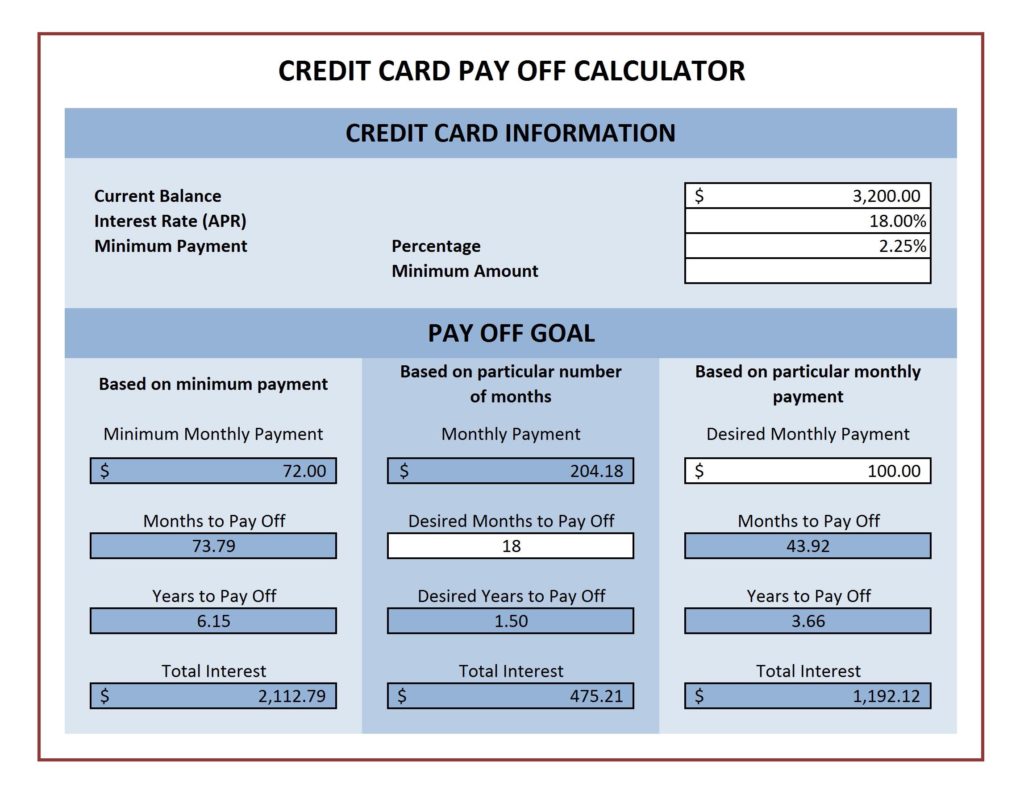

You can get rid of your credit card debt by using a simple spreadsheet. A spreadsheet can be used for so many things, and the same thing applies to credit card debt. The spreadsheet will make it easier for you to work with, and you will be able to track your progress more easily.

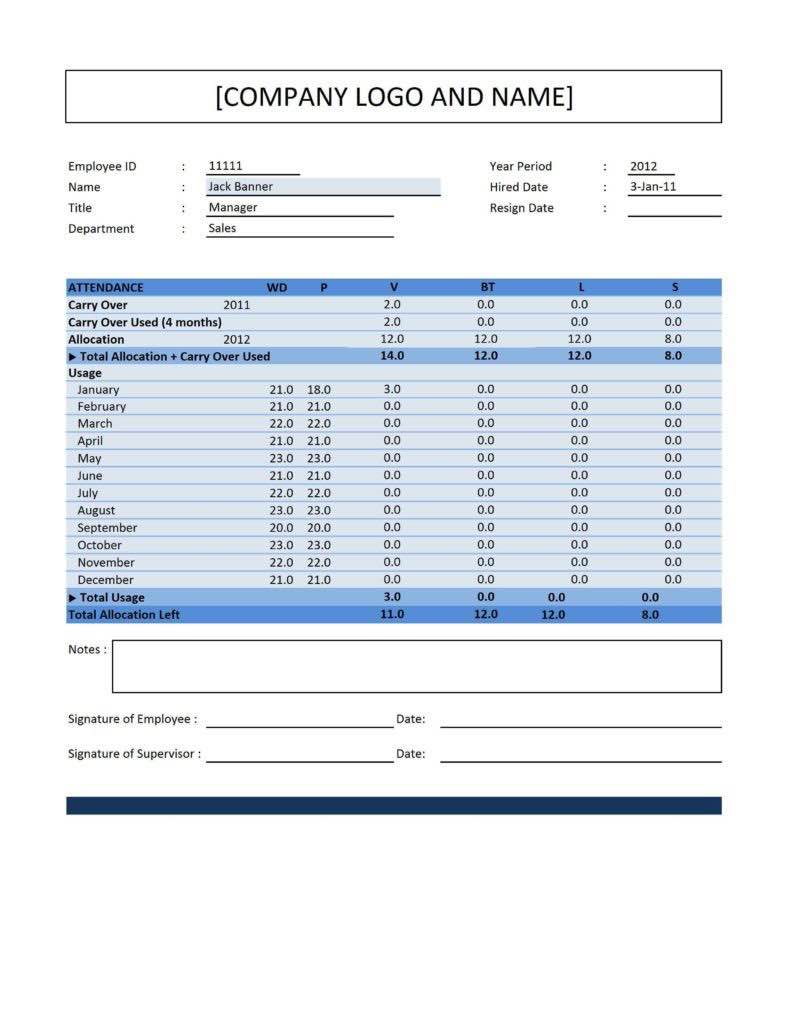

To find yourself financial freedom is to create an organized way to keep track of all of your bills. The spreadsheet will give you all of the information you need to make sure that you are paying all of your bills on time and to ensure that you will not be back in debt before you know it.

Now you do not have to hire a professional service to pay off your debt. You can use the spreadsheet to start looking at how much you owe. It will also show you how much you have paid so far. The spreadsheet is like a personal banker, and he will help you pay off your debt as quickly as possible.

You need to figure out how much money you can afford to pay out each month on your credit card debt. You should take the minimum amount you can pay each month and then use the spreadsheet to figure out how much you should put into your pay. Then you can pay your minimum amount out, and once you have spent the minimum, you can make another payment.

When you are paying your monthly minimum, you can still add more money to your budget. This is because the spreadsheet will subtract the minimum amount from your account every month. You can add a little more than the minimum amount if you are only paying the minimum, but you should not add more than what you can afford to pay out.

The spreadsheet will automatically add to your account any new debt you create. You can add this to your account, and the spreadsheet will tell you when to make any additional payments. This is going to save you time, because you will not have to keep track of your payables.

Another reason you want to use a spreadsheet is because it will help you be more organized. You will not have to worry about which money you are spending on which account. It will do all of the work for you.

A debt payoff spreadsheet can help you to quickly pay off your credit card debt. You can see how much you can afford to pay each month and you can figure out how much you should spend each month, and then you can automatically add money to your budget to pay off your debt.