Are you ready to take control of your financial future? Look no further than the Annuity Worksheet! In this guide, we’ll explore everything you need to know about annuities, how they work, and how to use our worksheet to make informed decisions about your financial well-being.

Understanding Annuities

Before we delve into the Annuity Worksheet, let’s first understand what annuities are. An annuity is a financial product that provides a steady stream of income over a set period of time, typically in retirement. It’s a contract between you and an insurance company, where you make either a lump-sum payment or a series of payments, and in return, you receive regular payouts.

Why Use an Annuity Worksheet?

Managing your finances can be daunting, especially when it comes to planning for retirement. That’s where the Annuity Worksheet comes in handy. It’s a tool designed to help you assess your financial situation, determine your goals, and decide if an annuity is the right choice for you.

How to Use the Annuity Worksheet

- Gather Your Financial Information

Start by gathering all relevant financial information, including your current savings, investments, and expected expenses in retirement. - Assess Your Goals

Determine your financial goals for retirement. Do you want to maintain your current lifestyle, travel the world, or leave a legacy for your loved ones? - Evaluate Annuity Options

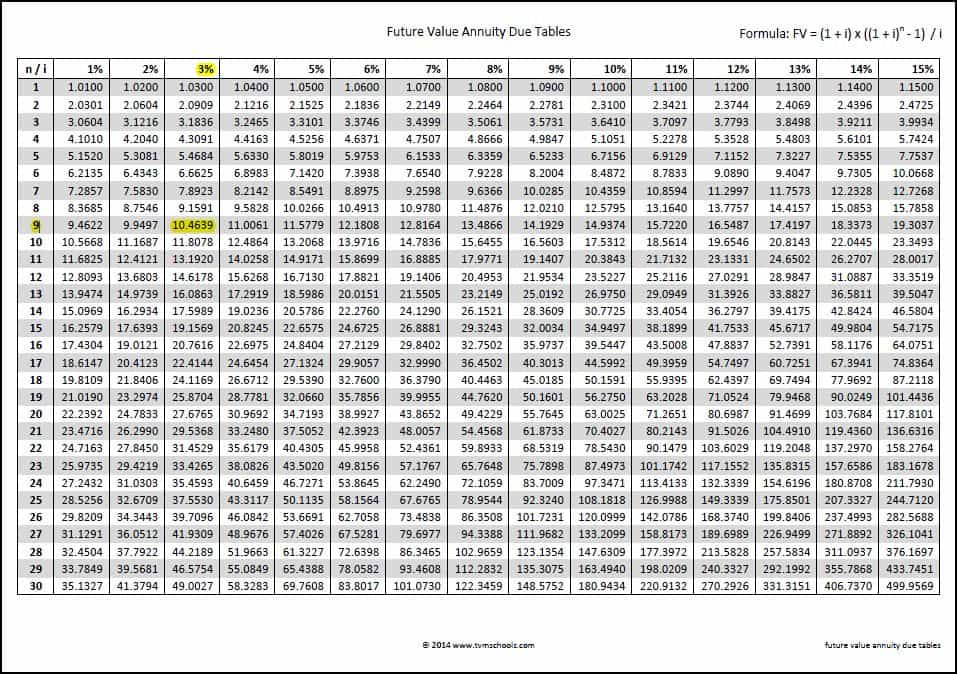

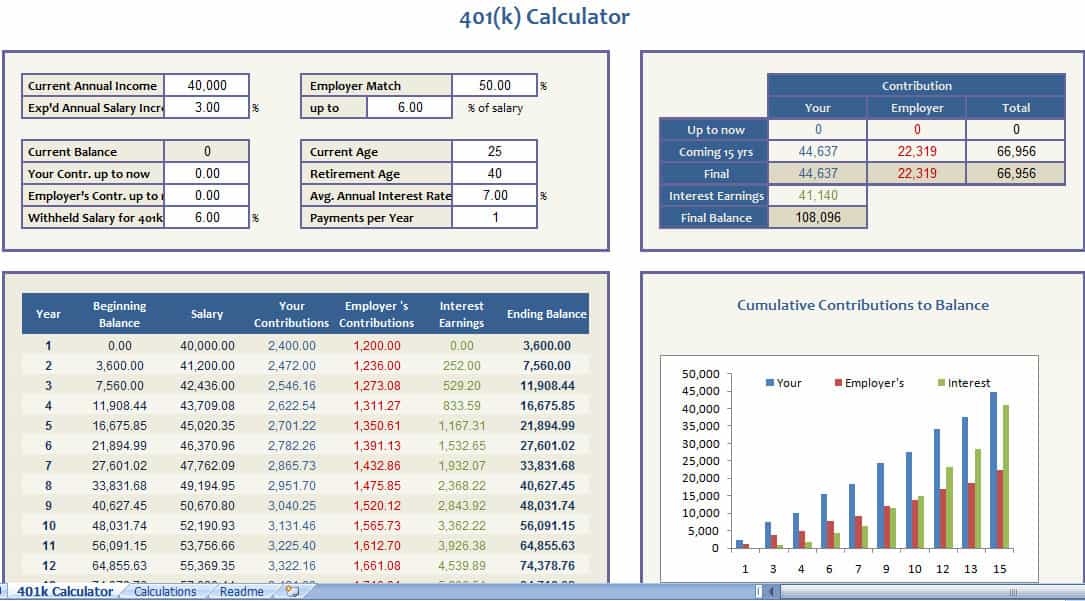

Use the Annuity Worksheet to compare different annuity options, including fixed, variable, and indexed annuities. Consider factors such as payout rates, fees, and surrender charges. - Calculate Potential Income

Estimate the potential income you could receive from an annuity based on your investment amount, payout options, and life expectancy. - Review Your Decision

Once you’ve completed the Annuity Worksheet, review your decision carefully. Consider consulting with a financial advisor to ensure you’re making the best choice for your individual needs.

Benefits of Using the Annuity Worksheet

- Clarity

The Annuity Worksheet provides clarity on complex financial concepts, making it easier to understand your options and make informed decisions. - Customization

It allows you to customize your annuity strategy based on your unique financial situation and retirement goals. - Empowerment

By using the Annuity Worksheet, you take control of your financial future and empower yourself to make confident decisions about retirement planning.

Exploring Annuity Options

Now that you understand the importance of the Annuity Worksheet, let’s dive deeper into the various annuity options available:

- Fixed Annuities

These provide a guaranteed income stream for a specified period or for life. With fixed annuities, your payments remain the same, offering stability and predictability. - Variable Annuities

With variable annuities, your payouts are linked to the performance of underlying investment options, such as mutual funds. While they offer the potential for higher returns, they also come with greater risk. - Indexed Annuities

Indexed annuities provide returns based on the performance of a specific index, such as the S&P 500. They offer the potential for growth, with downside protection, making them a popular choice for retirees seeking a balance between risk and reward. - Immediate Annuities

Immediate annuities begin payouts shortly after you make your initial investment, providing an immediate source of income in retirement. - Deferred Annuities

Deferred annuities, on the other hand, allow you to accumulate funds over time before starting withdrawals at a later date, providing a way to grow your savings tax-deferred.

Key Considerations When Using the Annuity Worksheet

- Risk Tolerance

Consider your risk tolerance when evaluating annuity options. Are you comfortable with market fluctuations, or do you prefer the stability of fixed returns? - Time Horizon

Your time horizon plays a crucial role in determining the type of annuity that best suits your needs. Consider how long you have until retirement and how long you expect to receive payouts. - Fees and Charges

Be mindful of the fees and charges associated with annuities, including administrative fees, investment fees, and surrender charges. These can impact your overall returns and should be factored into your decision-making process. - Tax Implications

Understand the tax implications of annuities, including how withdrawals are taxed and any potential penalties for early withdrawals.

Final Thoughts

The Annuity Worksheet is a valuable tool that can help you navigate the complexities of annuities and make informed decisions about your retirement planning. By carefully evaluating your financial situation, goals, and risk tolerance, you can use the worksheet to create a customized annuity strategy that aligns with your needs and objectives.

Remember, retirement planning is not one-size-fits-all. It requires careful consideration and personalized attention to ensure you’re adequately prepared for life after work. So, whether you’re just starting your retirement savings journey or looking to optimize your existing portfolio, the Annuity Worksheet is here to guide you every step of the way. Take control of your financial future today and start planning for the retirement you deserve!