In the hustle and bustle of modern life, managing your finances can sometimes feel like trying to solve a complex puzzle. Amidst bills, expenses, and unexpected costs, finding a way to keep track of your money can be a daunting task. That’s where the magic of “Keeping A Budget Worksheet” comes into play. Let’s delve into the art of financial management and explore how a simple worksheet can pave the way for a more secure and prosperous future.

Understanding the Basics: What is a Budget Worksheet?

A Budget Worksheet serves as your financial compass, guiding you through the labyrinth of income, expenses, and savings. It’s a tool that empowers you to take control of your financial journey, providing a clear snapshot of where your money comes from and where it goes. Think of it as your personal financial GPS, helping you navigate the twists and turns of your financial landscape.

Getting Started: Setting Up Your Budget Worksheet

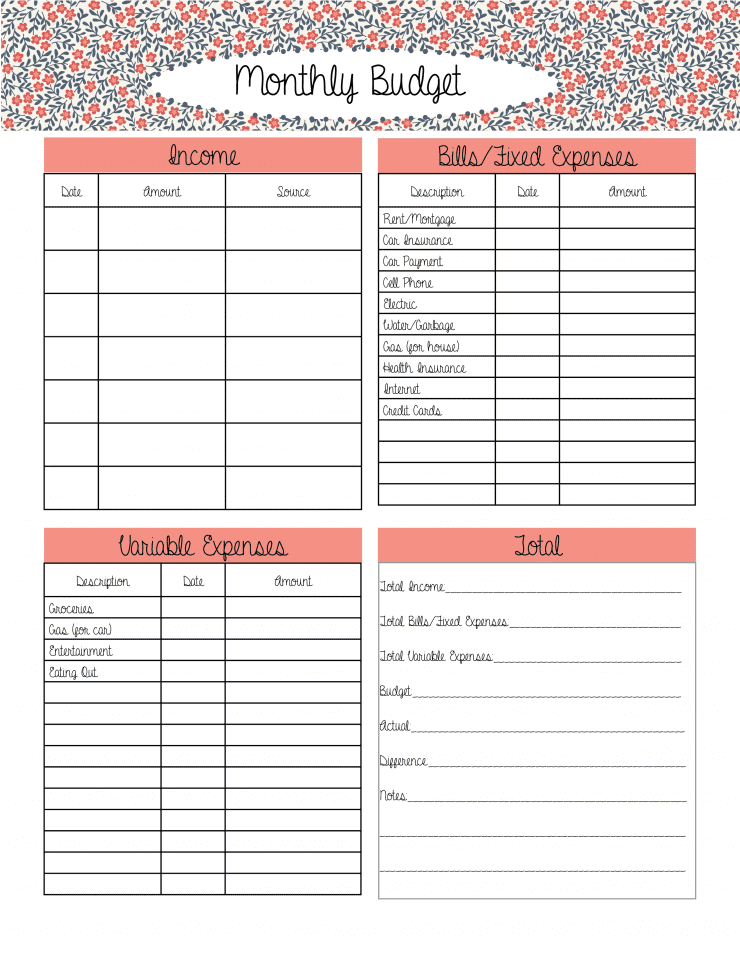

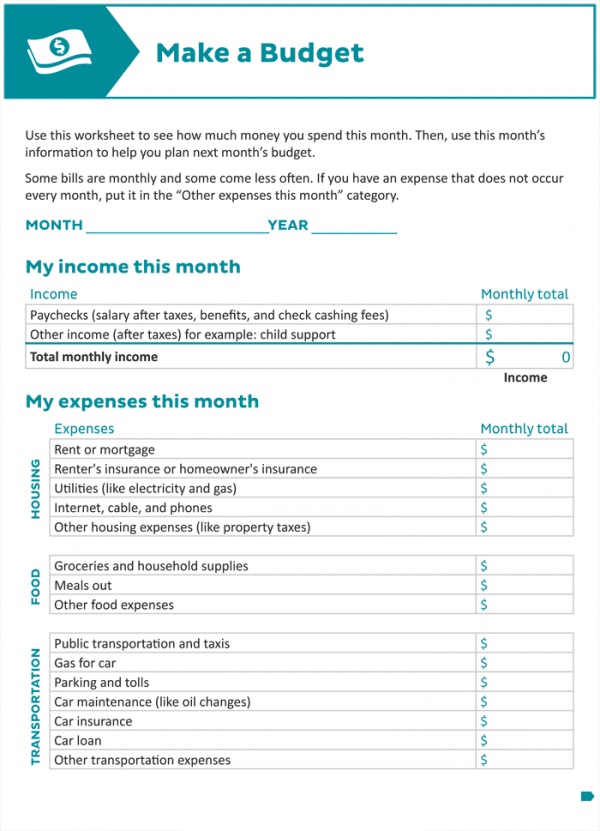

Creating a budget worksheet doesn’t have to be an intimidating task. Begin by listing all your sources of income, including your salary, side hustles, and any other money that flows into your wallet. Next, jot down your fixed expenses – those regular bills that you can’t escape, like rent or mortgage, utilities, and insurance.

Now comes the crucial part – variable expenses. These are the costs that can fluctuate from month to month, such as groceries, dining out, entertainment, and miscellaneous expenses. Be honest and thorough when documenting these items, as it’s the key to crafting a realistic budget that reflects your lifestyle.

The Art of Categorization: Making Your Budget Worksheet Work for You

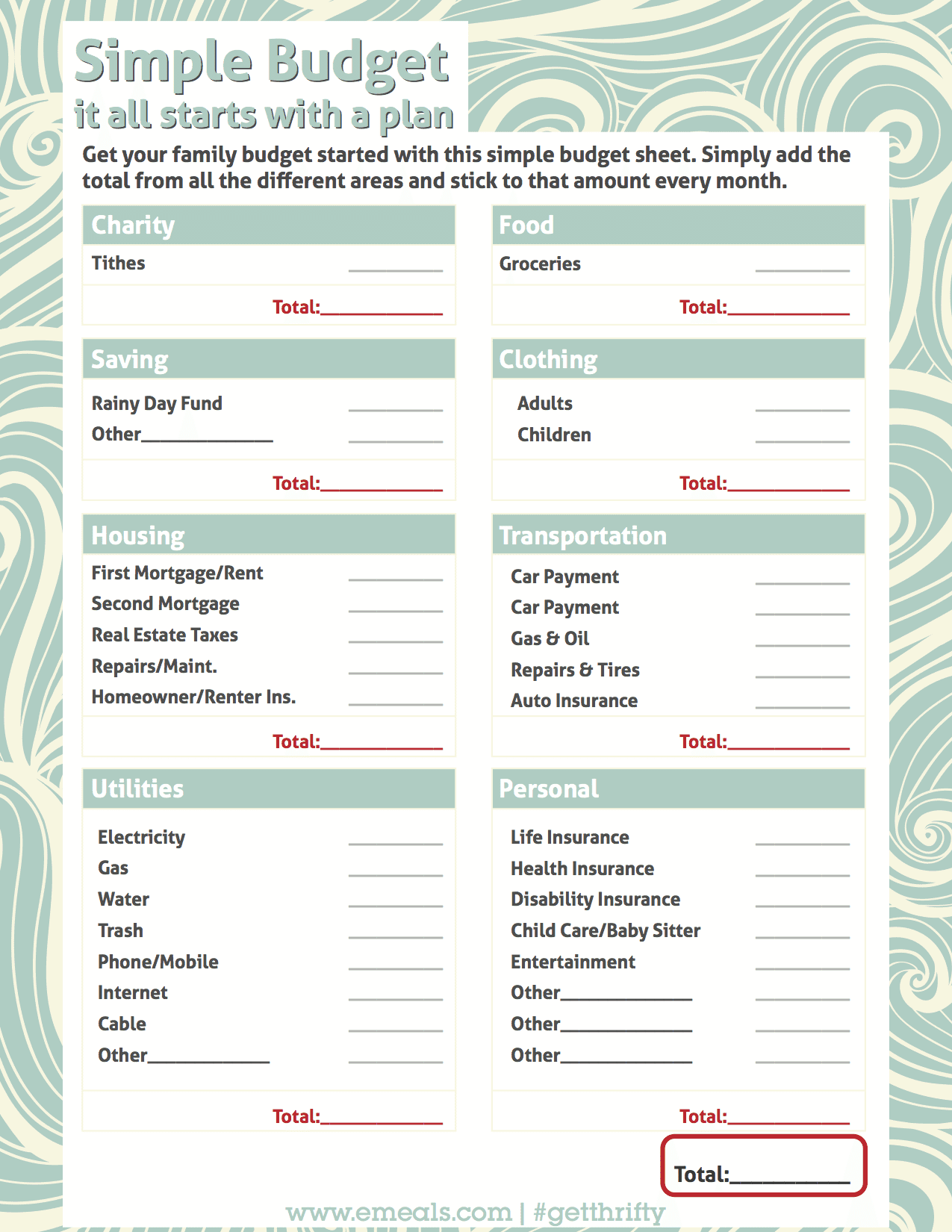

To make your budget worksheet truly effective, consider categorizing your expenses into broader sections. This not only simplifies the tracking process but also provides a deeper understanding of your spending patterns. Common categories include:

- Essentials

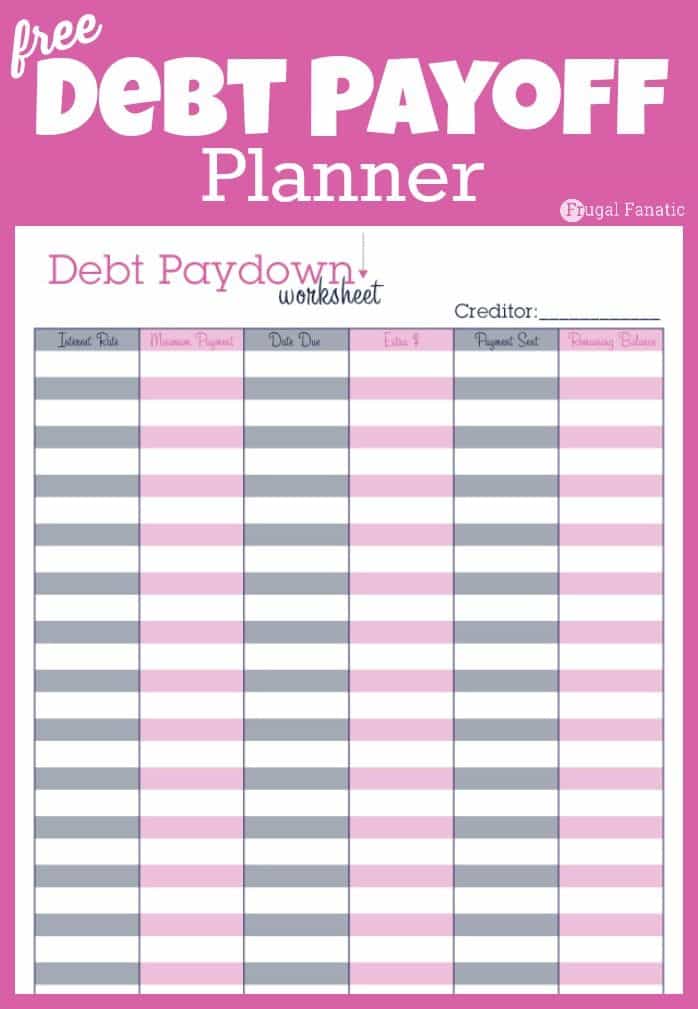

Covering necessities like housing, utilities, groceries, and transportation. - Debt Repayment

Tackling credit card payments, loans, or any outstanding debts. - Savings and Investments

Building a secure financial future through savings, investments, and retirement contributions. - Discretionary Spending

Allowing room for leisure and entertainment while staying within budget constraints.

Remember, the key is not just to track expenses but to analyze and adjust as needed. The goal is to align your spending with your financial goals, ensuring a healthy balance between enjoying life and securing your future.

Tips and Tricks: Maximizing the Potential of Your Budget Worksheet

Now that your budget worksheet is taking shape, let’s explore some tips to make the most of this financial tool:

- Regular Updates

A budget worksheet is not a one-and-done task. Regularly update it to reflect changes in income, expenses, or financial goals. This ensures that your budget stays relevant and adaptable. - Emergency Fund Allocation

Don’t forget to allocate a portion of your budget to an emergency fund. This safety net can be a lifesaver in unexpected situations, preventing financial stress and turmoil. - Celebrate Achievements

As you adhere to your budget and achieve financial milestones, take a moment to celebrate. Rewarding yourself for staying on track can be a powerful motivator to maintain financial discipline. - Explore Digital Tools

Leverage the power of technology by using budgeting apps and tools. These can automate processes, provide real-time insights, and make financial management a more seamless experience.

Staying Motivated: Overcoming Challenges in Your Budgeting Journey

It’s essential to acknowledge that challenges may arise as you navigate the waters of budgeting. Unexpected expenses, fluctuating income, or the temptation to splurge on non-essential items can test your financial discipline. However, these challenges are opportunities for growth and learning.

When faced with unexpected expenses, use your budget worksheet as a flexible tool. Adjust your spending in other areas, and remember that setbacks are a natural part of any financial journey. Stay motivated by focusing on the bigger picture – achieving your financial goals and building a secure future.

Harnessing the Power of Visualization: Turning Goals into Reality

One effective way to stay motivated is by incorporating visualization into your budgeting routine. Create a visual representation of your financial goals and place it where you can see it daily. Whether it’s a dream vacation, a new home, or a debt-free life, visualizing success can serve as a powerful reminder of why you’re committed to budgeting.

As you review your budget worksheet regularly, witness the progress you’ve made toward these goals. Celebrate each milestone, no matter how small, and let these achievements fuel your motivation to stay on course.

Sharing the Journey: Engage in Open Financial Conversations

Budgeting doesn’t have to be a solo endeavor. Engage in open and honest conversations about finances with family, friends, or even seek guidance from financial experts. Sharing your goals and challenges creates a support system that can provide valuable insights, encouragement, and accountability.

Consider involving your family in the budgeting process. Discuss financial goals together, ensuring that everyone is on the same page. This not only fosters a sense of shared responsibility but also strengthens your collective commitment to financial well-being.

Embracing Continuous Learning: Evolving with Your Finances

The financial landscape is dynamic, and your budgeting strategies should evolve accordingly. Stay informed about changes in your income, tax laws, or expenses that may impact your budget. Attend financial literacy workshops, read books, and stay curious about new tools and techniques that can enhance your financial management skills.

As you grow and learn, your budget worksheet can become more refined and tailored to your unique circumstances. Don’t be afraid to modify your budgeting approach to align with your evolving financial goals and lifestyle.

Final Thoughts: Your Budget Worksheet, Your Financial Freedom

In conclusion, “Keeping A Budget Worksheet” is not merely a task; it’s a lifelong companion on your journey to financial freedom. As you navigate the ebb and flow of your financial landscape, remember that your budget worksheet is a versatile tool, adapting to your needs and empowering you to make informed decisions.

So, embark on this journey with confidence, armed with the knowledge that you are not alone. The power of your budget worksheet lies not just in the numbers but in the financial empowerment it provides. Take charge of your finances, celebrate every step forward, and let your budget worksheet be the compass guiding you toward a future of financial security, freedom, and prosperity. Your journey to financial well-being starts now!