A Consumer Credit Counseling Budget Worksheet can be an excellent tool for managing your finances. Learn how to use it effectively to take control of your money and achieve your financial goals.

Are you struggling to make ends meet? Do you find yourself living paycheck to paycheck? Are you worried about falling behind on bills or accruing debt? If so, you’re not alone. Many people face financial challenges at some point in their lives, but the good news is that there are resources available to help you take control of your money and achieve your financial goals.

One such resource is a Consumer Credit Counseling Budget Worksheet. This tool can help you track your income and expenses, identify areas where you can cut back on spending, and create a budget that works for your unique financial situation. Here’s how to use a Consumer Credit Counseling Budget Worksheet to take control of your finances:

Step 1: Gather Your Financial Information

Before you can create a budget, you need to know exactly where your money is going. Start by gathering all of your financial information, including:

- Your income

This includes your salary or wages, as well as any other sources of income, such as rental income or alimony. - Your expenses

This includes everything you spend money on, from rent or mortgage payments to groceries, utilities, and entertainment. - Your debts

This includes any outstanding debts you owe, such as credit card balances, student loans, or medical bills.

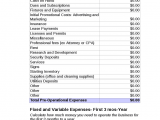

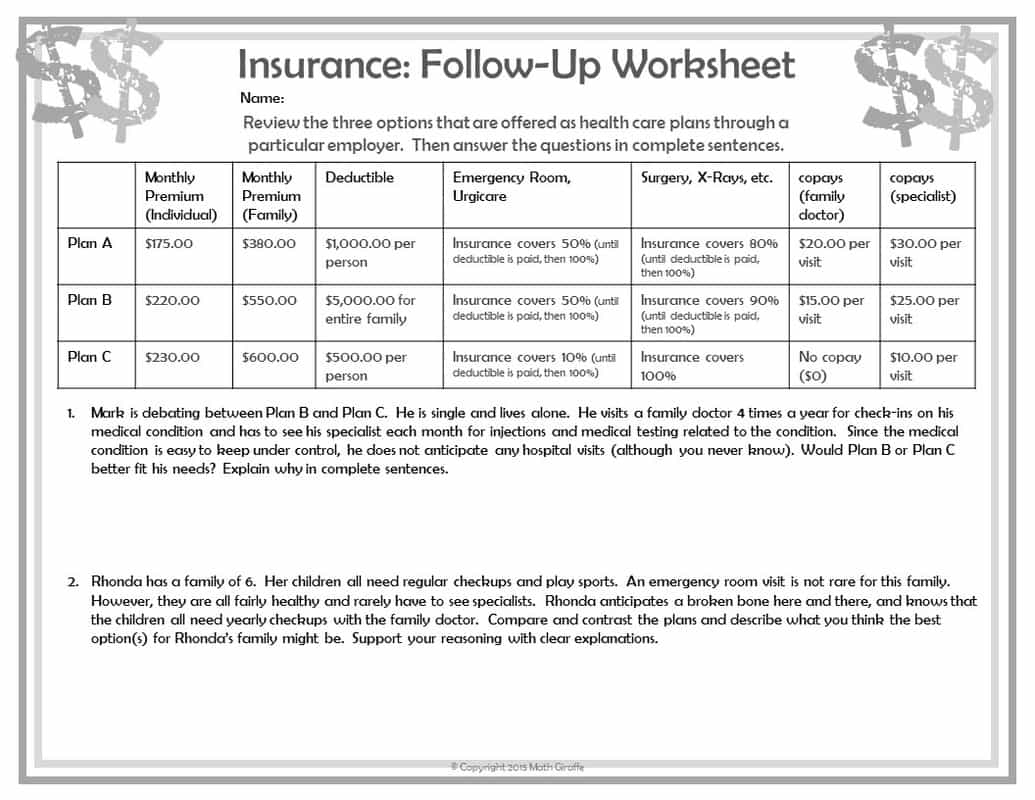

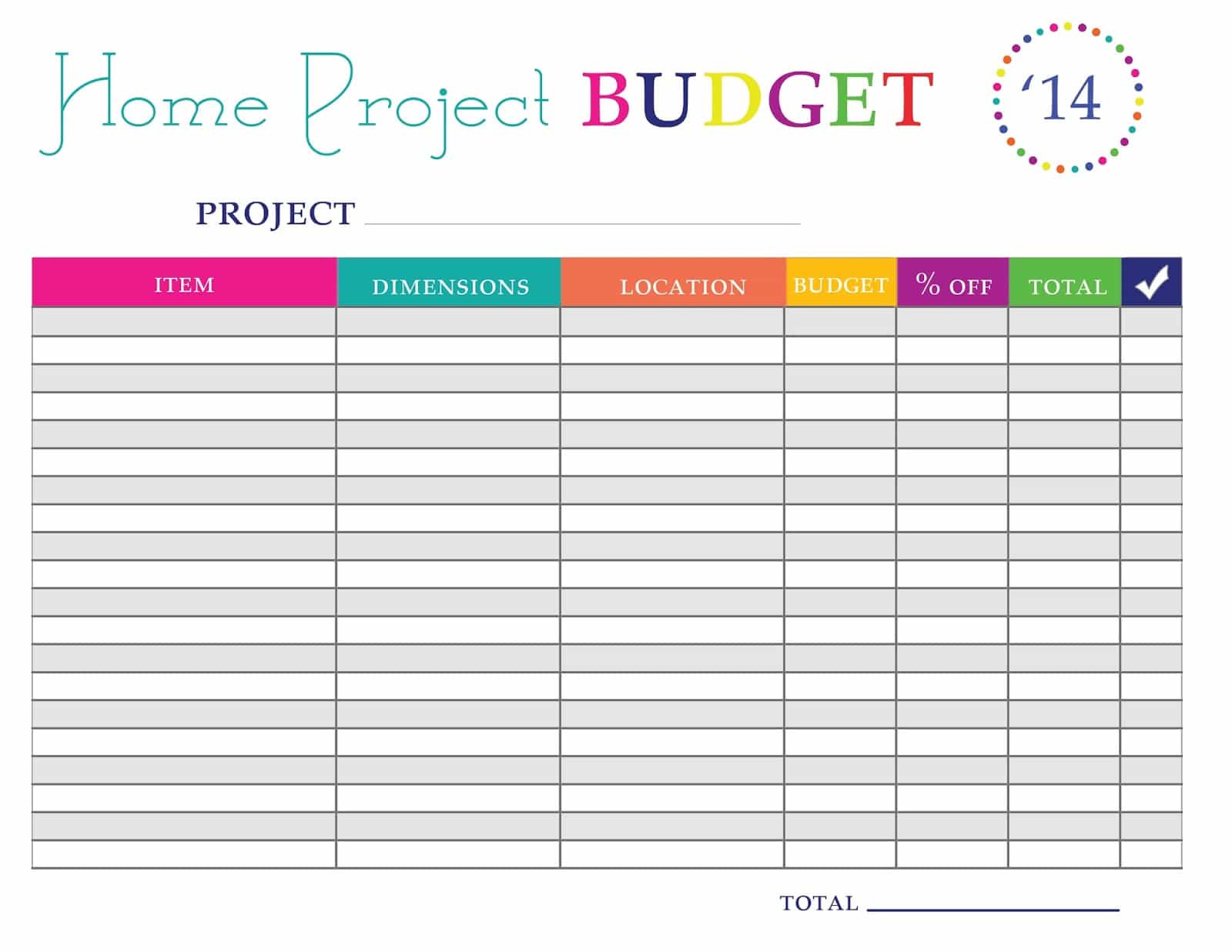

Step 2: Fill Out the Worksheet

Once you have all of your financial information in one place, it’s time to fill out the Consumer Credit Counseling Budget Worksheet. This worksheet typically includes several categories of expenses, such as housing, transportation, food, and entertainment. You’ll need to fill in the amount you spend on each category each month.

Be as accurate as possible when filling out the worksheet. If you’re not sure how much you spend on a particular category, take a look at your bank statements or receipts from the past few months to get an idea.

Step 3: Analyze Your Budget

Once you’ve filled out the worksheet, it’s time to analyze your budget. Look for areas where you might be overspending or where you can cut back on expenses. For example, if you’re spending a lot of money on eating out, you might consider cooking more meals at home. If you’re spending a lot of money on transportation, you might consider taking public transit or carpooling to save money.

Step 4: Make Adjustments

Based on your analysis, make adjustments to your budget as needed. This might involve cutting back on certain expenses, such as entertainment or dining out, or finding ways to increase your income, such as picking up a side job or negotiating a raise.

Step 5: Stick to Your Budget

Creating a budget is one thing, but sticking to it can be a challenge. To make it easier, consider using a budgeting app or tool that can help you track your expenses and stay on top of your budget. You might also consider setting financial goals for yourself, such as paying off debt or saving for a down payment on a house, to help motivate you to stick to your budget.

Additional Tips:

- Be realistic

When creating your budget, make sure to be realistic about your expenses and income. Don’t try to cut back too much or underestimate your expenses, as this can make it harder to stick to your budget in the long run. - Be flexible

Your budget isn’t set in stone. Life happens, and unexpected expenses can arise. Make sure to be flexible and adjust your budget as needed to accommodate these changes. - Seek help if needed

If you’re struggling to make ends meet or are facing significant debt, don’t be afraid to seek help. Consumer credit counseling services can provide you with guidance and support to help you get back on track. - Use your budget to plan for the future

A budget isn’t just about managing your day-to-day expenses. It can also help you plan for the future, whether that’s saving for a down payment on a house, planning for retirement, or setting aside money for a vacation. - Review your budget regularly

Once you’ve created your budget, make sure to review it regularly to ensure you’re staying on track. This can help you identify any areas where you may need to adjust your spending or income.

Conclusion

A Consumer Credit Counseling Budget Worksheet can be an invaluable tool for managing your finances and achieving your financial goals. By taking the time to gather your financial information, fill out the worksheet, analyze your budget, make adjustments, and stick to your budget, you can take control of your money and achieve financial freedom. Whether you’re struggling with debt or simply want to get a better handle on your finances, a Consumer Credit Counseling Budget Worksheet can help you get there.