Learn everything you need to know about creating an expense report for your business with our example of expense report guide. Get insights on the importance of expense reports, what to include, and tips for creating an accurate report.

As a business owner, tracking your expenses is essential for managing your finances and ensuring that your business stays profitable. An expense report is a document that records all the expenses incurred during a specific period, such as a month or a quarter. This report helps you to identify areas where you can cut costs and make more informed financial decisions. In this article, we provide a comprehensive guide on creating an example of expense report for your business.

Importance of Expense Reports

Expense reports are crucial for several reasons. Firstly, they help you to track your expenses accurately, providing you with a clear picture of your business’s financial health. This information is useful in making decisions on which expenses to cut or reduce.

Secondly, expense reports provide you with documentation that can be used to back up claims for tax deductions. You can claim deductions for expenses that are necessary and reasonable for your business, such as office supplies or travel expenses.

Lastly, expense reports help to deter fraud and ensure compliance with company policies. By requiring employees to submit detailed reports, businesses can deter fraud and prevent unauthorized spending.

What to Include in an Expense Report

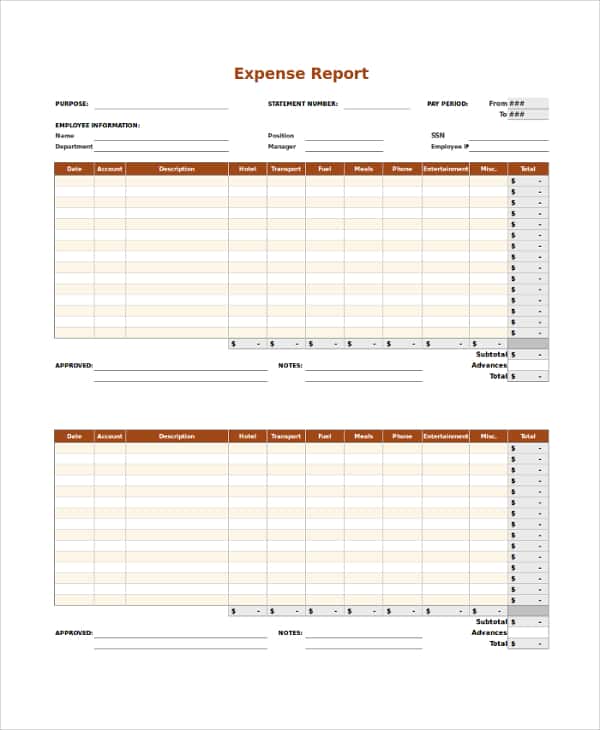

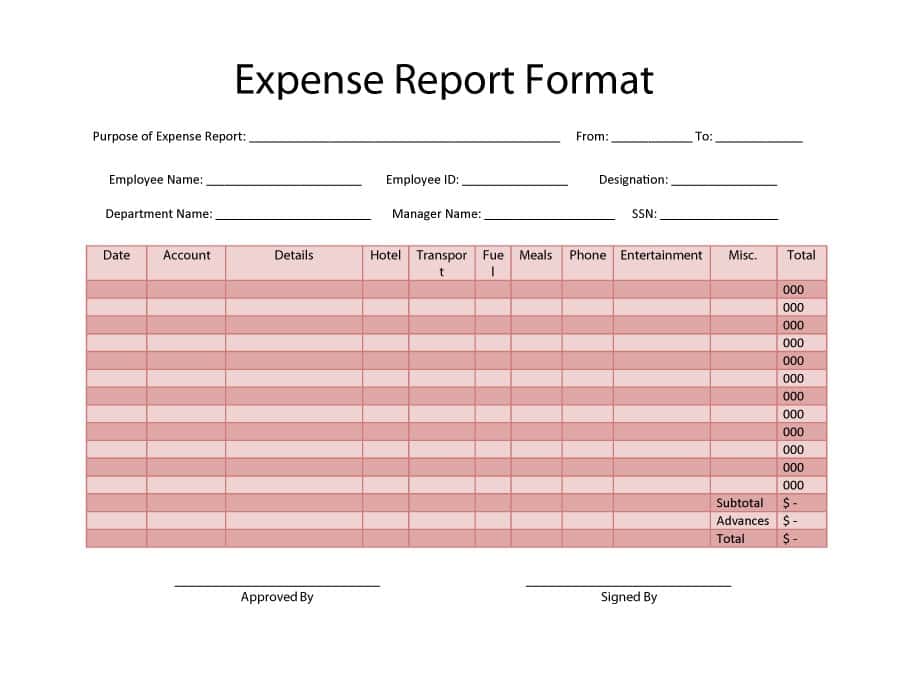

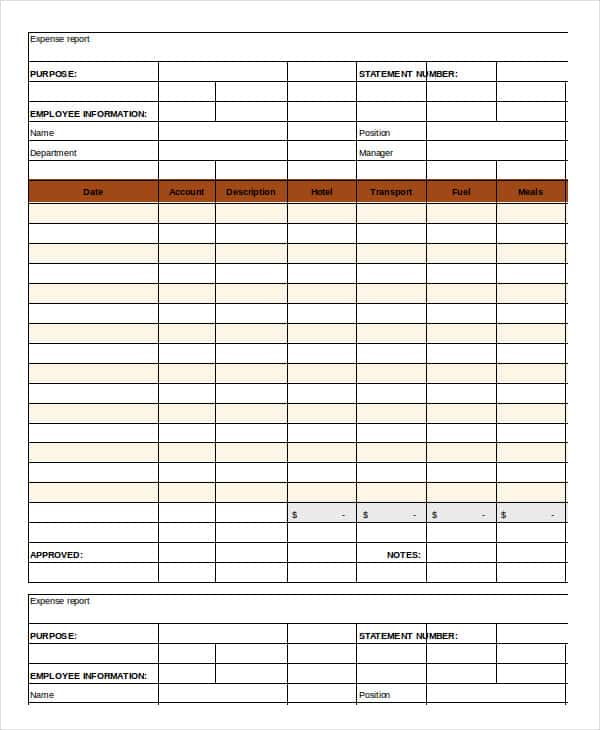

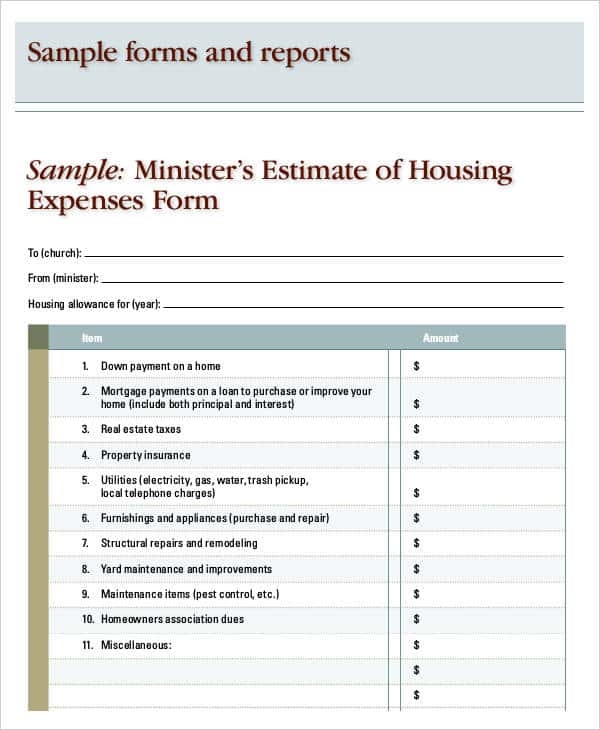

An expense report should be comprehensive and include all expenses incurred during the reporting period. It should also be easy to understand and organized in a logical manner. Here are some items to include in an expense report:

- Date

Record the date of each expense, including the month, day, and year. - Description

Describe the expense in detail, including the purpose of the expense and the item or service purchased. - Amount

Record the total cost of the expense, including taxes, tips, and any other charges. - Category

Assign each expense to a specific category, such as travel, meals, or office supplies. - Payment Method

Indicate how the expense was paid, such as cash, credit card, or check. - Receipts

Attach a copy of each receipt to the report. This is important as it provides evidence of the expense and helps to avoid any questions or disputes.

Tips for Creating an Accurate Expense Report

Creating an accurate expense report is essential for ensuring that your financial records are up to date and that you are making informed decisions. Here are some tips to help you create an accurate expense report:

- Set Guidelines

Establish clear guidelines for what expenses are eligible and what documentation is required. Communicate these guidelines to all employees. - Use Accounting Software

Consider using accounting software to help manage your expenses. This can streamline the process and make it easier to track expenses. - Review Regularly

Review your expense reports regularly to ensure that they are accurate and up to date. This can help you identify any discrepancies or errors before they become a problem. - Keep Records

Keep detailed records of all your expenses, including receipts, invoices, and bank statements. This makes it easier to track expenses and provides evidence for tax deductions.

Creating an effective expense report can seem daunting, but with the right approach, it can be a straightforward and manageable task. By following the steps outlined in this article and using our example of expense report as a guide, you can ensure that your reports are accurate, comprehensive, and easy to understand.

In addition to helping you track expenses, an expense report can also serve as a valuable tool for identifying areas where your business can cut costs and improve efficiency. By analyzing your reports regularly, you can identify patterns and trends in your spending, allowing you to make informed decisions about where to allocate resources.

It’s also essential to ensure that all employees are aware of the expense reporting process and understand the guidelines for submitting expenses. By communicating clearly and providing training where necessary, you can reduce the risk of errors, discrepancies, and fraud.

In conclusion, creating an example of expense report is an important part of managing your business finances effectively. By following the guidelines provided in this article, you can create reports that are accurate, comprehensive, and useful for making informed financial decisions. Whether you’re a small business owner or part of a large corporation, taking the time to create effective expense reports can help you stay on top of your finances and achieve long-term success.