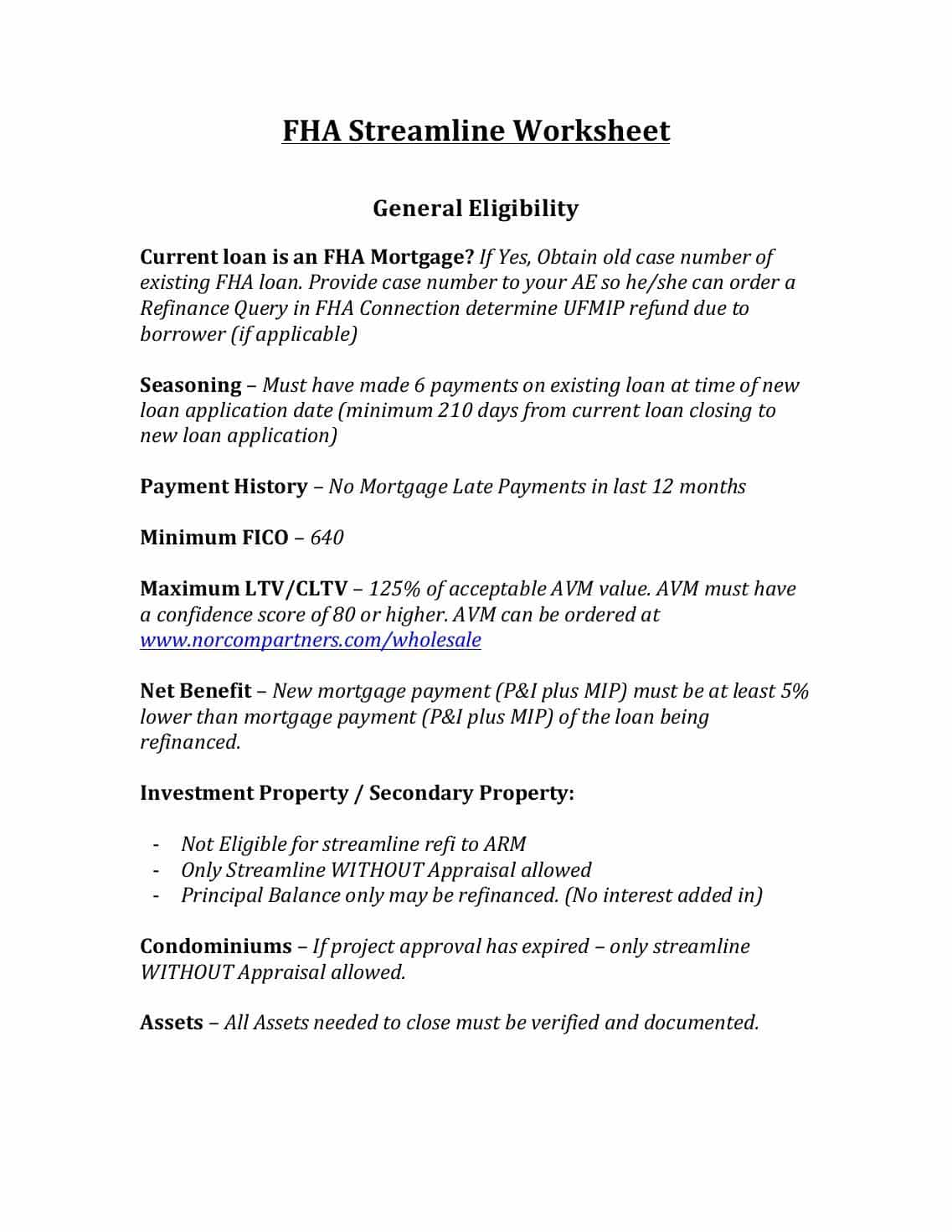

You can use a FHA Streamline Worksheet for your home mortgage loan application. If you are applying for a home mortgage loan, you should know that a FHA (Federal Housing Administration) refinance worksheet is used to help determine eligibility and the application process. This worksheet is very useful because it will help you understand the mortgage approval process and how it works. By reviewing the FHA Refinance Worksheet you will be able to apply for your loan and ensure that you get approved.

In order to learn more about the FHA Refinance Worksheet you should first download it. Once you have done this you should open it and read through it thoroughly. In fact, you should print it out so that you can take it with you to the application department. In order to properly apply for your home mortgage loan, you should go through it step by step.

It is very important that you know what the purpose of this worksheet is before you begin to answer any of the questions. The purpose of the worksheet is to help you answer all of the questions associated with your application. Knowing what you need to answer is important. Then you can easily answer the question that applies to you. When you apply for a home mortgage loan with the worksheet, it will help you learn how to answer the questions.

The information on the worksheet is very important. Before you start filling in any information you should know exactly what you need to enter. Some of the questions that will be asked are pre-qualifying and post-qualifying. You should be sure that you know the correct answers to these questions before you begin filling in the information.

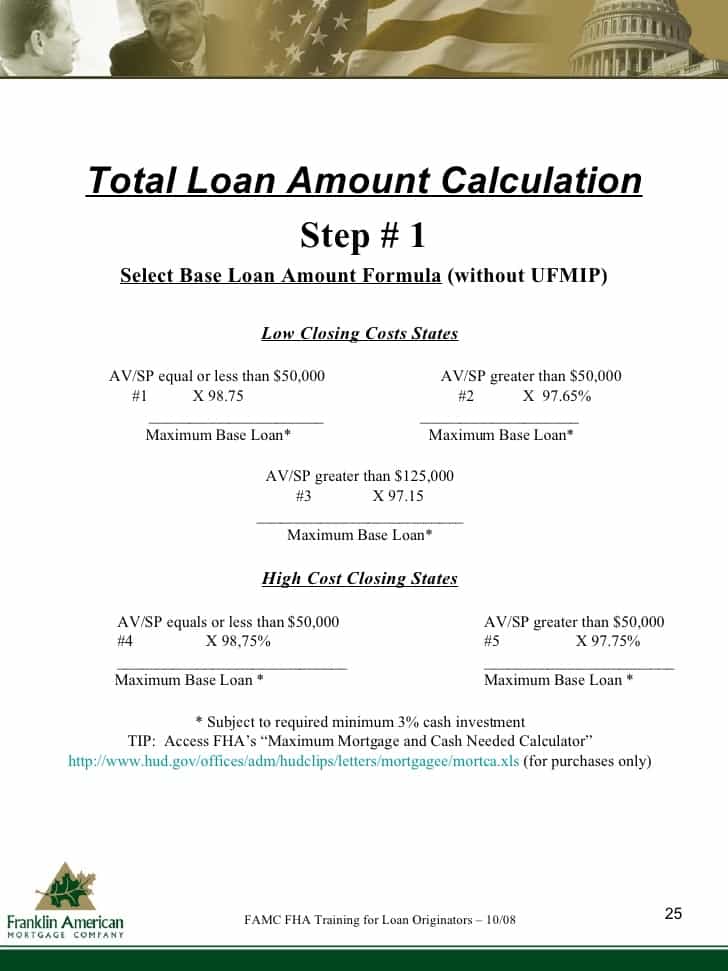

First, you will need to determine what type of FHA loan you are looking for. You should write down whether you are looking for a second or a third mortgage. Then you should see if there are any additional qualifications that you need to fulfill. If so, you should put a check mark next to the item on the worksheet. You should write down what you know about any additional qualifications that are needed.

Next, you should see if there are any FHA special requirements that you need to fulfill. If so, you should put a check mark next to the item on the worksheet. You should write down what you know about any additional special requirements that are needed.

Finally, you should see if there are any conditions that apply to your application that apply to both FHA and non-FHA loans. If so, you should put a check mark next to the item on the worksheet. You should write down what you know about any special conditions that apply to your application. Then you should repeat the process again and see if there are any changes to the application.

By reviewing the FHA Refinance Worksheet you will be able to apply for your loan without a problem. By answering all of the questions correctly you will be able to avoid wasting time. Then you can take the worksheet with you to the application department and avoid losing your time.