Sample Financial Statements For Non Profit Organizations: What You Need To Know

Learn how to read and understand financial statements for non-profit organizations. This guide provides a comprehensive overview of the key elements of financial statements and offers tips on how to interpret the information presented.

If you’re involved with a non-profit organization, you likely understand the importance of financial statements. These statements provide valuable insights into the organization’s financial health and help stakeholders make informed decisions about the allocation of resources.

In this article, we’ll take a closer look at sample financial statements for non-profit organizations, including the key elements and how to interpret the information presented.

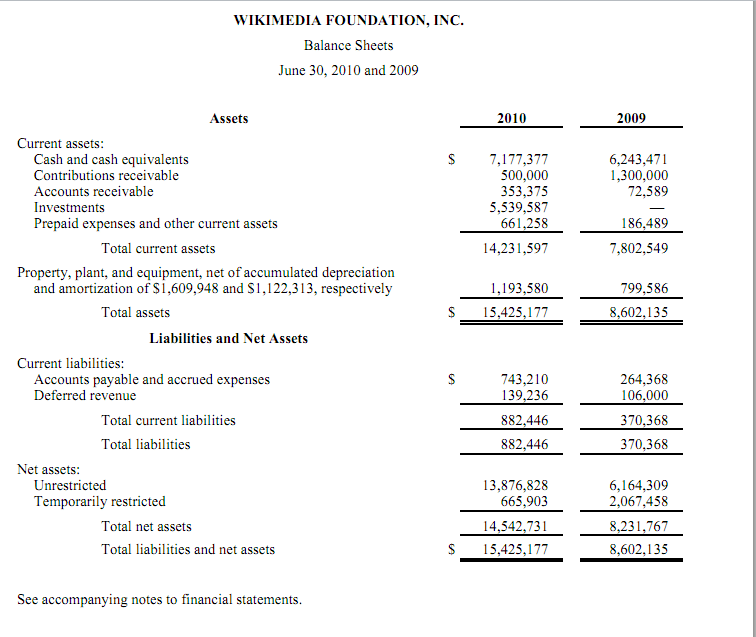

Balance Sheet

The balance sheet is a key financial statement that provides a snapshot of an organization’s financial position at a specific point in time. It includes three main sections: assets, liabilities, and net assets. Assets are resources owned by the organization, such as cash, investments, and property. Liabilities are amounts owed by the organization, such as loans and accounts payable. Net assets represent the difference between assets and liabilities and can be either unrestricted, temporarily restricted, or permanently restricted.

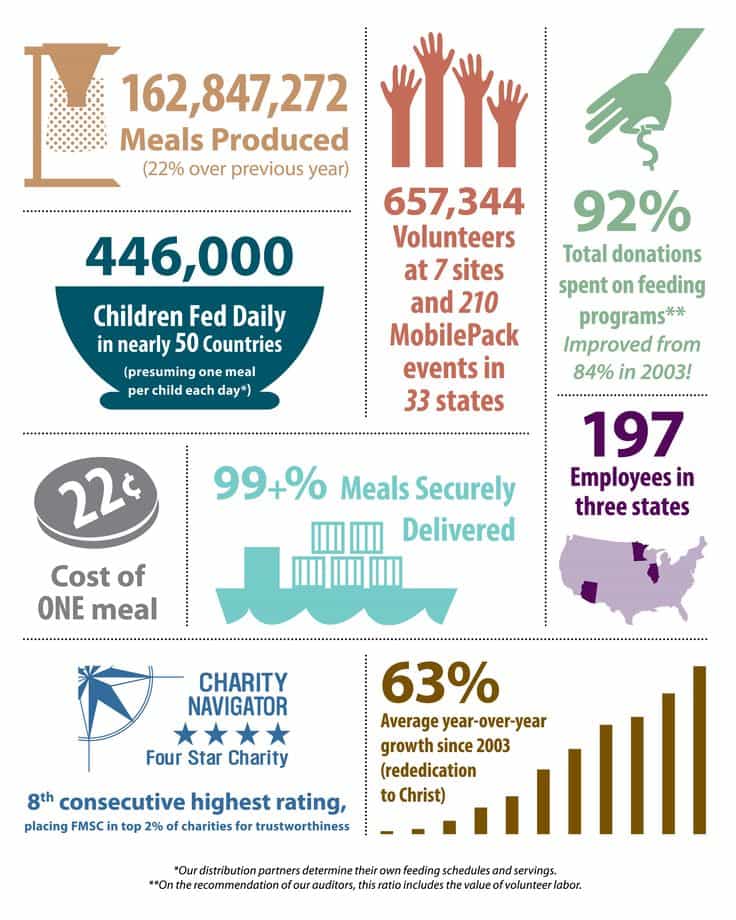

Income Statement

The income statement, also known as the statement of activities, provides an overview of an organization’s revenues and expenses over a specific period of time. It includes several sections, such as revenue, program expenses, and administrative expenses. Revenue represents the funds received by the organization, such as grants and donations. Program expenses are costs associated with delivering the organization’s mission, such as salaries and supplies. Administrative expenses are costs associated with running the organization, such as rent and utilities.

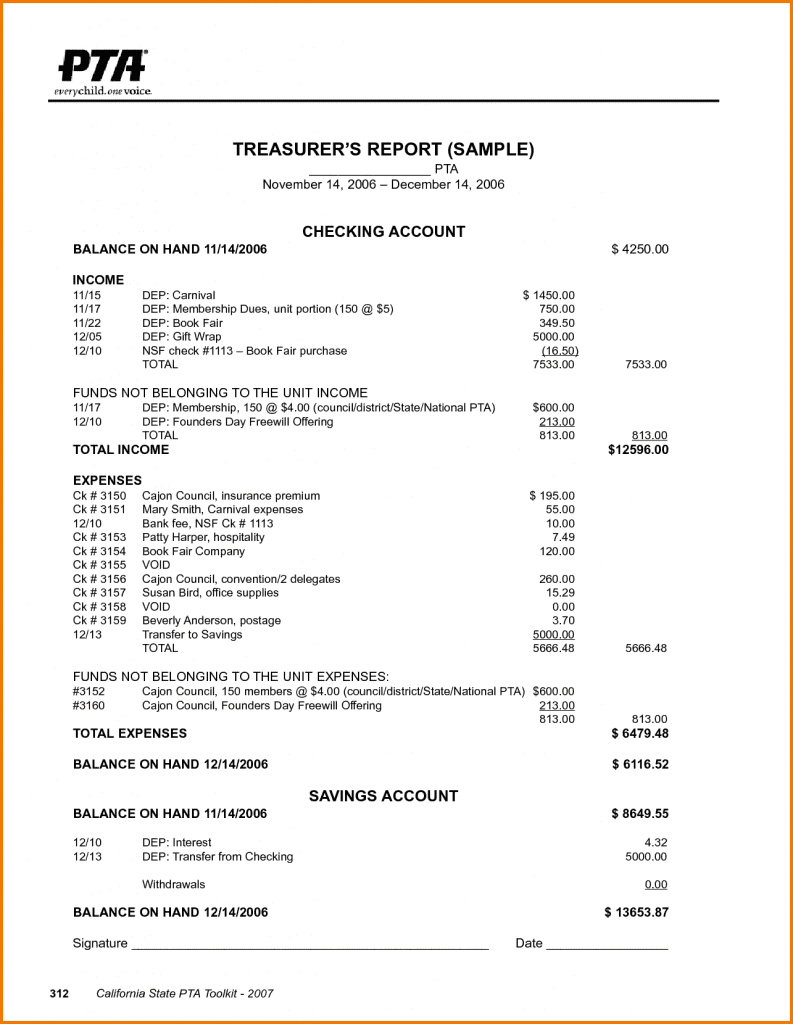

Cash Flow Statement

The cash flow statement provides information about an organization’s cash inflows and outflows over a specific period of time. It includes three main sections: cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Cash flows from operating activities represent the cash generated or used by the organization’s normal operations. Cash flows from investing activities represent the cash used or generated from investing in assets such as property, plant, and equipment. Cash flows from financing activities represent the cash used or generated from financing activities such as borrowing and repaying debt.

Interpreting Financial Statements

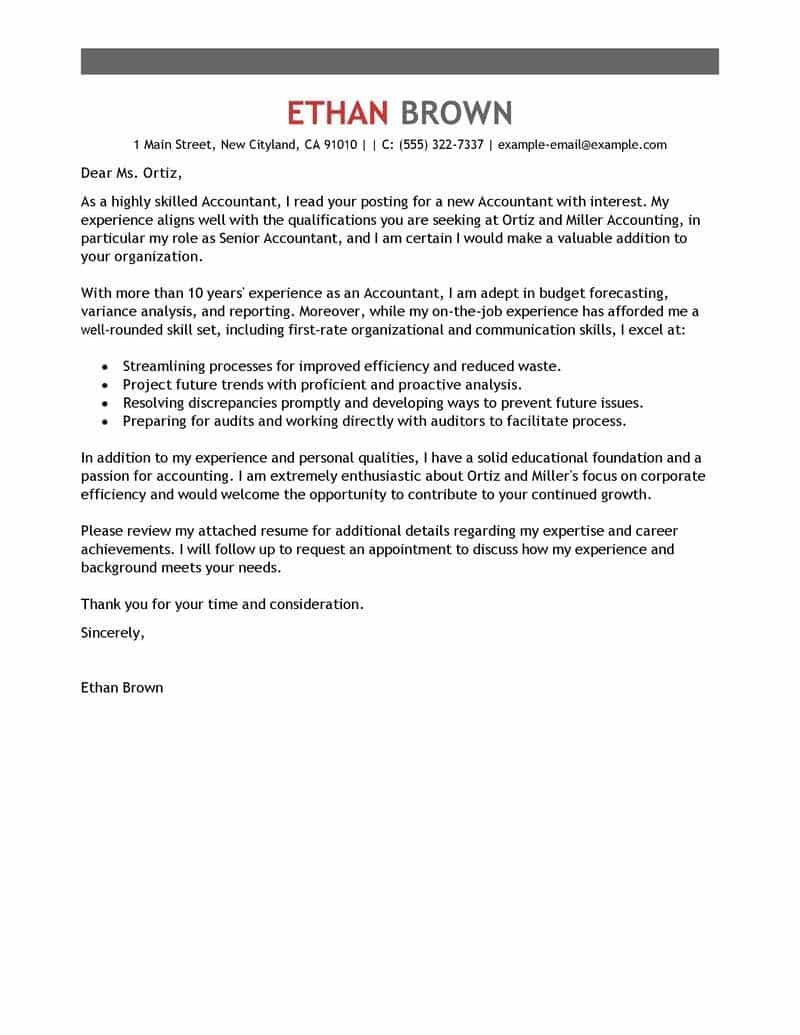

Understanding financial statements is essential for making informed decisions about non-profit organizations. Here are a few tips for interpreting financial statements:

- Look for trends: Look for patterns in revenue, expenses, and net assets over time. Are they increasing, decreasing, or staying the same?

- Understand ratios: Ratios, such as the current ratio and the debt-to-equity ratio, provide insights into an organization’s financial health.

- Compare to benchmarks: Comparing an organization’s financial statements to industry benchmarks can help identify areas of strength and weakness.

Conclusion

Sample financial statements for non-profit organizations can seem daunting at first glance. However, with a basic understanding of the key elements and how to interpret the information presented, stakeholders can make informed decisions about the allocation of resources. By reviewing the balance sheet, income statement, and cash flow statement, as well as looking for trends, understanding ratios, and comparing to benchmarks, stakeholders can gain a better understanding of the financial health of non-profit organizations.

It’s important to note that financial statements should be reviewed regularly, as they provide a snapshot of an organization’s financial position at a specific point in time. By reviewing financial statements on a regular basis, stakeholders can identify trends, potential risks, and opportunities for growth.

Non-profit organizations have unique financial reporting requirements, which can make it challenging for stakeholders to interpret financial statements. However, by understanding the key elements and how to interpret the information presented, stakeholders can gain a better understanding of the organization’s financial health.

In addition to understanding financial statements, it’s important for stakeholders to ask questions and seek clarification if they are unsure about any aspect of an organization’s finances. This can help ensure that all stakeholders are on the same page and have a clear understanding of the organization’s financial position.

Overall, sample financial statements for non-profit organizations provide valuable insights into an organization’s financial health. By reviewing the balance sheet, income statement, and cash flow statement, as well as looking for trends, understanding ratios, and comparing to benchmarks, stakeholders can make informed decisions about the allocation of resources and help ensure the long-term sustainability of non-profit organizations.