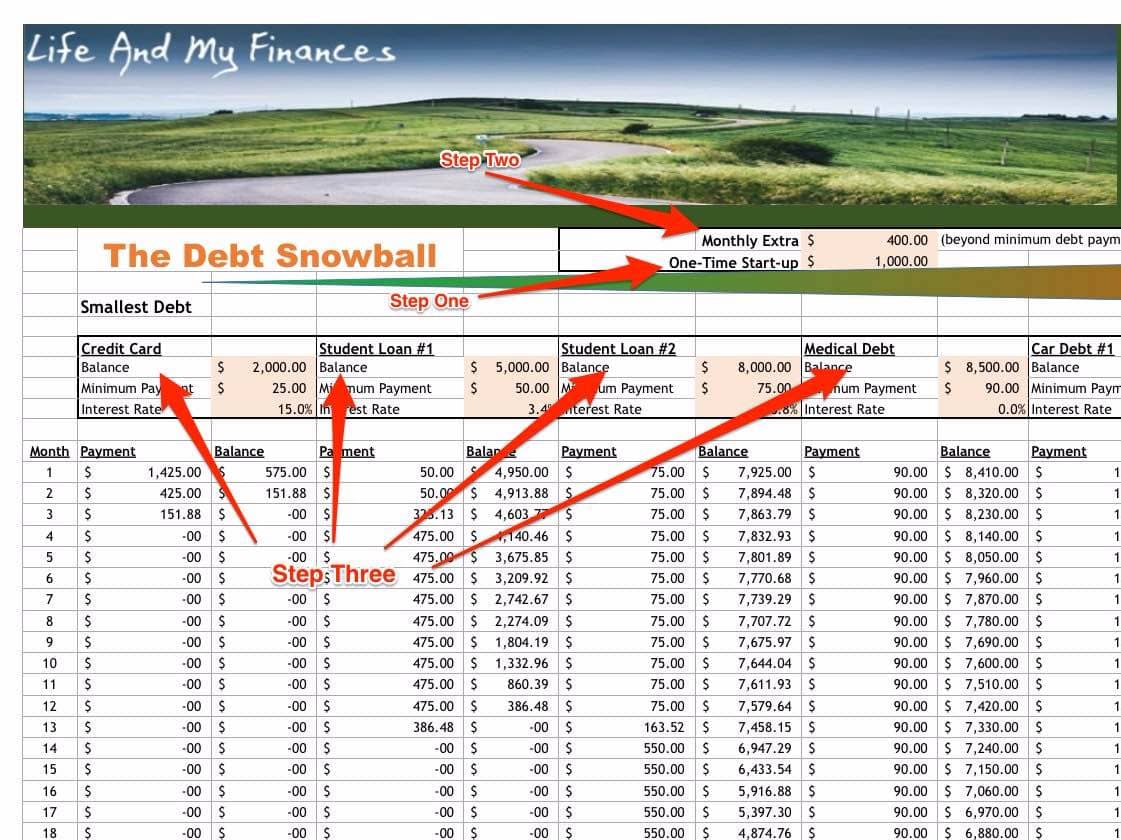

Preparing to pay off debt is crucial. How you go about paying off debt depends on your own personal situation and how much money you have to pay each month. If you are finding it difficult to make ends meet, getting your debts paid off can be very difficult and possibly even impossible.

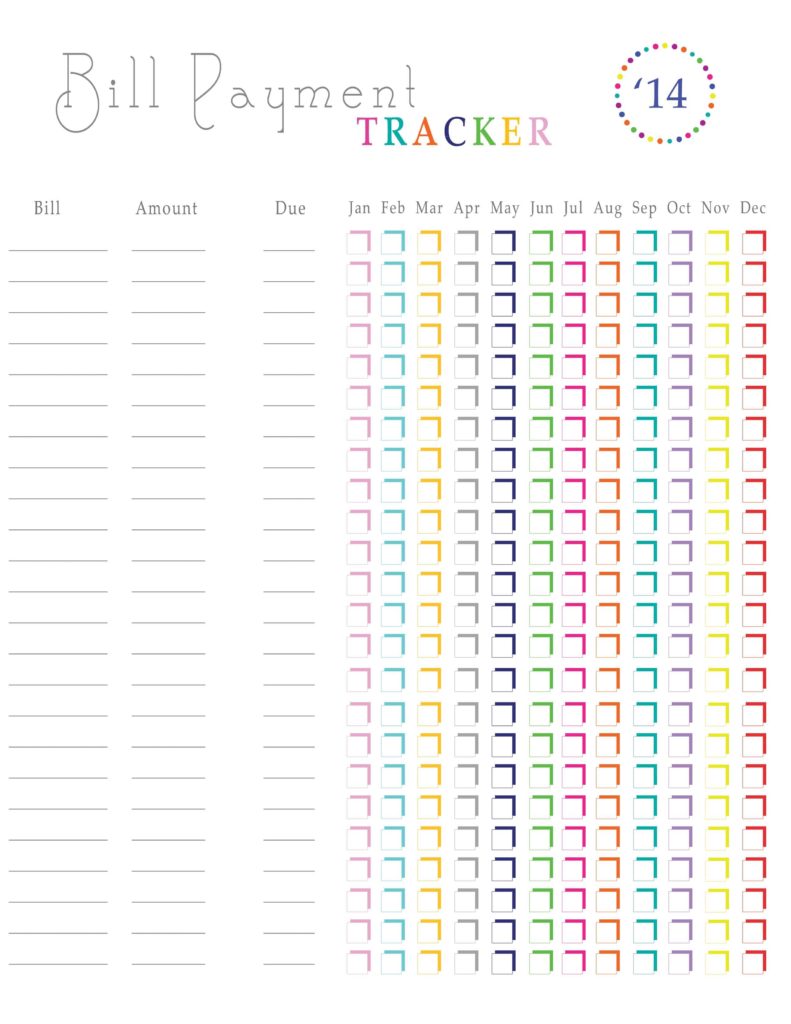

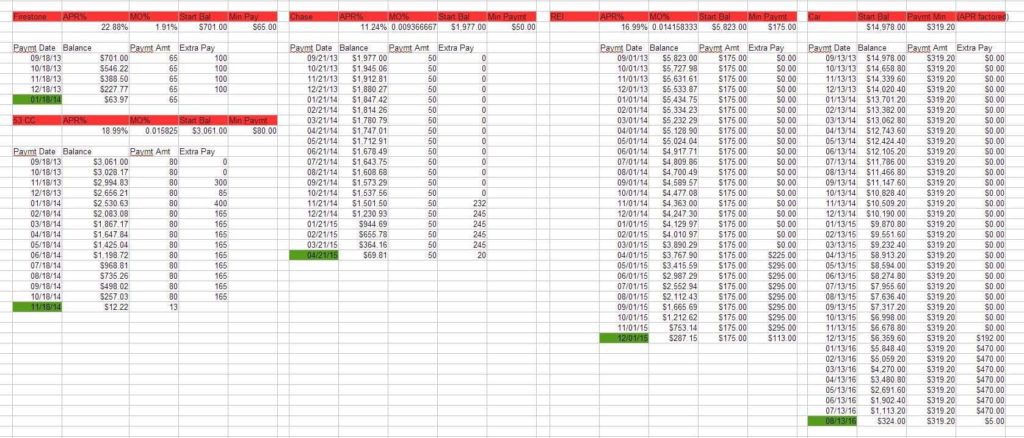

Fortunately, you do not need to be a professional accountant to prepare a spreadsheet sample. The spreadsheet will allow you to keep track of your monthly debt payments and see what you are spending most of your money on. In this way, you can be sure that you are not losing out on too much.

This is also the first step in creating a debt management plan. Your spreadsheet should include all of your debt, including current and past due payments. You will also need to list all of your other expenses, which can include transportation costs, utilities, groceries, and anything else that will be deducted from your account every month.

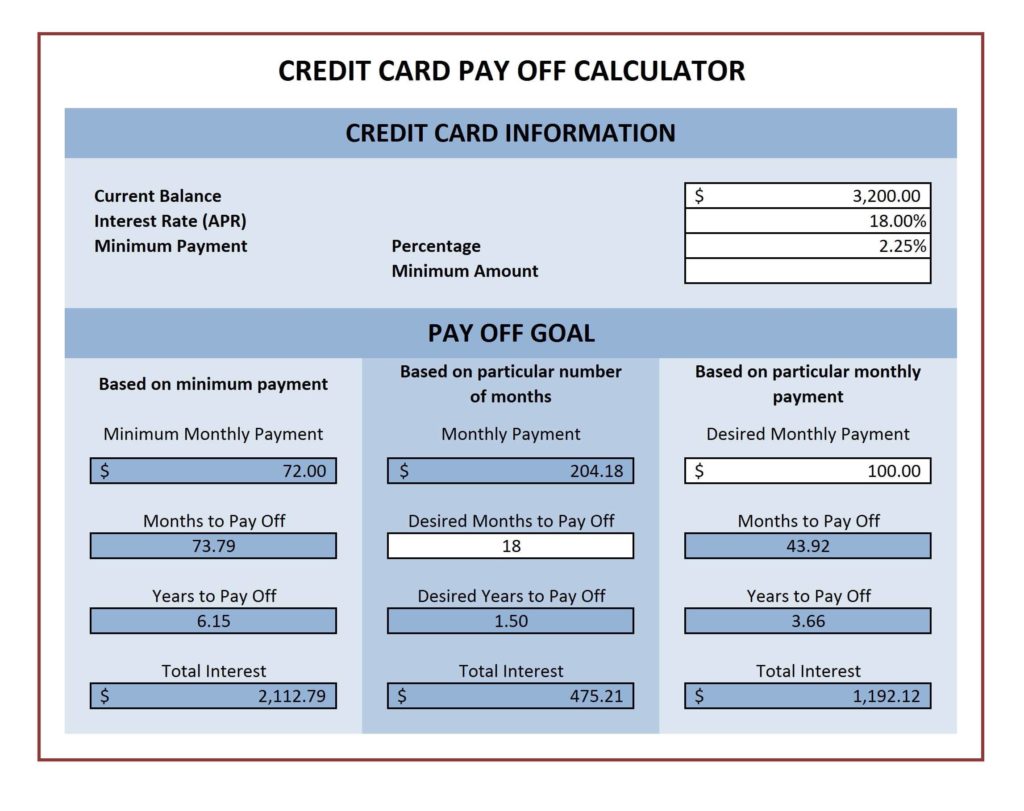

Once you have everything listed out, you will be able to calculate how much money you have left over after subtracting your current year’s expenses from your income. This figure can be used to find the exact amount you need to pay off each of your debts. Next, you will need to make some calculations to figure out how much you need to be putting away each month. Keep in mind that this figure will change depending on how much you are currently paying on your debts.

Use the calculator to figure out how much each of your debts needs to be paid for each month, then add up all of these figures and make a minimum monthly payment. When you find that you need to put extra money aside each month, add an extra dollar or two for each of your debts. The best thing about your spreadsheet is that you can quickly adjust the amount that you need to put aside each month to make sure that you do not run out of money.

If you have any money leftover each month, you will need to budget for a separate amount for each of your debts each month. Now, when you find that you still do not have enough money to cover your debts, take the extra amount you had left and put it towards one of your debts. Make sure that you are sticking to your budget by not using this extra money for anything else.

This is the easy part of creating a spread sheet. The next step is to commit to paying off your debts and set a schedule for each of your debts. Your spreadsheet should tell you how much money you need to put aside each month so that you do not run out of money before you finish paying off your debts.

The important thing to remember is that a spreadsheet can help you in achieving financial freedom. You do not need to be a professional accountant to use a spreadsheet to help you make wise decisions about your finances. The spreadsheet can be used to keep track of your payments and make sure that you are paying off your debts in the best way possible.