You do not have to be a financial wizard to build your own Financial Budget Spreadsheet Template. All you need is a spreadsheet program and you can get up and running with the formulas in minutes. You can add new items or edit your existing budget and start saving money on things you don’t need. This is one of the best ways to change the way you live financially.

Every month, the government automatically creates a budget for every household in the country. The Social Security Administration then updates that budget with their monthly costs. To simplify the process, each household has a Financial Budget Spreadsheet Template. These spreadsheets, which are the foundation of a financial budget, are based on the tax code of the United States. Since most households have one or more deductions, the spreadsheet will reflect that.

The first step is to input all of your details. To get your Personal Income Tax Status, you must first figure out if you are single or married. If you are married, you will need to figure out if you have any dependents. There are two options available here. One option is that you can enter all of your dependents on the first line and the other option is that you can simply use your spouse’s Social Security Number as the Social Security Number of your dependents.

The next step is to determine how much income you have coming in each week. If you are single, enter the amount on the first line. To figure out how much you have coming in, you will need to add up your paycheck, add up the rest of your paychecks, and then add up the other income you have like dividends, interest, savings, and taxes. Then you will need to figure out how much you will need to pay each month in taxes.

For couples who are married filing jointly, they will also need to figure out their income tax status. Once you have figured out the amount you will need to pay on the first line, add that amount up to and enter it on the second line. The amount you will need to pay on the second line will be your taxable income. That amount will need to be split up between the husband and wife on the spreadsheet. Make sure to enter the totals on the third line as well.

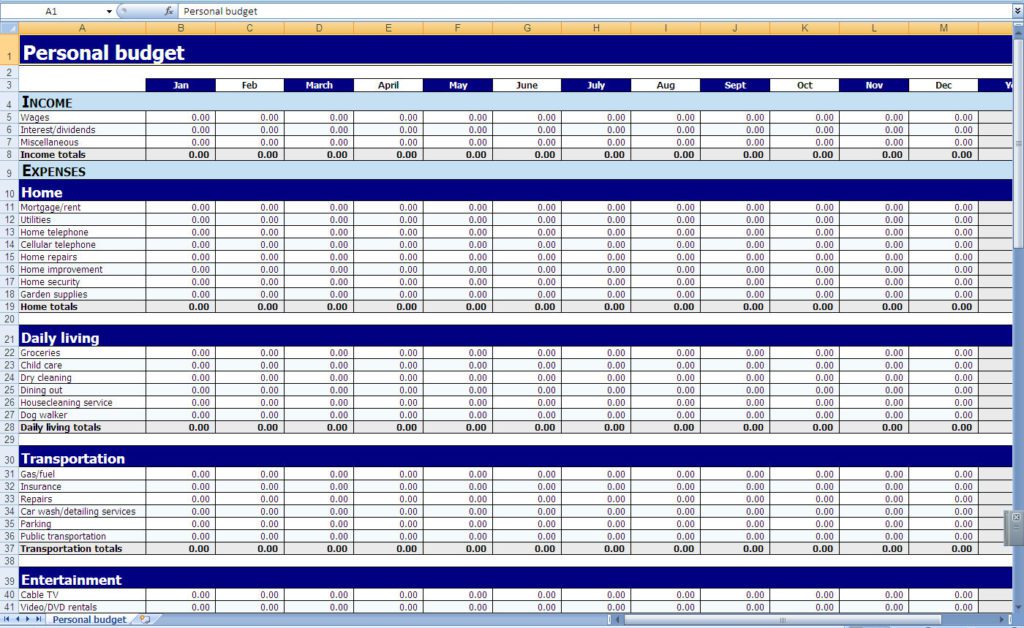

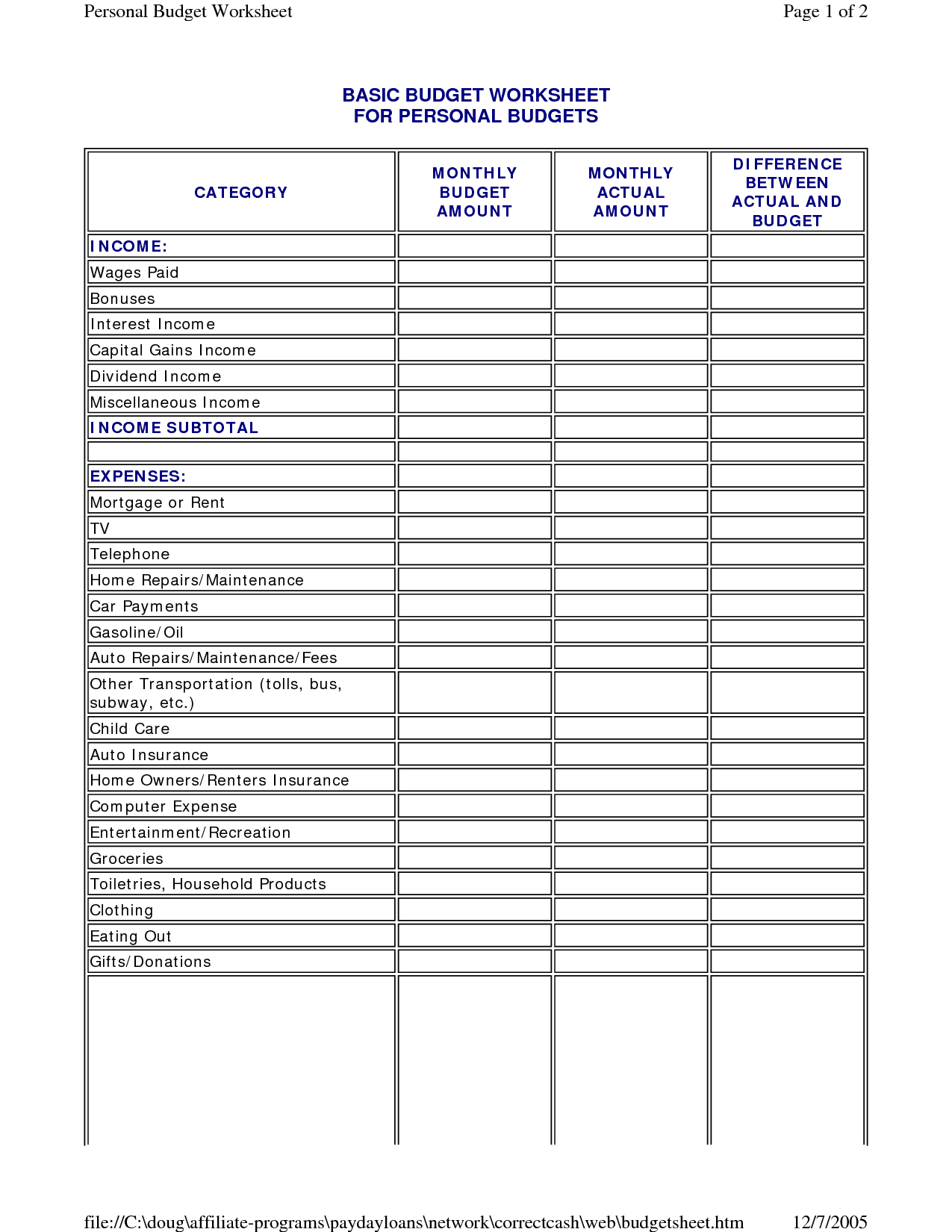

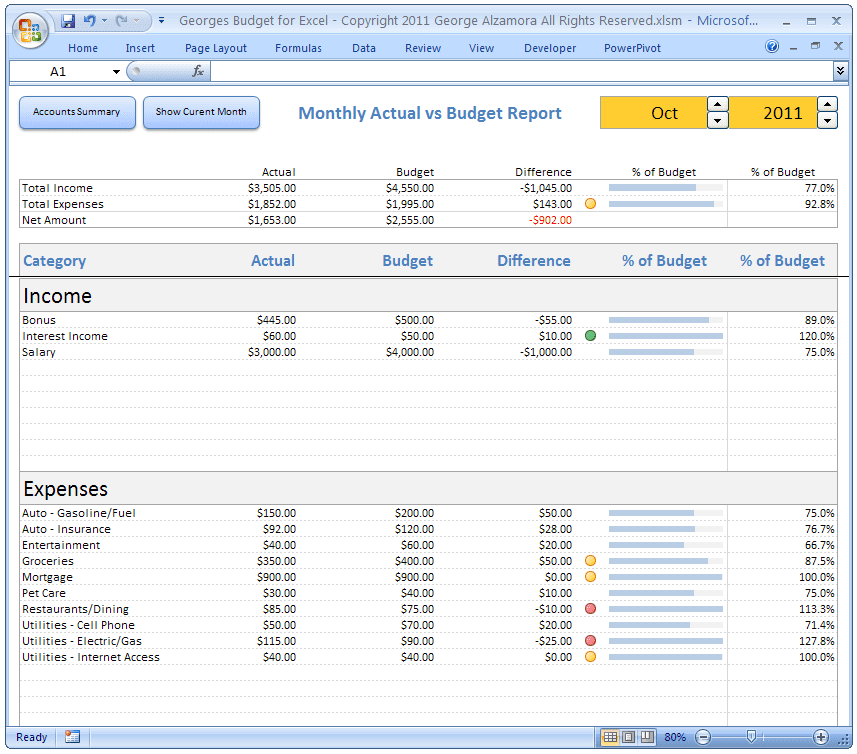

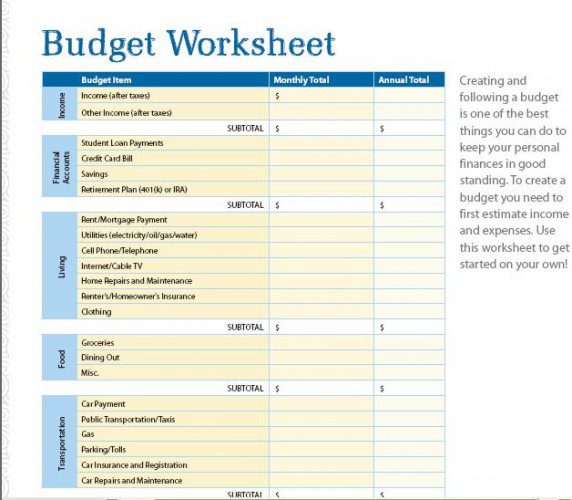

After you have calculated the total income that you will need to pay each month, you will need to decide what your major expenses are. There are six major expenses that you will want to account for. These include transportation, housing, food, education, clothing, entertainment, and miscellaneous items. Make sure to input these expenses on the first line.

There are also seven categories of major expenses that you can determine on the second line of the spreadsheet. These are credit card interest, mortgage interest, auto insurance, children’s tuition, child care fees, and miscellaneous items.