How a Get Out of Debt Spreadsheet Can Help You Manage Your Finances

Are you struggling with debt? A Get Out of Debt Spreadsheet can help you organize your finances and create a plan to become debt-free. Learn how to use this tool to take control of your financial situation.

If you are feeling overwhelmed by debt and struggling to keep up with payments, you are not alone. According to a recent study, the average American household carries over $137,000 in debt, including mortgages, student loans, credit card debt, and car loans. With so many financial obligations, it can be challenging to stay on top of payments and make progress towards becoming debt-free.

Fortunately, there are tools available to help you manage your finances and create a plan to get out of debt. One of the most effective tools is a Get Out of Debt Spreadsheet. In this article, we will explore how to use this tool and the benefits it can provide.

What is a Get Out of Debt Spreadsheet?

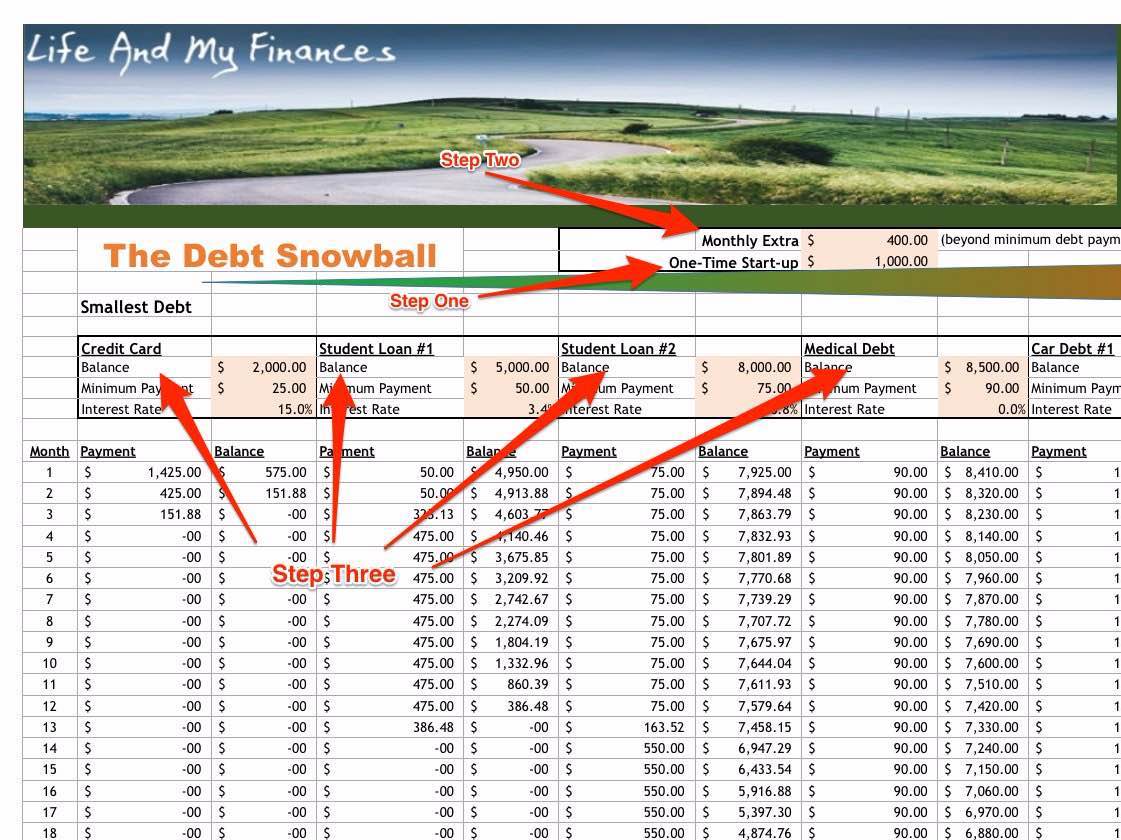

A Get Out of Debt Spreadsheet is a tool that helps you track your debt and create a plan to become debt-free. It is essentially a budgeting tool that focuses specifically on debt repayment. The spreadsheet allows you to list all of your debts, including the balance, interest rate, and minimum payment. You can also include additional information, such as the due date and the creditor’s name.

Once you have listed all of your debts in the spreadsheet, you can use it to create a debt repayment plan. The spreadsheet will calculate how long it will take you to pay off each debt based on your monthly payments and interest rates. You can adjust your payments to see how it affects your timeline and create a plan that works for your budget.

Benefits of Using a Get Out of Debt Spreadsheet

Using a Get Out of Debt Spreadsheet provides several benefits, including:

- Organization: By listing all of your debts in one place, you can easily keep track of what you owe and when payments are due. This can help you avoid missed payments, late fees, and penalties.

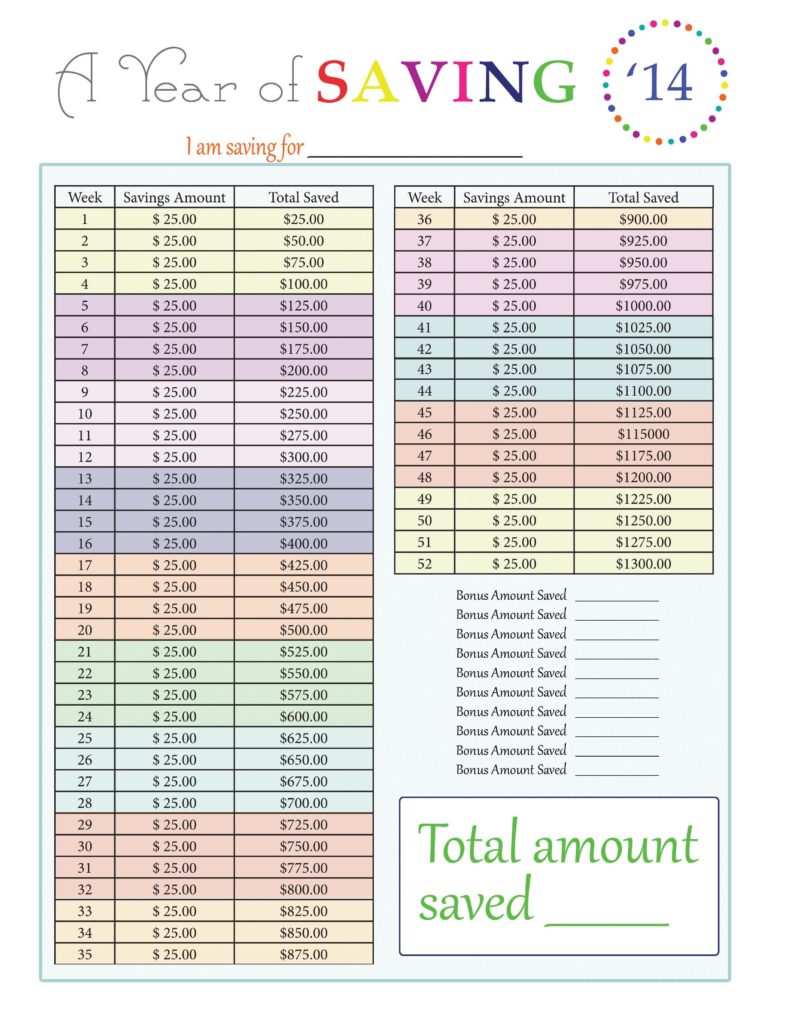

- Motivation: Seeing your progress towards becoming debt-free can be motivating. As you pay off each debt, you can update the spreadsheet to see how much closer you are to your goal.

- Visualization: The spreadsheet allows you to see your debt in a visual way, making it easier to understand your financial situation and create a plan to become debt-free.

- Flexibility: The spreadsheet allows you to adjust your payments and see how it affects your timeline. This can help you create a plan that works for your budget and financial goals.

How to Use a Get Out of Debt Spreadsheet

Using a Get Out of Debt Spreadsheet is relatively straightforward. Here are the steps you can follow:

- List all of your debts: Create a list of all your debts, including the balance, interest rate, minimum payment, due date, and creditor name.

- Create a debt repayment plan: Use the spreadsheet to create a debt repayment plan. Enter your monthly payments for each debt and adjust them to see how it affects your timeline.

- Stick to your plan: Once you have created your debt repayment plan, stick to it as closely as possible. Make your payments on time each month and avoid taking on new debt.

- Update the spreadsheet: As you pay off each debt, update the spreadsheet to track your progress towards becoming debt-free.

Conclusion

If you are struggling with debt, a Get Out of Debt Spreadsheet can be an effective tool to help you manage your finances and create a plan to become debt-free. By organizing your debts, creating a repayment plan, and tracking your progress, you can take control of your financial situation and achieve your financial goals. Whether you use a pre-made spreadsheet or create your own, a Get Out of Debt Spreadsheet can be a valuable asset in your journey to financial freedom.

Remember, becoming debt-free is a process that takes time and effort. It’s important to be patient with yourself and stay committed to your plan. A Get Out of Debt Spreadsheet can help you stay on track and make progress towards your goal.

In addition to using a Get Out of Debt Spreadsheet, there are other steps you can take to manage your finances and become debt-free. These include:

- Creating a budget: A budget can help you track your expenses and ensure that you are living within your means. It can also help you identify areas where you can cut back on spending and allocate more money towards debt repayment.

- Increasing your income: If you are struggling to make ends meet, consider finding ways to increase your income. This could include taking on a second job, freelancing, or starting a side hustle.

- Seeking professional help: If you are feeling overwhelmed by debt, consider seeking professional help. A financial advisor or credit counselor can help you create a plan to become debt-free and provide guidance and support along the way.

In conclusion, a Get Out of Debt Spreadsheet can be a powerful tool to help you manage your finances and create a plan to become debt-free. By organizing your debts, creating a repayment plan, and tracking your progress, you can take control of your financial situation and achieve your financial goals. Remember, becoming debt-free is a journey, but with the right tools and mindset, it is possible to achieve.