Are you struggling to keep track of your business’s financial performance? Financial statements are a crucial component of any company’s accounting process. They help you assess the overall health of your business, identify areas that need improvement, and make informed financial decisions.

Creating financial statements can be time-consuming and overwhelming, particularly for businesses with limited resources. Fortunately, a Corporate Financial Statement Template can simplify the process and save you valuable time and effort.

What is a Corporate Financial Statement Template?

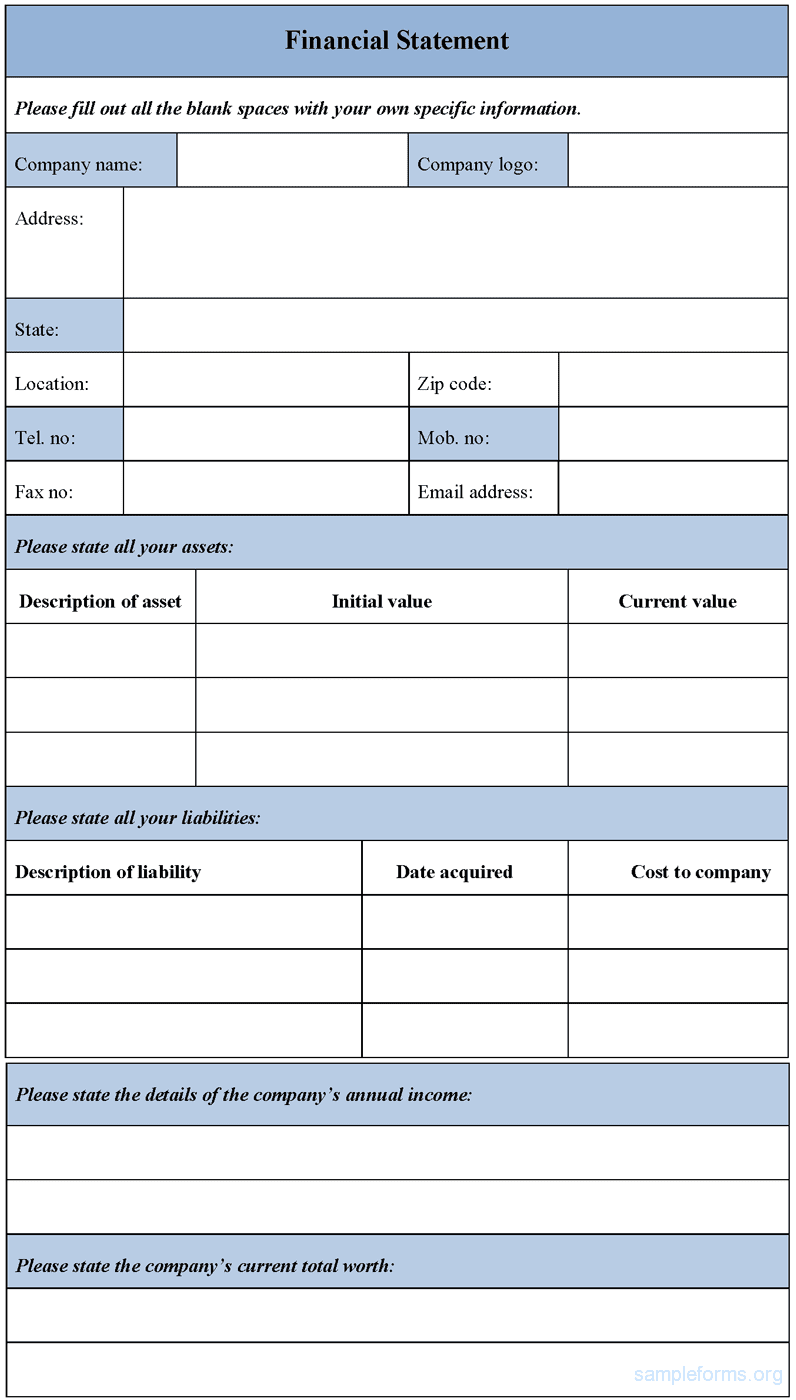

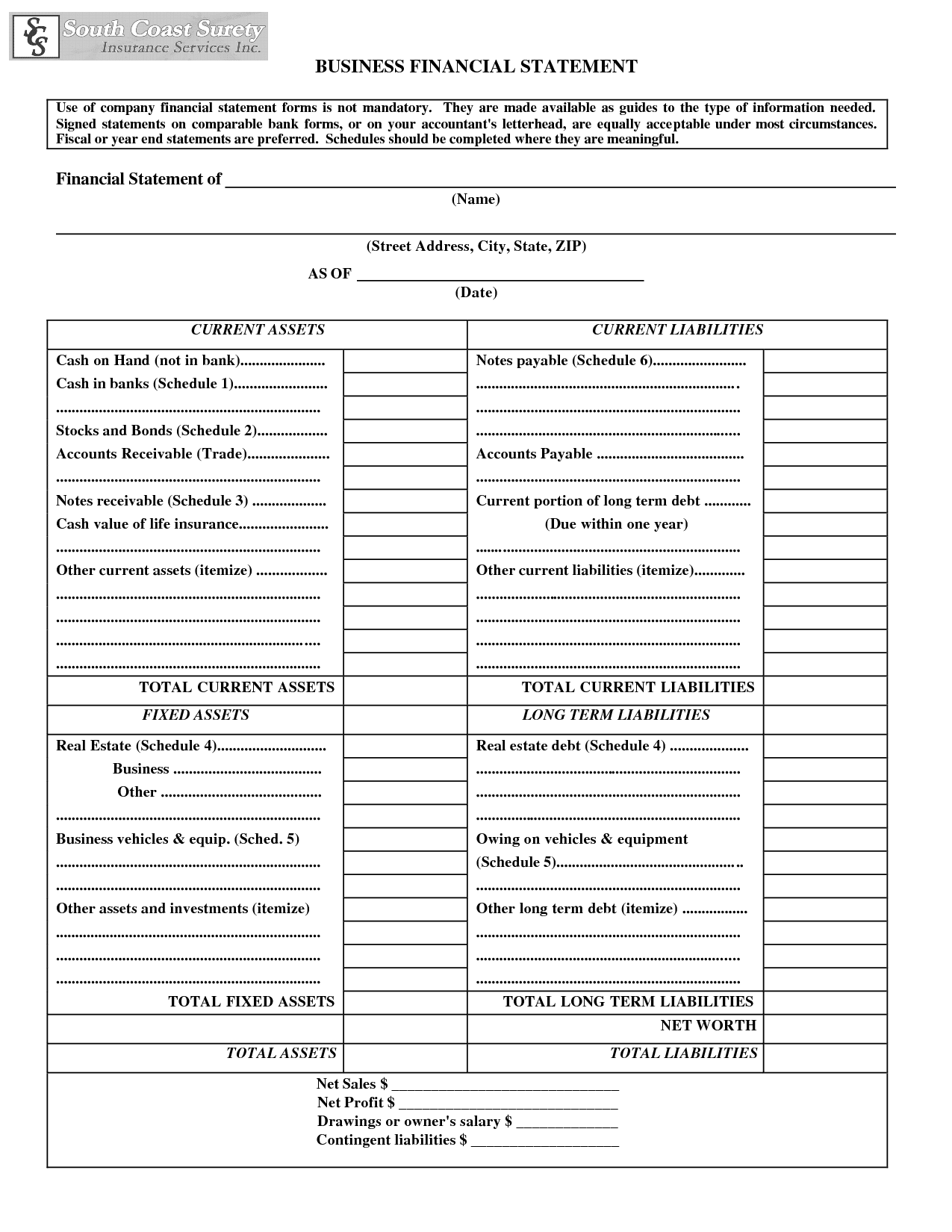

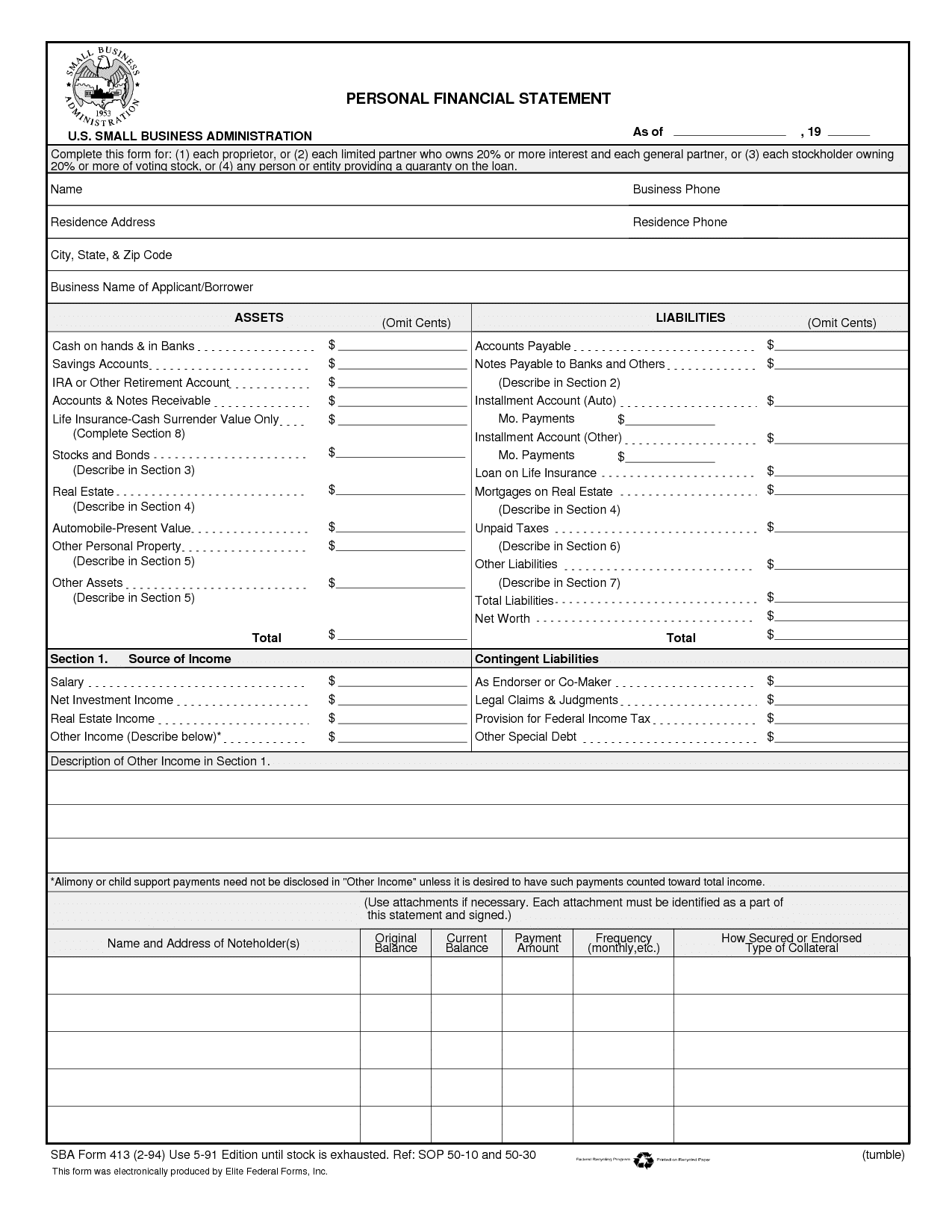

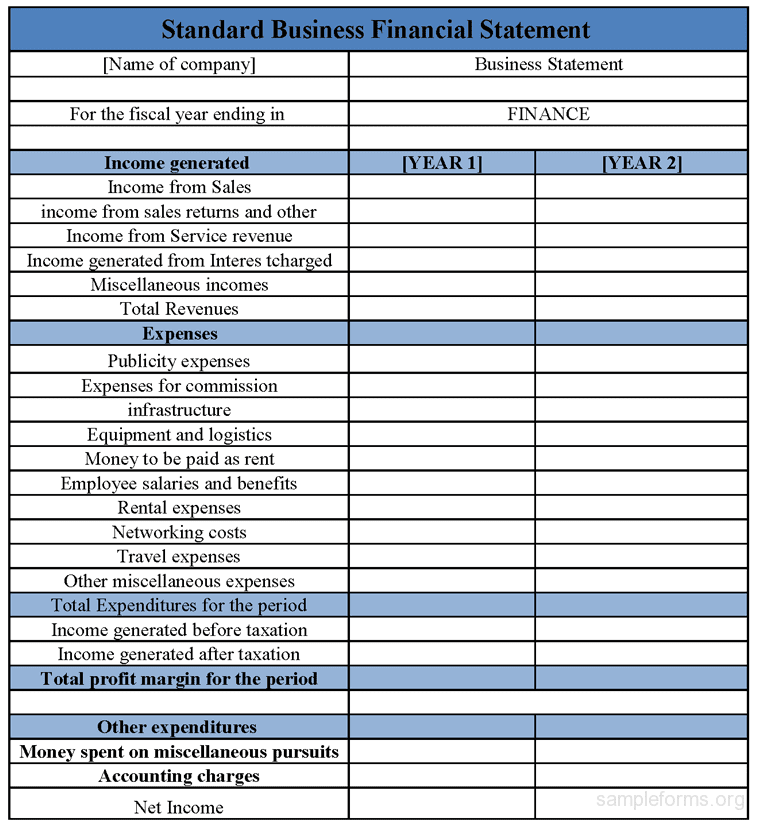

A Corporate Financial Statement Template is a pre-designed document that provides a framework for creating financial statements. It typically includes a balance sheet, income statement, and cash flow statement. The template allows you to input your financial data and generate accurate and comprehensive reports quickly.

Why use a Corporate Financial Statement Template?

Using a Corporate Financial Statement Template offers several benefits, including:

- Streamlined Reporting

The template simplifies the financial reporting process and enables you to generate reports quickly and accurately. - Improved Accuracy

The template ensures that your financial statements are consistent, accurate, and error-free. - Easy Analysis

The template makes it easier to analyze your financial data, identify trends, and make informed decisions. - Time-Saving

The template eliminates the need to create financial statements from scratch, saving you valuable time and effort.

How to use a Corporate Financial Statement Template

To use a Corporate Financial Statement Template, you need to follow a few simple steps:

Step 1: Gather Financial Data

Before you can use the template, you need to collect all relevant financial data, including income, expenses, assets, liabilities, and equity.

Step 2: Input Financial Data

Next, input your financial data into the template. The template should have sections for income, expenses, assets, liabilities, and equity.

Step 3: Generate Reports

Once you have input your financial data, the template will automatically generate financial statements, including a balance sheet, income statement, and cash flow statement.

Step 4: Analyze Results

Finally, analyze the financial statements and identify areas that need improvement. Use the results to make informed financial decisions and improve your business’s overall performance.

Choosing the Right Corporate Financial Statement Template

When choosing a Corporate Financial Statement Template, it’s essential to consider your business’s unique needs and requirements. Here are a few things to keep in mind:

- User-Friendly

Look for a template that is easy to use and understand, even if you have limited accounting knowledge. - Comprehensive

Ensure that the template includes all the financial statements you need, such as a balance sheet, income statement, and cash flow statement. - Customizable

Find a template that you can customize to suit your business’s specific needs and requirements. - Accuracy

Make sure that the template’s formulas and calculations are accurate and error-free. - Compatibility

Check that the template is compatible with your accounting software and other tools.

Where to Find a Corporate Financial Statement Template

You can find a Corporate Financial Statement Template in various places, including:

- Accounting Software

Many accounting software packages include pre-designed financial statement templates. - Online

You can find free or paid templates online by searching for “Corporate Financial Statement Template.” - Professional Accounting Services

You can also hire professional accounting services to create customized templates that meet your business’s specific needs.

In conclusion, a Corporate Financial Statement Template can help you streamline your financial reporting process and improve financial analysis. It offers a simple and efficient way to generate accurate and comprehensive financial statements, saving you time and effort. By selecting the right template and following the simple steps, you can create financial statements that help you make informed decisions and improve your business’s overall performance.