Need help with your federal taxes? Check out our guide on Federal Tax Worksheets for tips on how to simplify your tax preparation and ensure you get the most out of your tax return.

Are you struggling to keep track of your federal taxes? With so many different forms and deadlines to remember, it can be overwhelming to stay on top of everything. Fortunately, using a federal tax worksheet can help you organize your finances and ensure that you are maximizing your deductions.

In this article, we will discuss everything you need to know about federal tax worksheets, including what they are, why they are important, and how to use them effectively. We’ll also provide some helpful tips to help you get started.

What Is a Federal Tax Worksheet?

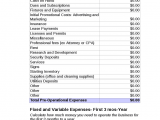

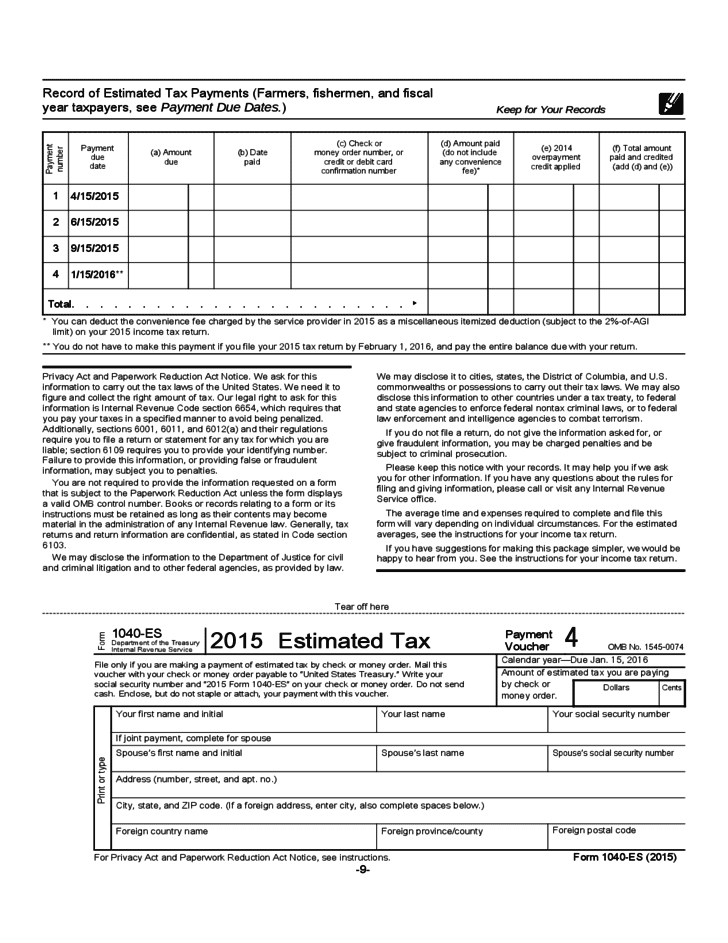

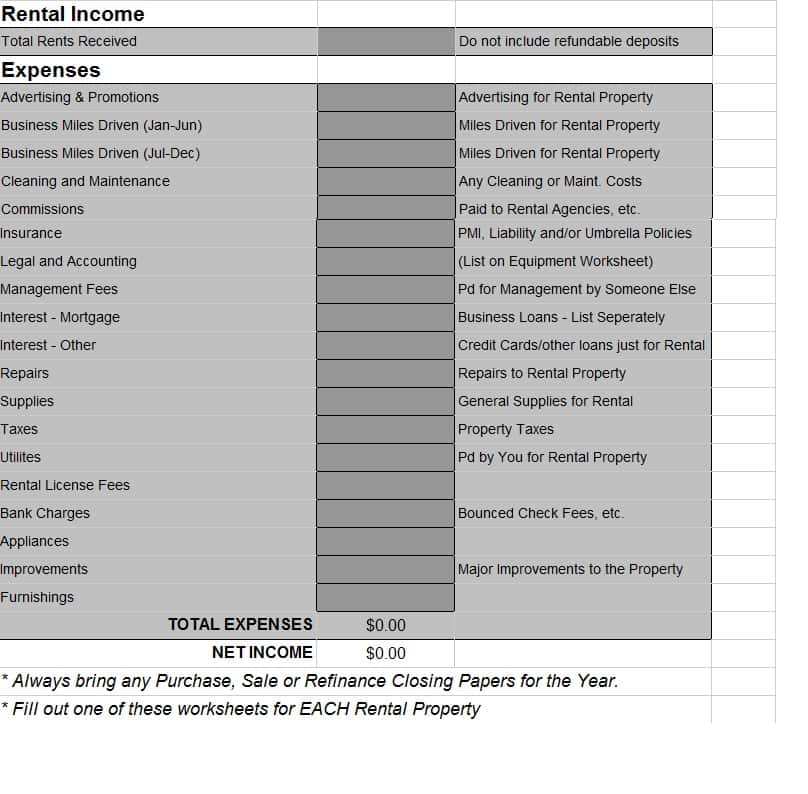

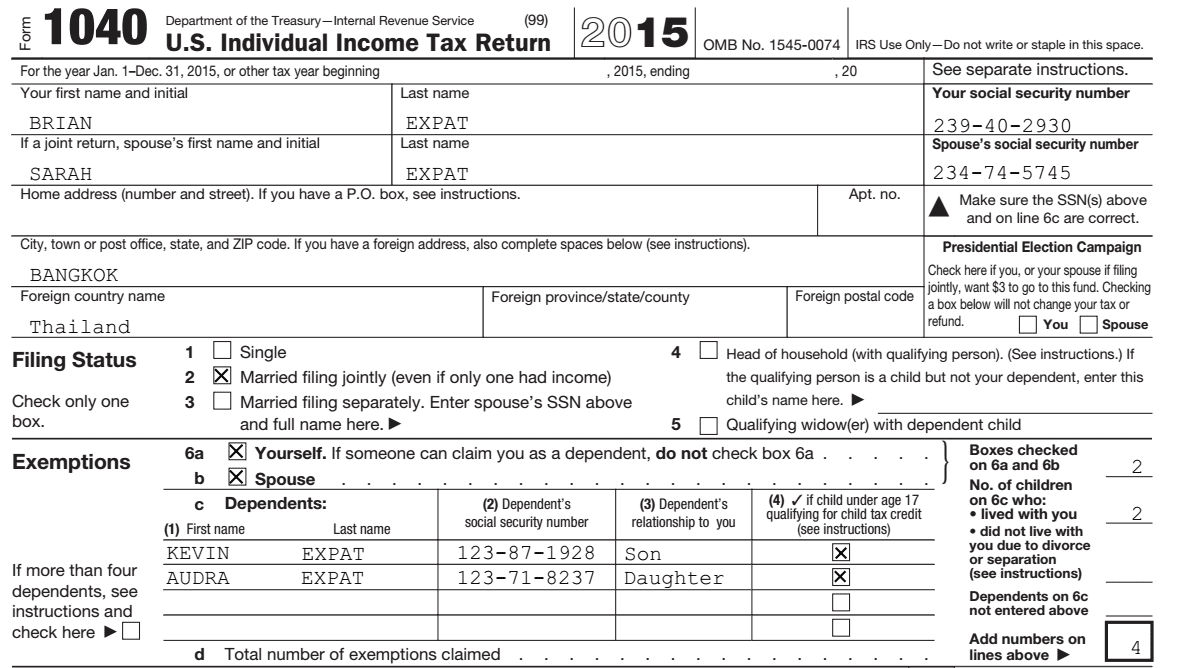

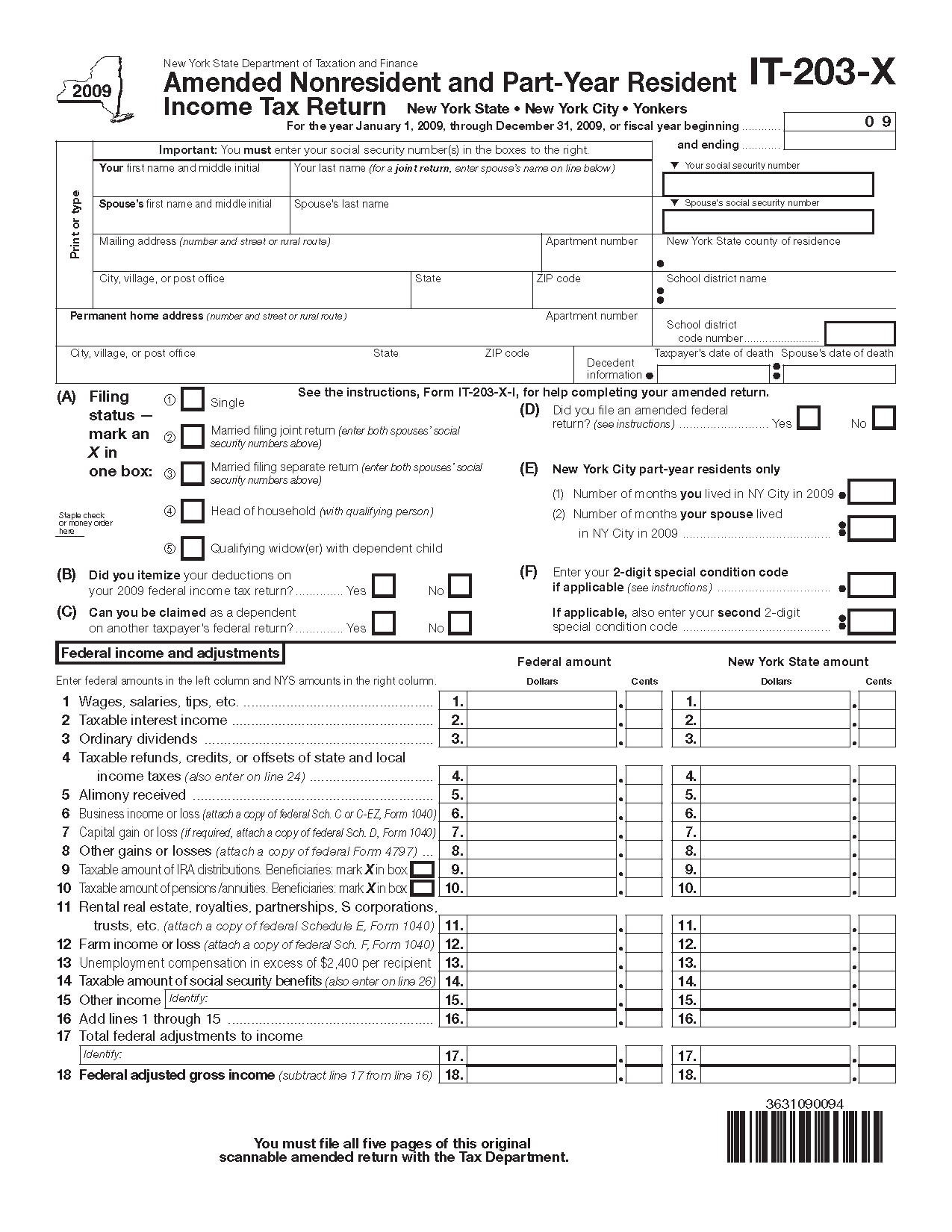

A federal tax worksheet is a document that helps you organize your tax information in a clear and concise way. It typically includes sections for your income, deductions, credits, and tax payments, making it easier to track your finances and ensure that you are in compliance with federal tax laws.

Why Are Federal Tax Worksheets Important?

Federal tax worksheets are important because they help you keep track of your finances and ensure that you are in compliance with federal tax laws. By using a worksheet, you can organize your income and expenses in a clear and concise way, making it easier to calculate your tax liability and identify any deductions or credits that you may be eligible for.

Additionally, federal tax worksheets can help you avoid mistakes when preparing your tax return. By keeping all of your financial information in one place, you can ensure that you don’t forget any important details that could impact your tax liability.

How to Use Federal Tax Worksheets

Using a federal tax worksheet is simple. First, download a copy of the worksheet from the IRS website or from a trusted tax preparation software provider. Then, fill in your income, deductions, credits, and tax payments for the year. Be sure to double-check your calculations and review your work for accuracy.

Once you have completed your federal tax worksheet, you can use the information to prepare your tax return. Simply transfer the information from your worksheet to your tax forms, making sure to include all necessary schedules and attachments.

Helpful Tips for Using Federal Tax Worksheets

Here are a few helpful tips to keep in mind when using federal tax worksheets:

- Keep all of your financial documents in one place, such as a folder or file cabinet. This will make it easier to find the information you need when it comes time to fill out your worksheet.

- Use separate worksheets for each tax year to avoid confusion and ensure that you have all of the necessary information for each year.

- Make sure to include all income sources, such as wages, salaries, tips, and investment income. You should also include any taxable income you received from sources outside the United States.

- Be sure to claim all of the deductions and credits that you are eligible for. This may include deductions for charitable contributions, mortgage interest, and medical expenses, as well as credits for education, child care, and energy-efficient home improvements.

Conclusion

Federal tax worksheets are a valuable tool for anyone who wants to simplify their tax preparation and ensure that they are in compliance with federal tax laws. By using a worksheet to organize your finances, you can avoid mistakes and maximize your deductions, resulting in a lower tax liability and a bigger refund. So why not give it a try? Download a federal tax worksheet today and see how much easier tax season can be!

In addition to using federal tax worksheets, there are other steps you can take to simplify your tax preparation process. One such step is to keep detailed records throughout the year. This can include keeping track of your income and expenses, as well as any receipts or other documentation that may be needed to support your deductions and credits.

Another helpful tip is to use tax preparation software. Many software programs offer built-in federal tax worksheets and other tools to help you streamline your tax preparation process. They can also help you identify deductions and credits that you may be eligible for, making it easier to maximize your tax savings.

It’s also important to stay up-to-date on changes to federal tax laws. The tax code is constantly evolving, and staying informed can help you avoid mistakes and take advantage of new tax-saving opportunities. Consider consulting with a tax professional or attending tax preparation workshops to stay informed.

In conclusion, federal tax worksheets are a valuable tool that can help simplify your tax preparation process and ensure that you are in compliance with federal tax laws. By using a worksheet to organize your finances, keeping detailed records throughout the year, using tax preparation software, and staying informed on changes to federal tax laws, you can make tax season a little less stressful and maximize your tax savings.