Keep track of your business finances and make informed decisions with a Profit and Loss Statement Template for Self Employed. Learn how to create and use one with our comprehensive guide.

As a self-employed individual, it can be challenging to keep track of your finances, especially when it comes to determining your profits and losses. This is where a Profit and Loss Statement Template for Self Employed comes in handy. In this article, we’ll guide you through the process of creating and using a Profit and Loss Statement Template to help you make informed business decisions.

What is a Profit and Loss Statement?

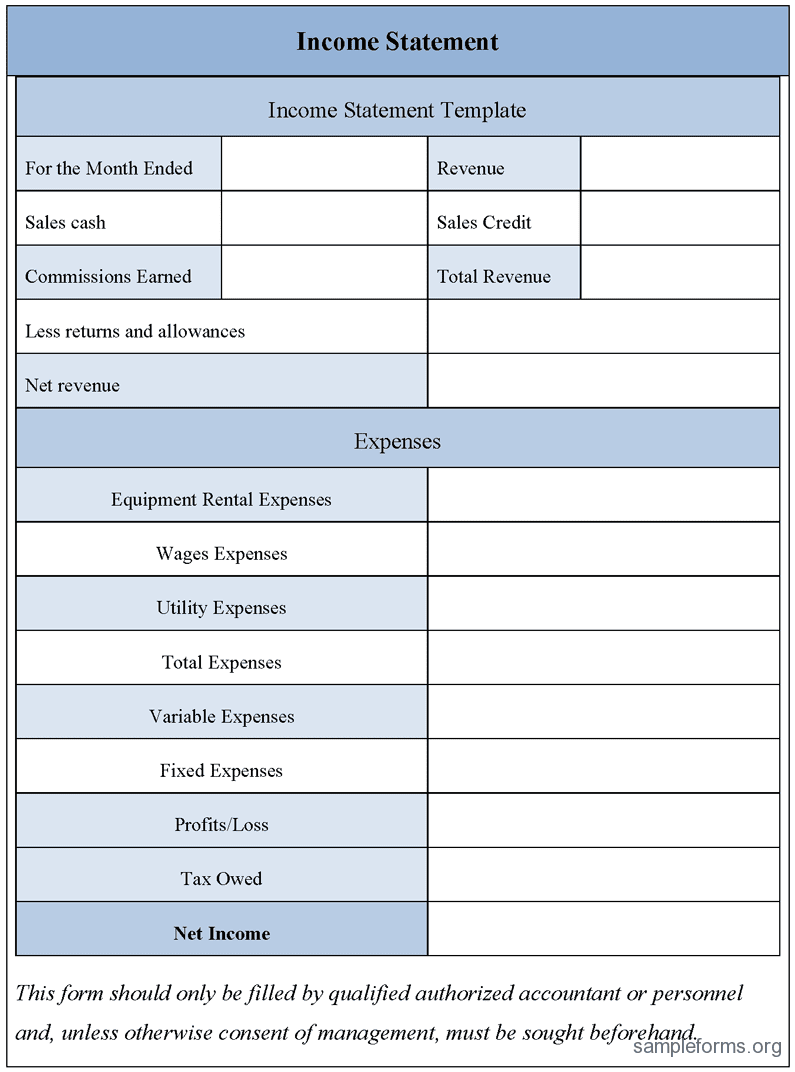

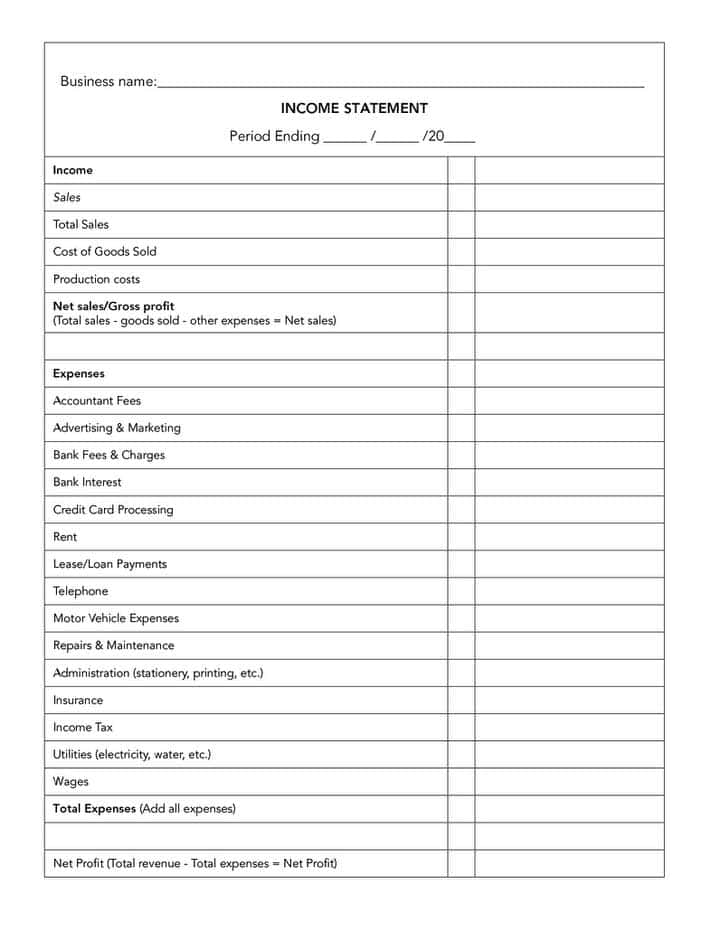

A Profit and Loss (P&L) Statement, also known as an income statement, is a financial report that shows the revenues and expenses of a business during a specific period. The purpose of this statement is to provide an overview of a company’s financial performance and profitability. It is an essential tool for monitoring the financial health of your business and making informed decisions.

Why is a Profit and Loss Statement important for Self Employed individuals?

As a self-employed individual, you are responsible for managing all aspects of your business, including your finances. A Profit and Loss Statement helps you keep track of your income and expenses, giving you an accurate picture of your financial situation. This information is critical when making important business decisions, such as whether to invest in new equipment, hire additional staff, or expand your business.

Creating a Profit and Loss Statement Template for Self Employed

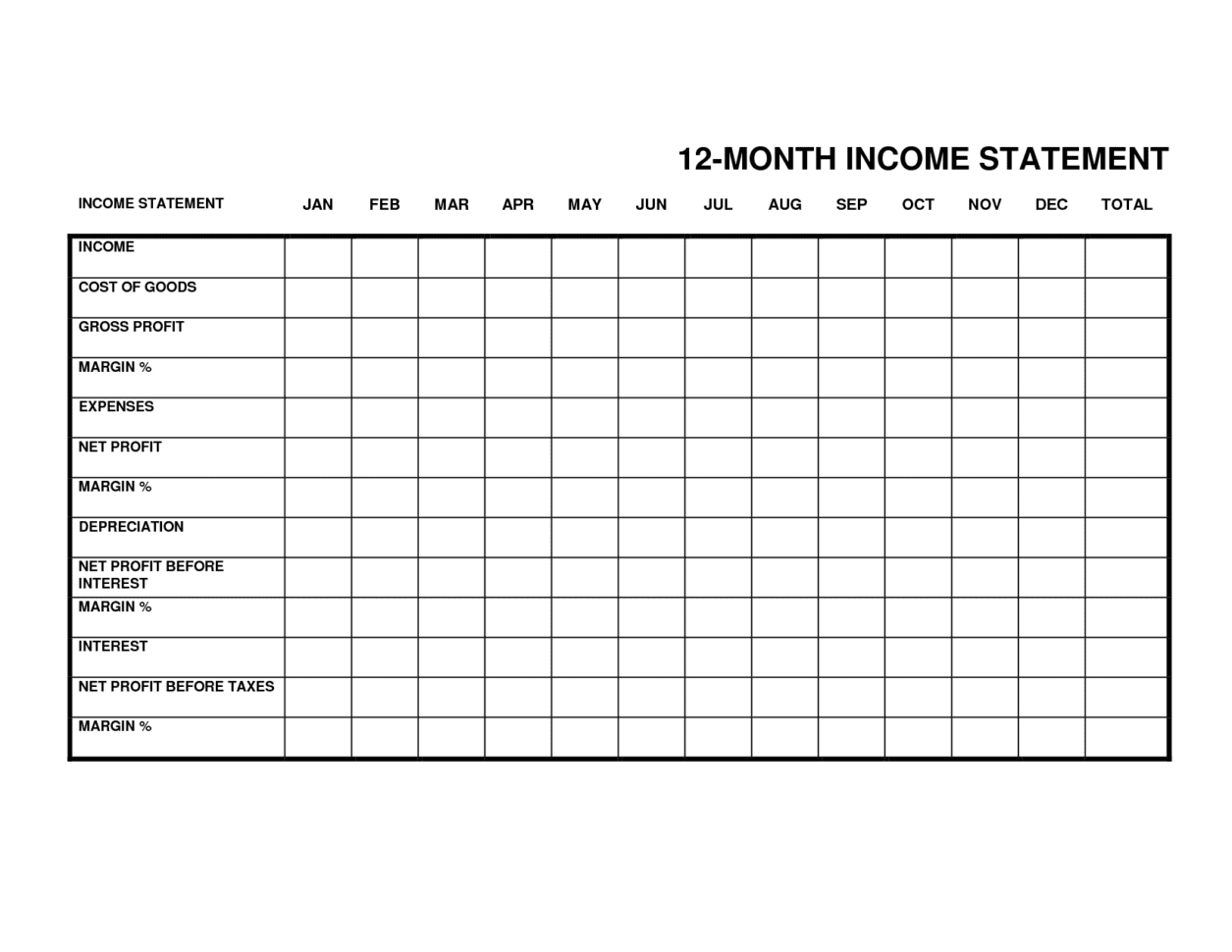

Creating a Profit and Loss Statement Template is not as complicated as it may seem. You can create one using a spreadsheet program like Microsoft Excel or Google Sheets. The template should include the following categories:

- Revenue

This includes all the income generated by your business, such as sales, services rendered, or any other sources of revenue. - Cost of Goods Sold (COGS)

This category includes all the expenses directly related to producing or delivering your products or services, such as raw materials, labor, and shipping. - Gross Profit

This is calculated by subtracting the COGS from your revenue. - Operating Expenses

This category includes all the expenses associated with running your business, such as rent, utilities, insurance, and office supplies. - Net Profit

This is calculated by subtracting the operating expenses from the gross profit.

Using a Profit and Loss Statement Template for Self Employed

Once you have created your Profit and Loss Statement Template, you can use it to monitor your financial performance and make informed business decisions. Here are some tips to help you use your template effectively:

- Update your template regularly

Make sure to update your template regularly to reflect your current financial situation. - Compare your performance to previous periods

Comparing your current financial performance to previous periods can help you identify trends and make necessary adjustments. - Use your template to create a budget

Your Profit and Loss Statement Template can be used to create a budget for your business, helping you plan your expenses and manage your cash flow effectively.

Conclusion

We hope this guide has provided you with valuable insights into creating and using a Profit and Loss Statement Template for Self Employed individuals. However, if you find yourself struggling to create one or interpret the financial data, it may be helpful to seek assistance from a professional accountant or bookkeeper.

Remember, understanding your business’s financial performance is crucial for making informed decisions and growing your business. A Profit and Loss Statement Template is just one tool to help you achieve this goal. By using it regularly and analyzing the data, you can gain a better understanding of your business’s financial health and take proactive steps to improve it.

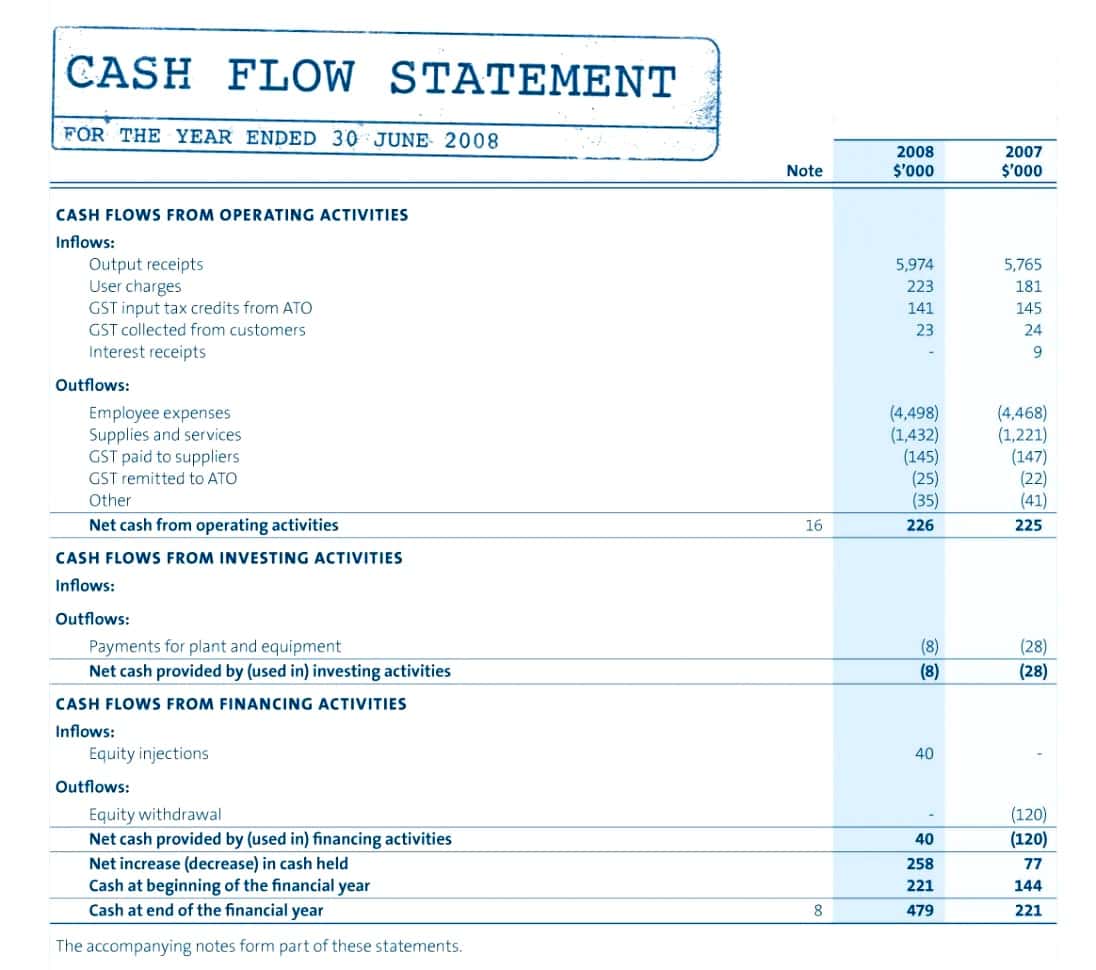

In addition to a Profit and Loss Statement Template, there are other financial reports and tools that self-employed individuals should consider, such as a balance sheet and cash flow statement. These reports provide a more comprehensive view of your business’s financial situation and can help you make more informed decisions.

In conclusion, managing your finances as a self-employed individual can be challenging, but with the right tools and knowledge, you can take control of your business’s financial performance. We encourage you to create and use a Profit and Loss Statement Template regularly and seek assistance from a professional if needed. With dedication and hard work, you can achieve financial success as a self-employed individual.