Learn how to effectively manage your household finances with an expense template for home. Track your expenses, set budgets, and save money with this essential tool.

Managing household finances can be a daunting task, especially when there are numerous bills to pay and expenses to keep track of. Without proper management, it can be easy to overspend and end up with a pile of debt. Fortunately, there are tools available to help you manage your household finances effectively, and one such tool is an expense template for home.

What is an Expense Template for Home?

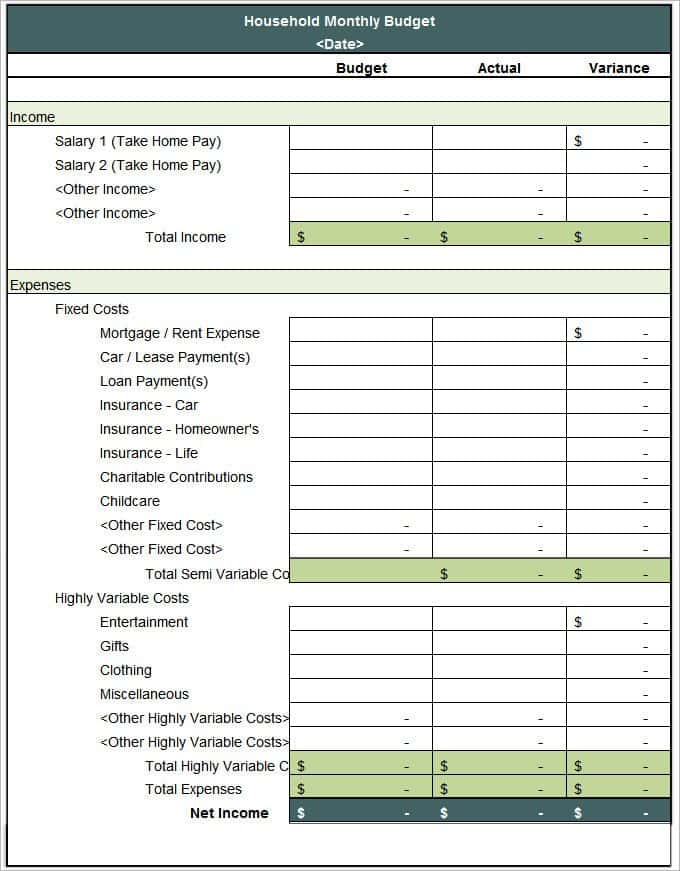

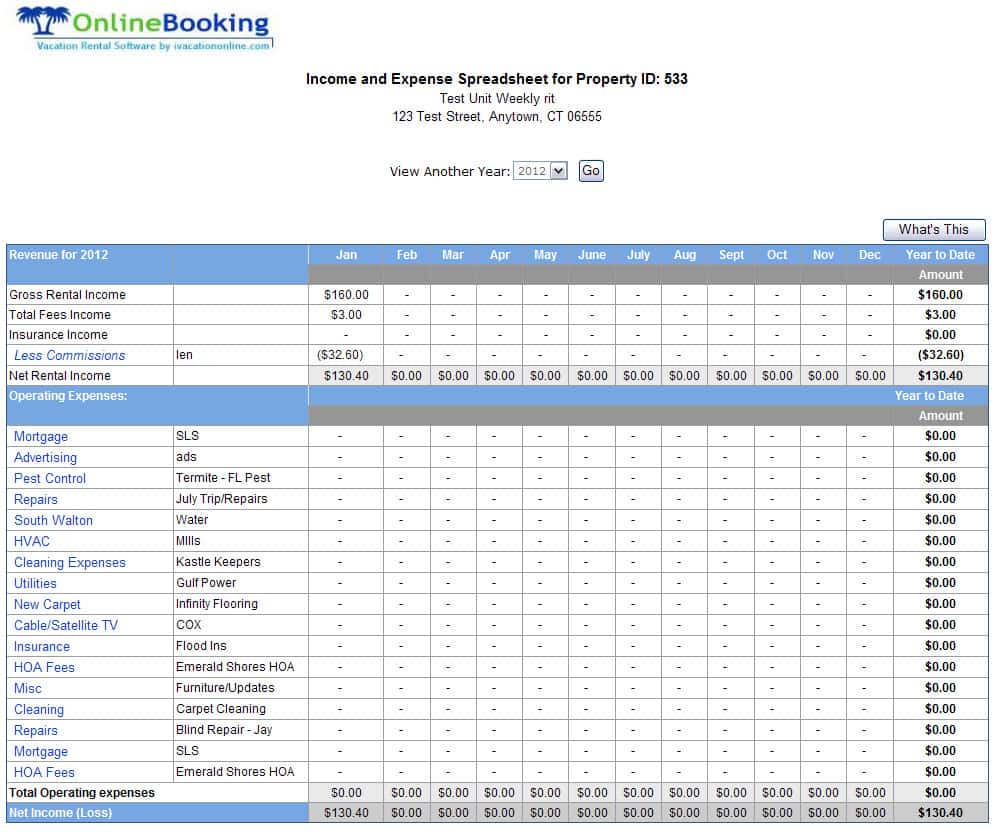

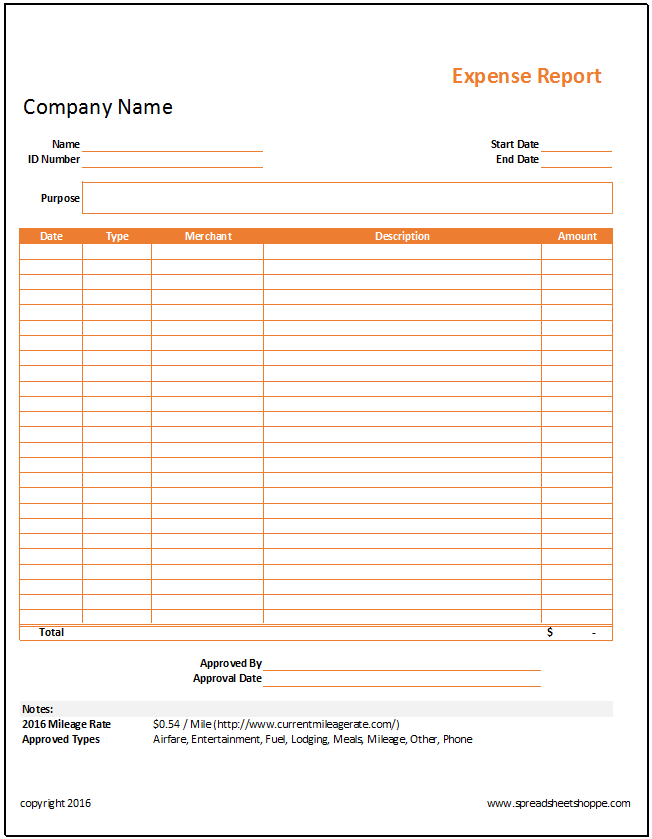

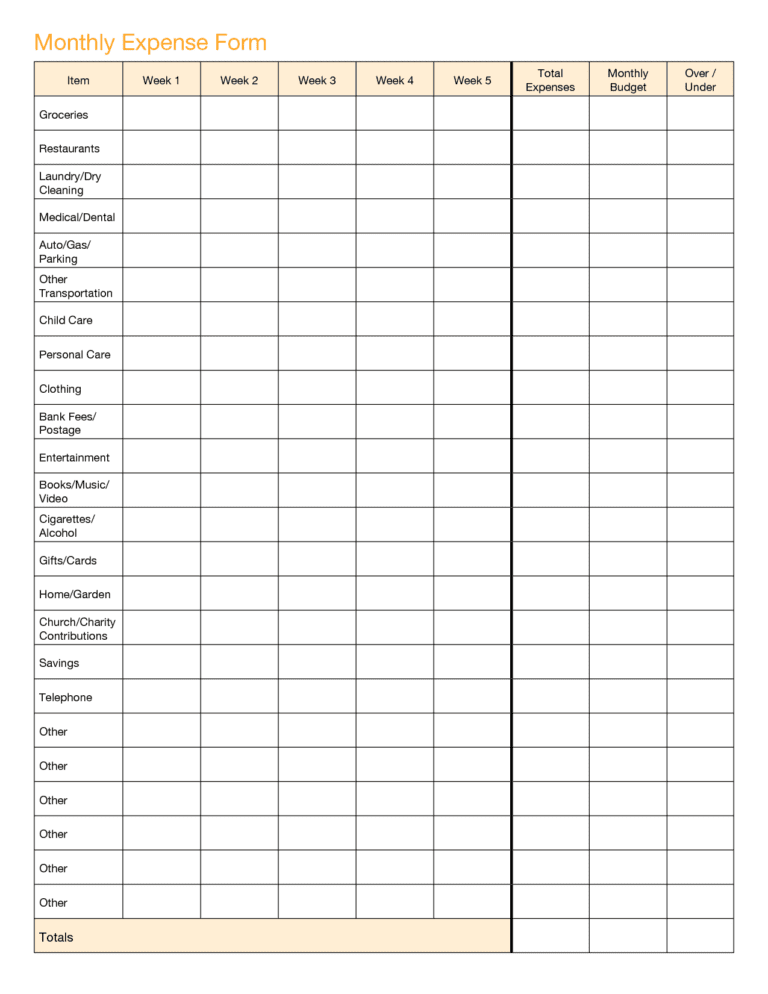

An expense template for home is a spreadsheet or document that you can use to track your household expenses. It typically includes categories for different types of expenses such as rent/mortgage, utilities, groceries, transportation, entertainment, and more. By keeping track of your expenses in an organized manner, you can identify areas where you may be overspending and make necessary adjustments.

How to Use an Expense Template for Home

Using an expense template for home is relatively easy. You can either create one from scratch or use a pre-made template that is available online. The first step is to identify all of your monthly expenses and categorize them accordingly. Once you have done that, you can start tracking your expenses by entering the amount spent in each category.

One of the benefits of using an expense template for home is that you can easily see how much you are spending in each category. This information can help you set realistic budgets for each category and make necessary adjustments to your spending habits. For example, if you notice that you are spending too much on dining out, you can set a budget for that category and make a conscious effort to reduce your spending.

Benefits of Using an Expense Template for Home

Using an expense template for home offers several benefits, including:

- Improved Financial Management

By keeping track of your expenses in an organized manner, you can identify areas where you may be overspending and make necessary adjustments. - Budgeting

An expense template for home can help you set realistic budgets for each category, which can help you save money and reduce debt. - Better Decision Making

With a clear understanding of your monthly expenses, you can make better decisions about how to allocate your money and prioritize your spending. - Financial Planning

By using an expense template for home, you can plan for future expenses and create a savings plan to achieve your financial goals.

Where to Find Expense Templates for Home

There are many expense templates available online, both free and paid. You can use popular programs like Microsoft Excel or Google Sheets to create your own expense template or download one that has already been created. Many websites offer free expense templates for home, and you can easily customize them to fit your specific needs.

Tips for Using an Expense Template for Home

To get the most out of your expense template for home, here are a few tips to keep in mind:

- Be Consistent

Make sure to consistently track your expenses each month to get an accurate view of your spending habits. - Categorize Your Expenses

Organize your expenses into categories to help you identify where you are overspending and where you can make adjustments. - Review Your Spending Habits Regularly

Set aside time each month to review your spending habits and make necessary adjustments to your budget. - Be Realistic

When setting budgets, be realistic about how much you can spend in each category. If you set unrealistic budgets, you may become discouraged and give up on using your expense template altogether.

In conclusion, an expense template for home is a valuable tool that can help you effectively manage your household finances. By tracking your expenses in an organized manner, you can identify areas where you may be overspending, set budgets, and make necessary adjustments to your spending habits. With consistent use and regular reviews, an expense template for home can help you achieve your financial goals and secure your financial future.