Learn everything you need to know about profit and loss statements and get a sample statement to guide you in preparing your financial reports.

As a business owner, it is important to keep track of your financial performance to ensure that you are meeting your financial goals and staying on track. One of the most important financial reports you need to prepare is a profit and loss statement. This statement summarizes your business’s revenues, expenses, and net income over a specific period, usually a month, quarter, or year.

If you are new to preparing a profit and loss statement or need a refresher, this article is for you. We will provide you with a sample of profit and loss statement, explain its components, and show you how to interpret the data.

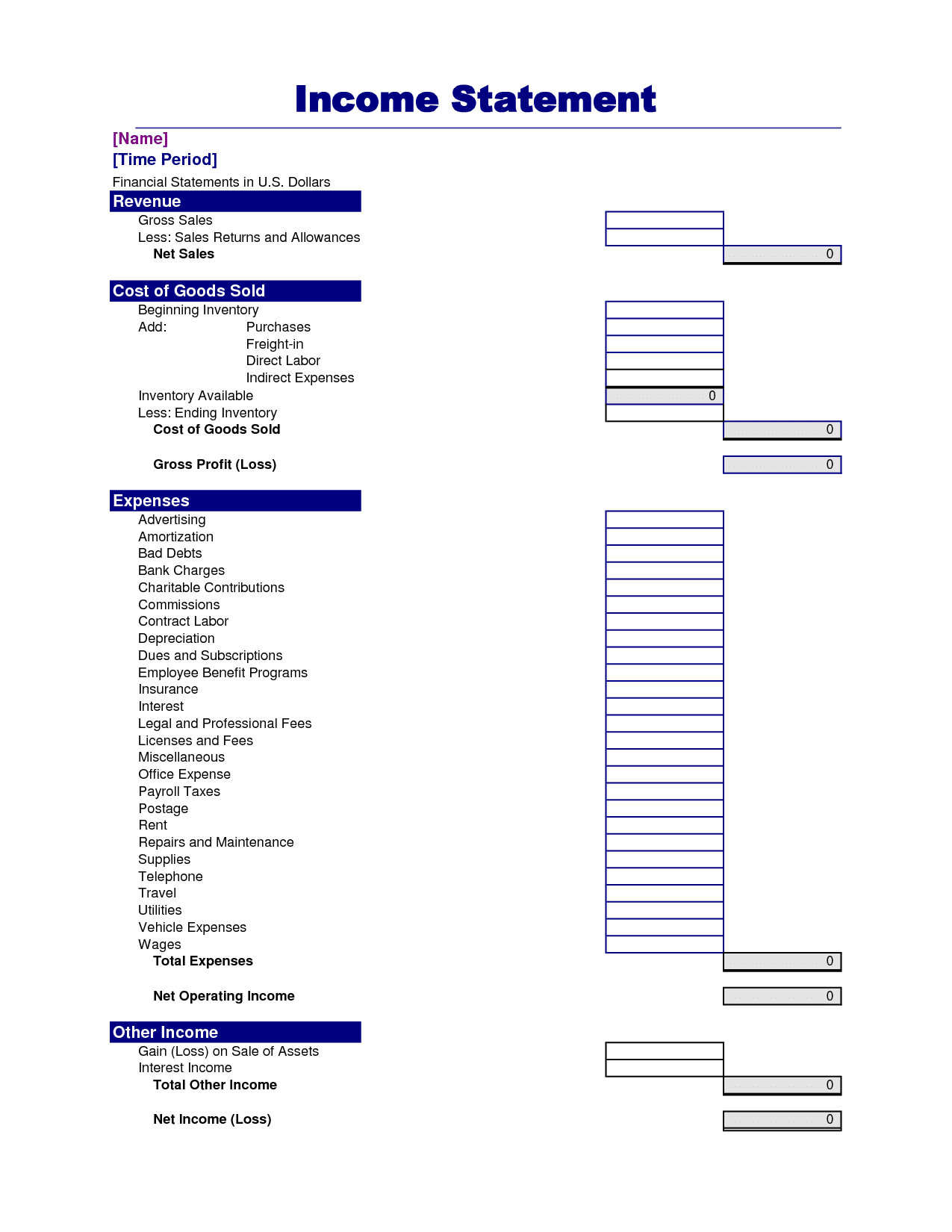

Components of a Profit and Loss Statement

A profit and loss statement, also known as an income statement, consists of three main sections: revenues, expenses, and net income.

Revenues

Revenues are the money your business earns from sales or services rendered. This section includes all your sales, returns, discounts, and allowances. It is important to note that revenues should only include money received during the reporting period, regardless of when the sale was made. For example, if you made a sale in December but received payment in January, the revenue should only be recorded in January.

Expenses

Expenses are the costs associated with running your business. This section includes all your operational expenses, such as rent, utilities, wages, and taxes. It is important to categorize your expenses accurately to get an accurate picture of your business’s financial health.

Net Income

Net income is the difference between your revenues and expenses. This section shows how much profit or loss your business has made over the reporting period. A positive net income indicates that your business is profitable, while a negative net income means your business is losing money.

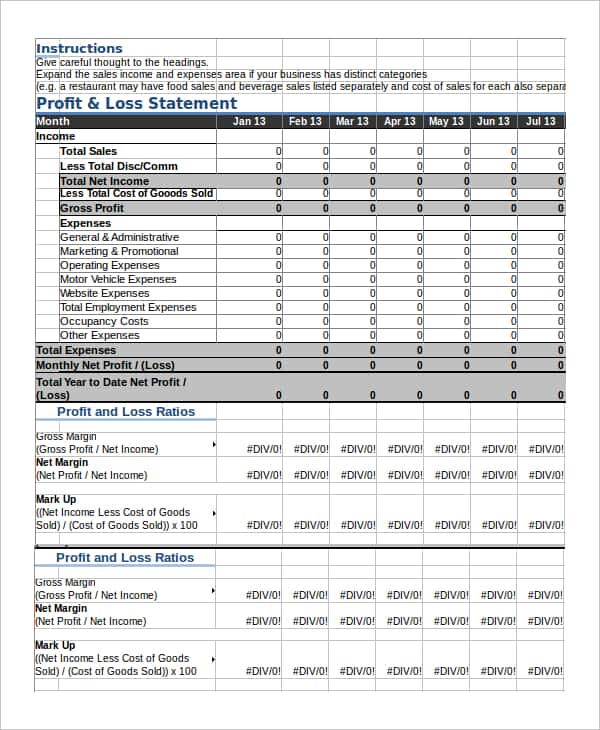

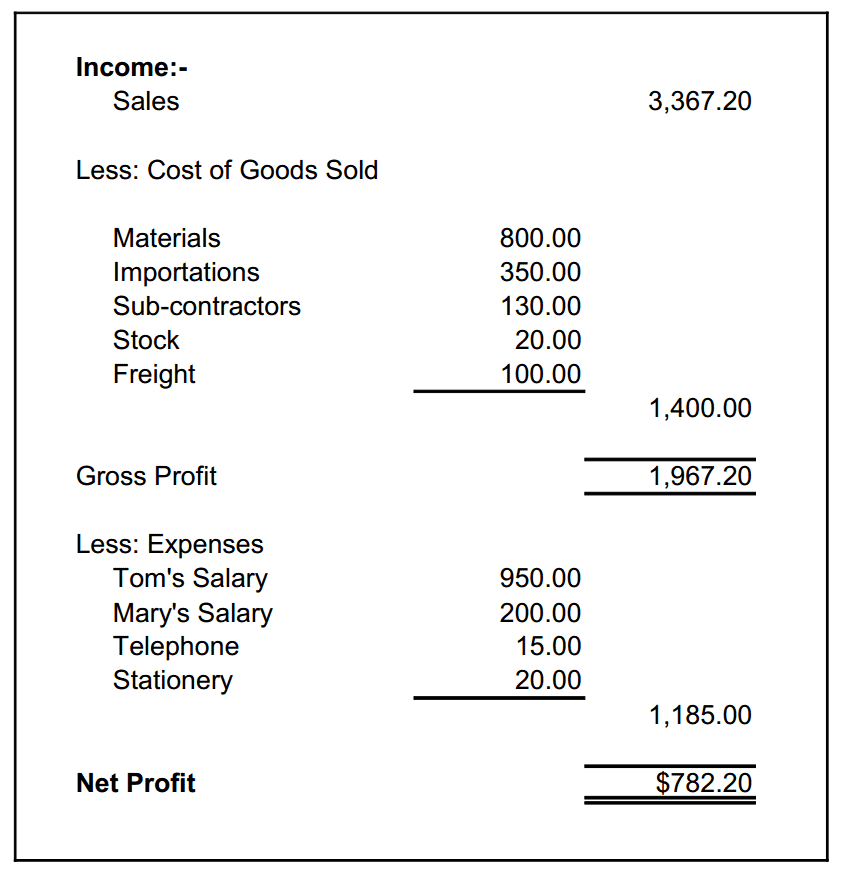

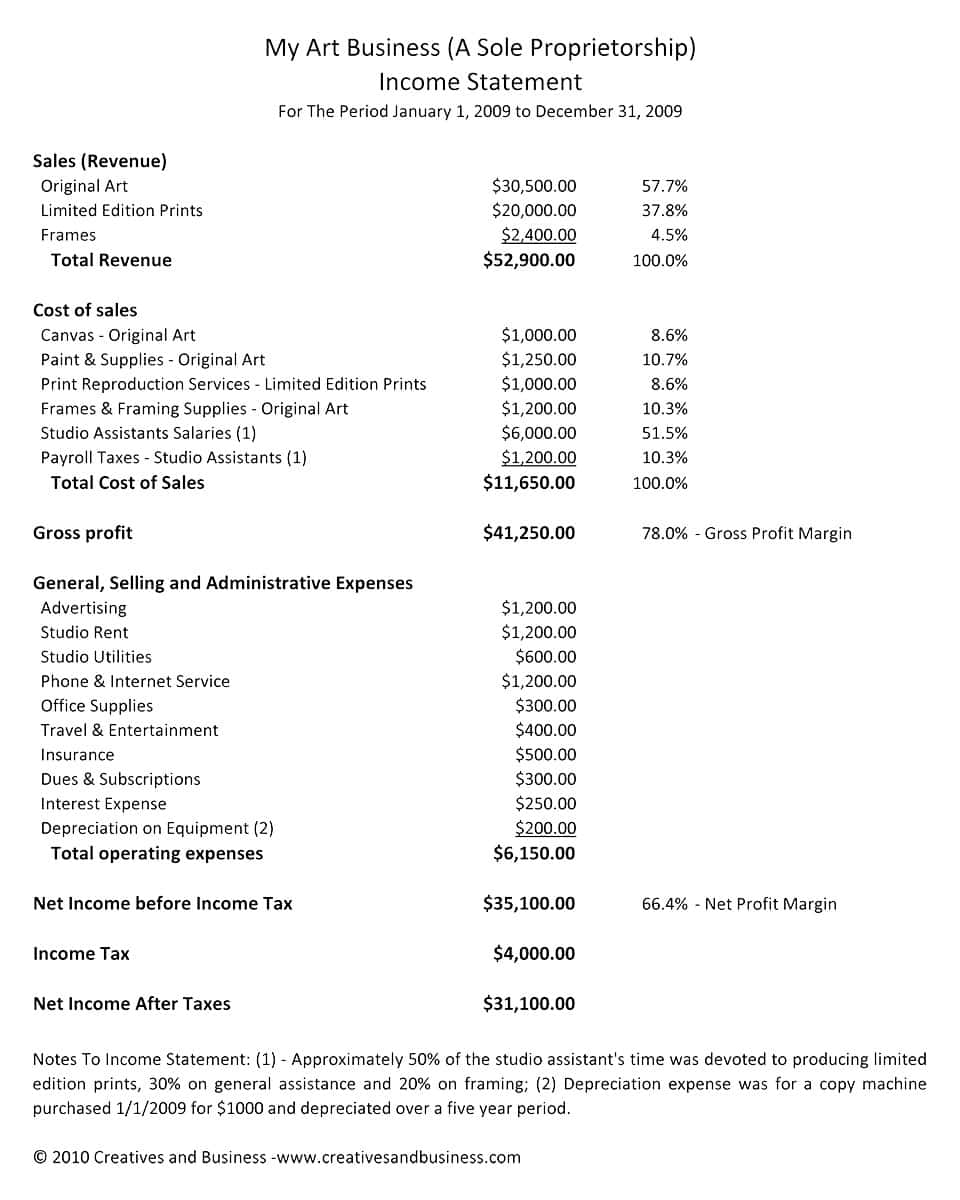

Sample of Profit and Loss Statement

To help you understand how a profit and loss statement looks like, we have provided a sample statement below.

ABC Corporation

Profit and Loss Statement

For the Year Ended December 31, 2022

Revenue

| Category | Amount |

|---|---|

| Sales | $500,000 |

| Returns | ($10,000) |

| Discounts | ($20,000) |

| Allowances | ($5,000) |

| Total Revenue | $465,000 |

Expenses

| Category | Amount |

|---|---|

| Cost of goods sold | $150,000 |

| Rent | $50,000 |

| Utilities | $10,000 |

| Wages | $100,000 |

| Taxes | $20,000 |

| Total Expenses | $330,000 |

Net Income = $135,000

Interpreting the Sample Statement

In the sample statement above, ABC Corporation made $465,000 in revenue and spent $330,000 in expenses, resulting in a net income of $135,000. This indicates that ABC Corporation is profitable and has made a profit of $135,000 over the reporting period.

Tips for Preparing a Profit and Loss Statement

- Keep accurate records

To prepare an accurate profit and loss statement, you need to keep accurate records of all your business’s financial transactions. This includes all your sales, expenses, and other transactions. - Categorize your expenses

To get an accurate picture of your business’s financial health, it is important to categorize your expenses accurately. This will help you identify areas where you can cut costs or increase revenue. - Use accounting software

Using accounting software can make it easier to prepare your profit and loss statement. Accounting software can help you track your financial transactions, categorize your expenses, and generate financial reports. - Review your statement regularly

Reviewing your profit and loss statement regularly can help you identify trends and make informed decisions to grow your business. It is recommended that you review your profit and loss statement at least once a month. - Seek professional help

If you are unsure about how to prepare your profit and loss statement or need help interpreting the data, it is recommended that you seek professional help from an accountant or financial advisor.

Conclusion

Preparing a profit and loss statement is an essential part of managing your business’s finances. It helps you understand your business’s financial health and make informed decisions to grow your business. With the sample statement and information provided in this article, you should be able to prepare your profit and loss statement accurately and interpret the data. Remember to keep accurate records of your finances to ensure that your financial reports are reliable and up-to-date.