Examples Of Financial Reports: Understanding Their Importance

Learn the importance of financial reports and explore some examples of different types of reports that can help you make informed decisions for your business.

Financial reports are a critical tool for businesses to assess their financial health, plan for the future, and make informed decisions. They provide a snapshot of a company’s financial situation at a specific time and help identify areas that need improvement. In this article, we will discuss the importance of financial reports and explore some examples of different types of reports that businesses can use.

Balance Sheet

The balance sheet is one of the most critical financial reports that a business can have. It provides a snapshot of a company’s financial health by showing its assets, liabilities, and equity. The balance sheet helps businesses understand their net worth and assess their financial stability. It can also be used to calculate important ratios, such as the debt-to-equity ratio, which can help businesses identify areas where they need to improve.

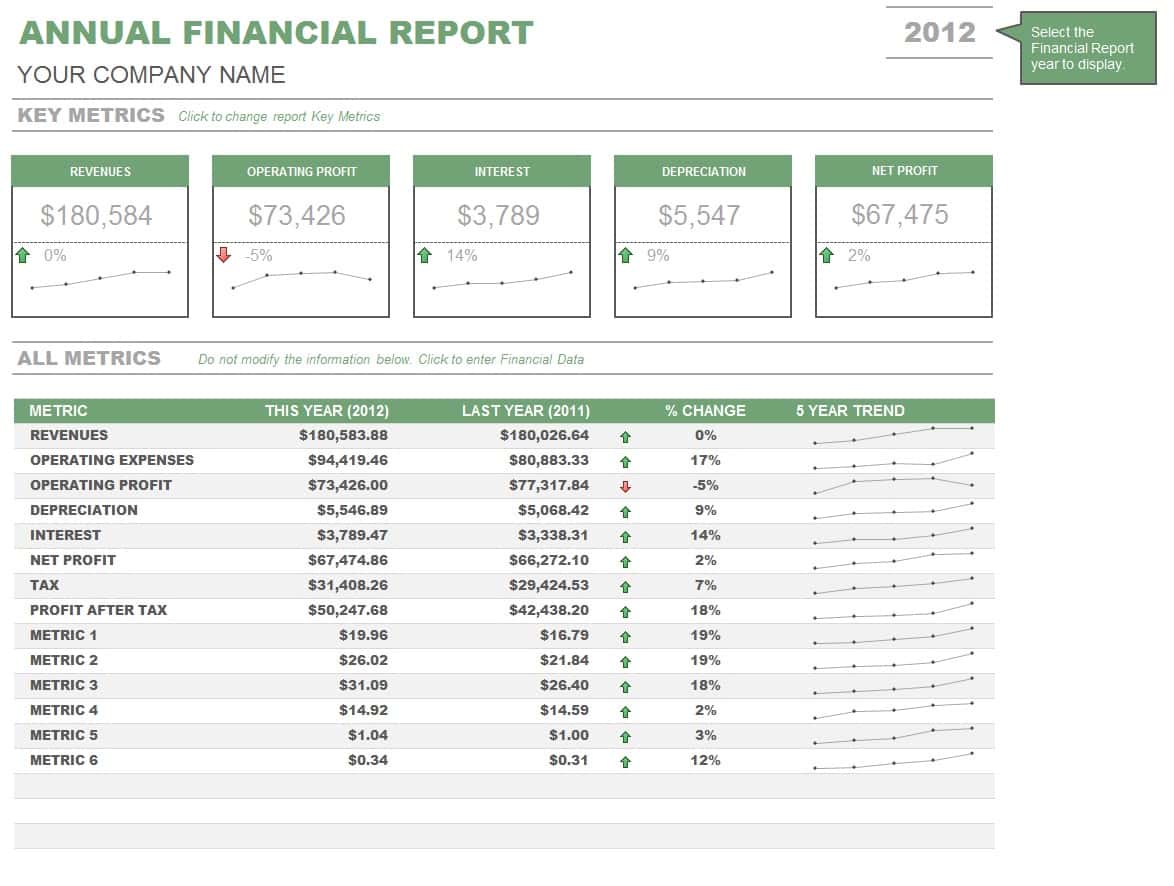

Income Statement

The income statement, also known as the profit and loss statement, provides an overview of a company’s revenues and expenses over a specific period. It helps businesses understand their profitability and identify areas where they can cut costs. The income statement can also be used to calculate important ratios, such as the gross profit margin and net profit margin, which can help businesses assess their financial health.

Cash Flow Statement

The cash flow statement provides an overview of a company’s cash inflows and outflows over a specific period. It helps businesses understand their liquidity and assess their ability to meet short-term obligations. The cash flow statement can also be used to calculate important ratios, such as the cash conversion cycle and the operating cash flow ratio, which can help businesses identify areas where they need to improve.

Budget vs. Actual Report

The budget vs. actual report compares a company’s actual financial performance against its budgeted performance. It helps businesses understand where they are exceeding or falling short of their financial goals and identify areas where they need to adjust their spending. The budget vs. actual report can also be used to calculate important ratios, such as the variance analysis, which can help businesses understand the reasons behind their performance.

Conclusion

Financial reports are a crucial tool for businesses to assess their financial health, plan for the future, and make informed decisions. By using different types of reports, businesses can gain a comprehensive understanding of their financial situation and identify areas where they need to improve. As such, it is essential for businesses to take the time to generate and review financial reports regularly.

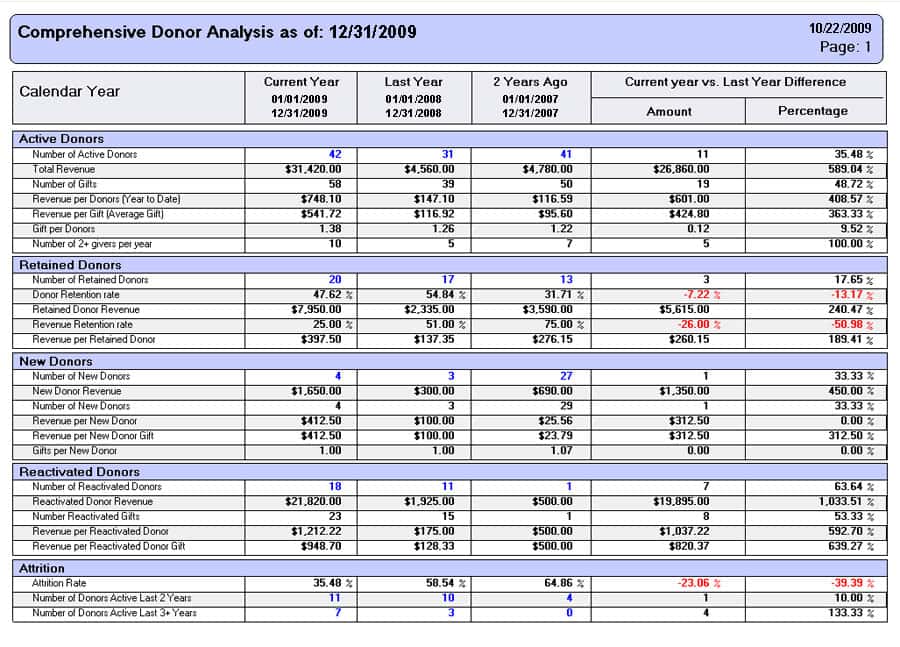

In addition to the reports mentioned above, businesses may also use other types of financial reports, depending on their specific needs. For example, a company may generate a sales report to track their sales performance, or a project report to track the financial performance of a specific project.

Regardless of the type of report, the key to making the most of financial reports is to generate them regularly and review them thoroughly. By doing so, businesses can identify trends, spot potential issues before they become major problems, and make informed decisions to drive growth and profitability.

Another advantage of financial reports is that they can be used to communicate a company’s financial performance to stakeholders, such as investors and lenders. Financial reports provide a transparent and objective view of a company’s financial health, which can help build trust and confidence among stakeholders.

In conclusion, financial reports are an essential tool for businesses to understand their financial health and make informed decisions. By generating and reviewing different types of reports, businesses can gain a comprehensive understanding of their financial situation and identify areas where they need to improve. As such, businesses should prioritize generating and reviewing financial reports regularly and using them to drive growth and profitability.