Understanding Credit Reports: An Example of a Credit Report

Get a better understanding of credit reports by checking out this example of a credit report. Learn what information is included and how to interpret it to improve your credit score.

If you’re looking to borrow money, apply for a credit card, or even rent an apartment, your credit score is going to play a big role in your approval or denial. But what exactly is a credit score, and how is it determined? Well, your credit score is based on the information contained in your credit report. In this article, we’ll take a closer look at credit reports by providing an example of a credit report, explaining what information is included, and how you can interpret it.

What is a Credit Report?

A credit report is a detailed summary of your credit history. It includes information on your credit accounts, payment history, and any outstanding debts or bankruptcies. Credit reports are used by lenders, landlords, and even employers to determine your creditworthiness and financial responsibility.

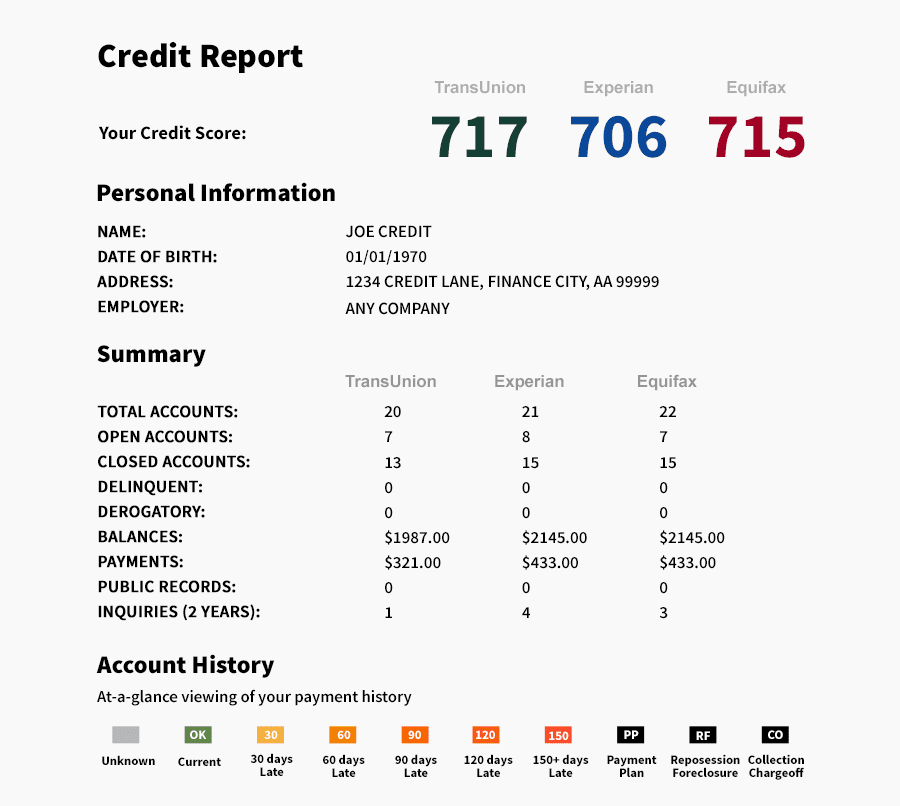

Example of a Credit Report

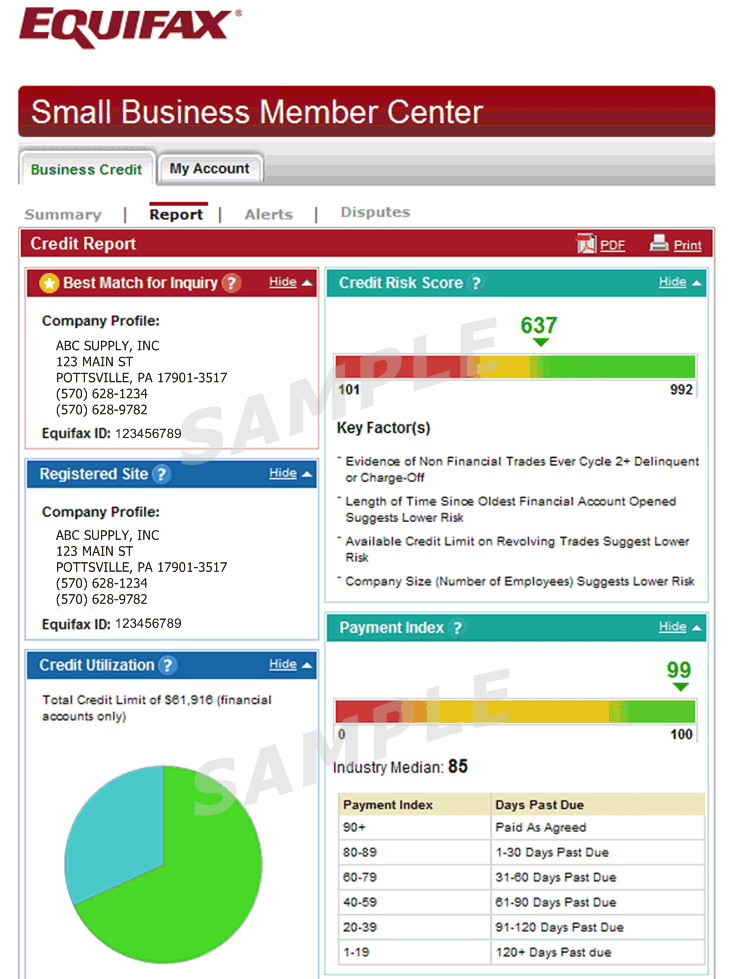

To better understand what information is included in a credit report, let’s take a look at an example credit report. For the purpose of this article, we’ll use a sample credit report from Equifax, one of the three major credit bureaus.

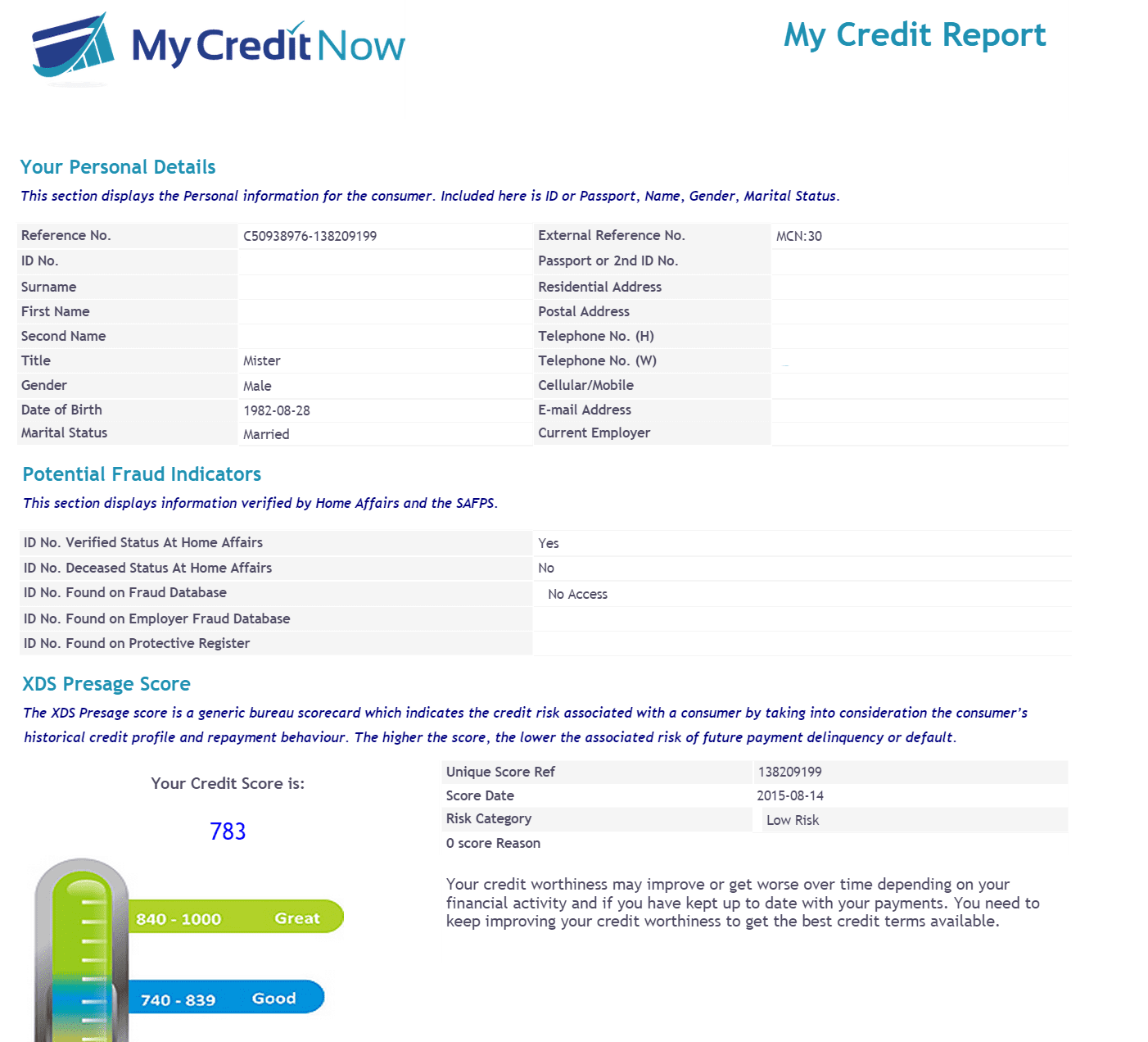

Personal Information

The first section of the credit report contains your personal information, including your name, address, social security number, and date of birth. It’s important to review this section for accuracy, as any errors could negatively impact your credit score.

Credit Accounts

The next section of the credit report provides information on your credit accounts, including credit cards, loans, and mortgages. It lists the creditor’s name, account number, and the date the account was opened. It also includes the type of account, such as revolving or installment, the credit limit or loan amount, and the current balance or amount owed.

Payment History

The payment history section of the credit report provides a summary of your payment history for each credit account. It includes the date the payment was due, the date it was made, and whether the payment was on time or late. Late payments can have a negative impact on your credit score, so it’s important to review this section carefully.

Public Records

If you have any bankruptcies, foreclosures, or tax liens on your credit history, they will be listed in the public records section of your credit report. These negative marks can stay on your credit report for up to 10 years and can severely impact your credit score.

Inquiries

The last section of the credit report contains a list of inquiries made on your credit history. This includes any time you applied for credit, such as a credit card or loan, and a potential lender pulled your credit report. Too many inquiries in a short period of time can negatively impact your credit score, as it may indicate that you are a risky borrower.

How to Interpret a Credit Report

Now that you understand what information is included in a credit report, it’s important to know how to interpret it. The most important factor in your credit score is your payment history, so be sure to review this section carefully. Make sure all payments are on time and dispute any errors.

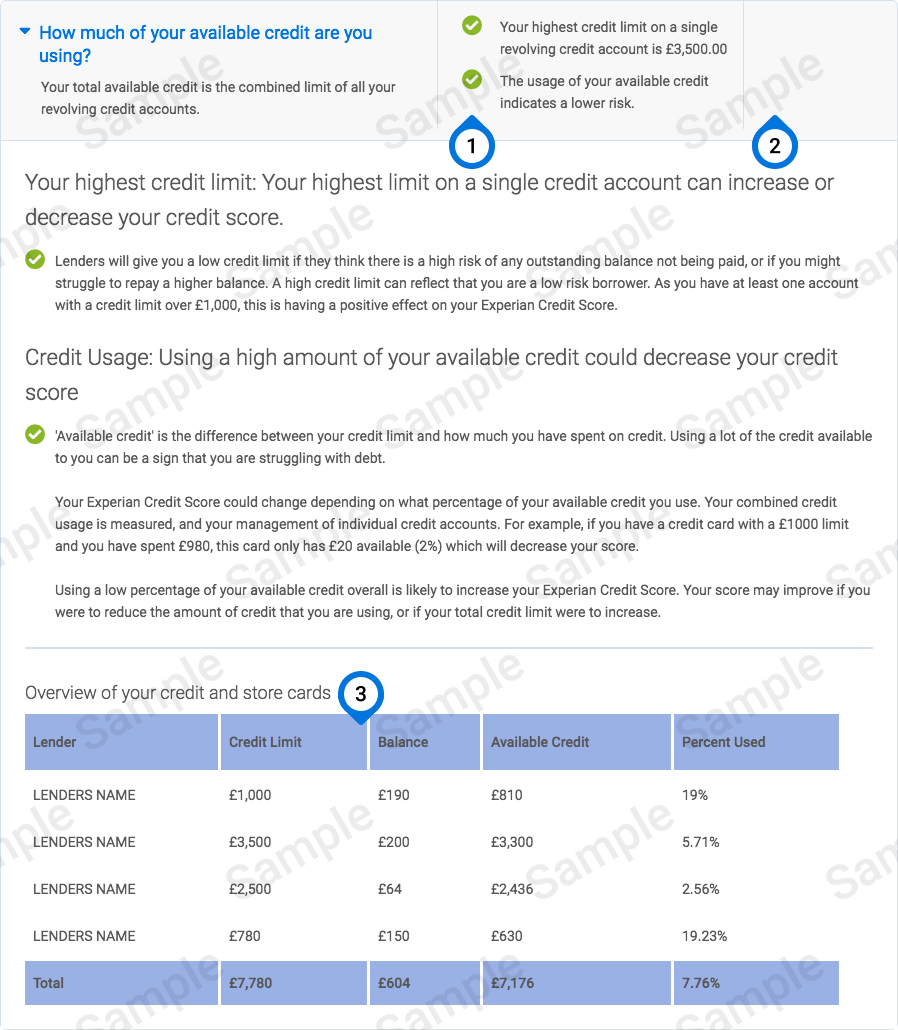

It’s also important to review your credit accounts and outstanding debts. Paying off outstanding debts can have a positive impact on your credit score, as it lowers your credit utilization rate. This is the amount of credit you are using compared to your total available credit. Ideally, you want to keep your credit utilization rate below 30%.

Lastly, be sure to review the inquiries section of your credit report. Limit the number of inquiries you make on your credit history and only apply for credit when necessary.

Conclusion

Your credit report is an important tool in determining your creditworthiness and financial responsibility. Understanding what information is included in a credit report and how to interpret it is crucial for maintaining a good credit score.

By checking out this example of a credit report, you can get a better understanding of what information is included and how to review it for accuracy. Make sure to review your credit report regularly and dispute any errors or inaccuracies that may negatively impact your credit score.

Remember, a good credit score can open up a world of opportunities for you, from better interest rates on loans and credit cards to approval for a mortgage or rental application. So take the time to review your credit report and make sure it accurately reflects your credit history.

In conclusion, we hope this example of a credit report has provided valuable insight into how credit reports work and what information they contain. Use this knowledge to take control of your credit history and improve your credit score over time.