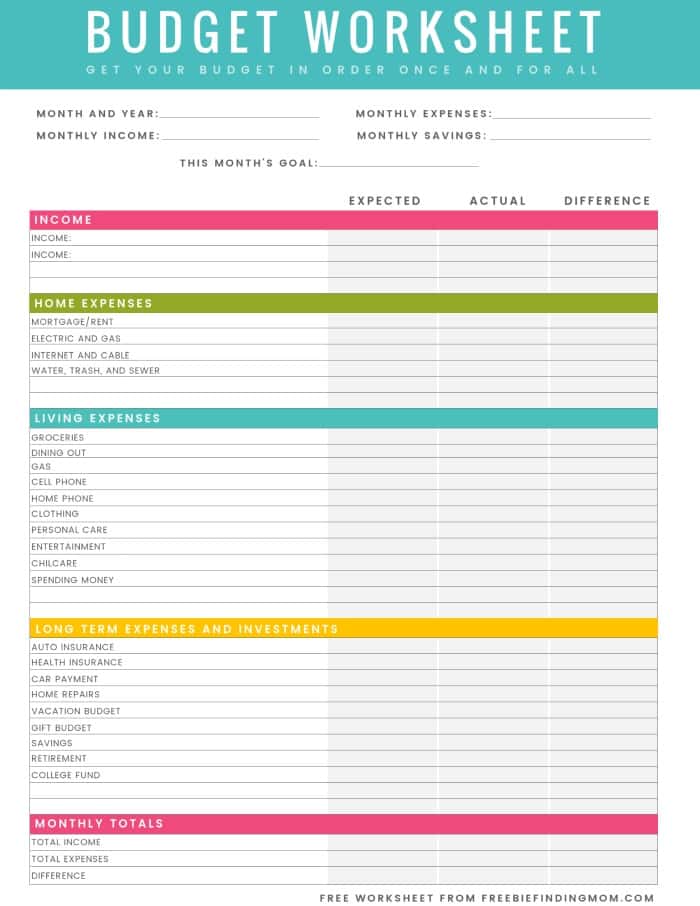

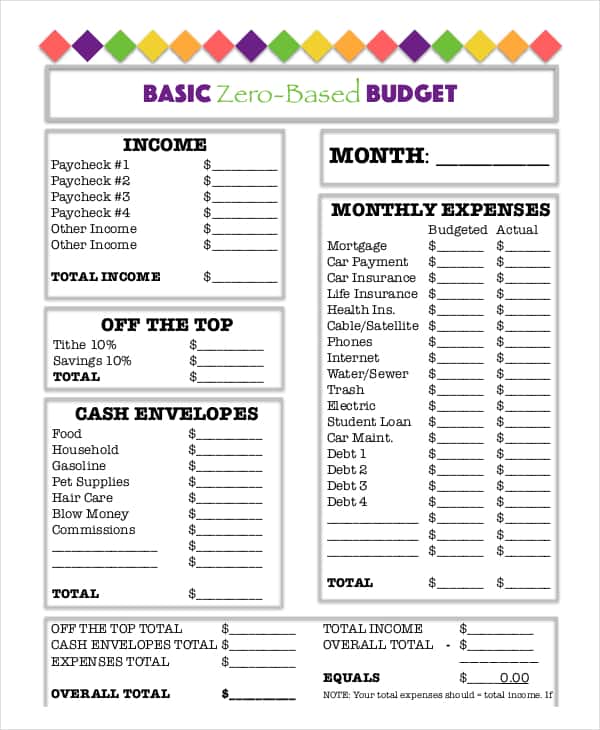

Keep your finances in check with our easy family budget worksheet. Learn how to create a budget plan and track your expenses with our step-by-step guide.

Managing finances can be challenging, especially when you have a family to take care of. With various expenses and bills to pay, it’s easy to lose track of your budget and overspend. However, with a proper budget plan in place, you can manage your finances efficiently and achieve your financial goals.

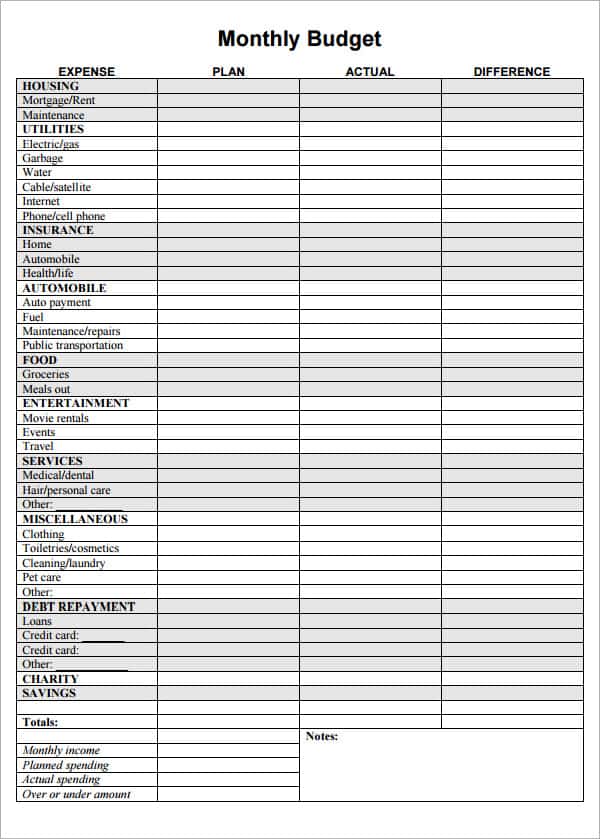

To help you get started, we’ve created an easy family budget worksheet that you can use to track your income and expenses. In this article, we’ll guide you through the process of creating a budget plan and using our worksheet to track your finances.

Step 1: Set Your Financial Goals

Before you create a budget plan, you need to set your financial goals. Determine what you want to achieve financially, whether it’s saving for a vacation, paying off debt, or building an emergency fund. Setting specific and measurable goals will help you stay motivated and focused on your budget plan.

Step 2: Calculate Your Income

The next step is to calculate your total monthly income. This includes your salary, freelance income, rental income, and any other sources of income. Make sure you have an accurate estimate of your income to create a realistic budget plan.

Step 3: Track Your Expenses

The key to successful budgeting is tracking your expenses. This includes all your monthly bills, such as rent, utilities, groceries, and transportation costs. Use our easy family budget worksheet to record your expenses and categorize them by type.

Step 4: Identify Areas to Cut Expenses

Once you’ve tracked your expenses, identify areas where you can cut costs. For example, you can reduce your dining out expenses, cancel subscriptions you don’t need, or negotiate your bills with service providers.

Step 5: Set Your Budget Limits

Based on your income and expenses, set your budget limits for each category. Make sure you allocate enough money for your essential expenses and prioritize your financial goals.

Step 6: Stick to Your Budget Plan

Finally, the most crucial step is to stick to your budget plan. Use our easy family budget worksheet to track your expenses and ensure you stay within your budget limits. Review your budget plan regularly and adjust it as necessary.

Using our easy family budget worksheet can help you keep track of your finances and stay organized. Here are some tips for using the worksheet effectively:

- Update the worksheet regularly

Make sure to update the worksheet every time you make a purchase or pay a bill. This will help you keep track of your spending and stay within your budget limits. - Categorize your expenses

Use the different categories in the worksheet to categorize your expenses by type. This will help you identify areas where you can cut costs and prioritize your spending. - Review your budget plan regularly

Review your budget plan regularly and adjust it as necessary. For example, if you find that you’re overspending in a particular category, you may need to cut back on expenses or allocate more money to that category. - Be flexible

Remember that your budget plan should be flexible and adapt to changes in your financial situation. If you experience a change in income or expenses, adjust your budget plan accordingly.

By following these tips and using our easy family budget worksheet, you can take control of your finances and achieve your financial goals.

In addition to using our easy family budget worksheet, there are other steps you can take to manage your family’s finances effectively. Here are some additional tips:

- Create an emergency fund

An emergency fund can help you cover unexpected expenses, such as a car repair or medical bill. Aim to save at least three to six months’ worth of living expenses in your emergency fund. - Reduce debt

If you have credit card debt or other high-interest loans, focus on paying off these debts as quickly as possible. This will help you save money on interest payments and free up more money for your other financial goals. - Automate your savings

Set up automatic transfers from your checking account to your savings account to make saving money easier. This will help you save money consistently and reach your financial goals faster. - Teach your children about money

Teach your children about the importance of money management from a young age. This will help them develop healthy financial habits and be more responsible with their money as they grow up.

In conclusion, managing your family’s finances can be challenging, but it’s essential for achieving your financial goals. By using our easy family budget worksheet and following these additional tips, you can take control of your finances and build a strong financial future for your family.