In a world where financial literacy is a crucial life skill, providing students with the right tools to navigate the complex realm of personal finance is essential. One such tool that proves invaluable is the set of Checking Account Worksheets designed specifically for students. At PruneyardInn.com, we understand the importance of cultivating financial acumen from a young age, and our comprehensive worksheets are tailored to make learning about checking accounts engaging and practical.

Understanding the Basics: Why Checking Account Worksheets Matter

1. Financial Foundations:

Our Checking Account Worksheets serve as the building blocks for understanding the fundamentals of financial management. Students are introduced to the concept of a checking account, learning how it differs from other types of accounts and the role it plays in daily transactions.

2. Budgeting Made Simple:

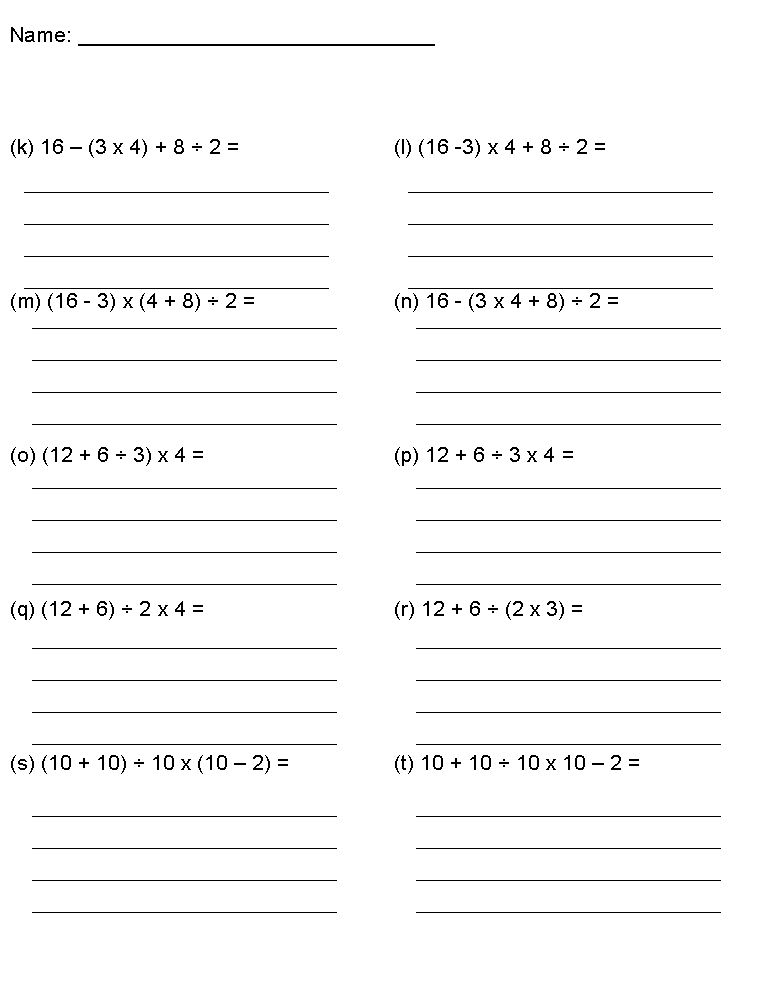

Through interactive exercises, students explore the art of budgeting within the context of a checking account. From tracking income to managing expenses, these worksheets provide hands-on experience in creating and maintaining a budget—a skill that will prove invaluable throughout their lives.

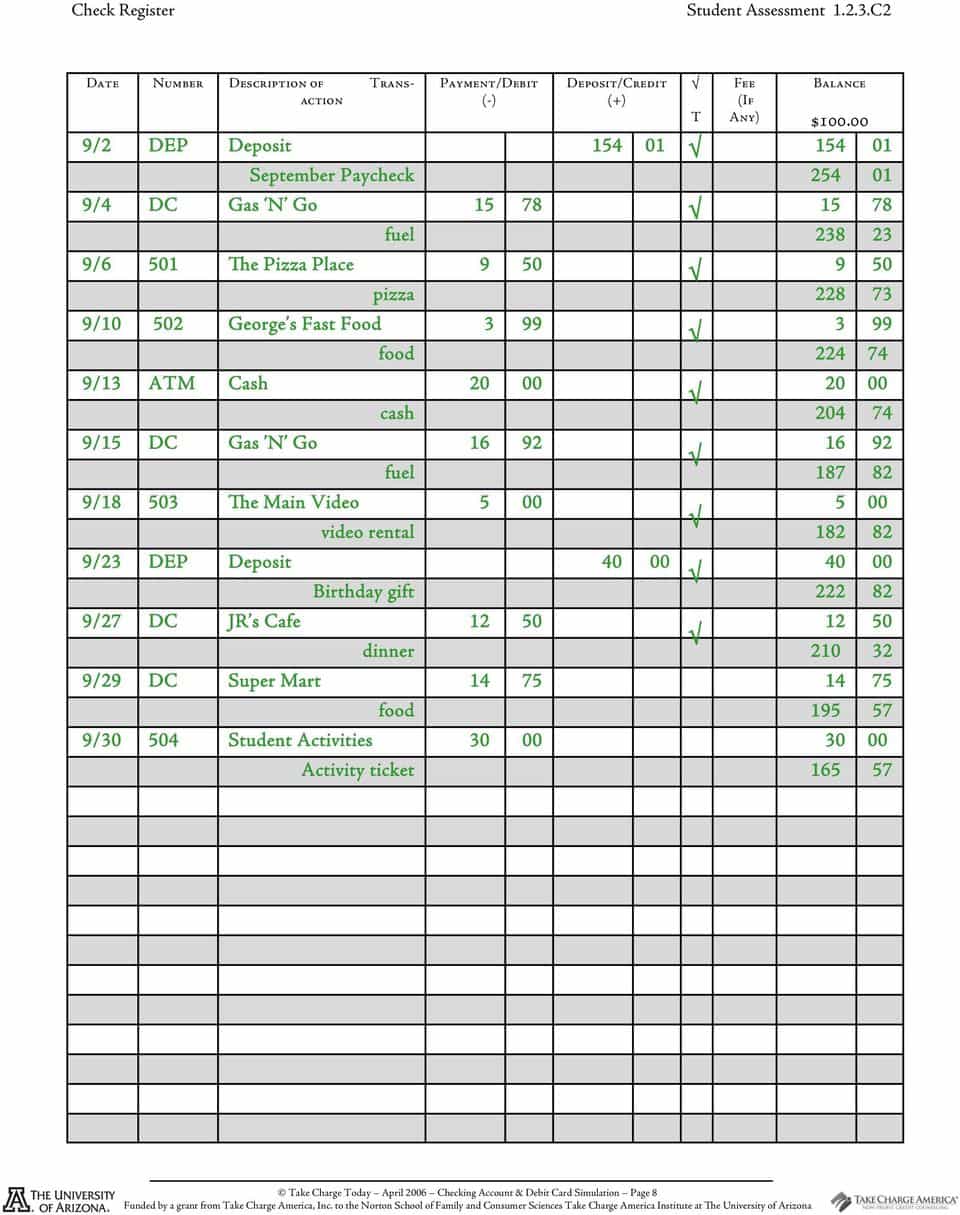

3. Transaction Tracking:

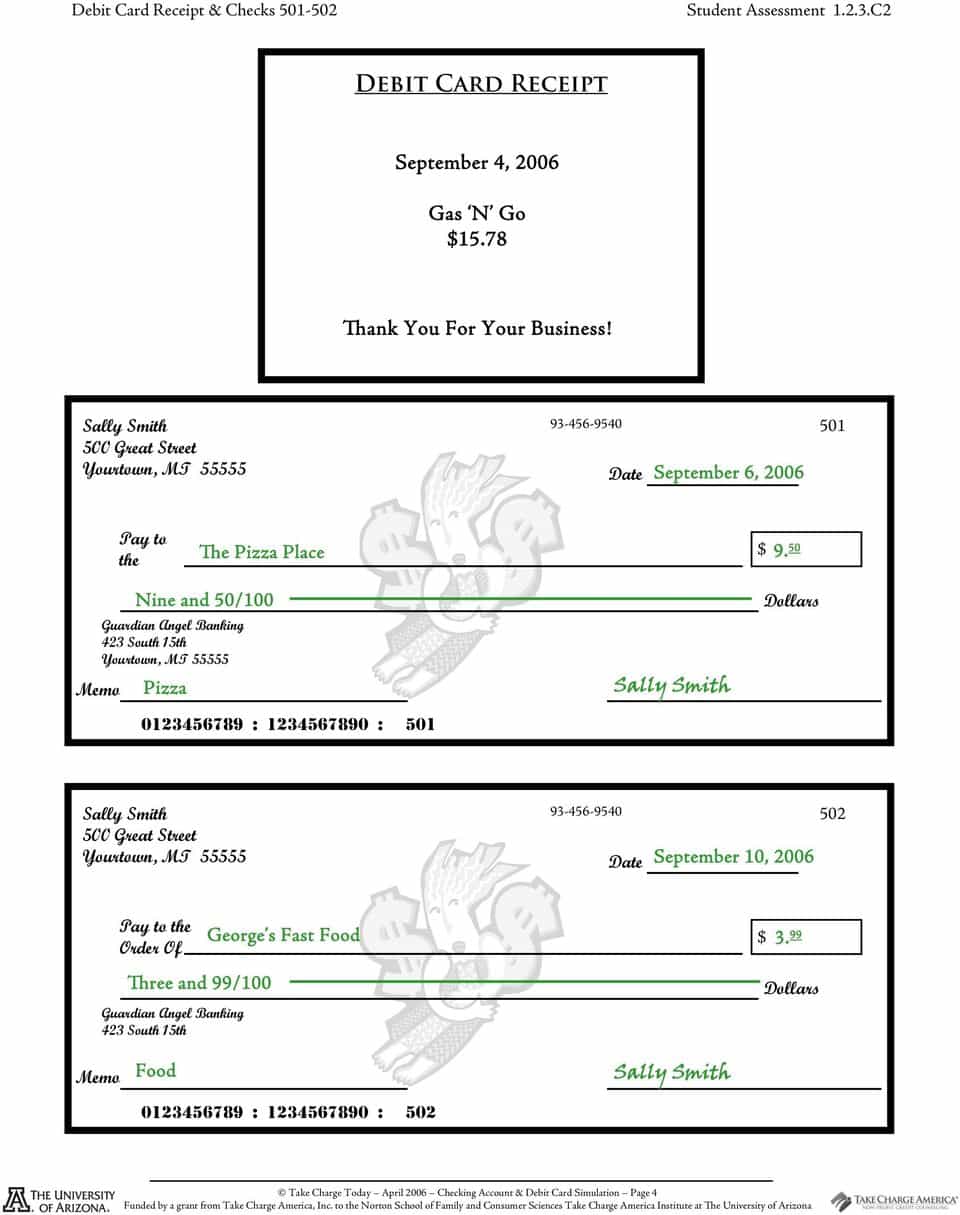

Students delve into real-world scenarios, practicing how to record transactions accurately. From writing checks to using a debit card, our worksheets guide them through the step-by-step process, ensuring they grasp the importance of keeping a meticulous record of their financial activities.

Navigating the Digital Age: Online Banking Simulations

1. Embracing Technology:

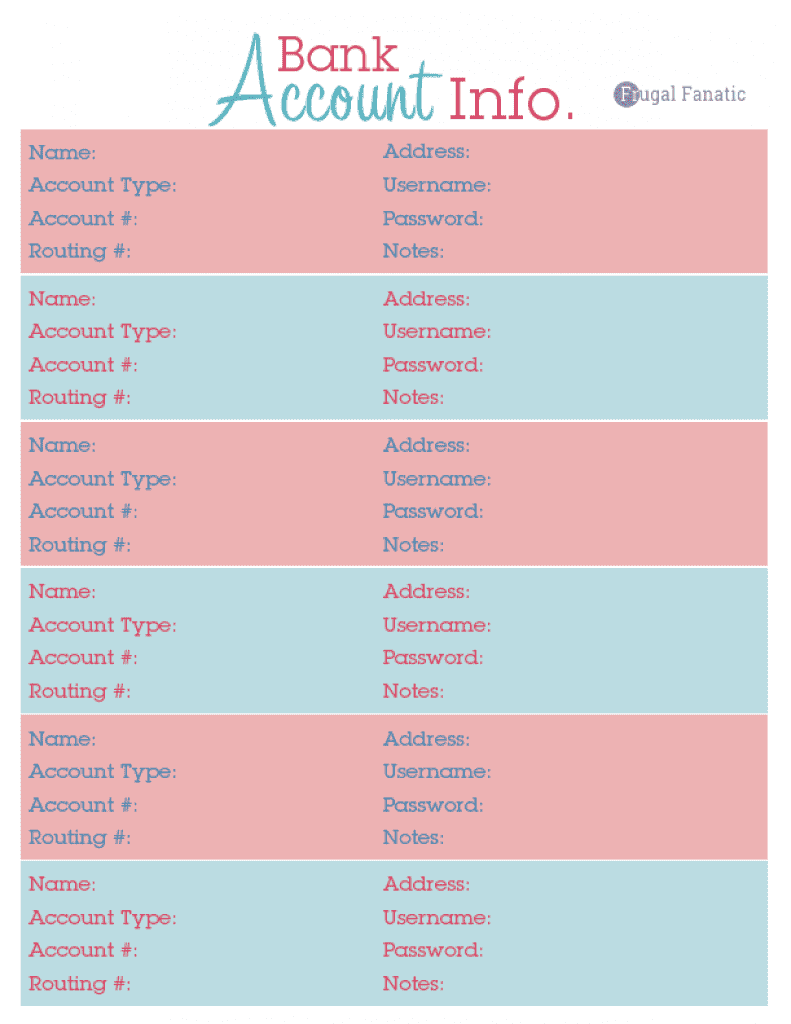

Recognizing the shift towards digital transactions, our worksheets include simulated exercises on online banking. Students become familiar with navigating digital platforms, checking account balances, and conducting transactions securely in the online realm.

2. Fraud Awareness:

In an era where online security is paramount, our worksheets address the importance of safeguarding personal information. Students learn to identify potential fraud risks and adopt best practices for protecting their financial assets in the digital age.

Interactive Learning for Lasting Impact

1. Real-Life Scenarios:

Our Checking Account Worksheets bring financial education to life by incorporating real-life scenarios. Whether it’s managing unexpected expenses or planning for future goals, students gain a practical understanding of how checking accounts play a crucial role in their financial journey.

2. Customizable for All Levels:

Recognizing the diverse needs of students, our worksheets are designed to cater to various learning levels. From beginners to those seeking advanced financial knowledge, the content is customizable to ensure that every student can benefit from a tailored learning experience.

Sustainable Financial Growth: Beyond Worksheets

1. Building Credit Awareness:

Our comprehensive approach extends beyond the basics, delving into the significance of credit scores and their impact on financial well-being. Students gain insights into responsible credit usage, understanding how it can shape their financial future and open doors to opportunities like homeownership or entrepreneurial endeavors.

2. Goal Setting and Savings Strategies:

Encouraging a forward-thinking mindset, our worksheets guide students in setting financial goals. From short-term aspirations to long-term dreams, they learn practical savings strategies that align with their objectives, fostering a sense of responsibility and discipline.

Supporting Educators and Parents: A Collaborative Approach

1. Resource Hub for Educators:

Recognizing the vital role of educators, PruneyardInn.com provides supplementary resources to enhance the teaching experience. Access lesson plans, additional exercises, and tips to create an engaging classroom environment that sparks curiosity and facilitates meaningful discussions about financial literacy.

2. Parental Involvement:

We understand that learning doesn’t end in the classroom. Our Checking Account Worksheets come with guidance for parents, enabling them to reinforce financial concepts at home. By actively participating in their child’s financial education journey, parents play a pivotal role in instilling lifelong money management skills.

FAQs: Addressing Common Queries

1. Are the Worksheets Suitable for All Ages?

Absolutely! Our Checking Account Worksheets are adaptable to various age groups, ensuring that students at different stages of their educational journey can benefit from the content. Whether in middle school or high school, the material is tailored to meet the unique needs of each age bracket.

2. How Can I Integrate These Worksheets Into My Curriculum?

Integrating our worksheets into your curriculum is seamless. We provide guidance and suggestions on how to incorporate financial literacy into your lesson plans. Additionally, our resource hub offers supplemental materials to enhance the learning experience.

Conclusion: Shaping Financially Empowered Futures

In a world where financial landscapes are ever-evolving, PruneyardInn.com is committed to fostering financial literacy that goes beyond textbooks. Our Checking Account Worksheets for Students are not just tools; they are catalysts for empowering the next generation to make informed financial decisions and secure a prosperous future.

As we embark on this journey together, let’s sow the seeds of financial wisdom and watch as they blossom into a generation of financially savvy individuals. Explore our Checking Account Worksheets today and embark on a transformative educational experience that will shape brighter, more financially empowered futures for our students. Because at PruneyardInn.com, we believe in investing in education that pays lifelong dividends.