Examples of Expense Reports: Understanding Different Categories

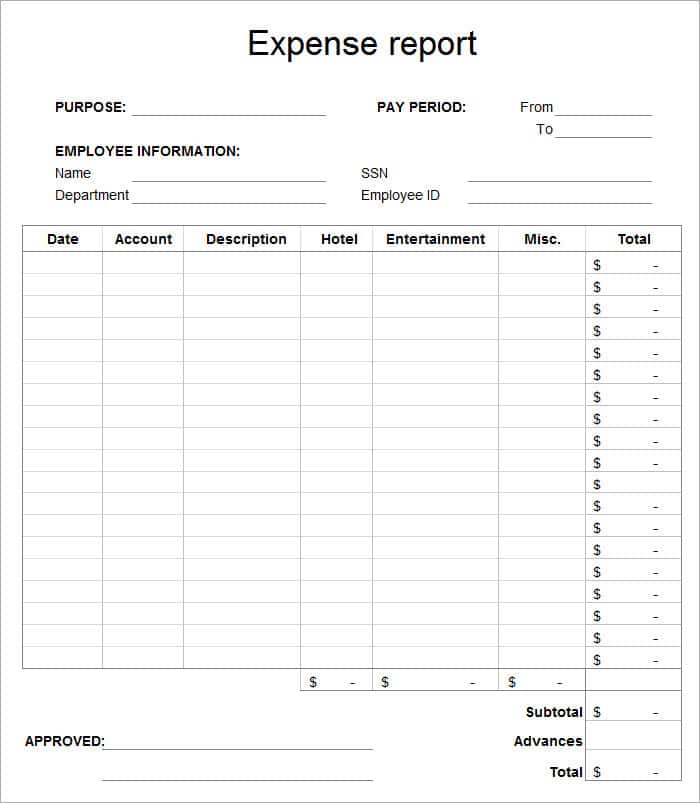

Expense reports are essential documents that help individuals and businesses keep track of their spending. These reports provide a detailed breakdown of expenses, which can be used to create budgets, monitor cash flow, and make informed financial decisions. However, not all expenses are created equal, and there are various categories of expenses that need to be considered. In this article, we will explore different categories of expense reports and provide examples of each.

- Travel Expenses

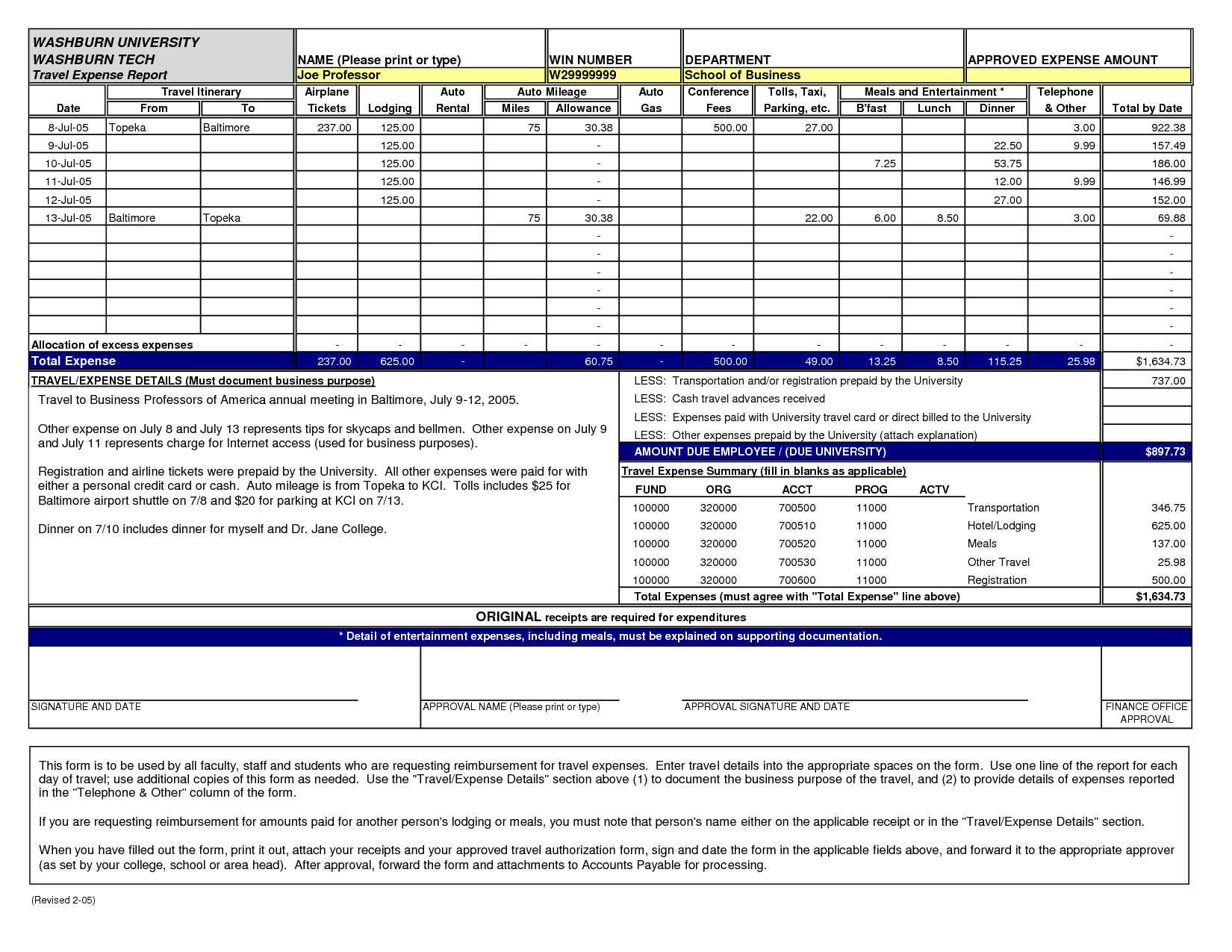

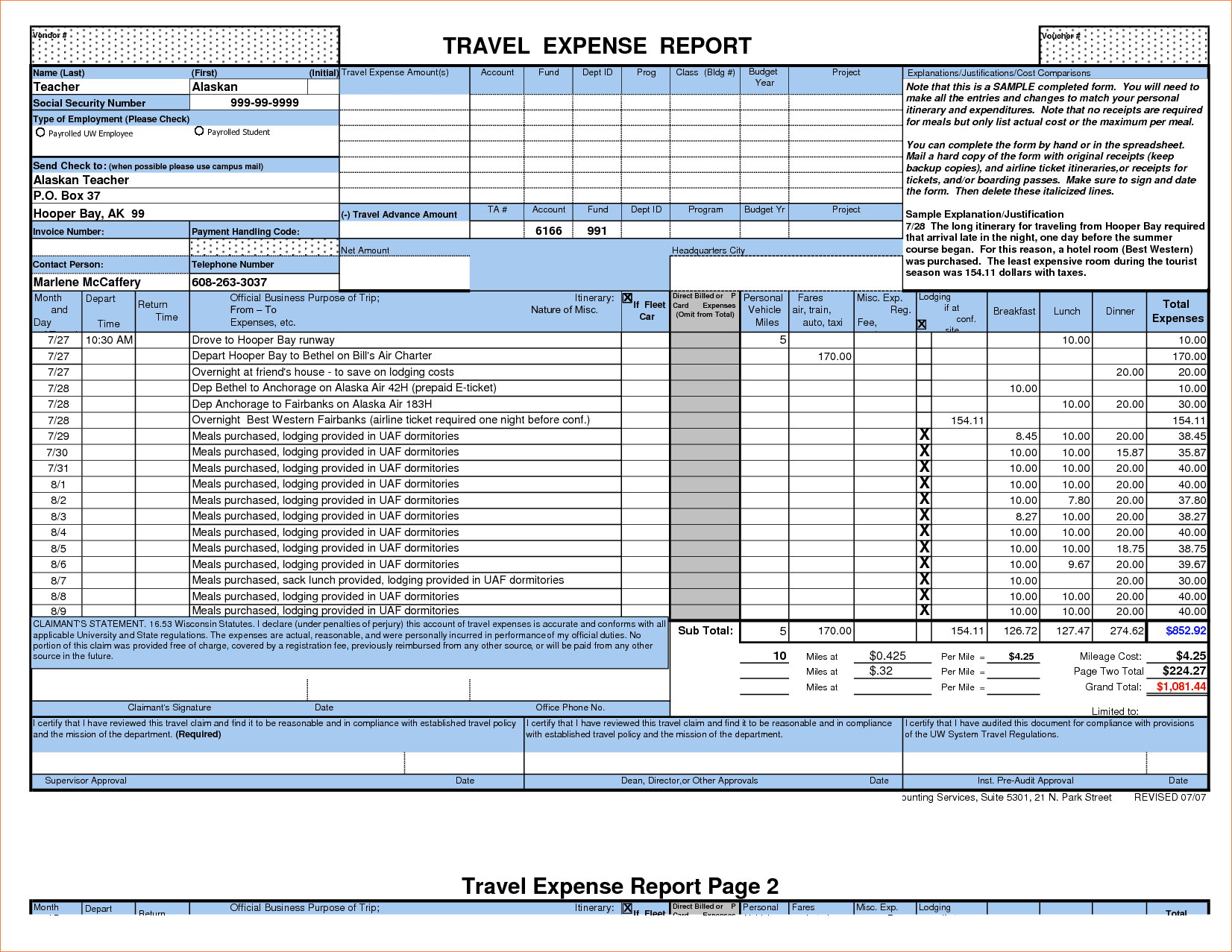

Travel expenses are some of the most common types of expenses that individuals and businesses incur. These expenses can include airfare, lodging, meals, and transportation. For example, if an employee travels for business purposes, they may submit an expense report that includes the cost of their plane ticket, hotel room, rental car, and meals.

- Entertainment Expenses

Entertainment expenses are another category of expenses that individuals and businesses may incur. These expenses can include the cost of meals, drinks, tickets to events, and other entertainment-related expenses. For example, if a business owner takes a client out to dinner to discuss a potential partnership, they may include the cost of the meal on their expense report.

- Office Expenses

Office expenses refer to any expenses that are related to running a business. These expenses can include rent, utilities, office supplies, and equipment. For example, if a business owner rents an office space, they may include the cost of rent, utilities, and other associated expenses on their expense report.

- Marketing and Advertising Expenses

Marketing and advertising expenses are another category of expenses that businesses may incur. These expenses can include the cost of advertising campaigns, marketing materials, and promotional events. For example, if a business owner hosts a trade show or conference, they may include the cost of renting a booth, printing marketing materials, and other associated expenses on their expense report.

- Training and Development Expenses

Training and development expenses refer to any expenses related to employee training and development. These expenses can include the cost of training courses, seminars, workshops, and conferences. For example, if a business owner sends an employee to a training seminar, they may include the cost of registration, travel, and lodging on their expense report.

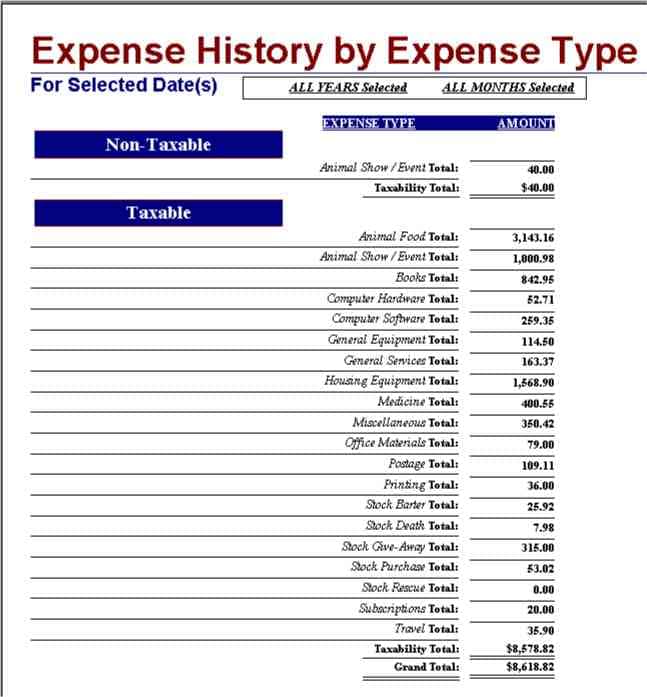

- Miscellaneous Expenses

Miscellaneous expenses are any expenses that do not fit into any of the above categories. These expenses can include bank fees, legal fees, and other miscellaneous expenses. For example, if a business owner pays for a legal consultation, they may include the cost of the consultation on their expense report.

In conclusion, expense reports are crucial for tracking expenses and managing finances. Understanding the different categories of expense reports can help individuals and businesses better manage their spending and make informed financial decisions. By accurately tracking expenses, businesses can improve their cash flow, reduce expenses, and increase profits.

When preparing an expense report, it’s essential to be thorough and accurate to ensure that all expenses are accounted for. It’s also important to note that different categories of expenses may have different requirements and limitations, such as maximum reimbursement amounts or specific documentation requirements.

For example, when submitting a travel expense report, it may be necessary to include copies of receipts for meals and transportation. In contrast, marketing and advertising expenses may require detailed information about the campaign or event, including the target audience, goals, and results.

In addition to tracking expenses, expense reports can also be used to identify areas where costs can be reduced or eliminated. For example, if a business owner notices that travel expenses are consistently higher than expected, they may investigate alternative travel options or negotiate better rates with vendors.

Overall, expense reports are an essential tool for managing finances and tracking expenses. By understanding the different categories of expenses and the requirements for each, individuals and businesses can ensure that their reports are accurate and complete. This, in turn, can help improve financial management, reduce costs, and increase profitability.