A life insurance needs analysis worksheet is a valuable tool to assess your insurance needs and ensure financial security for your family in case of unforeseen circumstances. Learn more about this worksheet and how it can benefit you.

Life Insurance Needs Analysis Worksheet

When it comes to securing your future, life insurance is one of the most important investments you can make. It not only offers financial protection to your loved ones in the event of your untimely demise but also provides peace of mind to you as the policyholder.

However, determining the right amount of coverage and type of policy can be a daunting task, especially when you don’t have a clear idea of your insurance needs. This is where a life insurance needs analysis worksheet comes in handy.

What is a Life Insurance Needs Analysis Worksheet?

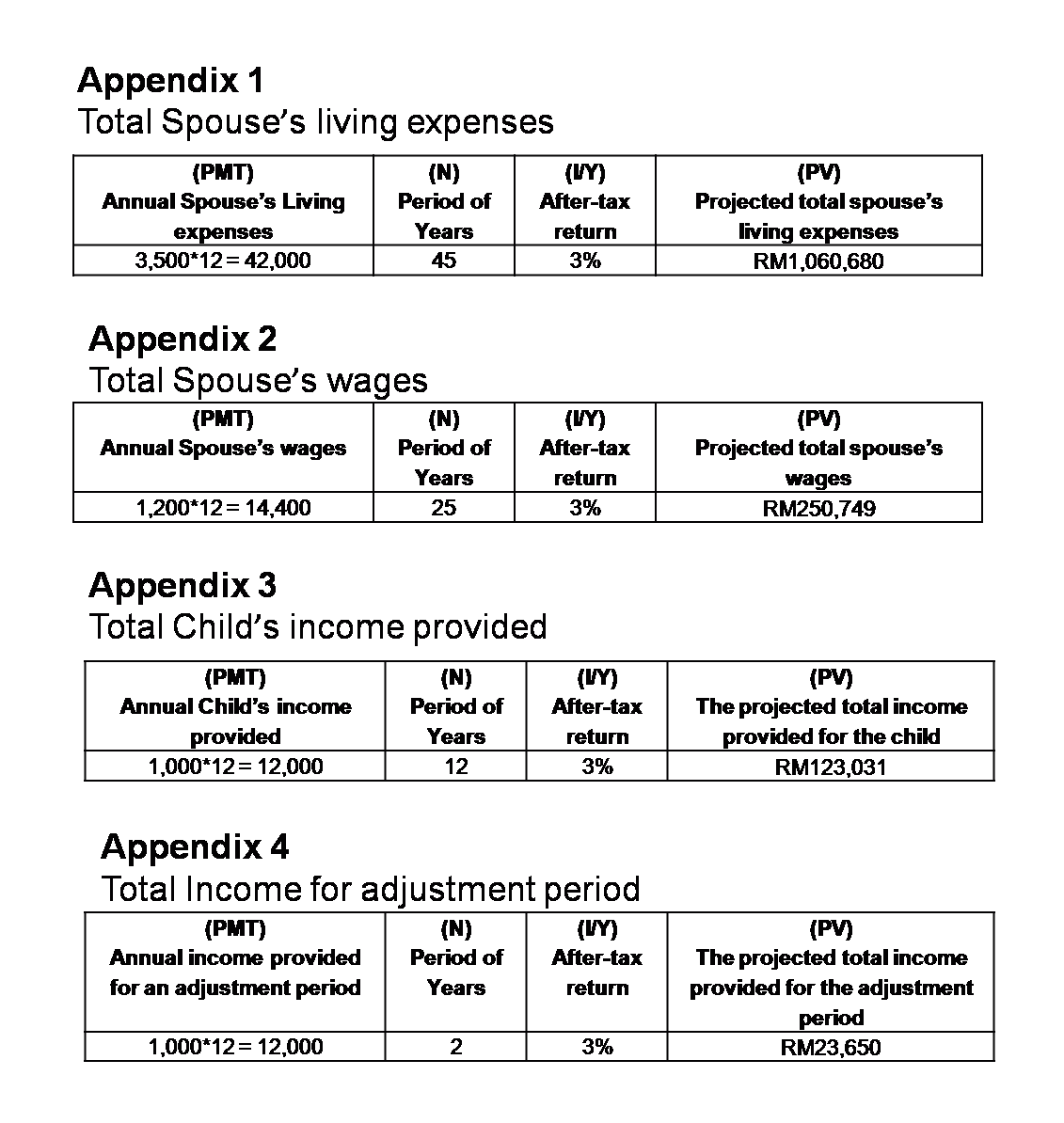

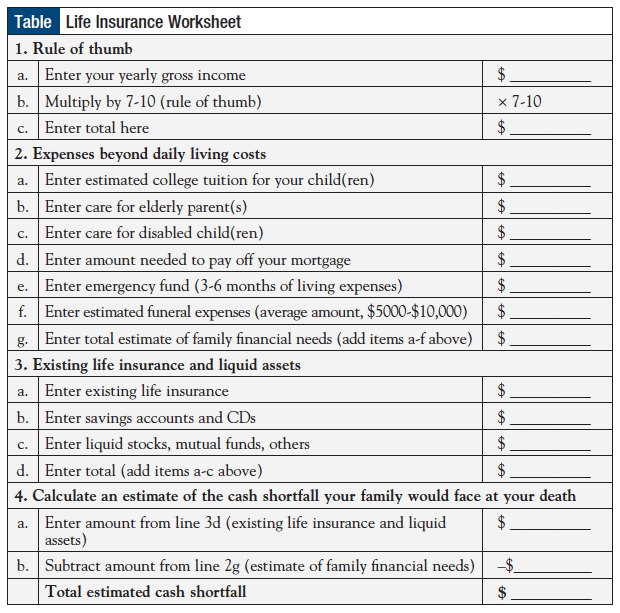

A life insurance needs analysis worksheet is a tool that helps you assess your insurance needs based on your current financial situation, future expenses, and other factors. It allows you to calculate the amount of coverage you need to ensure that your family is financially secure if something happens to you.

Why Do You Need a Life Insurance Needs Analysis Worksheet?

The primary reason to use a life insurance needs analysis worksheet is to make sure that you have the right amount of coverage to meet your family’s needs if you pass away. Without proper coverage, your family may struggle financially, which can lead to stress, anxiety, and uncertainty.

Here are some other reasons why a life insurance needs analysis worksheet is beneficial:

Assess Your Current Insurance Coverage

The worksheet helps you evaluate your existing insurance coverage and determine whether it is enough to meet your family’s needs in case of an emergency. It allows you to identify any gaps in your current coverage and make necessary adjustments to ensure that your family is protected.

Determine Your Future Expenses

The worksheet also helps you estimate your future expenses, such as mortgage payments, college tuition fees, and other costs that your family may incur after your demise. This allows you to calculate the amount of coverage you need to meet those expenses and provide financial security to your loved ones.

Choose the Right Type of Policy

The life insurance needs analysis worksheet also helps you choose the right type of policy based on your needs and preferences. For example, if you want coverage for a specific period, a term life insurance policy may be suitable. If you want coverage for life, a permanent life insurance policy may be more appropriate.

How to Use a Life Insurance Needs Analysis Worksheet

Using a life insurance needs analysis worksheet is relatively straightforward. Here are the steps involved:

Gather Your Financial Information

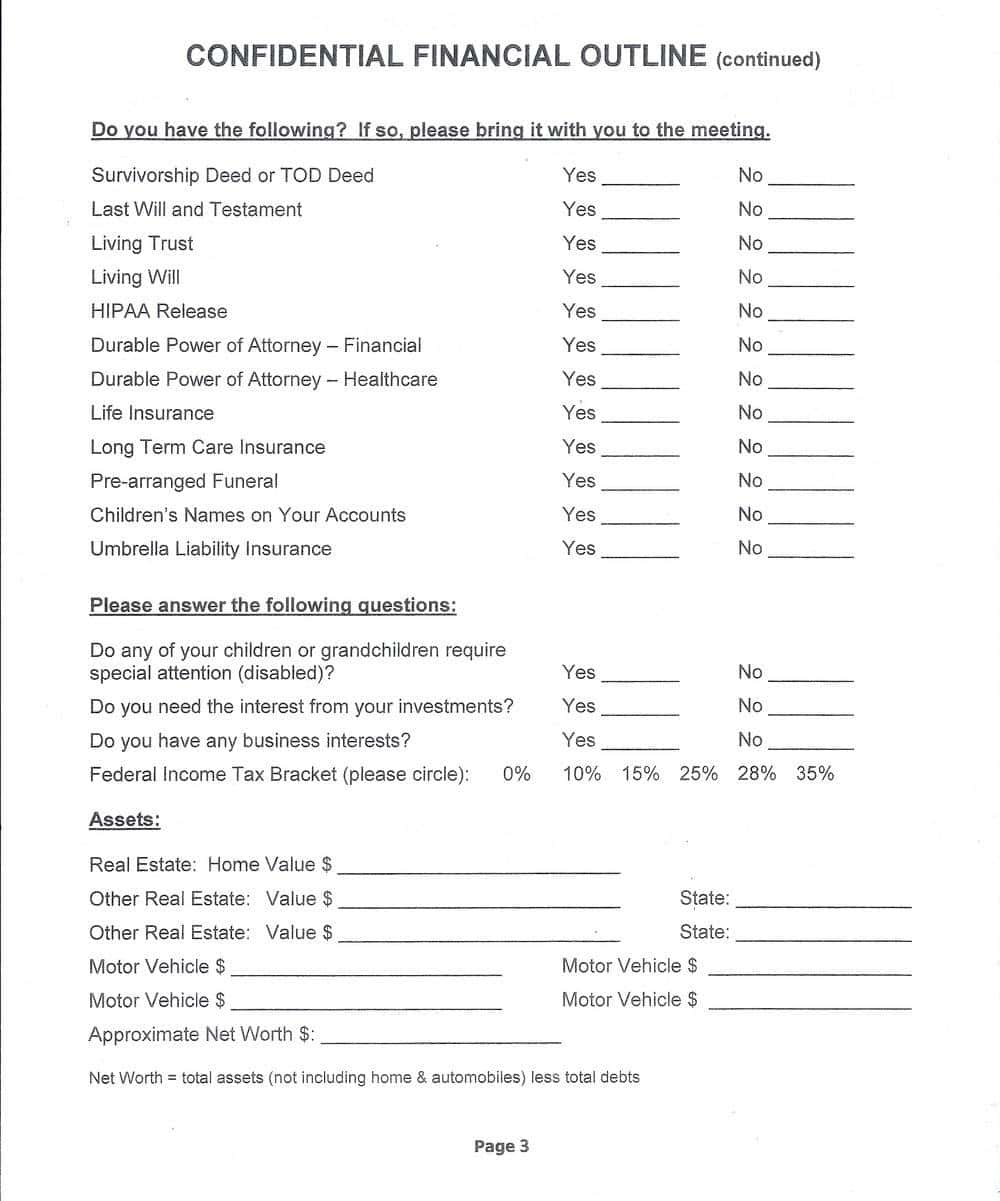

The first step is to gather your financial information, including your income, expenses, assets, and liabilities. This will help you determine your net worth and assess your current financial situation.

Estimate Your Future Expenses

Next, estimate your future expenses based on your family’s needs and goals. This may include expenses such as mortgage payments, education costs, and retirement savings.

Calculate Your Life Insurance Needs

Using the worksheet, calculate your life insurance needs by subtracting your existing savings and insurance coverage from your total financial needs.

Choose the Right Policy

Based on your life insurance needs, choose the right type of policy that fits your budget and preferences.

Important Considerations When Using a Life Insurance Needs Analysis Worksheet

While a life insurance needs analysis worksheet can be a useful tool, there are some important considerations to keep in mind when using it:

Be Honest About Your Finances

To get an accurate estimate of your life insurance needs, you need to be honest about your finances. This means disclosing all your sources of income, expenses, debts, and assets. If you underestimate your financial needs, you may end up with insufficient coverage, which can leave your family vulnerable in the future.

Consider Future Changes

Your financial situation may change in the future due to various reasons, such as a job loss, marriage, divorce, or birth of a child. When using a life insurance needs analysis worksheet, make sure to factor in these potential changes and adjust your coverage accordingly.

Seek Professional Advice

While a life insurance needs analysis worksheet can give you a general idea of your insurance needs, it’s always a good idea to seek professional advice. A financial advisor or insurance agent can help you evaluate your unique situation and recommend the best policy that meets your needs and budget.

Final Thoughts

A life insurance needs analysis worksheet is a powerful tool that can help you assess your insurance needs and secure your family’s financial future. By taking the time to complete this worksheet and choosing the right policy, you can ensure that your loved ones are protected if anything happens to you. So, start evaluating your insurance needs today and take the first step towards financial security!