Enterprise Risk Management Sample Report – Understanding the Importance of Risk Management

In this article, we will explore the significance of enterprise risk management and how an enterprise risk management sample report can help businesses mitigate risks and make informed decisions.

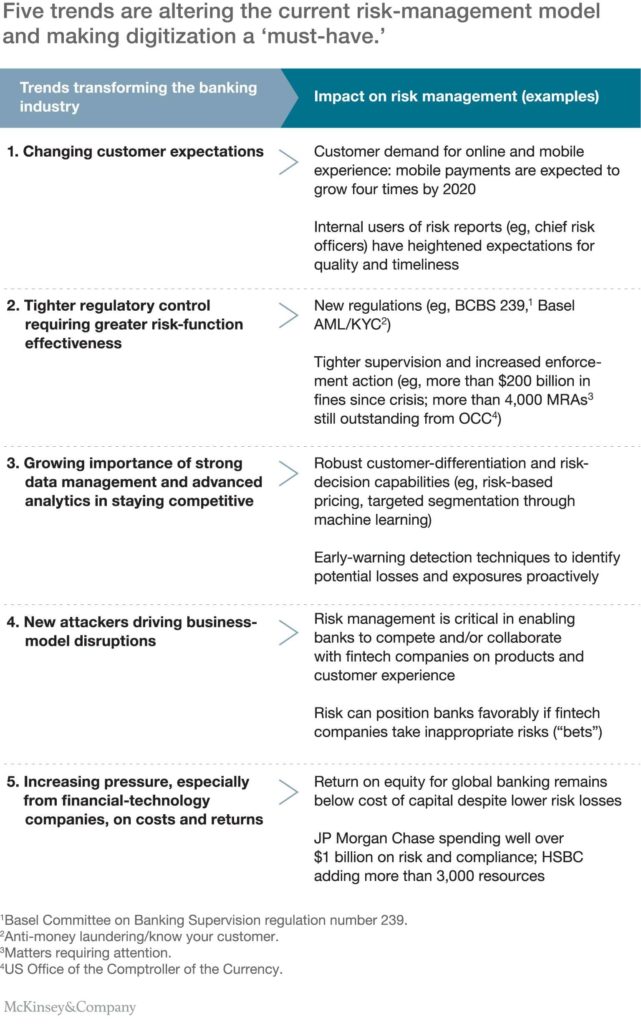

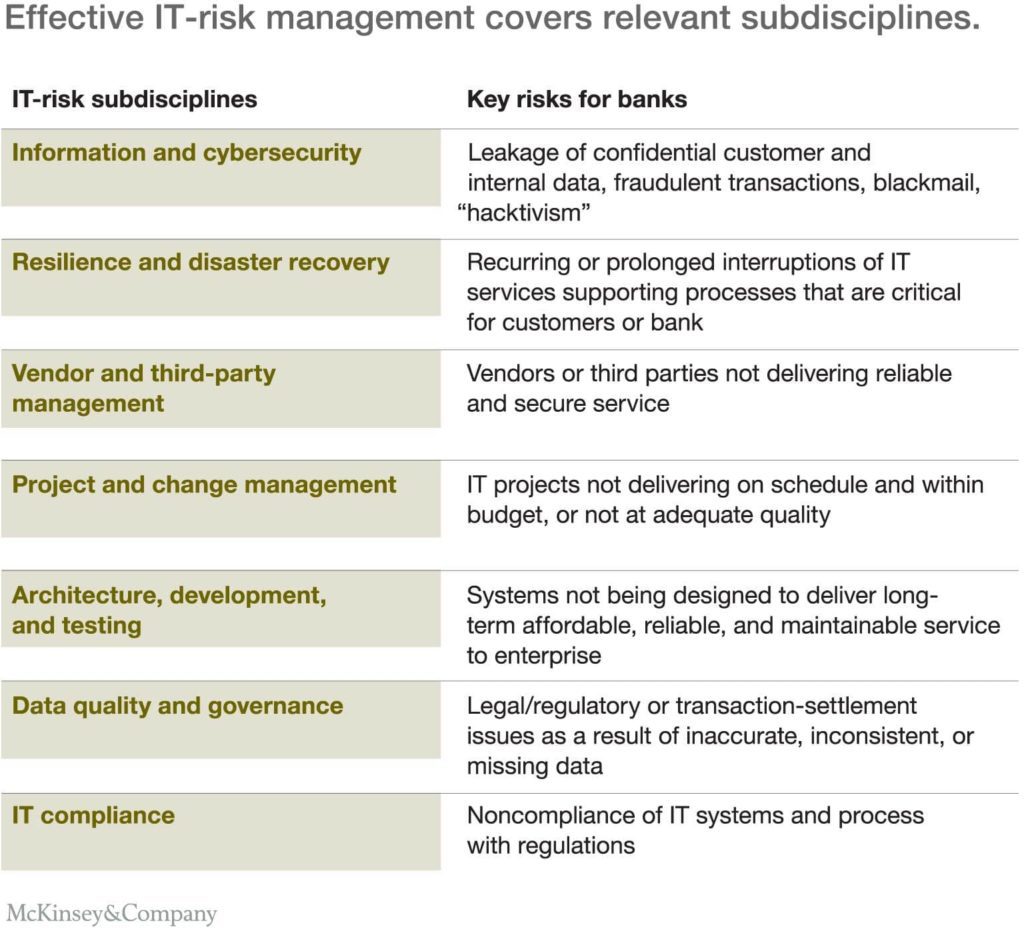

As businesses grow and evolve, they face a wide range of risks that can potentially impact their operations and bottom line. From natural disasters and cybersecurity breaches to economic downturns and regulatory changes, the list of potential risks is endless. To mitigate these risks and safeguard their business, organizations turn to enterprise risk management (ERM).

Enterprise risk management involves identifying, assessing, and managing risks that can affect an organization’s strategic objectives. ERM is a continuous process that helps organizations identify and prioritize risks, allocate resources to mitigate those risks, and monitor and review risk management activities.

One of the key benefits of ERM is that it enables organizations to take a proactive approach to risk management. By identifying and assessing risks in advance, organizations can take steps to mitigate those risks and reduce their impact. This not only helps to protect the organization but can also create opportunities for growth and innovation.

To implement an effective ERM program, organizations need to develop a comprehensive risk management framework that aligns with their strategic objectives. This framework should include a range of tools and processes, such as risk assessment, risk mitigation, risk monitoring, and reporting.

One valuable tool in the ERM process is the enterprise risk management sample report. A sample report provides organizations with a clear understanding of their current risk profile and helps them identify potential risks that they may not have considered before. It also provides a roadmap for implementing risk management strategies and helps organizations prioritize their risk management activities.

The enterprise risk management sample report typically includes a risk assessment matrix that categorizes risks based on their impact and likelihood. It also provides an overview of the organization’s risk management activities, including risk mitigation strategies and risk monitoring processes.

In addition to the risk assessment matrix, the sample report may also include a risk register, which is a comprehensive list of all the risks identified by the organization. The risk register should include details such as the risk description, potential impact, likelihood of occurrence, risk owner, and mitigation strategies.

Another important element of the enterprise risk management sample report is the risk management plan. The risk management plan outlines the strategies and actions that the organization will take to mitigate identified risks. This may include implementing controls to reduce the likelihood of a risk occurring, developing contingency plans to address risks if they do occur, and monitoring and reporting on risk management activities.

In conclusion, enterprise risk management is a critical component of any organization’s risk management strategy. By implementing an effective ERM program, organizations can identify and mitigate potential risks, protect their operations and bottom line, and create opportunities for growth and innovation. An enterprise risk management sample report can provide organizations with valuable insights into their risk profile and help them develop a comprehensive risk management framework that aligns with their strategic objectives.

Furthermore, the enterprise risk management sample report can help organizations communicate their risk management activities and progress to stakeholders. This includes board members, investors, and regulators who are interested in understanding how the organization is managing its risks. By providing clear and concise information on risk management activities, the organization can demonstrate its commitment to risk management and increase stakeholder confidence.

Another benefit of using an enterprise risk management sample report is that it can help organizations stay up-to-date with the latest risk management practices and trends. The sample report can serve as a benchmark for the organization’s risk management activities and highlight areas where improvements can be made. This can help the organization stay ahead of emerging risks and trends and ensure that its risk management activities are effective and efficient.

It’s worth noting that an enterprise risk management sample report is not a one-size-fits-all solution. The report should be customized to meet the specific needs and objectives of the organization. This may include tailoring the risk assessment matrix to reflect the organization’s unique risk profile or developing specific risk mitigation strategies based on the organization’s industry or market.

In conclusion, enterprise risk management is a critical component of any organization’s risk management strategy. An enterprise risk management sample report can provide organizations with valuable insights into their risk profile, help them develop a comprehensive risk management framework, and communicate their risk management activities to stakeholders. By implementing an effective ERM program and using an enterprise risk management sample report, organizations can identify and mitigate potential risks, protect their operations and bottom line, and create opportunities for growth and innovation.