Dive into the world of sales documents with our guide on “Examples of Bill of Sales.” Learn how to create, use, and understand these crucial documents for various transactions.

In the world of business and commerce, the term “bill of sales” holds significant importance. It is a fundamental document used to record and confirm the sale of goods or services. Whether you’re a business owner, a buyer, or just someone curious about the intricacies of financial transactions, understanding the basics and exploring examples of bill of sales can be both enlightening and beneficial.

What Is a Bill of Sales?

A bill of sales, often referred to as a sales receipt, is a legal document that serves as proof of a transaction between a seller and a buyer. It outlines the details of the sale, including the parties involved, the items or services sold, the price, and the terms and conditions of the agreement. The primary purpose of a bill of sales is to protect both the buyer and the seller by providing a clear record of the transaction.

The Key Elements of a Bill of Sales

To create a legally binding bill of sales, there are specific elements that must be included:

- Parties Involved

The bill of sales should clearly identify the seller and the buyer by providing their names and contact information. - Description of Items or Services

A detailed description of the items or services being sold, including any serial numbers, model numbers, or other relevant identifying information. - Purchase Price

The total purchase price, including any taxes, fees, or other additional costs, should be clearly stated. - Payment Terms

The bill of sales should specify the payment terms, such as the method of payment and any agreed-upon installment plan. - Date and Location

The date of the transaction and the location where it took place should be mentioned. - Warranty Information

If applicable, any warranties, guarantees, or return policies should be clearly outlined. - Signatures

The bill of sales should be signed by both the seller and the buyer to make it legally binding.

Examples of Bill of Sales

To better understand how a bill of sales works, let’s explore some common examples:

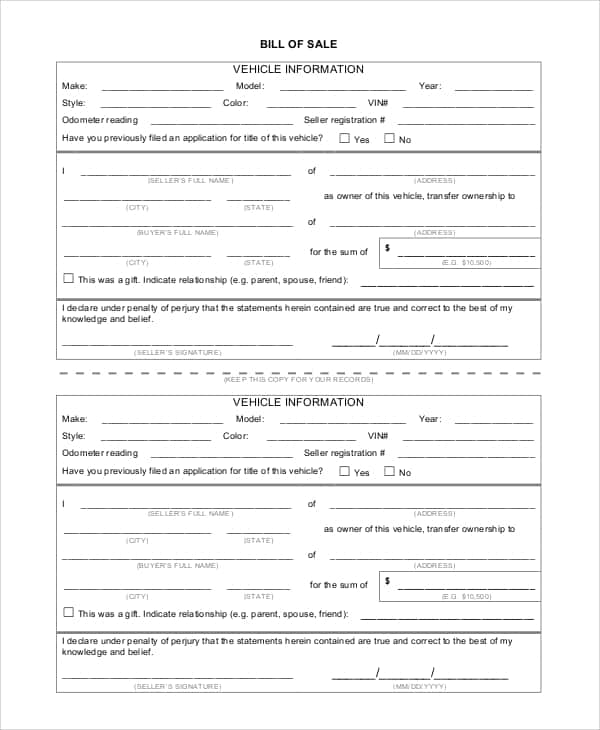

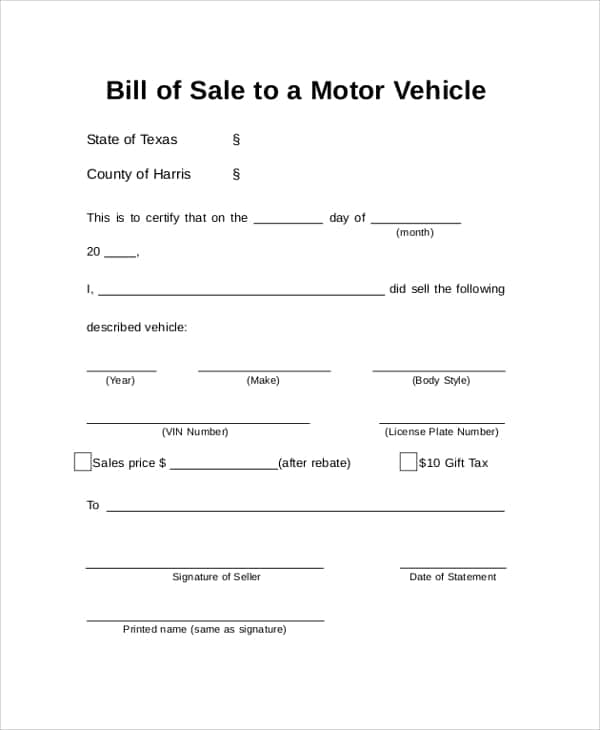

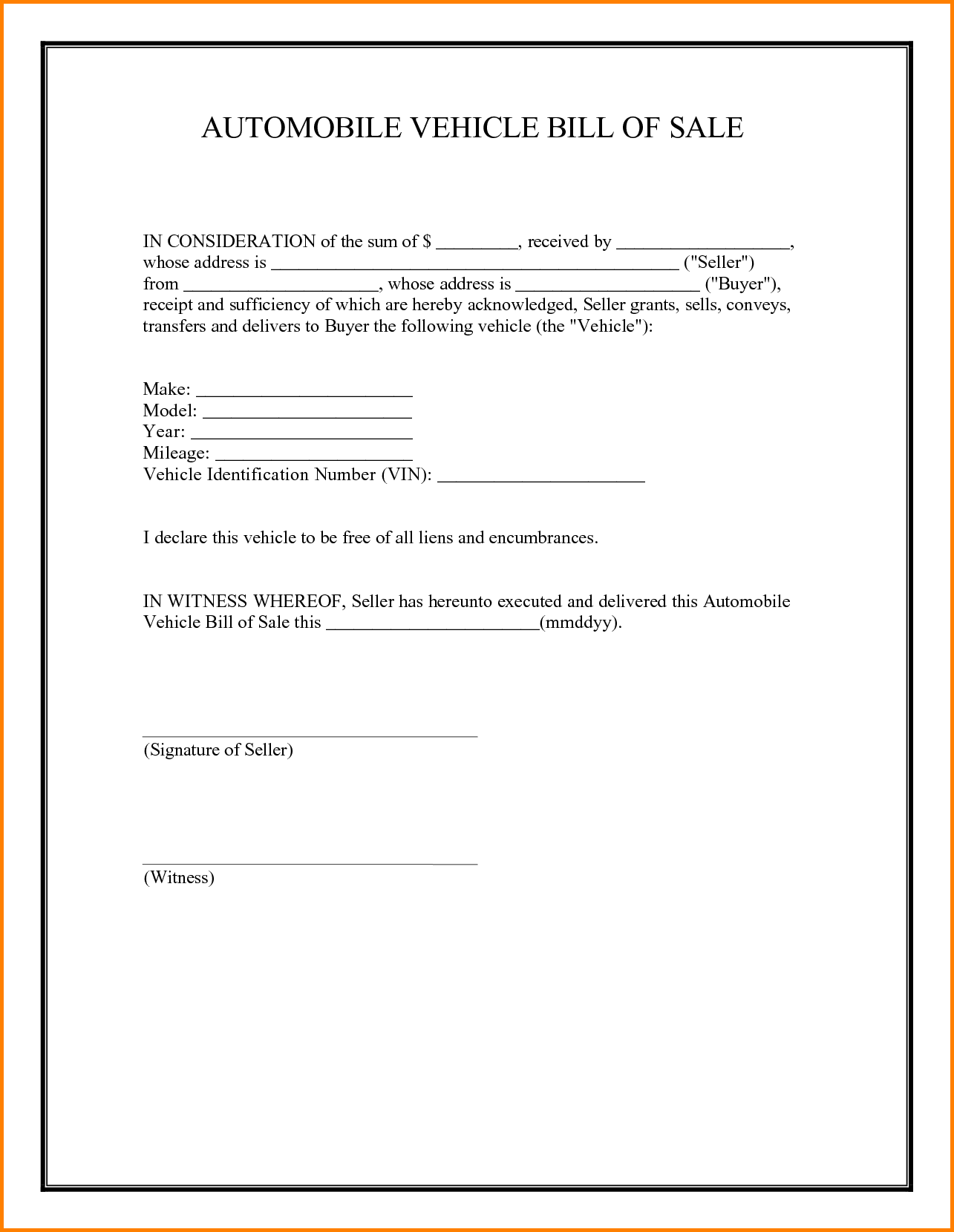

1. Vehicle Bill of Sales

When buying or selling a car, a vehicle bill of sales is essential. It includes details like the vehicle’s make, model, VIN, sale price, and odometer reading. This document ensures that the buyer has proof of ownership and that the seller is released from any liability related to the vehicle.

2. Real Estate Bill of Sales

In real estate transactions, a bill of sales is used to transfer ownership of a property from the seller to the buyer. It includes a detailed description of the property, the purchase price, and any contingencies or conditions of the sale.

3. Personal Property Bill of Sales

For items other than vehicles or real estate, such as electronics, furniture, or collectibles, a personal property bill of sales is used. This document is especially important when buying or selling high-value items, as it provides a record of the transaction and can be used for warranty claims.

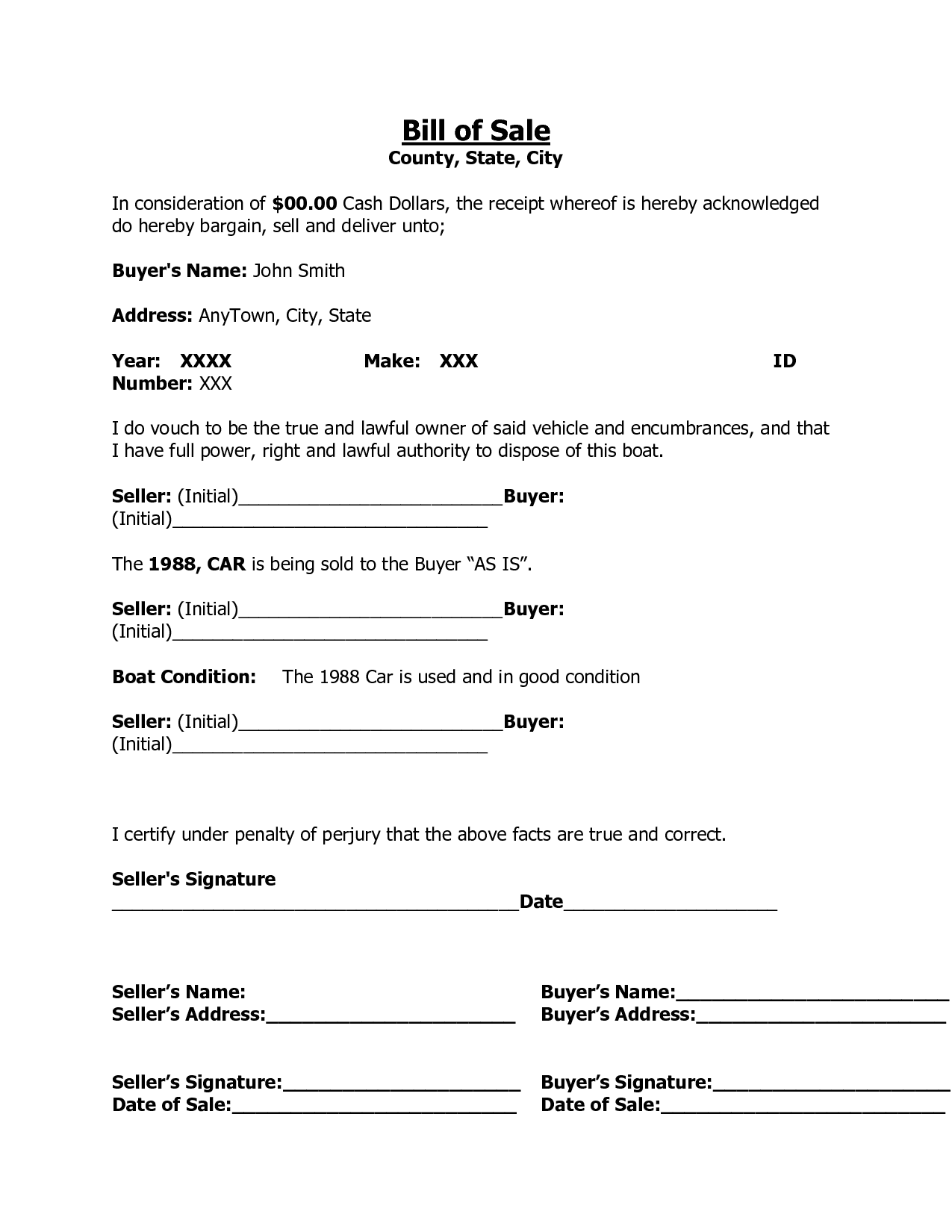

4. General Bill of Sales

A general bill of sales can be used for a wide range of transactions, including the sale of goods or services in a business context. It typically includes the basic elements mentioned earlier and can be customized to suit the specific needs of the parties involved.

How to Create a Bill of Sales

Creating a bill of sales is relatively straightforward, and you can easily find templates online to guide you. However, it’s crucial to ensure that the document complies with the legal requirements in your jurisdiction. If you’re unsure, it’s advisable to consult with a legal professional to avoid any potential issues in the future.

The Importance of a Bill of Sales

Having a well-documented bill of sales is essential for various reasons:

- Legal Protection

It protects both the seller and the buyer by providing proof of the transaction’s terms and conditions. - Proof of Ownership

It establishes ownership of the item or service, which can be vital in case of disputes or warranty claims. - Tax Purposes

A bill of sales can serve as evidence for tax purposes, especially when dealing with high-value items. - Warranty Claims

It helps in facilitating warranty claims, as it serves as a record of the purchase.

Conclusion

Understanding the significance of a bill of sales and exploring various examples can greatly benefit anyone involved in financial transactions. Whether you’re a business owner looking to streamline your sales processes, a buyer safeguarding your purchase, or someone curious about the world of commerce, this fundamental document plays a crucial role in ensuring transparency and accountability.

Remember to approach the creation and usage of a bill of sales with care and attention to detail, as it can have a substantial impact on the success and security of your transactions. The key elements and examples provided in this article should serve as a valuable resource to guide you through this process.