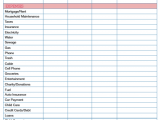

The 1031 Exchange Worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

If you’re just using standard excel, then this worksheet is easy to use. Simply copy and paste the information into the cell. You can also do it in reverse to save time. To make it more advanced, then you can create formulas for your data.

If you have an account in a particular company, then you will have a specific sheet that you can enter information on. This is called the corporate or trade account. These can come from the company’s internal database or other third parties.

You can easily import this worksheet as needed by clicking Import Worksheet. Once you import it, you can then make changes and insert data as needed. You can use different formatting styles to give it some style and flair. You can make it private, or have it viewable to anyone who needs to access it.

You can also view the data from this worksheet so that you can see what important business items are listed. This is handy if you need to keep track of a number of business transactions and receipts. It is also a great way to keep track of a customer’s information. It is very user friendly and also provides access to a lot of different functions that are important to have.

In this format, you can easily move the information from one place to another, or you can go back to the beginning. All of this makes it very flexible and useful, but it does take time to learn how to use this worksheet.

There are a few additional features that are available in this Excel worksheet that can help you out. One of them is the ability to sort a large number of different objects and create columns, which allows you to organize the information in a certain way.

The other thing this worksheet can do is convert between several different types of file formats, including Excel spreadsheets and text files. There are other ways to do this as well, but this is the most simple and effective way to get the data you need from Excel. If you need more information about the worksheet, then you can find it online. There are many sites that sell different versions of it, as well as downloadable versions.

If you are interested in getting an Excel worksheet made for free, then you will want to check out a few sites. You can search for a site that offers them or a site that has them for free. If you want to get the best version, then you should make sure you buy one because the quality varies greatly. Between them.

Check out the available options so you know what to look for. The features you need should be clearly listed so you can pick out what you need to make sure you are getting the best product for your money.

Make sure the website has testimonials from people who have already bought and used the product, so you can get a good work at home job and get started on the right foot. If they recommend it, then you know you will be getting a good one. That is always good.

A good site should offer you support, as well as the ability to get help when you need it. If the site has no support or any help at all, then you need to look for another site to shop at.

Make sure you do a little research to find a good product, as you will be able to save yourself a lot of money if you make a purchase online. You should not hesitate to shop around for something that suits your needs. It is not difficult, but it can be tricky sometimes.