Personal financial statements are critical tools for managing your finances. They give you an overview of your current financial situation, including your assets, liabilities, income, and expenses. With this information, you can make informed decisions about your finances and plan for your future.

If you’re not sure where to start, don’t worry. In this article, we’ll walk you through everything you need to know about personal financial statement templates and how to use them effectively.

Why Use Personal Financial Statements Templates?

Personal financial statements templates can help you in many ways. Here are some of the key benefits:

- Get an overview of your finances

With a personal financial statement template, you can quickly see your net worth, income, and expenses in one place. This information can help you make better decisions about your finances. - Plan for the future

By understanding your current financial situation, you can plan for the future more effectively. You can set financial goals, create a budget, and make informed decisions about investments and savings. - Track your progress

Regularly updating your personal financial statement template allows you to track your progress over time. You can see how your net worth, income, and expenses have changed, and adjust your financial plans accordingly.

How to Create a Personal Financial Statement Template

Creating a personal financial statement template may seem daunting, but it’s actually quite simple. Here’s a step-by-step guide to help you get started:

Step 1: Gather your financial information

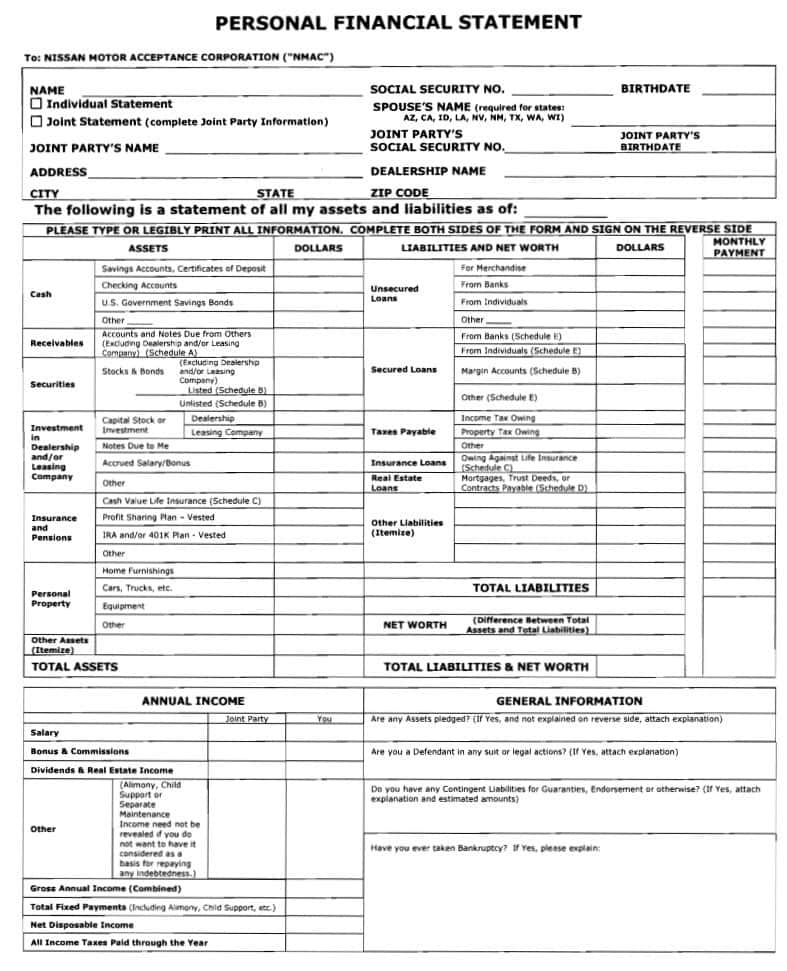

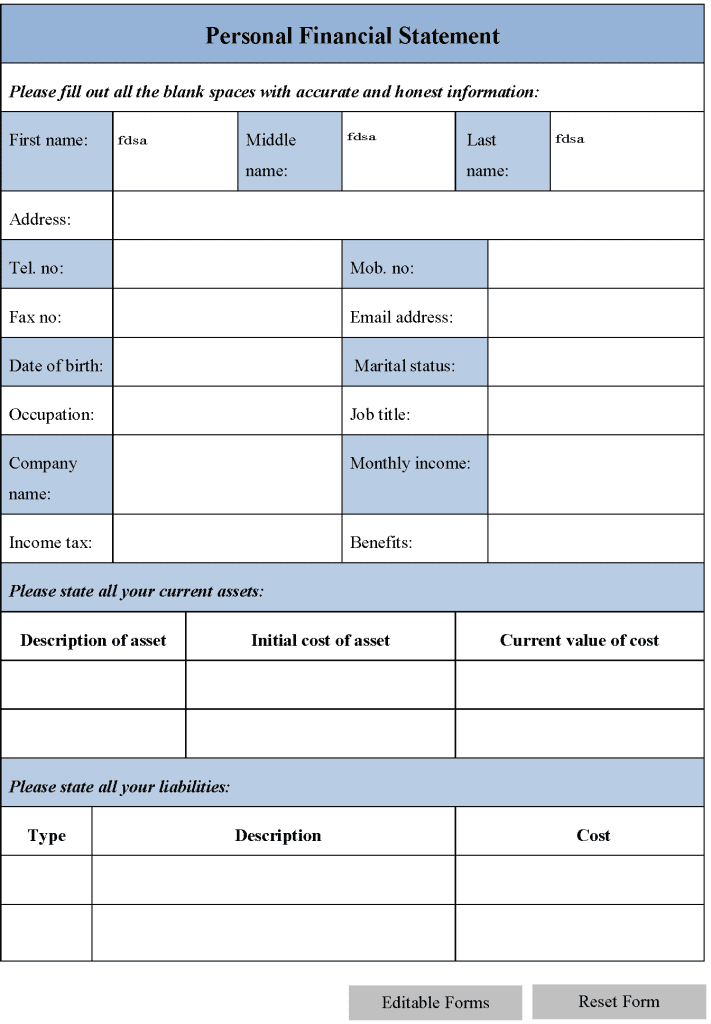

To create your personal financial statement template, you’ll need to gather information about your assets, liabilities, income, and expenses. Here’s what you should include:

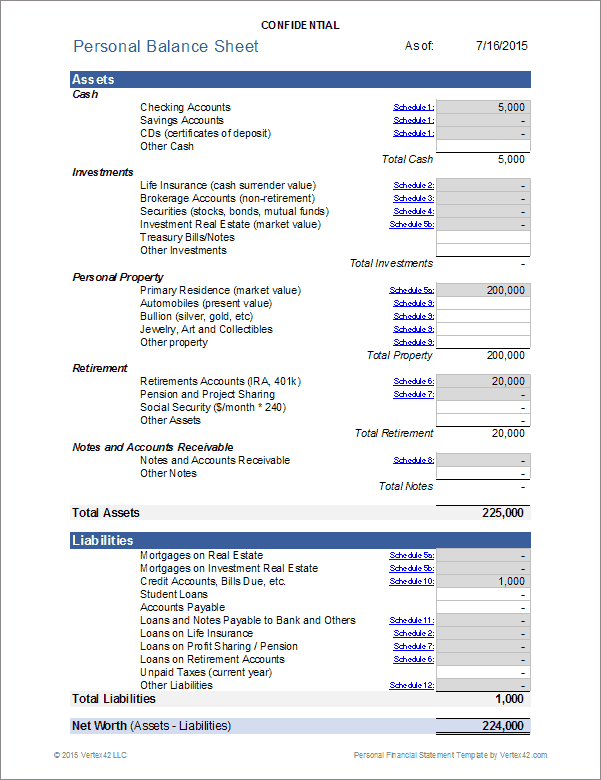

- Assets

This includes everything you own that has value, such as cash, investments, property, and vehicles. - Liabilities

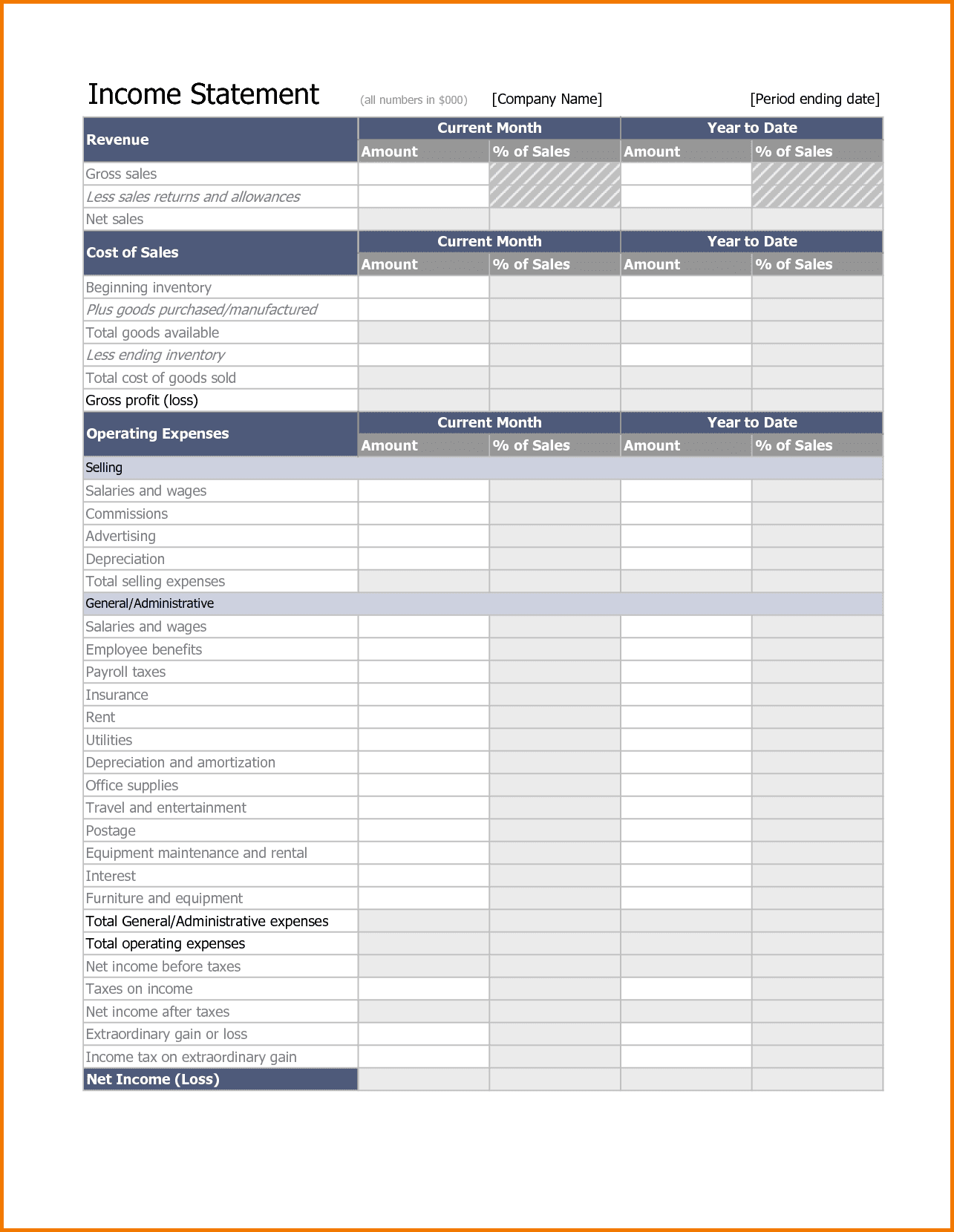

This includes everything you owe, such as mortgages, credit card debt, and personal loans. - Income

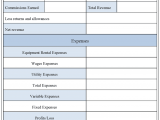

This includes all the money you earn, such as your salary, bonuses, and investment income. - Expenses

This includes all the money you spend, such as rent, utilities, groceries, and entertainment.

Step 2: Choose a personal financial statement template

Once you have all your financial information, you can choose a personal financial statement template. You can find many free templates online, or you can create your own using a spreadsheet program like Excel.

Step 3: Input your financial information

Using your financial information, input your assets, liabilities, income, and expenses into your personal financial statement template.

Step 4: Calculate your net worth

To calculate your net worth, subtract your total liabilities from your total assets. This will give you a clear picture of your financial standing.

Step 5: Analyze your personal financial statement

Once you have your personal financial statement template set up, take some time to analyze it. Look for areas where you can cut expenses, increase income, or reduce debt. Use this information to make informed decisions about your finances.

Tips for Using Personal Financial Statements Templates

Now that you have created your personal financial statement template, here are some tips on how to use it effectively:

- Update it regularly

Your financial situation is always changing, so it’s essential to update your personal financial statement template regularly. This will help you keep track of your progress and make any necessary adjustments. - Set financial goals

Once you have a clear picture of your financial situation, set financial goals for yourself. These could include paying off debt, saving for a down payment on a house, or investing in a retirement account. - Create a budget

Use your personal financial statement template to create a budget that works for you. This will help you manage your expenses and save money. - Monitor your credit score

Your credit score is an essential factor in your financial health. Use your personal financial statement template to monitor your credit score and take steps to improve it if necessary. - Seek professional advice

If you’re struggling to manage your finances or achieve your financial goals, consider seeking professional advice from a financial planner or advisor.

Final Thoughts

Personal financial statements templates are an essential tool for managing your finances. By understanding your current financial situation, you can make informed decisions about your finances and plan for your future. With the help of our guide, you can create a personal financial statement template that works for you and take control of your finances. Remember to update it regularly, set financial goals, create a budget, monitor your credit score, and seek professional advice if necessary.