Simplify Your Expense Reporting with a Per Diem Expense Report Template

Keep track of your daily expenses with ease using a Per Diem Expense Report Template. Learn how to use one and get your hands on a free template here!

Are you tired of manually keeping track of your expenses while on a business trip? Look no further than a Per Diem Expense Report Template. This tool simplifies the process of expense reporting by allowing you to record your daily expenses in an organized and efficient manner.

What is a Per Diem Expense Report Template?

A Per Diem Expense Report Template is a pre-designed document that you can use to keep track of your daily expenses while on a business trip. The template typically includes sections for recording meals, transportation, lodging, and other miscellaneous expenses. The purpose of this template is to make it easy for you to report your expenses to your employer or accounting department.

How to Use a Per Diem Expense Report Template?

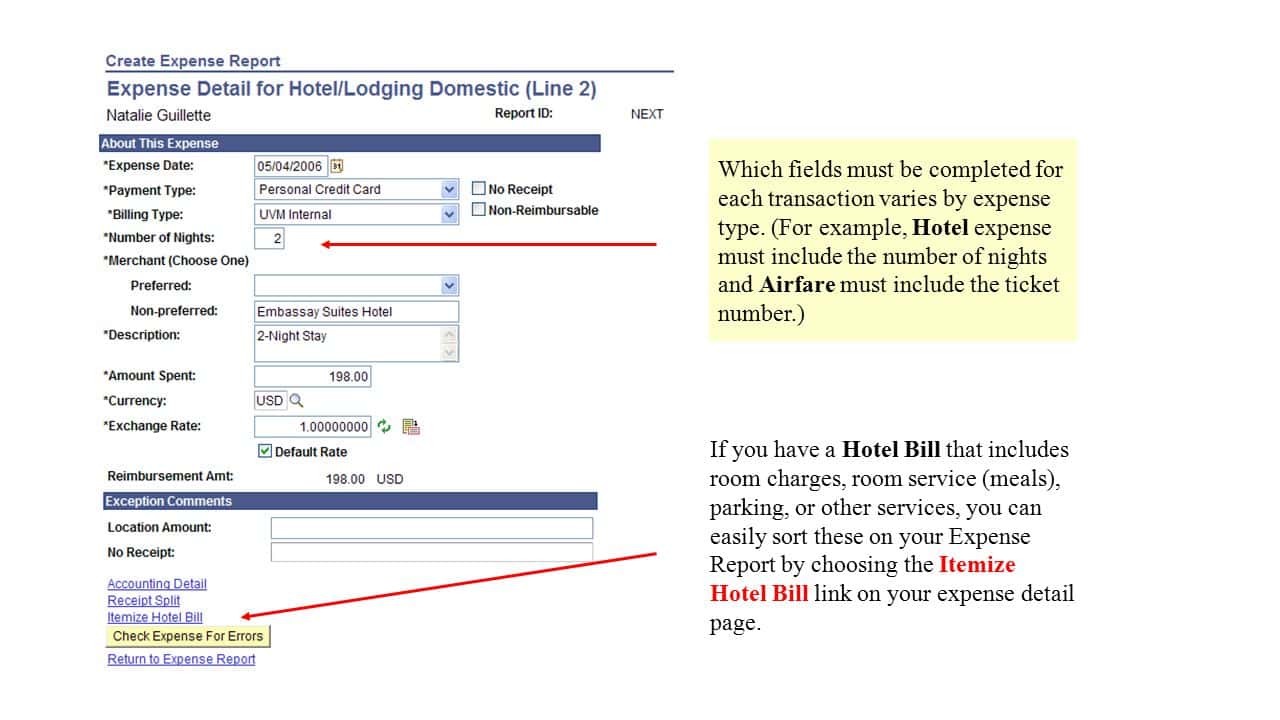

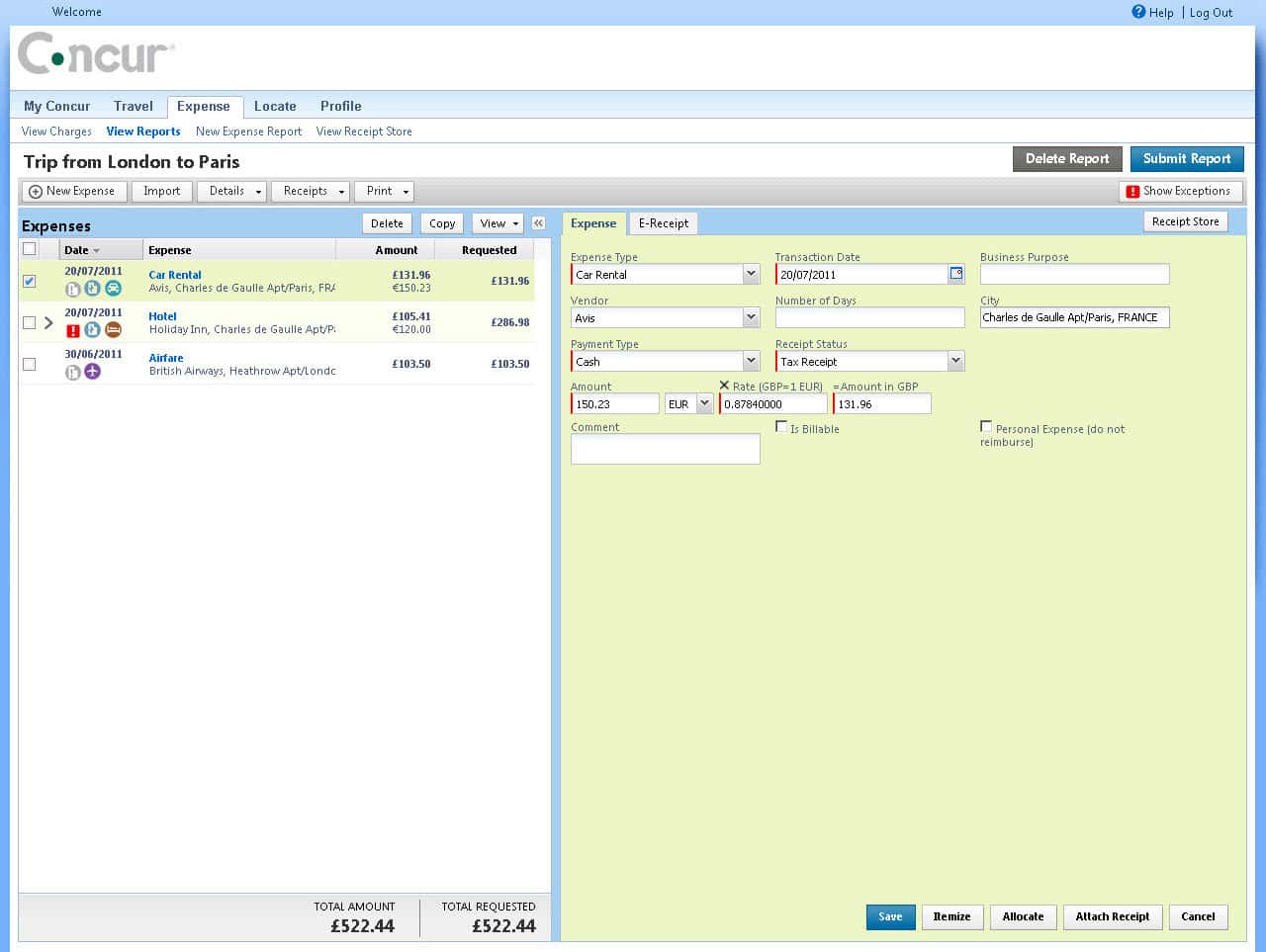

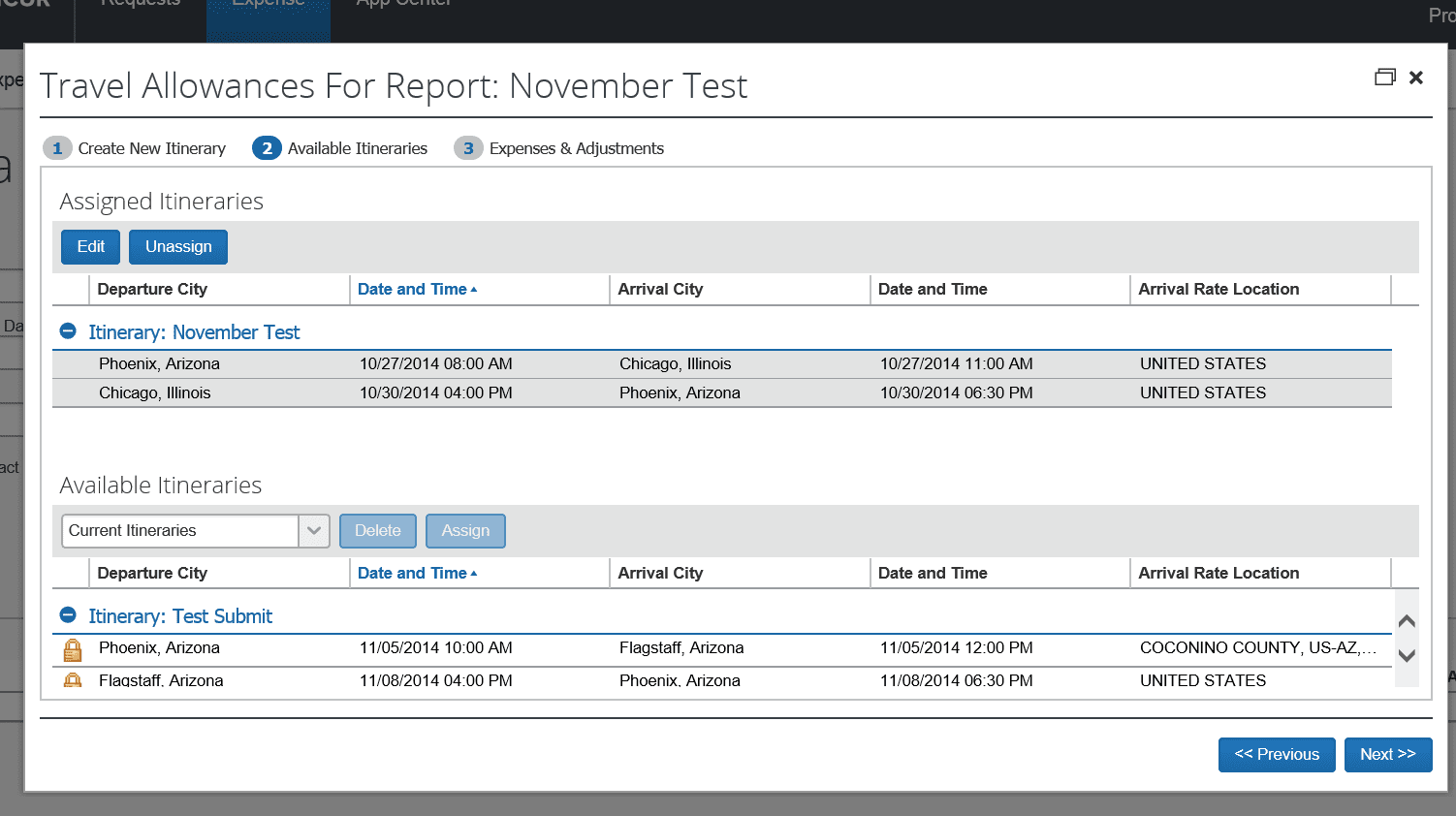

Using a Per Diem Expense Report Template is easy. Simply download the template and customize it to suit your needs. You can add or remove sections as necessary to ensure that you are recording all of your expenses accurately.

Once you have customized your template, begin filling in your daily expenses. Be sure to record the date, amount, and purpose of each expense. If you have any receipts, attach them to your expense report to provide evidence of your spending.

Benefits of Using a Per Diem Expense Report Template

Using a Per Diem Expense Report Template offers several benefits, including:

- Increased accuracy: By using a pre-designed template, you can ensure that you are recording all of your expenses accurately. This reduces the risk of errors and makes it easier for your employer or accounting department to process your expenses.

- Time-saving: Manually tracking your expenses can be time-consuming, especially if you are on a long business trip. A Per Diem Expense Report Template allows you to record your expenses quickly and efficiently, freeing up more time for you to focus on your work.

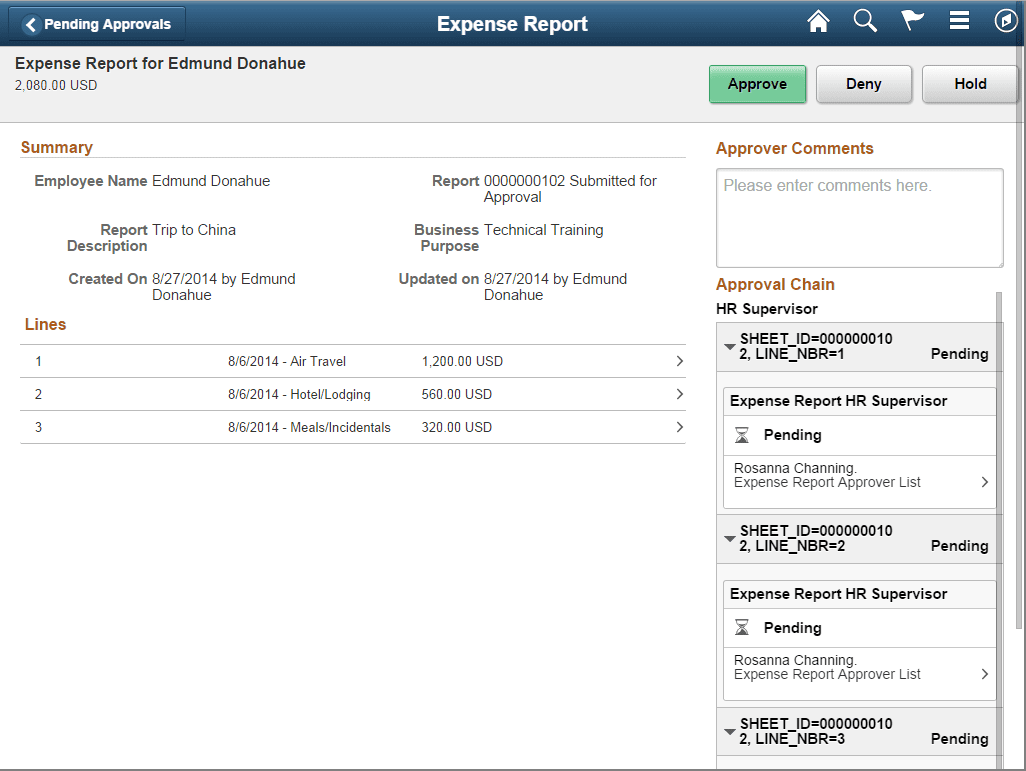

- Easy reporting: With a Per Diem Expense Report Template, you can easily report your expenses to your employer or accounting department. The template provides a clear and organized record of your expenses, making it easier for others to review and process your expenses.

Conclusion

A Per Diem Expense Report Template is a valuable tool for anyone who travels for business. By using this template, you can easily keep track of your expenses, reduce errors, save time, and make reporting your expenses a breeze. Download our free template today and start simplifying your expense reporting!

Additionally, using a Per Diem Expense Report Template can help you stay within your budget. By keeping track of your expenses, you can easily see how much you have spent and how much you have left to spend. This can prevent overspending and ensure that you stay on track with your budget.

When it comes to business travel, expense reporting can be a hassle. However, with a Per Diem Expense Report Template, the process can be streamlined and stress-free. You can rest assured that your expenses are being accurately recorded and easily reported to your employer or accounting department.

In conclusion, a Per Diem Expense Report Template is a simple but powerful tool that can save you time, reduce errors, and make expense reporting a breeze. Download our free template today and start simplifying your expense reporting. Happy travels!