Donation Spreadsheet Template: Simplify Your Fundraising Efforts

Streamline your donation tracking and fundraising efforts with a donation spreadsheet template. Read on to learn more about how this tool can make your life easier.

Are you tired of manually tracking your donations and fundraising efforts? Are you struggling to keep track of who has donated and how much they’ve given? If so, a donation spreadsheet template may be just what you need to simplify your life.

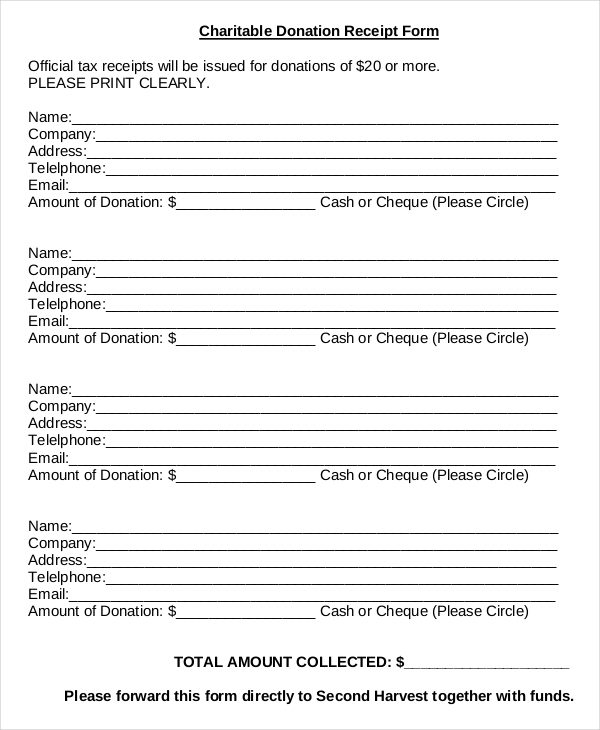

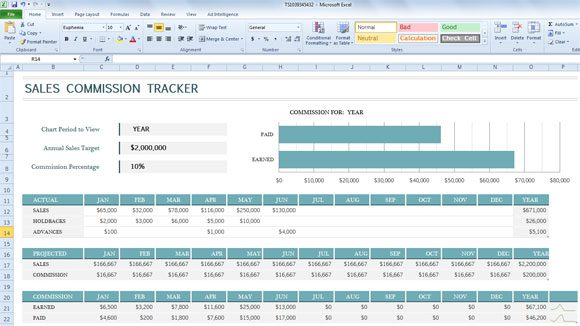

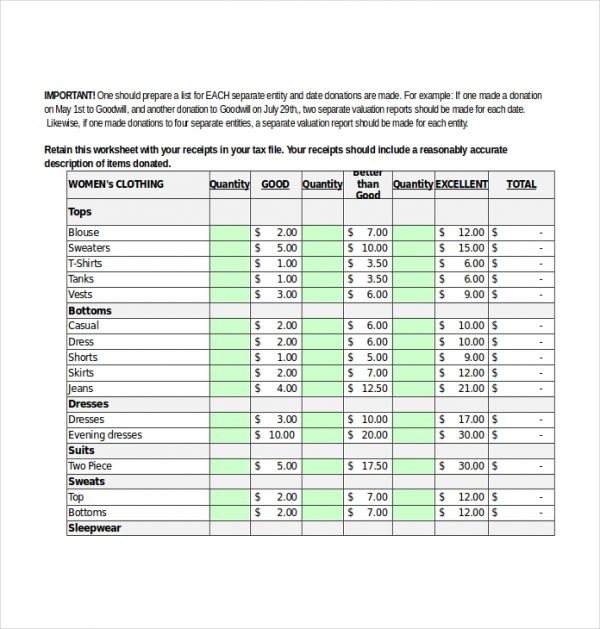

A donation spreadsheet template is a pre-made Excel or Google Sheets document that is specifically designed to track donations and fundraising efforts. It can help you keep track of your donors, their contact information, how much they’ve donated, and when they donated. Additionally, it can help you set goals, track progress, and generate reports to show your progress.

Here are just a few ways that a donation spreadsheet template can make your fundraising efforts easier:

- Streamlined tracking

With a donation spreadsheet template, you can easily track donations and fundraising efforts in one place. No more sifting through emails, spreadsheets, and other documents to figure out who has donated and how much they’ve given. - Automated calculations

Most donation spreadsheet templates come with built-in formulas that automatically calculate totals, percentages, and other important metrics. This saves you time and ensures accuracy. - Goal setting

A donation spreadsheet template can help you set fundraising goals and track progress towards those goals. This can motivate you and your team to keep pushing towards your target. - Reporting

With a donation spreadsheet template, you can generate reports that show your progress towards your fundraising goals. This can be especially helpful when reporting to stakeholders, board members, or donors.

If you’re ready to simplify your fundraising efforts and streamline your donation tracking, consider using a donation spreadsheet template. There are many templates available online, some of which are free and others that require a small fee. Choose the one that works best for you and get started today!

When choosing a donation spreadsheet template, consider your specific needs and the type of fundraising efforts you will be undertaking. For example, if you are running a crowdfunding campaign, you may want a template that has a section for rewards or perks for donors. Or if you are hosting an event, you may want a template that has a section for ticket sales.

It’s also important to make sure that the donation spreadsheet template you choose is customizable. While pre-made templates can save you time and effort, they may not be a perfect fit for your organization or campaign. Look for a template that allows you to add or remove columns, adjust formulas, and customize the layout to suit your needs.

Using a donation spreadsheet template can also help you keep your donors’ information organized and secure. Make sure that you are using a template that is compliant with data privacy regulations and that you are storing donor information securely.

In addition to tracking donations and fundraising efforts, a donation spreadsheet template can also help you identify trends and opportunities for improvement. By analyzing your donation data, you may be able to identify which donors are your biggest supporters, which fundraising methods are most effective, and which areas you need to focus on to improve your fundraising efforts.

In conclusion, a donation spreadsheet template is a valuable tool for any organization or individual who is involved in fundraising efforts. By simplifying the tracking and organization of donations, you can save time and effort, stay organized, and focus on reaching your fundraising goals. With many templates available online, you’re sure to find one that meets your needs and makes your life easier.