Keep your finances in check and simplify your tax season with a business expense template. Learn how to streamline your expenses and save time with this essential tool.

Are you tired of scrambling to find receipts and track your business expenses every tax season? A business expense template can simplify your finances and make tax time a breeze. In this article, we’ll explore the benefits of using a business expense template for taxes, and provide tips for choosing the right one for your needs.

What is a Business Expense Template?

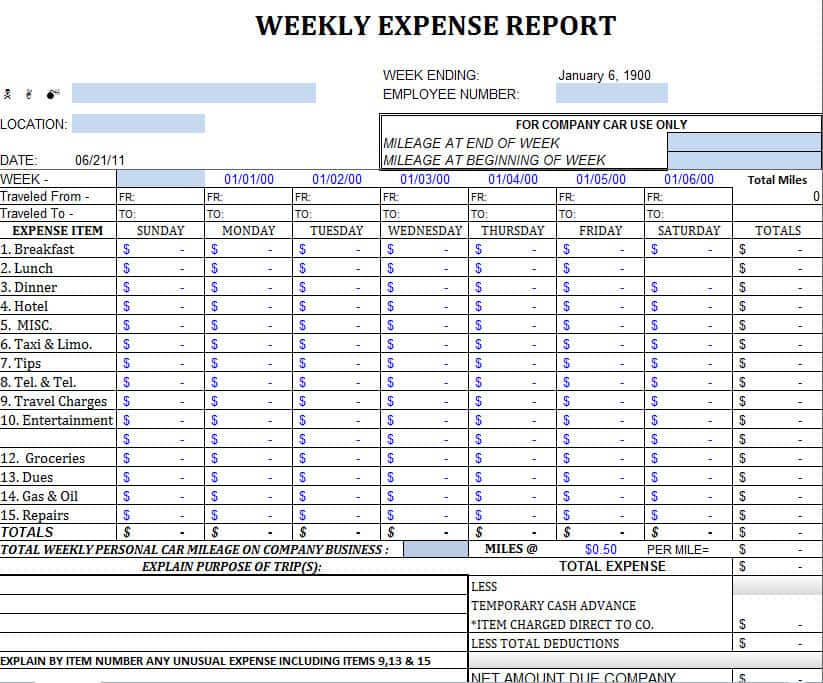

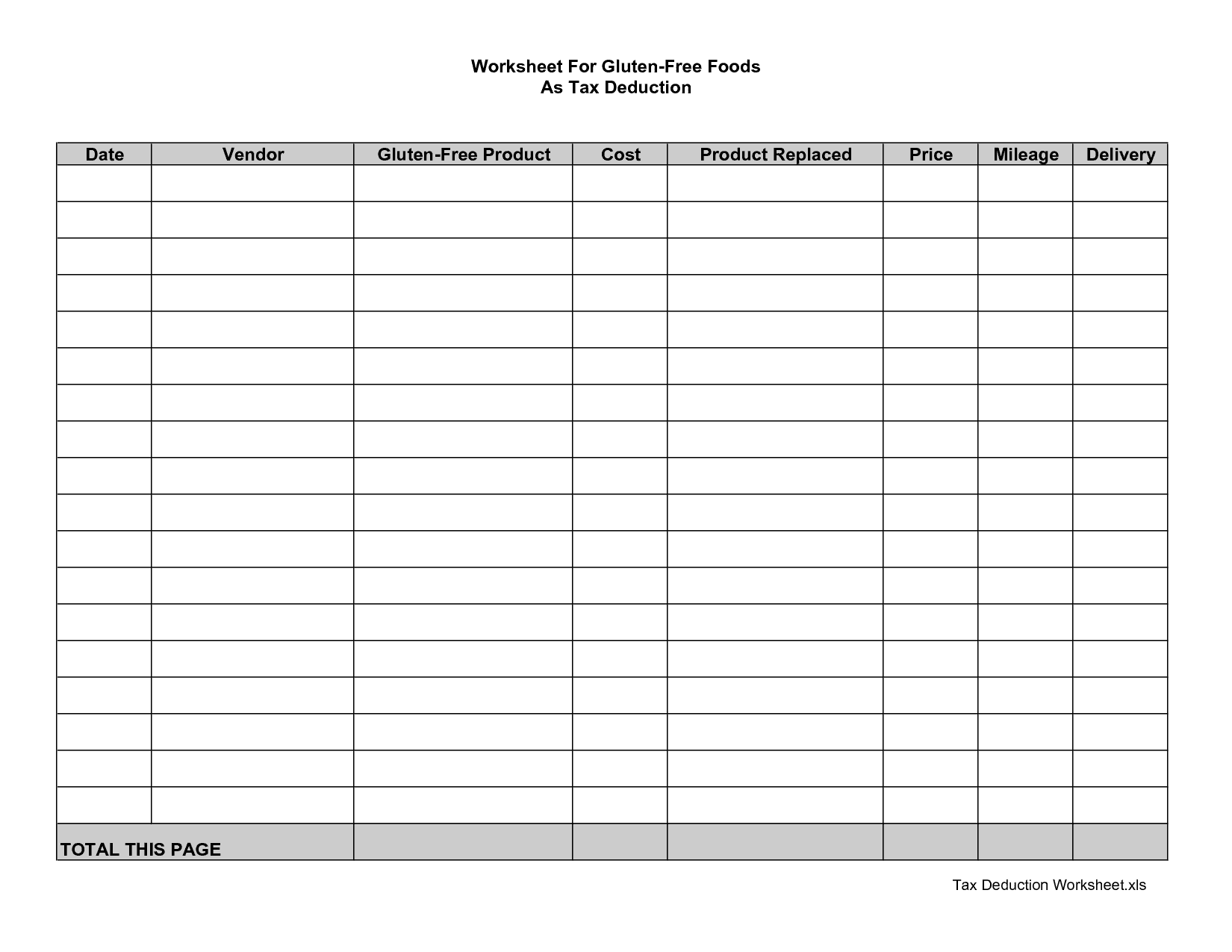

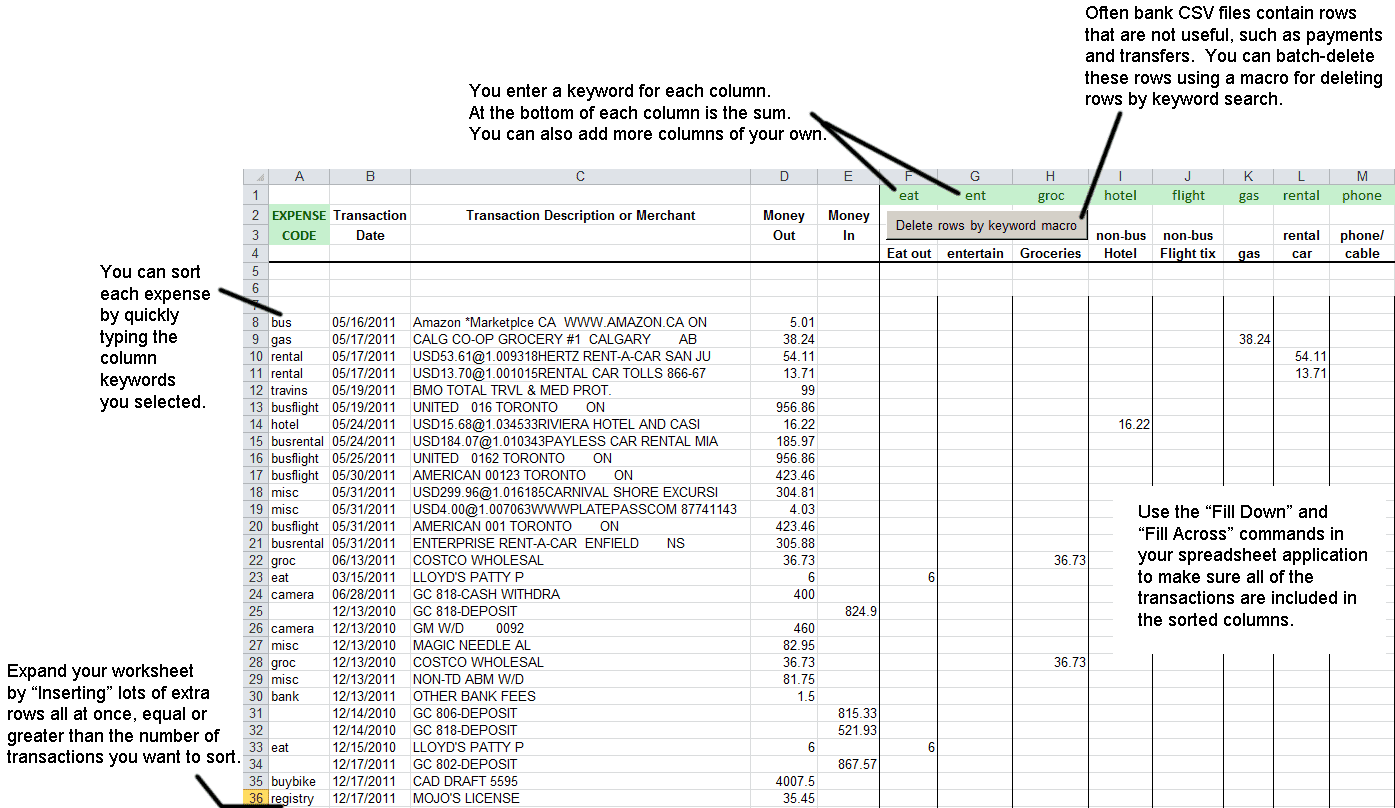

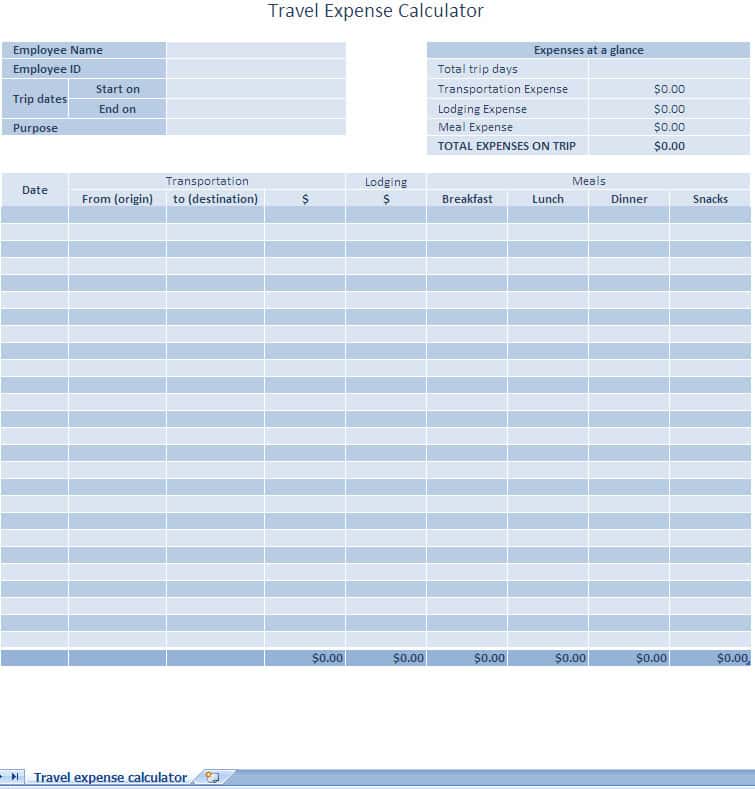

A business expense template is a tool that helps you track your business expenses throughout the year. It’s essentially a spreadsheet that allows you to record your expenses in categories, such as office supplies, travel, and meals and entertainment. By using a business expense template, you can ensure that you don’t miss any deductions and have a clear picture of your financial situation at any given time.

Benefits of Using a Business Expense Template for Taxes

- Saves time: With a business expense template, you can easily record your expenses as they occur, rather than having to sort through piles of receipts and invoices at the end of the year. This can save you a significant amount of time and stress during tax season.

- Increases accuracy: By using a business expense template, you can ensure that you don’t miss any deductions and that your records are accurate. This can help you avoid costly mistakes and potential audits.

- Simplifies tax preparation: When it’s time to file your taxes, you’ll have all of your expenses neatly organized and categorized. This can make the tax preparation process much simpler and less stressful.

How to Choose the Right Business Expense Template for Taxes

When choosing a business expense template, it’s important to consider your specific needs and preferences. Here are some factors to consider:

- Format: Business expense templates come in a variety of formats, including Excel spreadsheets, online tools, and mobile apps. Consider which format would work best for you.

- Categories: Look for a template that includes categories that are relevant to your business. For example, if you frequently travel for work, you’ll want a template that includes a travel category.

- Customization: Some templates allow you to customize the categories and fields to meet your specific needs. If you have unique expenses that aren’t covered by a standard template, look for one that allows for customization.

Conclusion

A business expense template is an essential tool for any business owner who wants to simplify their finances and save time during tax season. By tracking your expenses throughout the year and organizing them in a clear and consistent way, you can ensure that you don’t miss any deductions and have a clear picture of your financial situation. When choosing a template, consider your specific needs and preferences to find the one that works best for you.

In addition to choosing the right business expense template, it’s also important to make sure you’re using it consistently and accurately. Here are some tips for getting the most out of your template:

- Record expenses as they occur: To ensure accuracy and prevent missed deductions, make a habit of recording your expenses as soon as they occur. This could be as simple as snapping a photo of a receipt with your phone or entering the details into an app or spreadsheet.

- Keep receipts organized: Even with a business expense template, it’s still important to keep your receipts organized and accessible. Consider using a digital filing system or physical file folders to keep your receipts in order.

- Review regularly: Set aside time each month to review your expenses and make sure everything is accurately recorded. This can also help you identify any areas where you might be overspending or where you could cut costs.

By using a business expense template and following these tips, you can simplify your finances, save time, and ensure accuracy during tax season. So why not give it a try and see how it can benefit your business?