You can make use of the free debt reduction spreadsheet to meet your financial goals. The truth is that many people are not aware of what they need to do in order to achieve financial success. You see, most people have too much debt and as a result have to settle for whatever they can get their hands on.

I know exactly how you feel because I used to be in your shoes. I didn’t realize the full extent of my debt until I was served with a summons to appear in court. As it turned out, I had more than five thousand dollars in credit card debt that I was unable to repay.

This was about three years ago and I discovered that bill collectors were calling me at all hours of the day and night. They wanted me to pay them before they would stop calling. At this point, I was about ready to file for bankruptcy.

Fortunately, I was able to secure financial freedom through the help of the Federal Credit Union. I signed up for a secured line of credit with the Federal Credit Union and as a result was able to put myself back on track. Now that I’m debt free, I want to share with you a free debt reduction spreadsheet I found online.

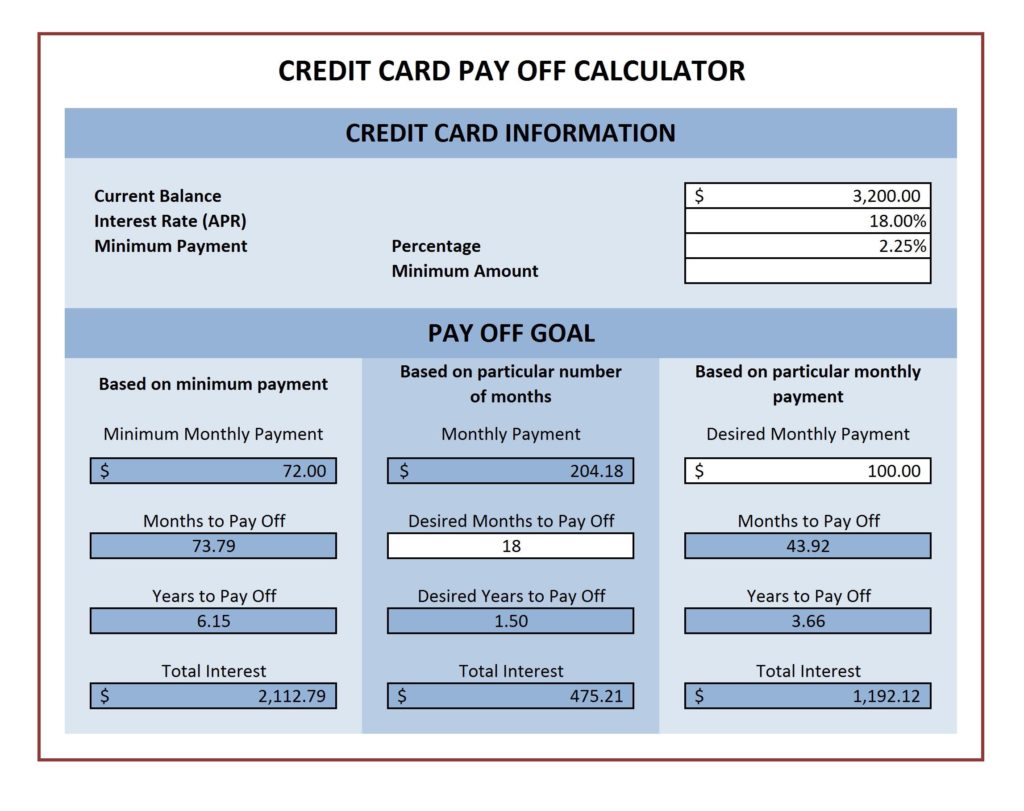

The free debt reduction spreadsheet will assist you in developing your own debt relief plan that is tailored to your individual circumstances. If you are worried about having a hard time gathering the data that will help you analyze your financial situation, you can also download the spreadsheet on your computer and analyze it on your own.

There are various areas that will be represented. Your total debt, the amount you owe each month, and your total debts are included in the total that you should keep track of. It is crucial that you keep track of all your monthly payments and take care of these first.

Next, you should consider your total monthly expenses. Are there any hidden costs that you are not including on your monthly budget? After you have finished tracking all of these things, you should develop a spending plan that is based on these figures.

Finally, follow a common sense strategy. I know that you can’t afford to get into debt in a hurry, but if you don’t do anything to change your finances in the short term, then the snowball effect of more money coming from more payments will take over. This will have severe repercussions on your finances and will only end in disaster.