Year To Date Profit And Loss Statement Free Template: A Comprehensive Guide

When it comes to managing a business, keeping track of the financial health of your company is crucial. One of the most important documents that can provide insight into your company’s finances is the Year To Date Profit and Loss Statement. A profit and loss statement (also known as an income statement) is a financial report that provides a summary of your company’s revenues, costs, and expenses over a specified period of time. In this article, we will discuss the importance of a Year To Date Profit and Loss Statement and provide a free template for you to use.

What is a Year To Date Profit and Loss Statement?

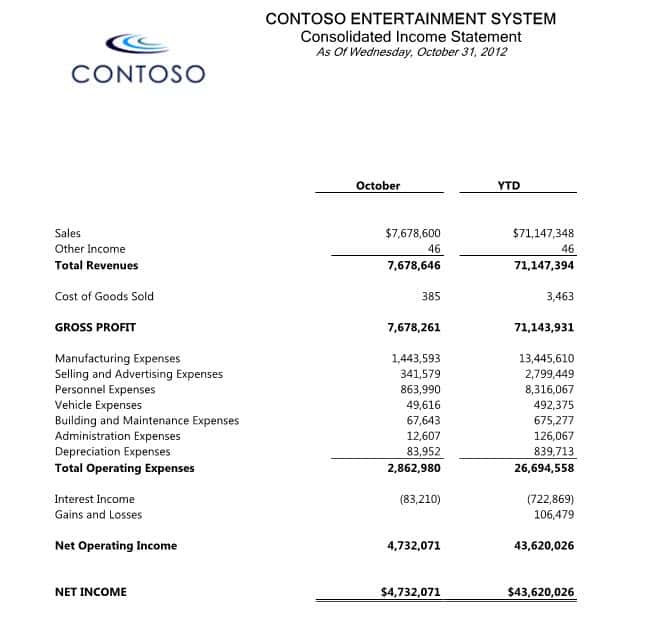

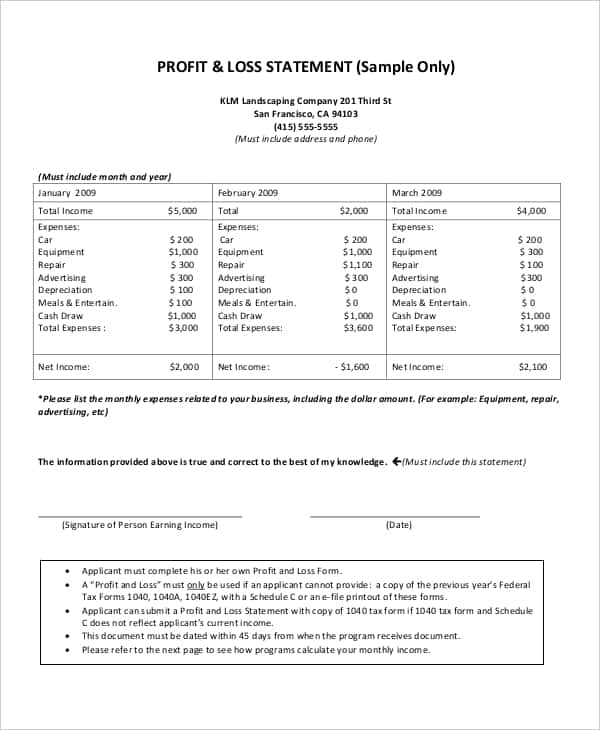

A Year To Date Profit and Loss Statement is a financial report that provides a snapshot of your company’s financial performance for the current year. It summarizes the revenue, cost of goods sold, gross profit, expenses, and net income for your company from the beginning of the year until the current date. This document is important for business owners because it can help identify trends in revenue and expenses and provide insight into how well the company is performing financially.

Why is a Year To Date Profit and Loss Statement important?

A Year To Date Profit and Loss Statement is important for several reasons. First, it provides a snapshot of your company’s financial performance over a specific period of time. This information can help you identify trends in revenue and expenses and make adjustments to your business operations accordingly.

Second, a Year To Date Profit and Loss Statement is an important tool for tracking your company’s financial progress over time. By comparing Year To Date Profit and Loss Statements from different periods, you can see how your company’s financial performance has changed and identify areas for improvement.

Finally, a Year To Date Profit and Loss Statement is an important document for tax purposes. It provides a summary of your company’s income and expenses for the year and can be used to calculate your company’s tax liability.

Free Year To Date Profit and Loss Statement Template

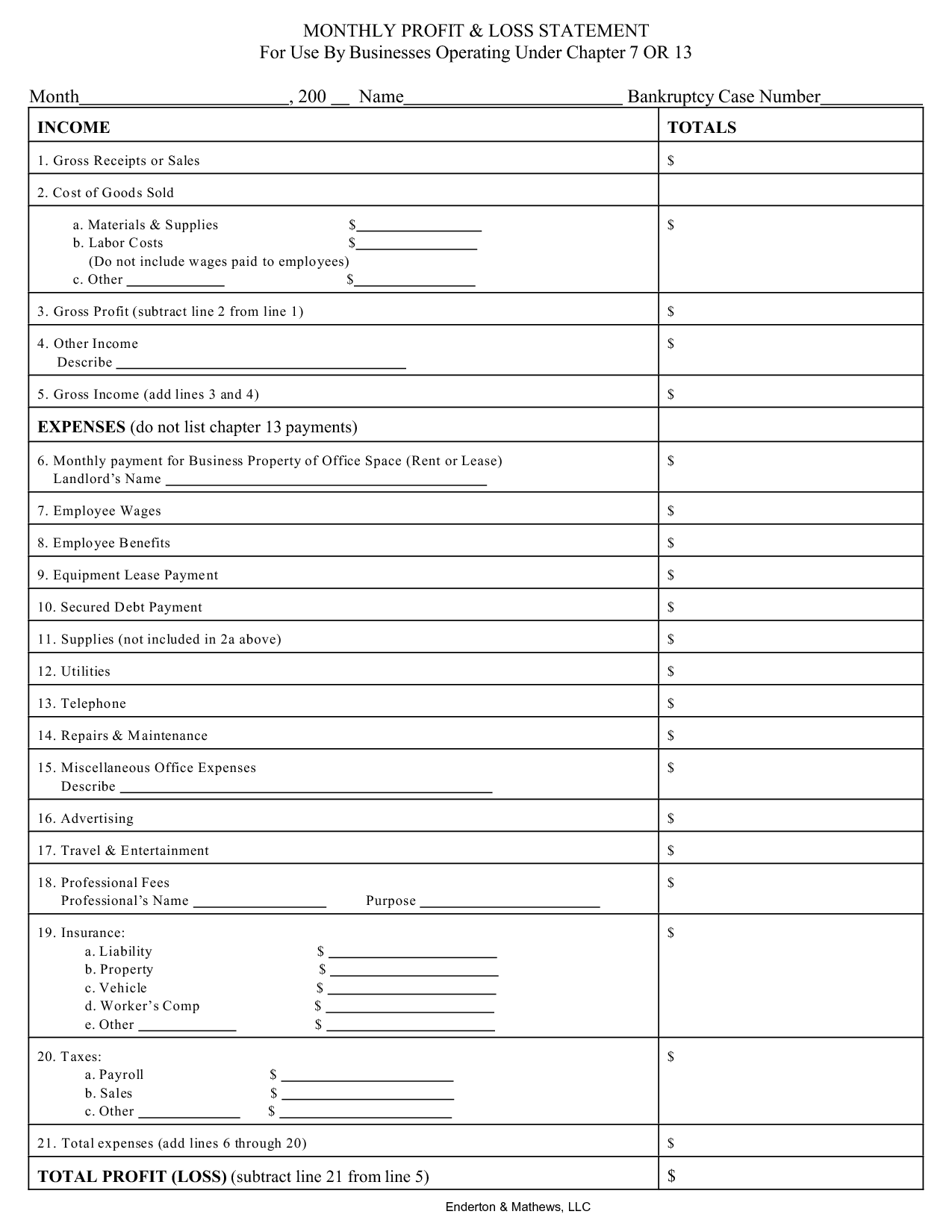

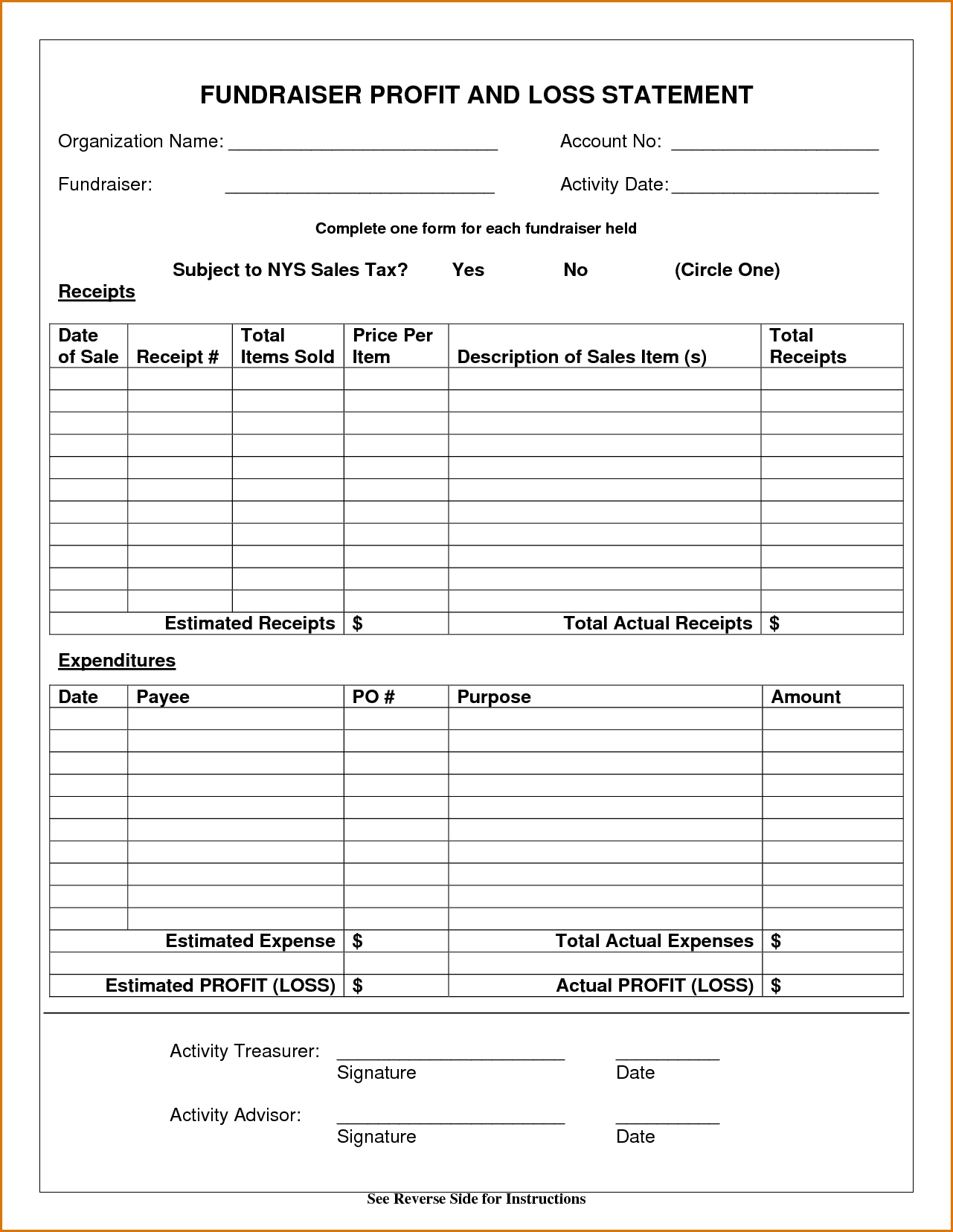

To help you get started, we have created a free Year To Date Profit and Loss Statement Template that you can use for your business. The template is easy to use and can be customized to meet the specific needs of your business. You can download the template in Excel format and input your own data to generate a Year To Date Profit and Loss Statement for your business.

Conclusion

A Year To Date Profit and Loss Statement is an important tool for managing your business’s finances. It provides a snapshot of your company’s financial performance over a specific period of time and can help you identify trends and areas for improvement. By using our free Year To Date Profit and Loss Statement Template, you can easily create a customized financial report for your business.

Creating a Year To Date Profit and Loss Statement is an important task for any business owner, whether they’re just starting out or have been in business for years. It provides a snapshot of the financial health of the company and allows for the identification of areas that may need improvement. However, creating a Profit and Loss Statement from scratch can be a daunting task, especially for those who are not familiar with accounting terminology. This is where a Year To Date Profit And Loss Statement Free Template can come in handy.

Using a pre-designed Year To Date Profit And Loss Statement Free Template can save business owners a lot of time and effort. With just a few clicks, they can input their financial data into the template and have a professional-looking Profit and Loss Statement in no time. These templates can be found online for free or for a small fee, and they come in a variety of formats such as Excel, Google Sheets, or PDF.

When choosing a Year To Date Profit And Loss Statement Free Template, it’s important to find one that meets the specific needs of the business. Some templates may be better suited for small businesses, while others may be more appropriate for larger corporations. It’s also important to ensure that the template includes all the necessary categories, such as revenue, cost of goods sold, and operating expenses. A well-designed template should also be easy to read and understand, with clear labeling and formatting.

Once the template is downloaded, business owners can begin inputting their financial data. This may include information such as sales revenue, the cost of goods sold, and various expenses such as rent, utilities, and payroll. The template will then automatically calculate the gross profit and net profit for the business, providing a clear picture of the financial health of the company.

By using a Year To Date Profit And Loss Statement Free Template, business owners can easily track their financial progress throughout the year. They can compare their current financial standing to previous periods and make informed decisions about how to grow their business moving forward. It can also be a valuable tool when applying for loans or seeking investment, as it provides potential lenders or investors with a clear understanding of the company’s financial performance.

In conclusion, a Year To Date Profit And Loss Statement Free Template is a valuable resource for any business owner. It saves time and effort while providing an accurate snapshot of the financial health of the company. By using a well-designed template, business owners can easily track their financial progress and make informed decisions about the future of their business. So, whether you’re a new entrepreneur or a seasoned business owner, a Year To Date Profit And Loss Statement Free Template can be an invaluable tool for success.