A Sample Profit and Loss Statement Form is a financial document that provides insights into a company’s financial performance. Read on to learn more about this crucial form and how to prepare it.

Running a successful business requires a deep understanding of your company’s financial performance. One of the most critical financial documents that you need to prepare regularly is the Sample Profit and Loss Statement Form.

The Sample Profit and Loss Statement Form, also known as an income statement, provides insights into your company’s financial performance over a specific period. The form shows your business’s revenue, costs, and expenses, allowing you to track your profitability and make informed decisions about your operations.

In this article, we will provide you with a comprehensive guide on understanding Sample Profit and Loss Statement Form and how to prepare it for your business.

What is a Sample Profit and Loss Statement Form?

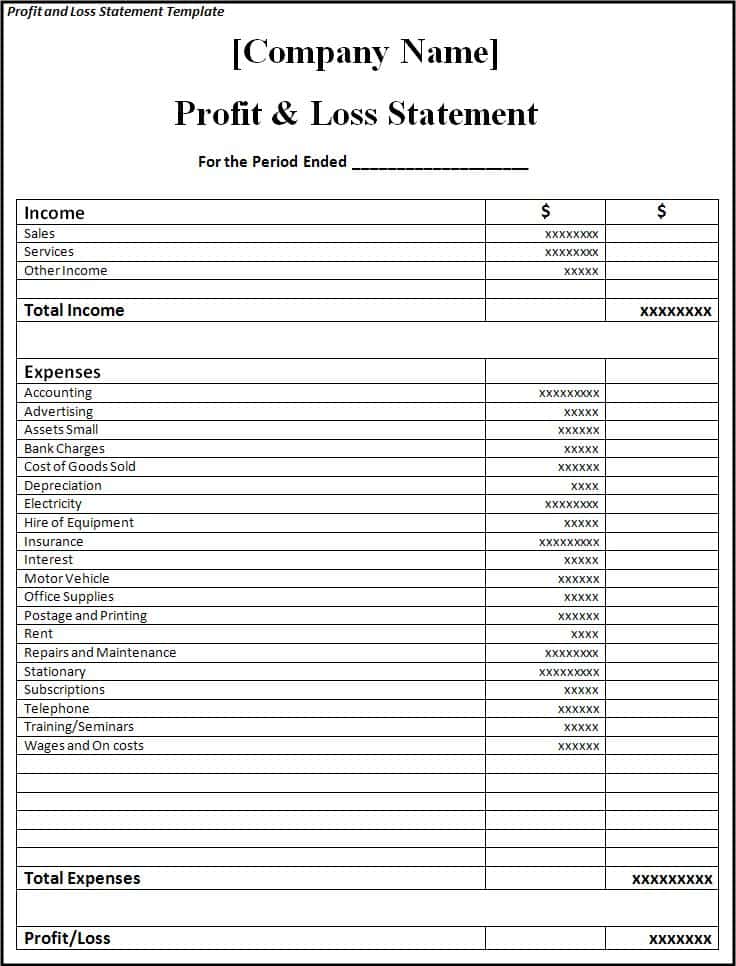

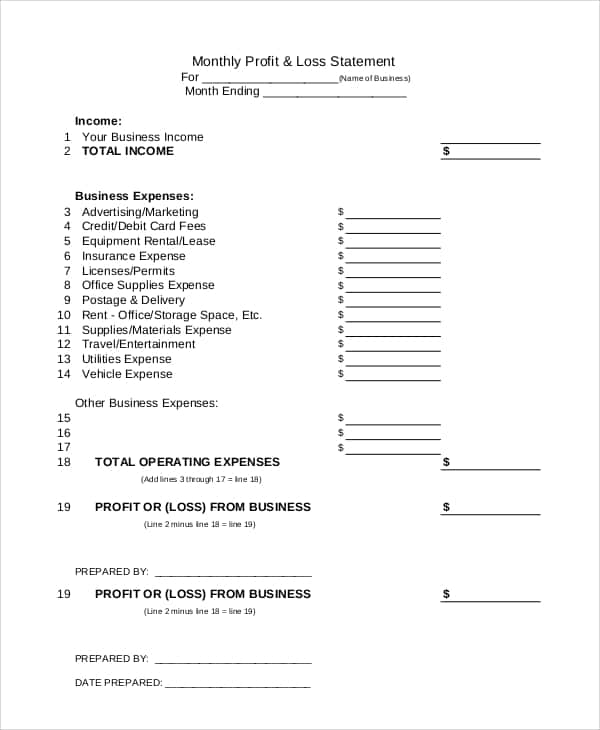

A Sample Profit and Loss Statement Form is a financial document that summarizes your company’s revenue, costs, and expenses for a particular period, usually a month, quarter, or year. The form provides insights into your business’s profitability and helps you identify areas of your operations that need improvement.

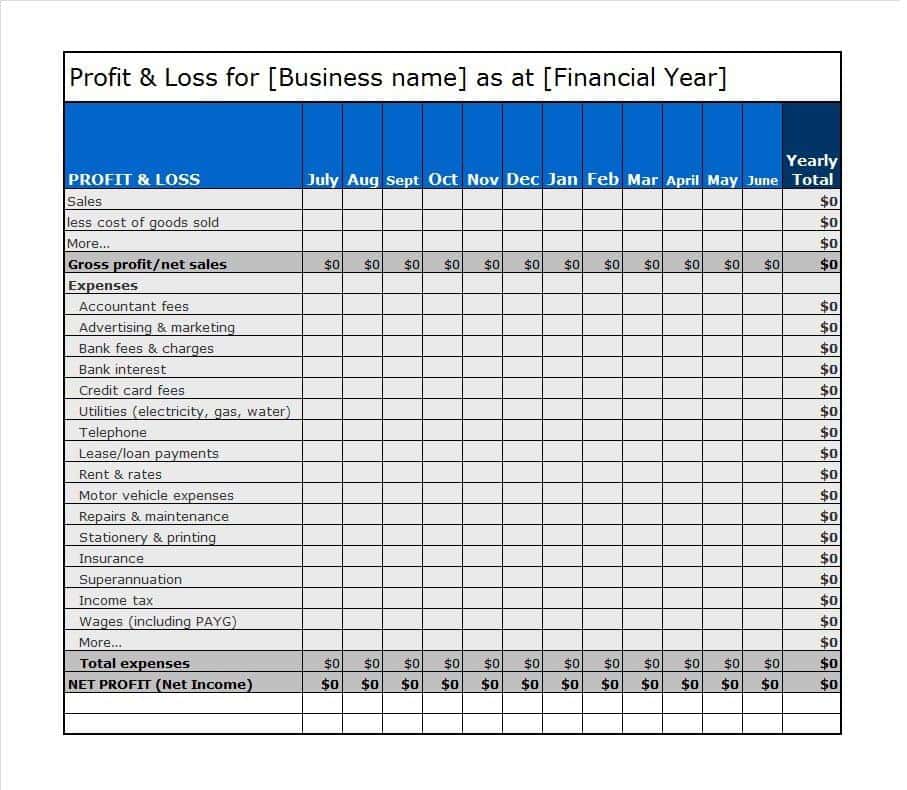

The Sample Profit and Loss Statement Form comprises two main sections: the revenue section and the expense section. The revenue section includes all the money that your business has earned during the period, while the expense section lists all the costs associated with running your business, such as rent, salaries, and utilities.

Why is a Sample Profit and Loss Statement Form Important?

Preparing a Sample Profit and Loss Statement Form is critical for every business, regardless of its size or industry. Here are some reasons why:

- Helps you make informed business decisions

The Sample Profit and Loss Statement Form provides insights into your company’s financial performance, allowing you to make informed decisions about your business’s future. - Tracks your profitability

The Sample Profit and Loss Statement Form shows your company’s revenue, costs, and expenses, allowing you to track your profitability over time. - Identifies areas for improvement

By analyzing your Sample Profit and Loss Statement Form, you can identify areas of your operations that need improvement, such as reducing costs or increasing revenue.

How to Prepare a Sample Profit and Loss Statement Form?

Preparing a Sample Profit and Loss Statement Form may seem daunting at first, but it’s a straightforward process that you can complete with ease. Here’s a step-by-step guide to help you prepare your Sample Profit and Loss Statement Form:

Step 1: Gather your financial information

To prepare your Sample Profit and Loss Statement Form, you need to gather your financial information, such as your revenue, costs, and expenses. Make sure to organize your financial data in a spreadsheet or accounting software to ensure accuracy and efficiency.

Step 2: Calculate your revenue

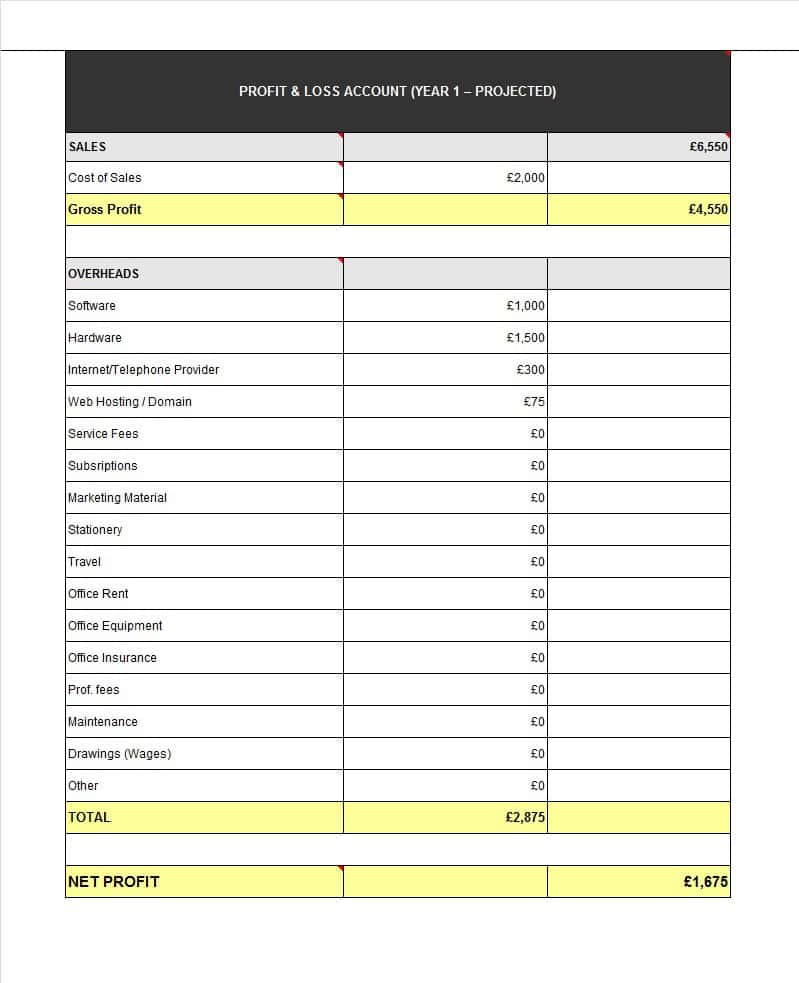

The revenue section of your Sample Profit and Loss Statement Form includes all the money that your business has earned during the period. To calculate your revenue, add up all the money that your business has received from sales, services, and other sources.

Step 3: Calculate your costs of goods sold

If your business sells products, you need to calculate your costs of goods sold (COGS), which includes all the costs associated with producing and delivering your products. To calculate your COGS, subtract your ending inventory from your beginning inventory and add the cost of any additional inventory purchased during the period.

Step 4: Calculate your gross profit

Your gross profit is the difference between your revenue and your COGS. To calculate your gross profit, subtract your COGS from your revenue.

Step 5: Calculate your operating expenses

The expense section of your Sample Profit and Loss Statement Form includes all the costs associated with running your business, such as rent, salaries, and utilities. To calculate your operating expenses, add up all the costs associated with your business operations, including marketing, advertising, legal fees, office supplies, and any other expenses.

Step 6: Calculate your net income

Your net income is the profit or loss your business has made during the period. To calculate your net income, subtract your operating expenses from your gross profit.

Step 7: Review and analyze your Sample Profit and Loss Statement Form

Once you have completed all the calculations, review and analyze your Sample Profit and Loss Statement Form to gain insights into your business’s financial performance. Look for trends, patterns, and areas that need improvement, such as reducing costs or increasing revenue.

Conclusion

In conclusion, a Sample Profit and Loss Statement Form is a critical financial document that provides insights into your business’s financial performance. By preparing and analyzing your Sample Profit and Loss Statement Form regularly, you can make informed decisions about your business’s future, track your profitability, and identify areas for improvement.

Remember to keep accurate records of your financial data and use accounting software or spreadsheets to ensure efficiency and accuracy. With the right tools and knowledge, preparing and analyzing your Sample Profit and Loss Statement Form can be a straightforward and valuable process for your business’s success.