Learn how Household Budget Worksheets can help you take control of your finances and achieve your financial goals. Explore practical tips and free downloadable templates.

In today’s fast-paced world, managing your household finances can be quite challenging. Keeping track of expenses, income, and savings can often feel like an overwhelming task. However, there is a simple and effective solution to help you take control of your finances and work towards your financial goals: Household Budget Worksheets. In this article, we’ll explore the importance of Household Budget Worksheets and provide you with valuable insights to help you get started on your path to financial success.

The Power of Household Budget Worksheets

Household Budget Worksheets are invaluable tools that enable you to create a comprehensive overview of your financial situation. These worksheets are designed to help you track your income, expenses, and savings, allowing you to make informed financial decisions. Here’s why they are essential:

- Financial Clarity

Household Budget Worksheets provide a clear and detailed snapshot of your financial status. By categorizing your income and expenses, you can quickly identify areas where you can cut costs or increase savings. - Goal Setting

With a budget worksheet, you can set specific financial goals, such as paying off debt, saving for a vacation, or investing for the future. The worksheet helps you allocate funds towards these goals. - Expense Tracking

You can easily keep track of your monthly expenses, identify areas of overspending, and make necessary adjustments to your spending habits. - Savings Planning

Household Budget Worksheets help you allocate a portion of your income to savings, ensuring you have money set aside for emergencies and long-term goals. - Debt Management

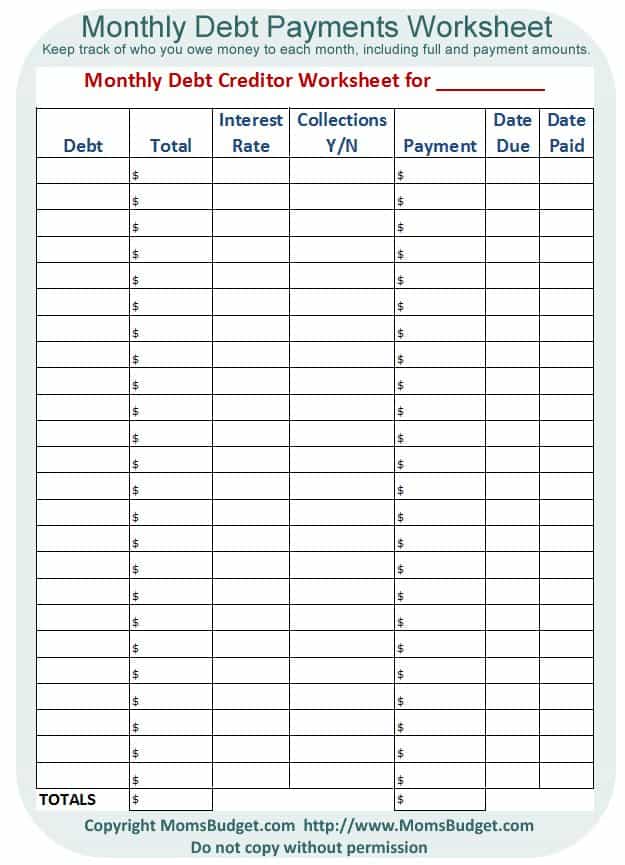

If you have outstanding debts, a budget worksheet can help you plan your debt repayment strategy, minimizing the financial burden.

Getting Started with Household Budget Worksheets

To get started with Household Budget Worksheets, follow these simple steps:

- Gather Financial Information

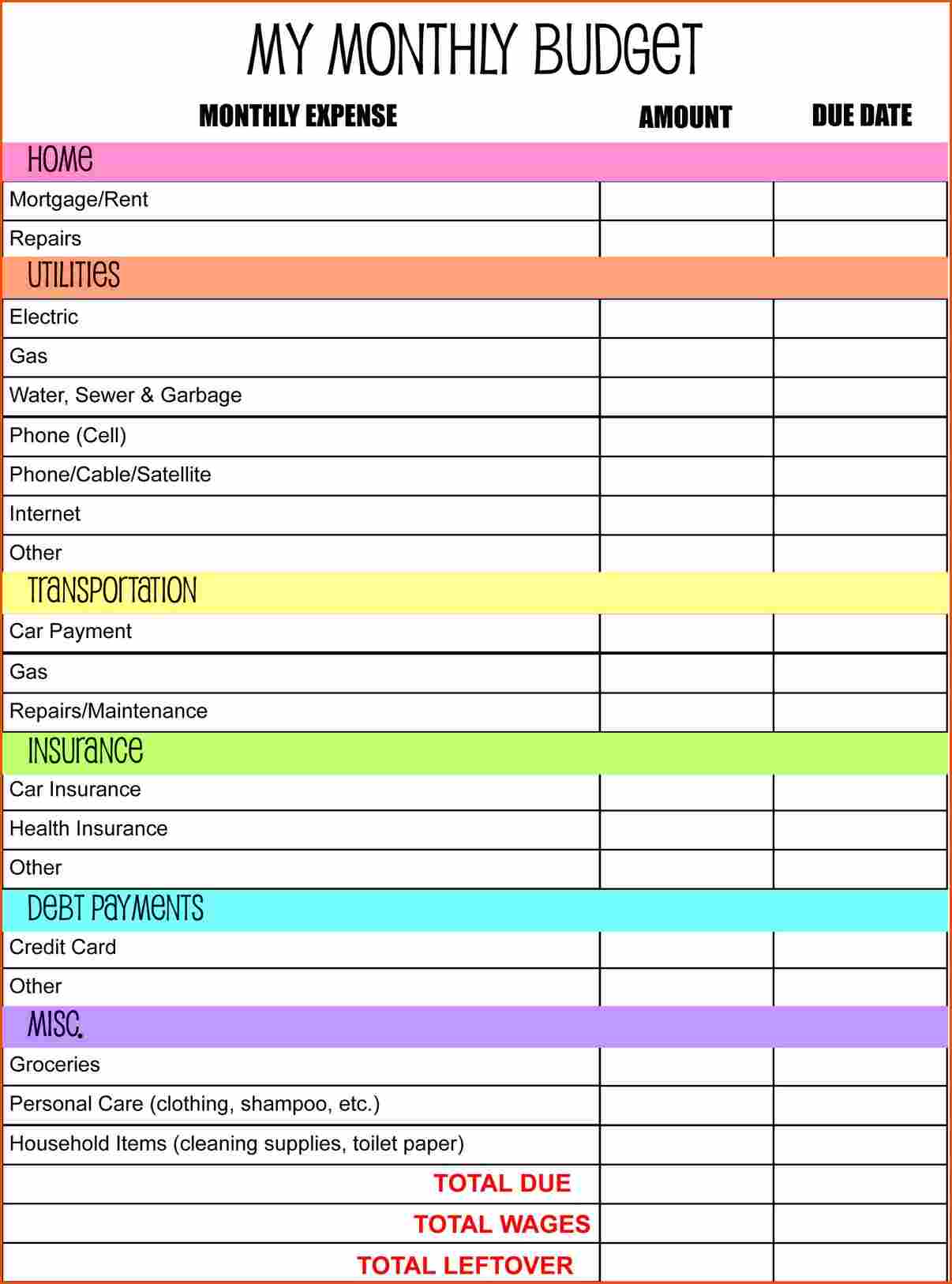

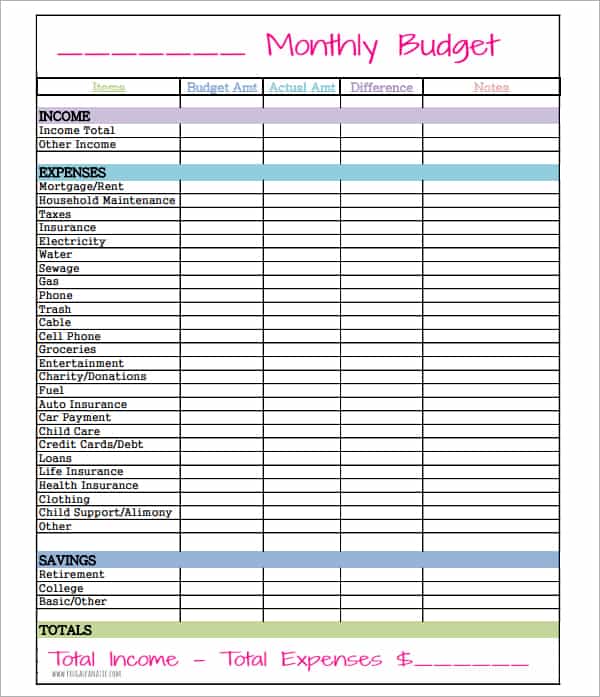

Collect all relevant financial documents, such as bank statements, pay stubs, and bills. This will give you a clear picture of your income and expenses. - Choose a Worksheet Template

You can find numerous free budget worksheet templates online. Select one that suits your preferences and financial goals. - Income Assessment

List all sources of income, including your salary, rental income, or any other financial streams. - Expense Categorization

Categorize your expenses, such as housing, groceries, transportation, entertainment, and debt payments. Be as detailed as possible. - Monthly Projections

Estimate the amount you expect to earn and spend in each category for the upcoming month. This will be your budgeted amount. - Tracking

As the month progresses, enter your actual income and expenses into the worksheet to compare with your budgeted amounts. - Review and Adjust

At the end of the month, review your budget worksheet. Analyze any discrepancies between the budgeted and actual amounts and make necessary adjustments for the next month.

Making the Most of Household Budget Worksheets

To maximize the effectiveness of your Household Budget Worksheets, consider the following tips:

- Stick to Your Budget

Discipline is key to successful budgeting. Stay committed to your financial plan and make adjustments as needed. - Emergency Fund

Allocate a portion of your income for an emergency fund to cover unexpected expenses without derailing your budget. - Automate Savings

Set up automatic transfers to your savings account to ensure that you consistently save a portion of your income. - Debt Reduction

If you have outstanding debts, allocate extra funds to pay them off faster, reducing interest expenses. - Regular Review

Review your budget regularly, ideally on a monthly basis, to stay on top of your financial progress.

Conclusion

Household Budget Worksheets are powerful tools that can help you take control of your finances, reduce stress, and work towards your financial goals. With a clear budget in place, you can make informed financial decisions and pave the way for a more secure and prosperous future. So, start using Household Budget Worksheets today and take the first step toward financial success. Get your free downloadable templates from Pruneyard Inn and begin your journey to financial stability. Your financial future is in your hands.