Divorce Financial Planning Worksheet: A Guide to Managing Your Finances After Divorce

Learn how a divorce financial planning worksheet can help you organize your finances and plan for your future after divorce.

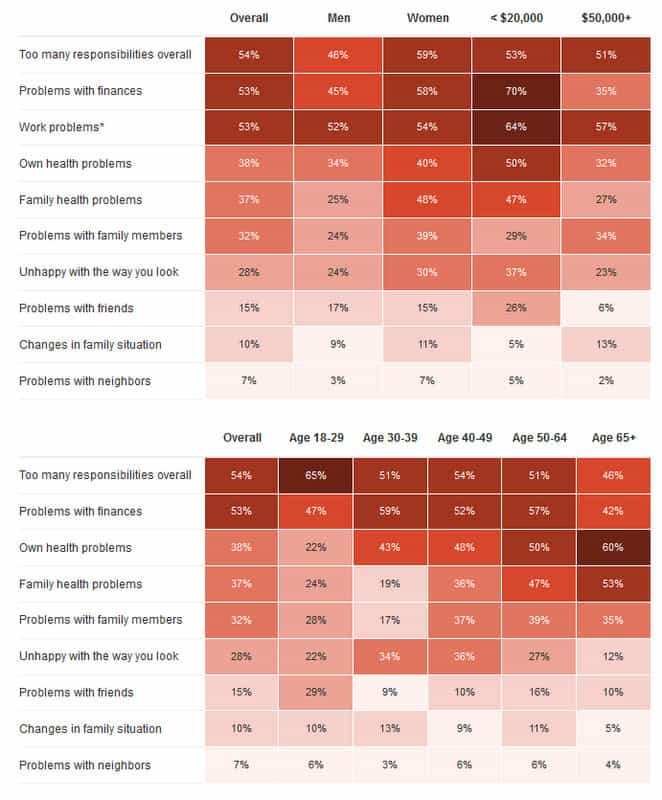

Divorce can be an emotionally challenging time, and it’s easy to get overwhelmed with all the changes and decisions that need to be made. One of the most important areas to focus on during this time is your finances. Whether you’re going through a divorce or have recently finalized one, a divorce financial planning worksheet can be an invaluable tool to help you manage your money and plan for the future.

What is a Divorce Financial Planning Worksheet?

A divorce financial planning worksheet is a document that helps you organize your finances and plan for your future after divorce. It’s essentially a budgeting tool that takes into account your new financial situation post-divorce, including changes to your income, expenses, assets, and debts.

The purpose of a divorce financial planning worksheet is to help you:

- Understand your financial situation: By listing all your assets and debts, you’ll have a better understanding of your financial situation.

- Plan for the future: You can use the worksheet to plan for your future expenses and income, including retirement planning and savings goals.

- Make informed decisions: Armed with a clear picture of your financial situation, you’ll be better equipped to make informed decisions about your money.

What should a Divorce Financial Planning Worksheet Include?

A divorce financial planning worksheet should include a comprehensive list of your assets, liabilities, income, and expenses. Here are some of the key items you’ll want to include:

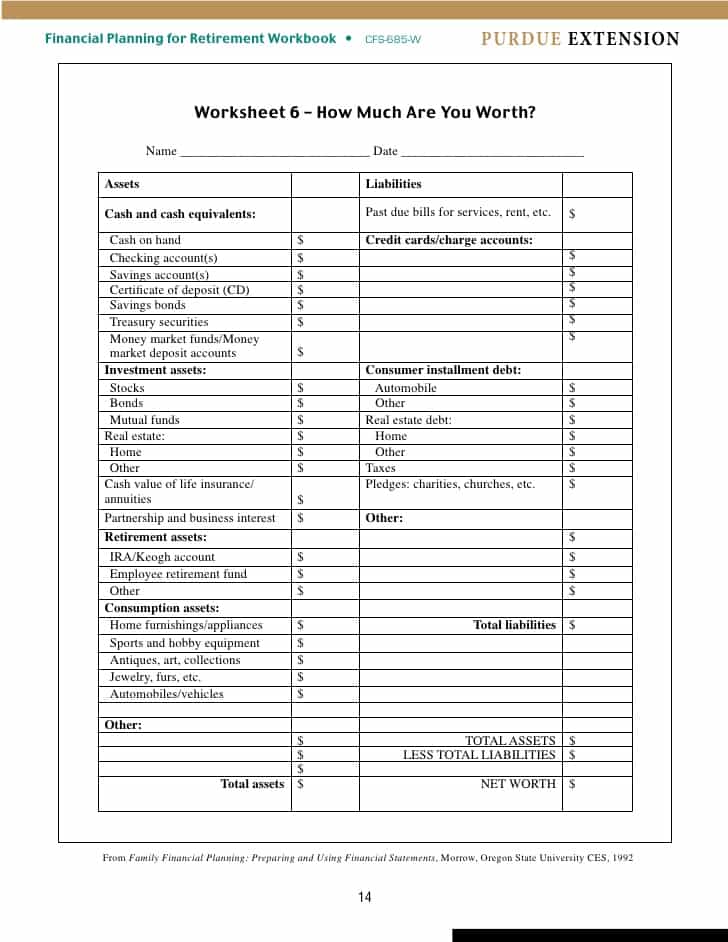

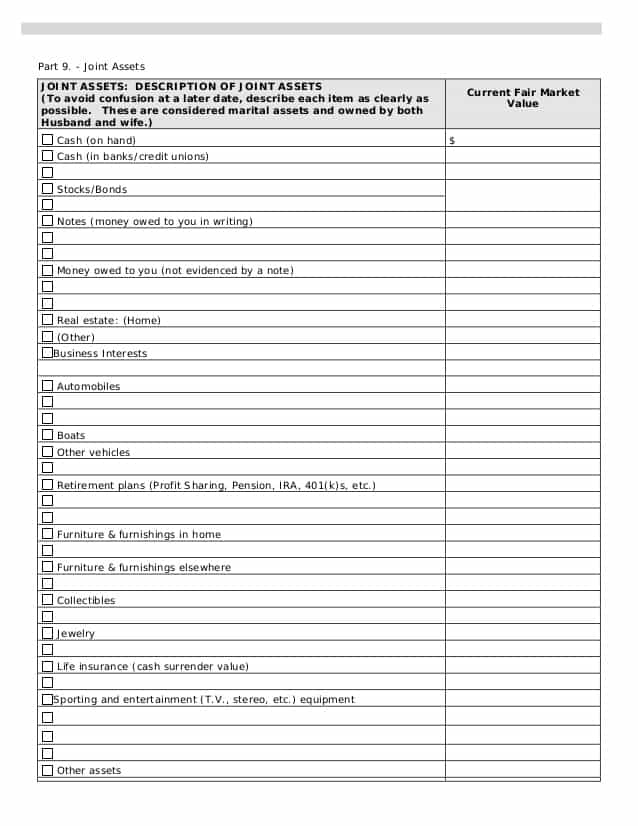

Assets:

- Bank accounts

- Retirement accounts

- Investment accounts

- Real estate

- Vehicles

- Personal property (jewelry, art, etc.)

Liabilities:

- Mortgage

- Car loans

- Credit card debt

- Student loans

- Other loans

Income:

- Salary

- Rental income

- Investment income

- Alimony

- Child support

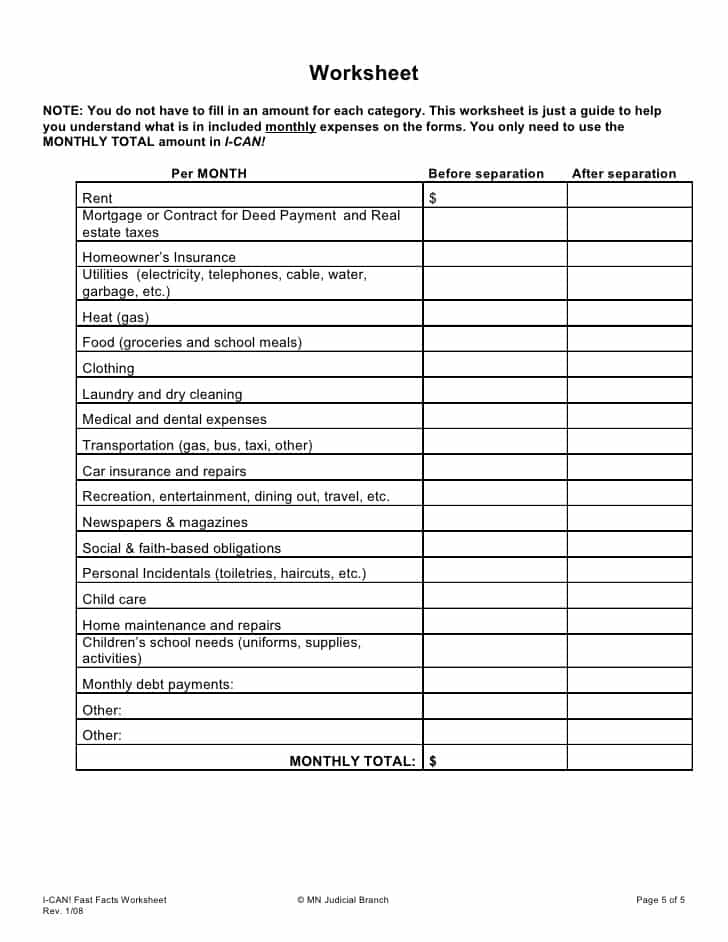

Expenses:

- Housing (rent/mortgage)

- Utilities

- Food

- Transportation

- Insurance

- Childcare

- Entertainment

How to Use a Divorce Financial Planning Worksheet

To use a divorce financial planning worksheet effectively, follow these steps:

- Gather all your financial documents: This includes bank statements, investment statements, mortgage and loan documents, and tax returns.

- List all your assets and liabilities: Using the worksheet, list all your assets and liabilities. Be sure to include account numbers, balances, and any other relevant information.

- Determine your income: List all sources of income, including salary, rental income, investment income, alimony, and child support.

- Calculate your expenses: Using the worksheet, list all your expenses, including housing, utilities, food, transportation, insurance, childcare, and entertainment.

- Review your budget: Once you have all your financial information listed, review your budget to ensure it’s realistic and sustainable. You may need to adjust your expenses or income to ensure you’re not overspending or undersaving.

- Plan for the future: Use the worksheet to plan for your future expenses and income, including retirement planning and savings goals.

- Seek professional advice: If you’re unsure how to proceed or have complex financial issues to address, consider seeking the advice of a financial planner or divorce attorney.

Conclusion

Going through a divorce is never easy, but taking control of your finances can help ease the transition and set you up for a successful future. A divorce financial planning worksheet can be a valuable tool to help you organize your finances and plan for the future. By using this tool, you’ll gain a better understanding of your financial situation, make informed decisions about your money, and ultimately, achieve financial stability and security.

In addition to using a divorce financial planning worksheet, there are several other steps you can take to manage your finances after divorce. These include:

- Update your estate plan: After divorce, you’ll want to update your estate plan to reflect your new circumstances. This includes updating your will, power of attorney, and any trusts you may have.

- Close joint accounts: If you have joint accounts with your ex-spouse, it’s important to close them or remove your name from them as soon as possible. This will help prevent any financial surprises or problems down the road.

- Establish credit in your own name: If you didn’t have credit in your own name prior to divorce, now is the time to start building it. Open a credit card or take out a small loan in your name to establish a credit history.

- Consider downsizing: If your expenses are too high or you’re struggling to make ends meet, consider downsizing your home or selling assets you no longer need. This can help free up cash flow and reduce stress.

- Stay organized: After divorce, it’s important to stay organized and keep track of all your financial documents and statements. This will help you stay on top of your finances and avoid any surprises or errors.

Remember, managing your finances after divorce takes time and effort, but with the right tools and strategies, you can achieve financial stability and security. By using a divorce financial planning worksheet, updating your estate plan, closing joint accounts, establishing credit, downsizing if needed, and staying organized, you’ll be on your way to a successful financial future.