In the realm of business operations, managing expenses efficiently is paramount for maintaining financial health and fostering growth. Whether you’re a small startup or a large corporation, keeping track of expenditures and reporting them accurately is crucial. This is where expense report examples come into play, serving as practical templates to guide you through the process.

Understanding Expense Reports

Expense reports are detailed documents that outline the expenses incurred by individuals or teams within an organization during a specific period. These reports typically include various categories such as travel expenses, meals, lodging, transportation, supplies, and miscellaneous costs. They serve as a means of tracking spending, ensuring compliance with company policies, and facilitating reimbursement processes.

Importance of Expense Reporting

Effective expense reporting offers several benefits to businesses:

- Financial Transparency

Transparent reporting of expenses provides insights into where the company’s money is being spent, enabling informed decision-making. - Cost Control

By analyzing expense reports, businesses can identify areas of overspending and implement measures to control costs effectively. - Compliance

Adhering to established expense reporting policies ensures compliance with internal regulations and external standards, minimizing the risk of fraud or misuse of funds. - Budgeting

Accurate expense reports help in creating realistic budgets for future projects or initiatives, aligning financial resources with organizational goals.

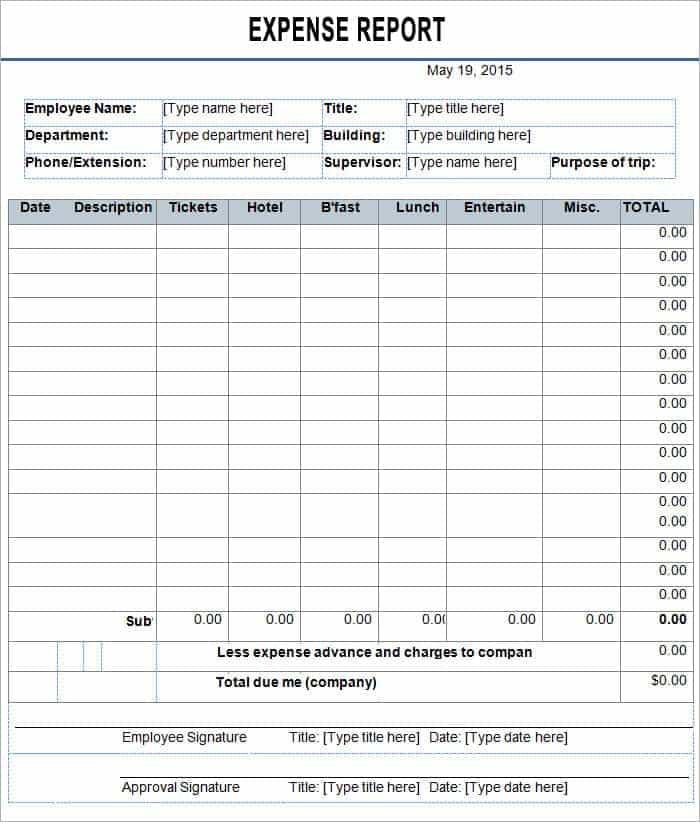

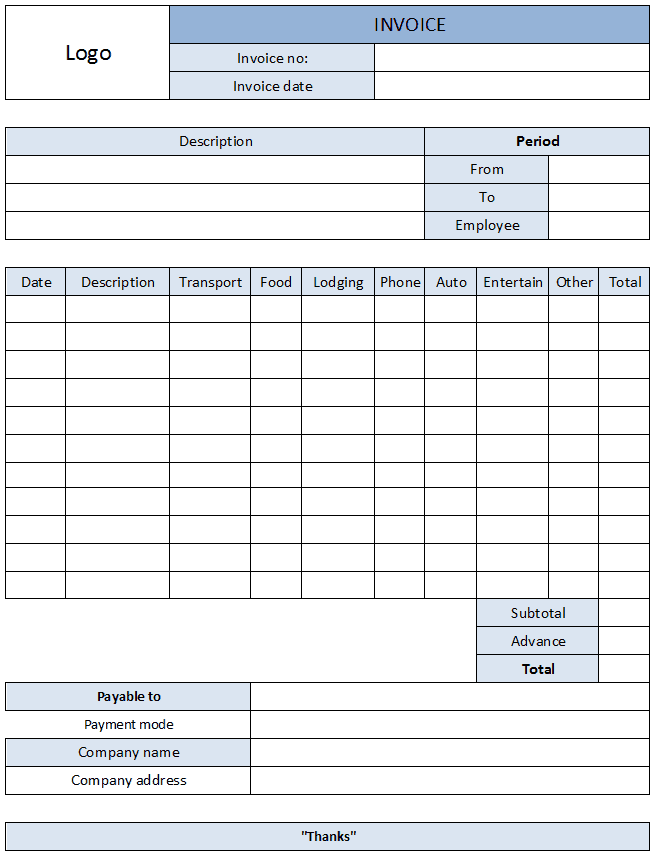

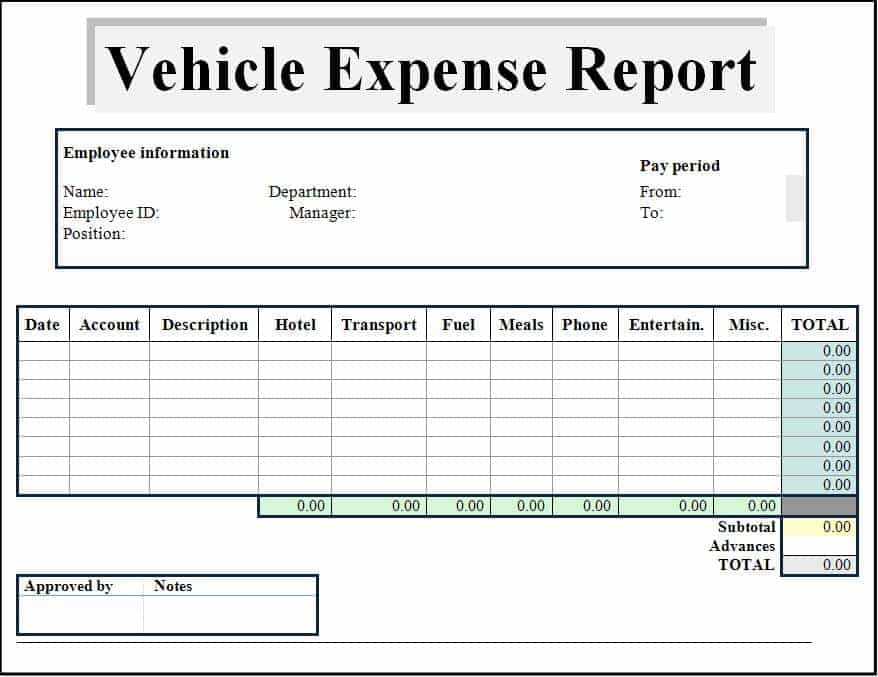

Components of an Expense Report

A well-structured expense report typically consists of the following components:

- Date and Time

Recording the date and time of each expense is essential for tracking purposes and ensuring accuracy. - Description

A brief description of the expense, including the purpose or nature of the expenditure. - Amount

The total amount spent on each expense, accompanied by supporting receipts or invoices. - Category

Expenses are categorized into relevant groups such as travel, meals, entertainment, office supplies, etc., for easy classification and analysis. - Approvals

Depending on the organization’s policies, expense reports may require approval from managers or designated personnel before processing.

Expense Report Examples

To illustrate the concept further, let’s explore some common expense report examples:

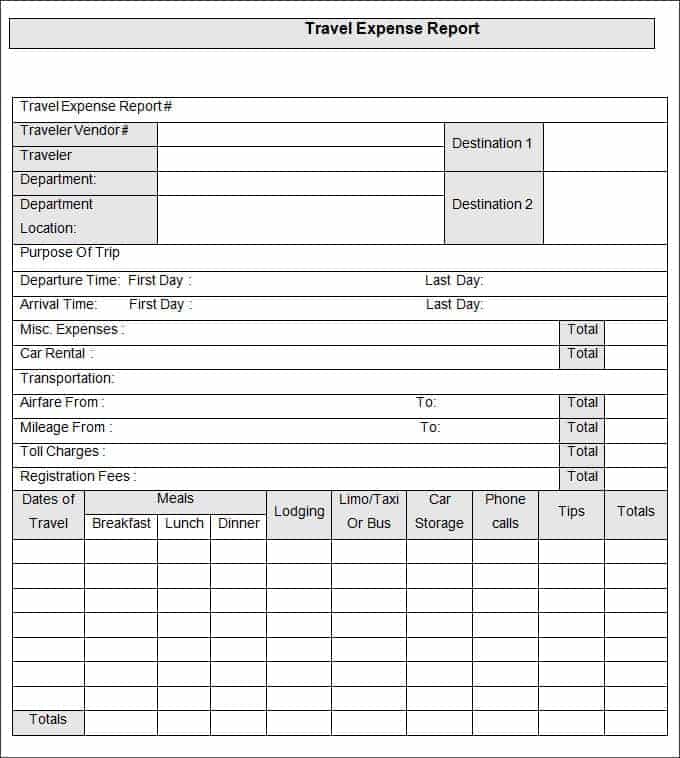

- Travel Expenses

This category includes costs associated with airfare, accommodation, ground transportation, and other travel-related expenses incurred during business trips. - Meal Expenses

Expenses related to meals and entertainment while conducting business activities, such as client meetings or team lunches. - Office Supplies

Purchases of office supplies, equipment, or software necessary for day-to-day operations. - Transportation

Expenses incurred for commuting to and from work, including fuel, parking fees, tolls, and public transportation fares. - Miscellaneous Expenses

Any other expenses not covered by the above categories, such as conference fees, postage, or business-related subscriptions.

Tips for Creating Effective Expense Reports

To optimize the efficiency of your expense reporting process, consider the following tips:

- Use Online Tools

Leverage expense management software or mobile apps to streamline the process of capturing, categorizing, and submitting expenses. - Keep Receipts Organized

Maintain a system for storing and organizing receipts electronically or physically to ensure accuracy and compliance with auditing requirements. - Be Detail-Oriented

Provide sufficient details for each expense entry, including dates, vendors, and purposes, to facilitate easy tracking and verification. - Review and Reconcile Regularly

Periodically review and reconcile expense reports to identify discrepancies or irregularities promptly. - Communicate Policies

Clearly communicate expense reporting policies and procedures to employees, offering training or guidance as needed to ensure compliance and consistency.

Leveraging Technology for Streamlined Expense Management

In today’s digital age, businesses have access to a plethora of tools and technologies designed to simplify expense management processes. Here are some innovative solutions to consider:

- Expense Management Software

Invest in specialized expense management software that automates the entire expense reporting process, from capturing receipts to generating detailed reports. These platforms often feature mobile apps for on-the-go expense tracking and approval workflows for seamless collaboration between employees and managers. - Integration with Accounting Systems

Choose expense management solutions that integrate seamlessly with your existing accounting software, such as QuickBooks or Xero. This integration ensures accurate and efficient synchronization of expense data, eliminating the need for manual data entry and reconciliation. - Receipt Scanning Technology

Explore tools that leverage optical character recognition (OCR) technology to scan and extract information from receipts automatically. This reduces the time and effort required to input expense details manually, minimizing errors and improving accuracy. - Policy Enforcement Features

Opt for solutions that allow you to configure and enforce expense policies within the system. These features help ensure compliance with company guidelines, flagging any expenses that fall outside predefined thresholds or categories for review and approval. - Real-Time Reporting and Analytics

Choose platforms that offer real-time reporting and analytics capabilities, providing valuable insights into spending patterns, trends, and potential areas for cost savings. These insights empower businesses to make data-driven decisions and optimize their expense management strategies continuously.

Conclusion: Empowering Financial Efficiency with Expense Report Examples

In today’s dynamic business landscape, effective expense management is essential for maintaining financial health, driving growth, and ensuring compliance with regulatory requirements. By leveraging practical expense report examples and embracing innovative technologies, businesses can streamline their expense reporting processes, improve accuracy, and enhance overall efficiency.

From tracking travel expenses to managing office supplies and beyond, the principles of effective expense reporting apply across various domains and industries. By adopting best practices, leveraging technology solutions, and fostering a culture of accountability and transparency, organizations can optimize their financial operations and position themselves for long-term success.

Remember, the journey towards financial efficiency begins with understanding the fundamentals of expense reporting and embracing continuous improvement. Whether you’re a seasoned finance professional or a small business owner, the insights and examples provided in this article serve as valuable resources for navigating the complexities of expense management with confidence and competence.

So, take charge of your finances, unlock the power of expense report examples, and pave the way towards a brighter, more prosperous future for your business!