Before you begin using a debt reduction spreadsheet, it is important to understand the different types of debt and the various ways to eliminate those debts. A good source for these sources is the government, as they have spent time researching, identifying, and researching again the different debt relief options.

There are two basic types of debt, both of which are categorized as unsecured debt: personal loans and credit card debts. Credit card debt can be eliminated through a credit counseling service or through debt settlement. Credit card companies do not want to be sued for the full repayment, so the goal for this type of debt is to reduce it to a manageable level. In some cases they will also settle your debt for less than the amount you owe them.

When it comes to non-recourse debt like student loans and traditional loans, the focus is on the consumer. Consumer debt is the most commonly eliminated in debt reduction programs. When the consumer has their accounts reduced to a payment arrangement with the creditors that will allow them to pay back the loan in full, it gives them the opportunity to get rid of their debt and rebuild their credit.

One of the best types of debt to use in a debt reduction program is a credit card. Credit cards were created to help with emergency expenses and are not meant to be a long-term solution. If you need to make emergency purchases in order to keep your family from losing their house, a credit card may be able to provide this assistance.

It is important to note that when it comes to consumer debt, there are three types of programs that are being run by debt reduction programs. The first two are negotiation programs and settlement programs, and they are designed to encourage the consumer to use their credit cards in different ways.

Negotiation programs usually allow the consumer to choose between paying more or less than what they owe. The last type of program is called a debt settlement program, and this is a program designed to force the debt into a specific payment arrangement that is reasonable. It also helps to get the consumer to agree to lower interest rates and late fees as well.

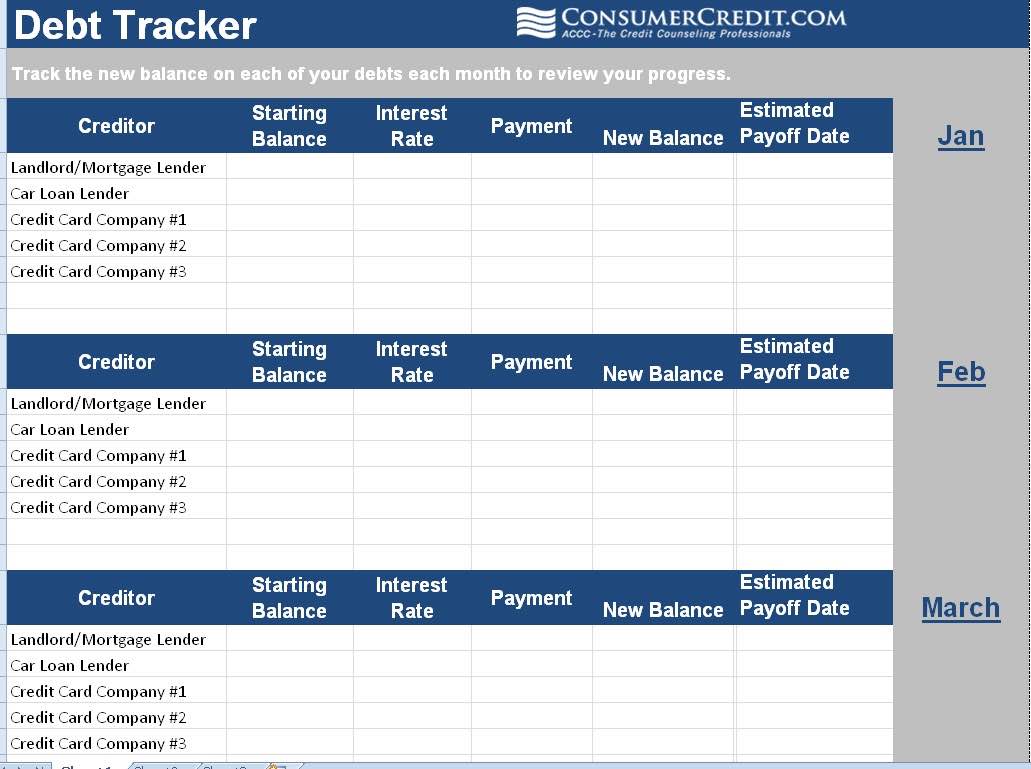

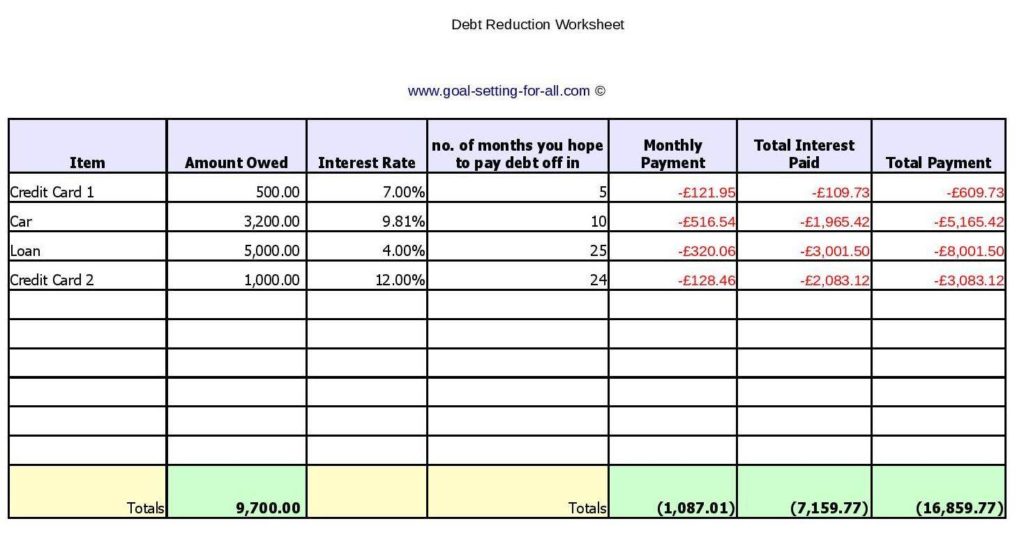

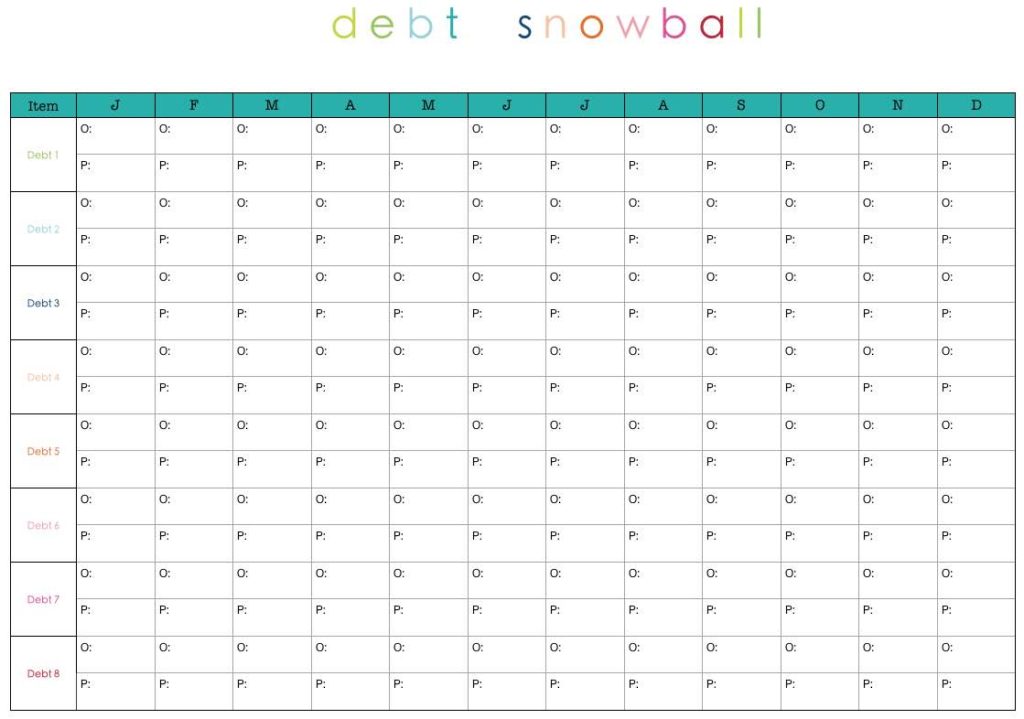

The key to using a debt reduction spreadsheet is to try to find information that can help you determine how much debt you owe. You will also want to consider how much you can afford to pay each month to get out of debt. It is also important to have a solid understanding of the government debt relief programs that are available to consumers.

Once you understand the different sources that you will need to eliminate your debt, you will want to use a spreadsheet to make the necessary calculations. After you have found a suitable debt reduction program for your particular situation, you will be able to begin eliminating your debt without stress and have more money to spend.