Learn how to use a spreadsheet to track and manage your independent contractor expenses efficiently. This guide will help you stay organized and save money come tax time.

Are you an independent contractor looking for a simple and effective way to manage your expenses? Look no further than a spreadsheet. By using a spreadsheet to track your expenses, you can easily keep track of your spending, stay organized, and save money come tax time.

Here are some tips on how to set up and use a spreadsheet to manage your independent contractor expenses:

- Choose the right software

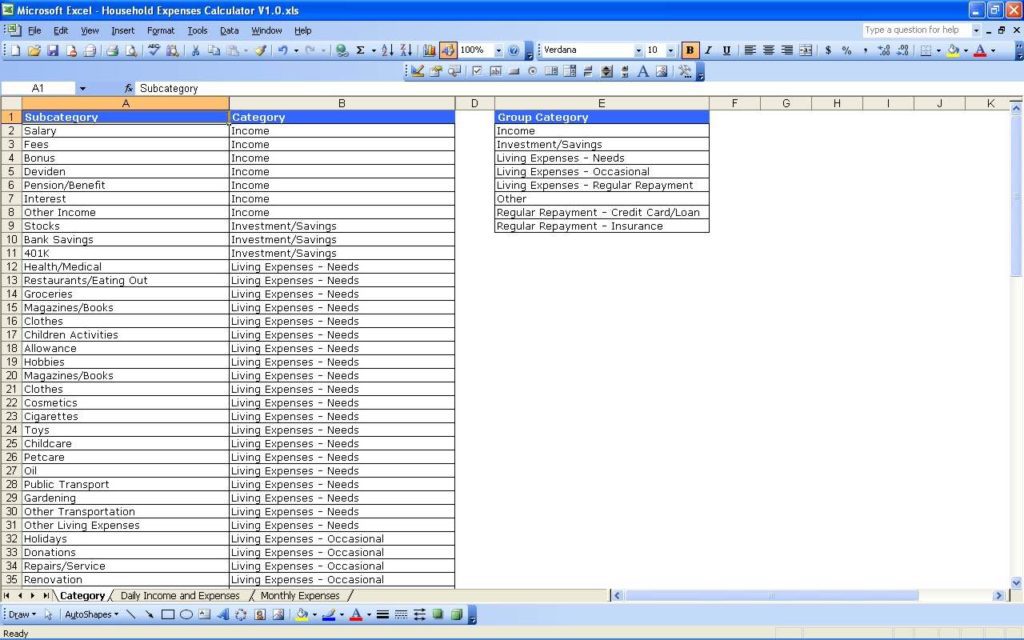

There are many spreadsheet programs available, such as Microsoft Excel, Google Sheets, and Apple Numbers. Choose the one that best suits your needs and budget. - Set up your spreadsheet

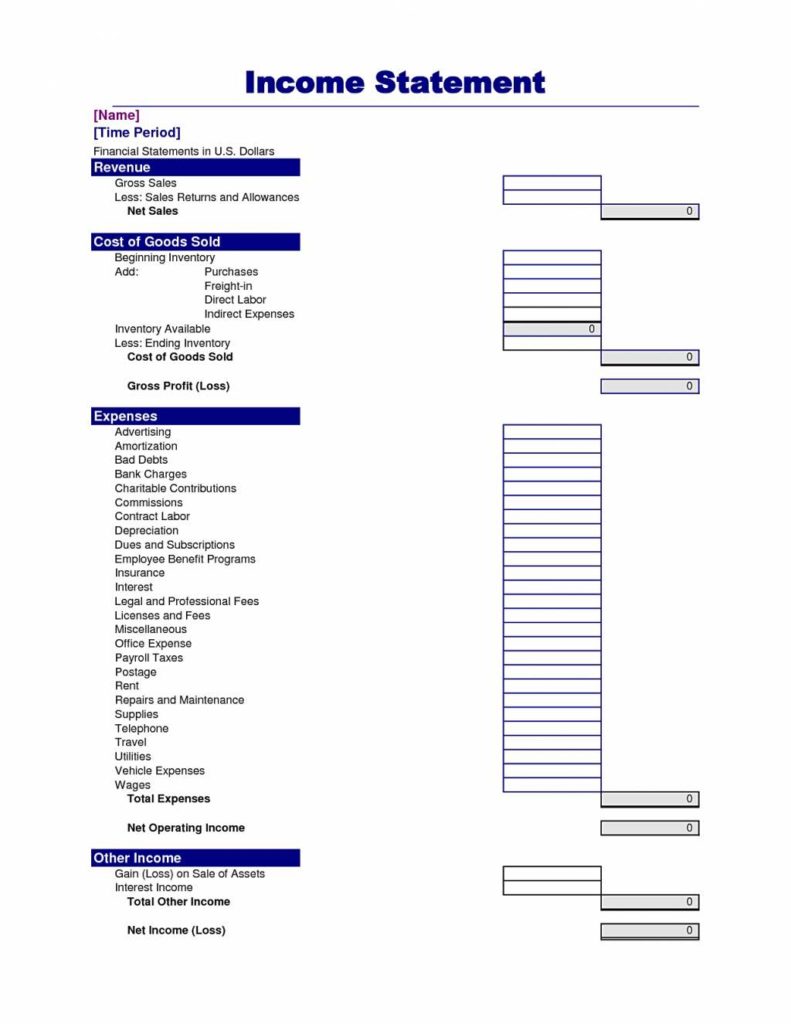

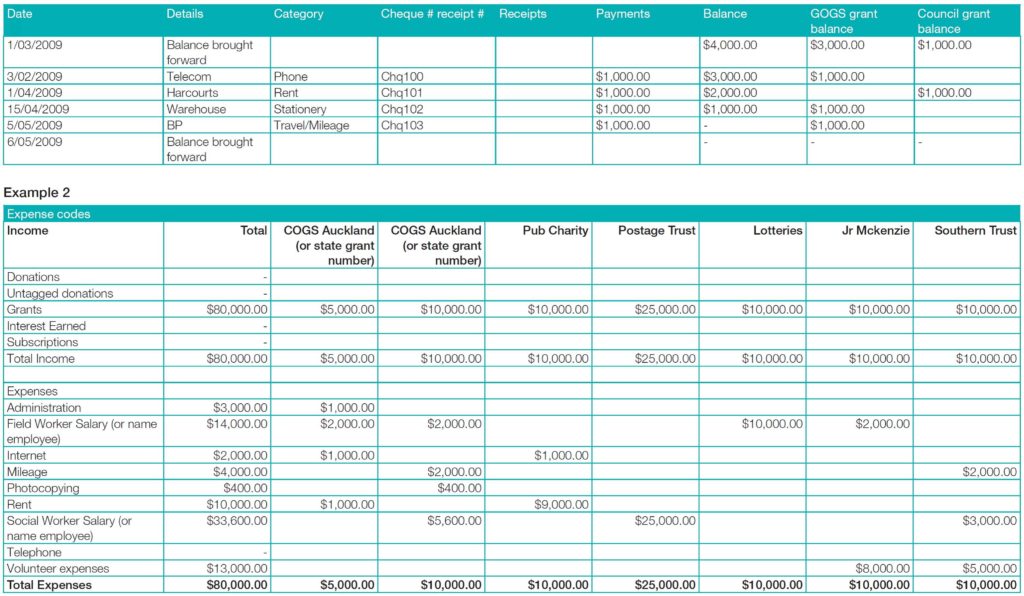

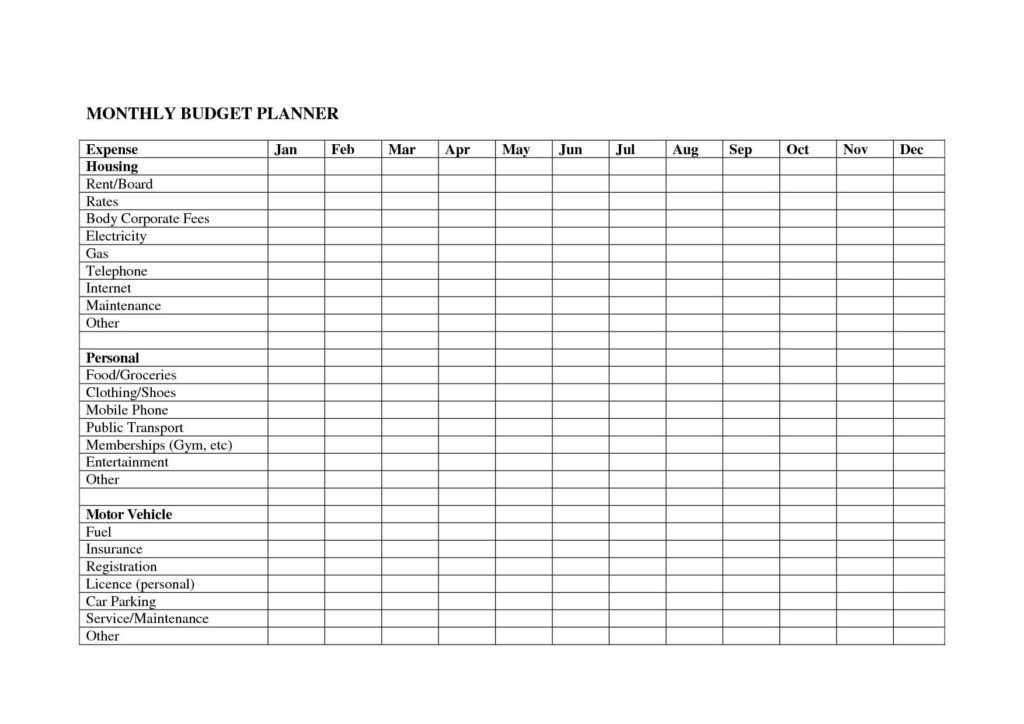

Create a new spreadsheet and label each column with the appropriate expense category, such as “office supplies,” “travel expenses,” “rent,” and “professional fees.” - Record your expenses

Each time you incur an expense, record it in your spreadsheet. Be sure to include the date, amount, and category. - Keep your receipts

Make sure to keep all receipts and invoices for your expenses. You may need them come tax time. - Use formulas and functions

To make your spreadsheet more efficient, use formulas and functions to automatically calculate totals, averages, and other important metrics. - Review and analyze your expenses

Regularly review and analyze your expenses to identify areas where you can cut costs and improve your bottom line. - Track your income

In addition to tracking your expenses, you should also track your income. This will help you understand your overall financial situation and identify areas where you can increase your revenue. - Use separate sheets for different time periods

If you have a lot of expenses, consider using separate sheets for different time periods, such as months or quarters. This will make it easier to manage your expenses and analyze your spending over time. - Back up your spreadsheet

Make sure to regularly back up your spreadsheet to avoid losing important data. You can do this by saving a copy of your spreadsheet to the cloud or an external hard drive. - Seek professional advice

If you are unsure about how to manage your independent contractor expenses, seek the advice of a professional accountant or tax expert. They can provide guidance on best practices and help ensure you are in compliance with tax laws.

By following these tips, you can easily set up and use a spreadsheet to manage your independent contractor expenses. Not only will this help you stay organized and save money, but it will also make tax time a breeze.

In conclusion, using a spreadsheet to manage your independent contractor expenses is a simple and effective way to stay organized, save money, and ensure you are in compliance with tax laws. So why not give it a try today?

Another benefit of using a spreadsheet to manage your independent contractor expenses is that it can help you with budgeting. By tracking your expenses in real-time, you can better understand your cash flow and adjust your spending accordingly.

For example, if you notice that you are spending more than you anticipated on office supplies, you may need to adjust your budget or find ways to cut costs in other areas. Or, if you have a slow month and your income is lower than usual, you can review your expenses to see where you can trim costs and make sure you have enough money to cover your bills.

Additionally, by using a spreadsheet, you can easily generate reports and graphs to help you visualize your financial data. This can be especially useful if you need to present your expenses to a client, lender, or potential investor.

Overall, a spreadsheet is a powerful tool that can help independent contractors manage their expenses, track their income, and make better financial decisions. By following the tips and best practices outlined in this article, you can set up and maintain a spreadsheet that works for you and your business.

So, if you’re an independent contractor looking for a simple and effective way to manage your expenses, consider using a spreadsheet. With a little bit of effort and some basic spreadsheet skills, you can take control of your finances and save time and money in the long run.