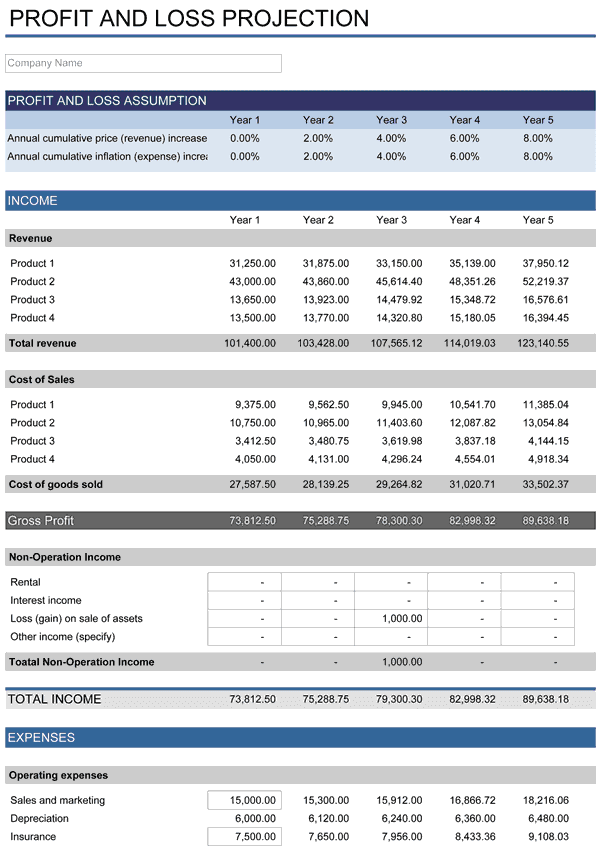

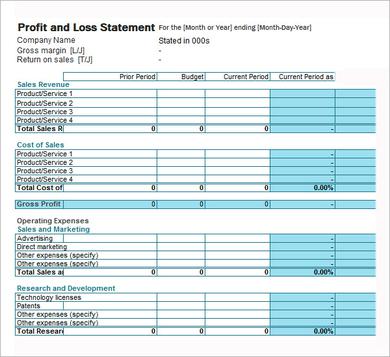

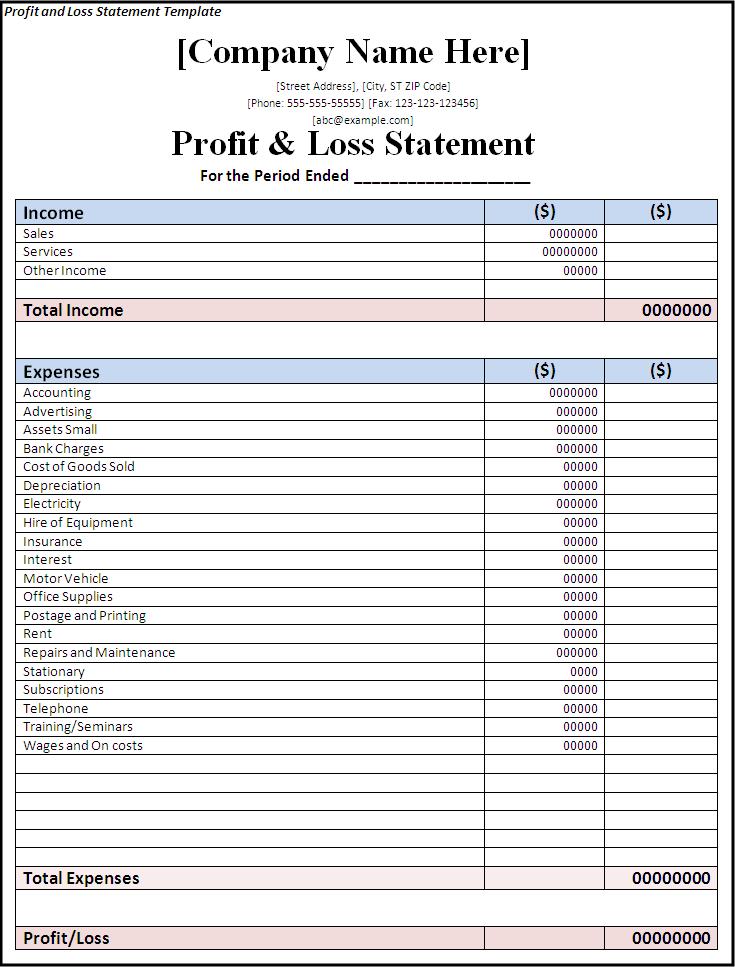

A P&L Spreadsheet Template is something you can use for financial management. This template is very simple but offers the ability to make changes to any section at any time. It comes with an easy-to-use interface, and it allows you to manage any asset or accounts you choose.

The template allows you to manage your accounts, assets, and income at a glance. With the P&L Spreadsheet Template, you can find any information you need quickly and easily.

When you’re looking at the budget template, there are different sections you can customize. There’s the expense category, which includes capital costs and expenses for other sources of income. Besides, there’s a separate category for each expense category. Then there’s a section for expenses for personal expenses for business expenses.

Finally, there’s the income section, which provides a list of expenses for each line item. Each line item is broken down into revenue or expenditure so that you can see exactly how much money you’re spending each month.

From here, you can add up any category you want in the account section. You can create as many new categories as you like, including additional categories for retirement, investments, insurance, foreign income, and vacation. Anything you want is possible, and you can even add a category for personal spending.

After you have created the list of categories you want, you will need to do some basic budgeting. First, you need to determine the total amount of income from each of your lines. This is how much income you have coming in each month, and you need to take that number and then multiply it by your total expenses.

This is known as a constant term interest rate, and it tells you how much money you are making every year. Once you have that figure, you can use it to calculate what you will owe every month and then set a budget. This budget includes all of your income and expense categories, and you will also be able to look at your balance sheet and credit report to see where your money is going.

From here, you will need to know what you’re spending your money on, and then adjust your budget accordingly. It may be a good idea to consolidate your debt first, then run some numbers to find out if this has done any good for your credit score. This will help you improve your credit score as well since a better credit score will show that you are responsible and budget yourself wisely.