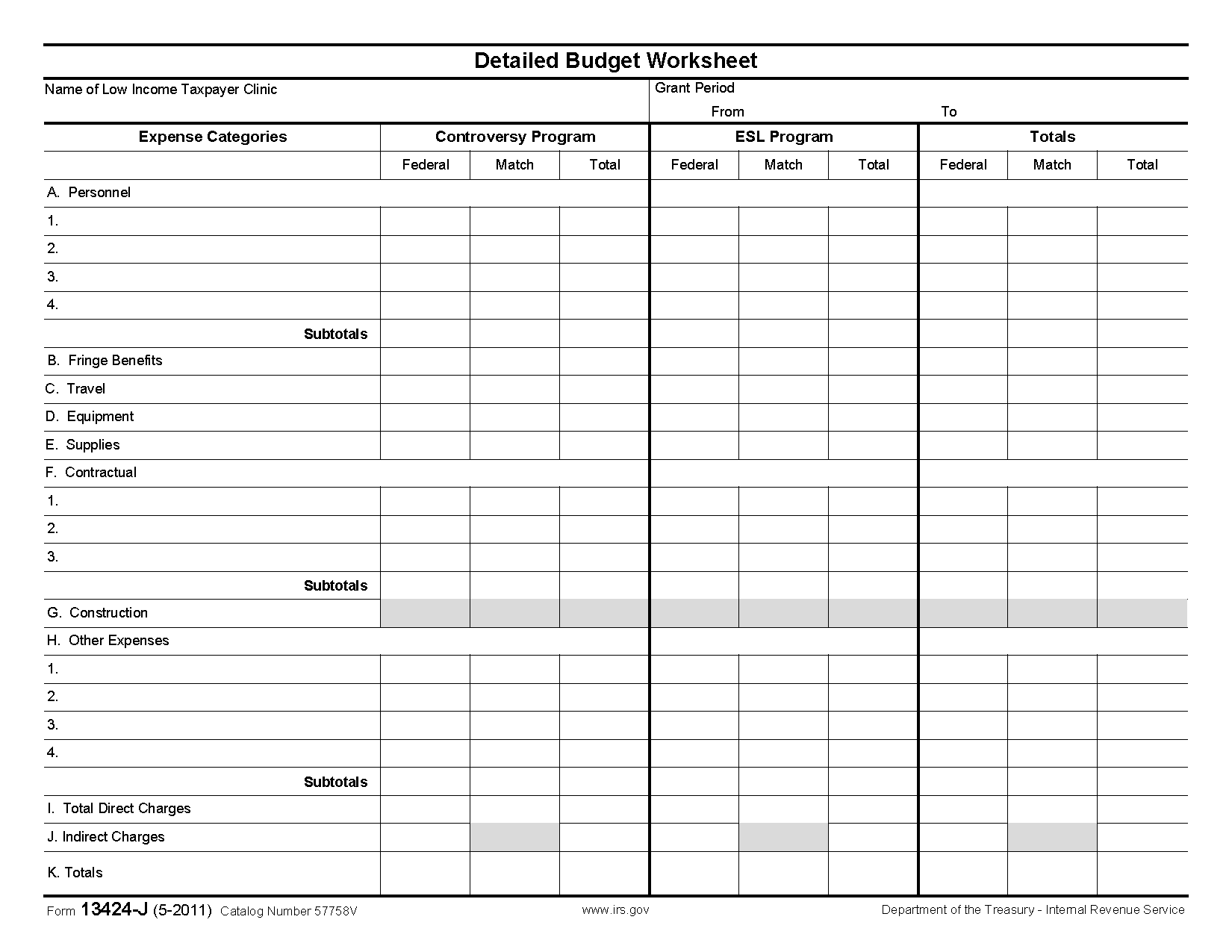

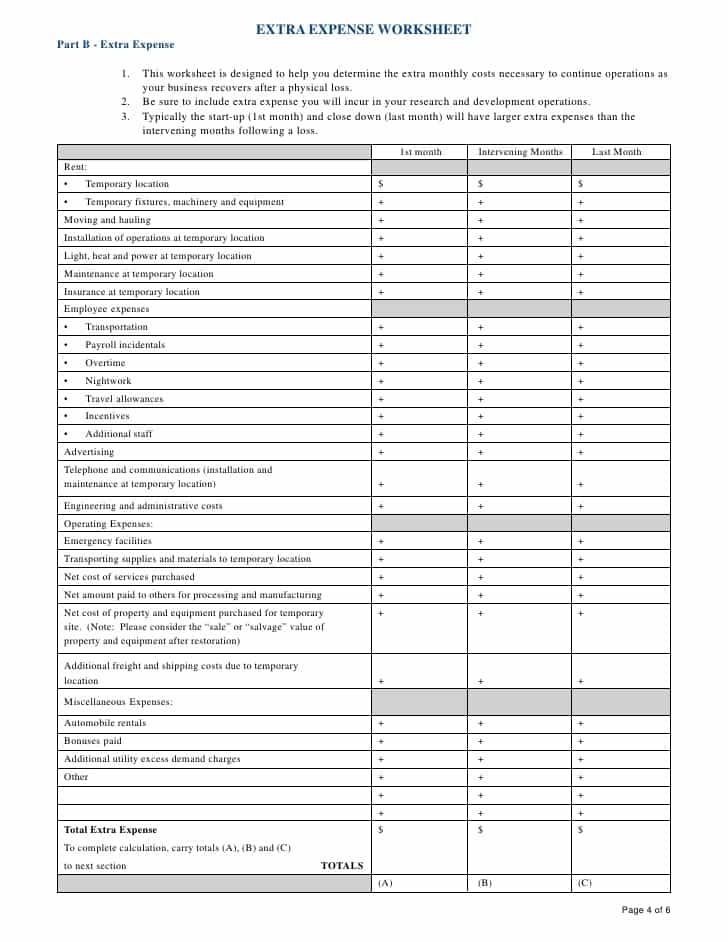

An Income Tax Worksheet is a comprehensive document designed to help taxpayers calculate their taxable income. It acts as a roadmap, guiding you through various income sources, deductions, and credits, ultimately arriving at the crucial figure – your taxable income. This worksheet is an invaluable resource, providing a systematic approach to ensure that you’re not missing out on any potential savings.

Breaking Down the Components

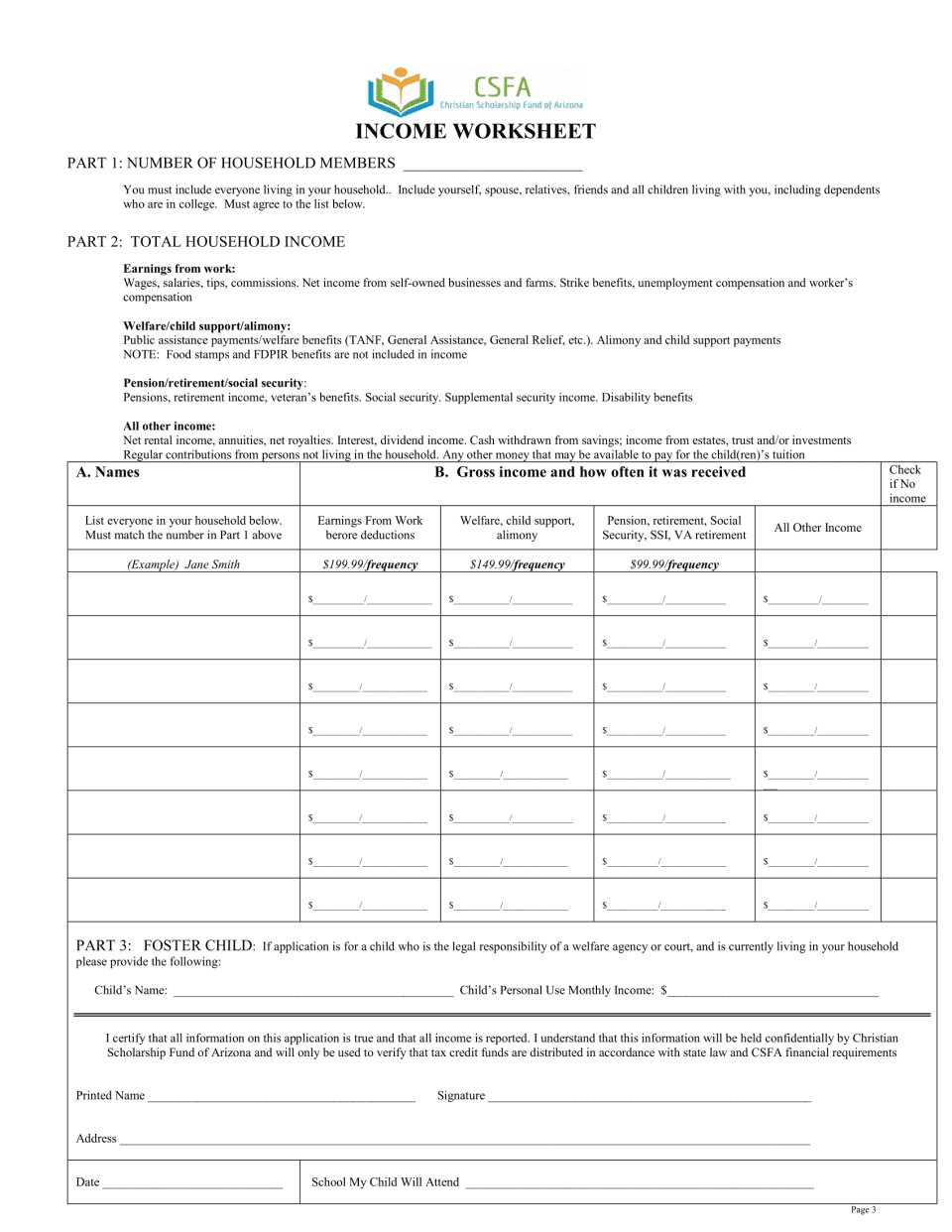

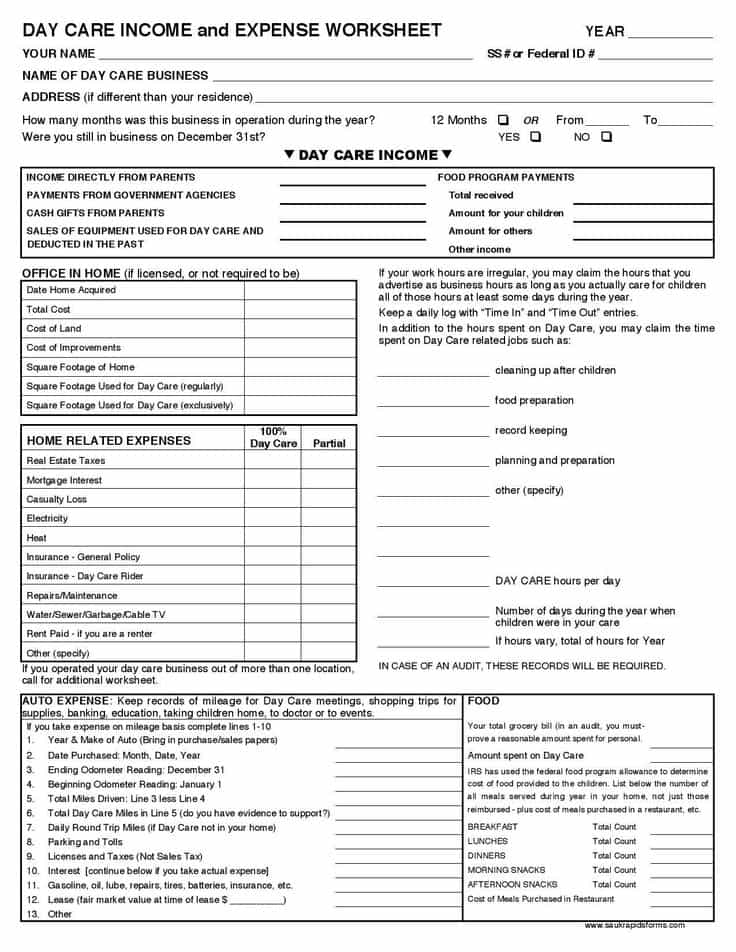

1. Income Section:

The foundation of the Income Tax Worksheet lies in the income section. Here, you’ll document all your income sources, from your regular salary to any additional income like dividends or rental earnings. This section sets the stage for the subsequent calculations, giving you a clear picture of your total income.

2. Deductions and Credits:

One of the most crucial aspects of the Income Tax Worksheet is the deductions and credits section. Here, you can offset your taxable income by including eligible deductions such as student loan interest, mortgage interest, or medical expenses. Additionally, tax credits can directly reduce your tax liability, making it essential to explore all available options.

3. Taxable Income Calculation:

Once you’ve accounted for your income and deducted eligible expenses, the Income Tax Worksheet guides you through the calculation of your taxable income. This step involves subtracting deductions and credits from your total income, revealing the amount on which your taxes are based.

Why Does It Matter?

1. Accuracy Ensures Maximum Returns:

By diligently filling out the Income Tax Worksheet, you minimize the risk of errors in your tax calculations. Accuracy is key when it comes to tax filings, and an error-free worksheet ensures you’re not leaving money on the table.

2. Comprehensive Financial Planning:

The Income Tax Worksheet is not just a tool for tax season; it’s a window into your overall financial landscape. Regularly updating this worksheet allows you to track changes in your income, deductions, and credits, enabling proactive financial planning.

3. Confidence in Tax Filing:

Understanding the intricacies of your tax situation instills confidence when filing your returns. The Income Tax Worksheet empowers you with knowledge, making the entire process less daunting and more manageable.

Tips for Maximizing Benefits

1. Stay Informed on Tax Law Changes:

Tax laws are dynamic and subject to change. Staying informed about updates ensures that you’re aware of new deductions or credits that could benefit you.

2. Seek Professional Guidance:

If the Income Tax Worksheet seems overwhelming, consider seeking guidance from tax professionals. Their expertise can help you navigate complex tax scenarios and optimize your financial outcomes.

3. Regularly Update Your Worksheet:

Make the Income Tax Worksheet a living document. Regular updates ensure that you’re always aware of your financial standing and can make informed decisions throughout the year.

Conclusion: Empowering Your Financial Journey

The Income Tax Worksheet is not just a formality; it’s a powerful tool that puts you in control of your financial destiny. Armed with this knowledge, you can approach tax season with confidence, knowing that you’ve maximized your benefits and optimized your financial well-being. As you delve into the intricacies of the Income Tax Worksheet, remember – it’s not just about numbers; it’s about empowering yourself on your financial journey.

Explore more insightful articles on financial management and tax strategies at pruneyardinn.com. Your financial empowerment begins here!