Learn how to create a sample of expenses sheet for your business that is comprehensive, accurate and easy to use. Our guide covers the essential elements you need to include and provides tips on tracking your expenses efficiently.

Are you looking for a way to keep track of your business expenses and stay on top of your finances? Creating a sample of expenses sheet is an excellent way to do just that. A comprehensive and well-organized expenses sheet can help you track your income and expenditures, monitor your cash flow, and ensure that you are not overspending or missing any deductions.

In this article, we will provide you with a step-by-step guide on how to create a sample of expenses sheet for your business. We will cover the essential elements you need to include and provide tips on tracking your expenses efficiently.

Step 1: Determine Your Business Expenses

The first step in creating a sample of expenses sheet is to determine all the expenses related to your business. This includes both fixed and variable costs, such as rent, utilities, insurance, advertising, supplies, and equipment. It’s essential to make a list of all your expenses to ensure that you don’t forget anything.

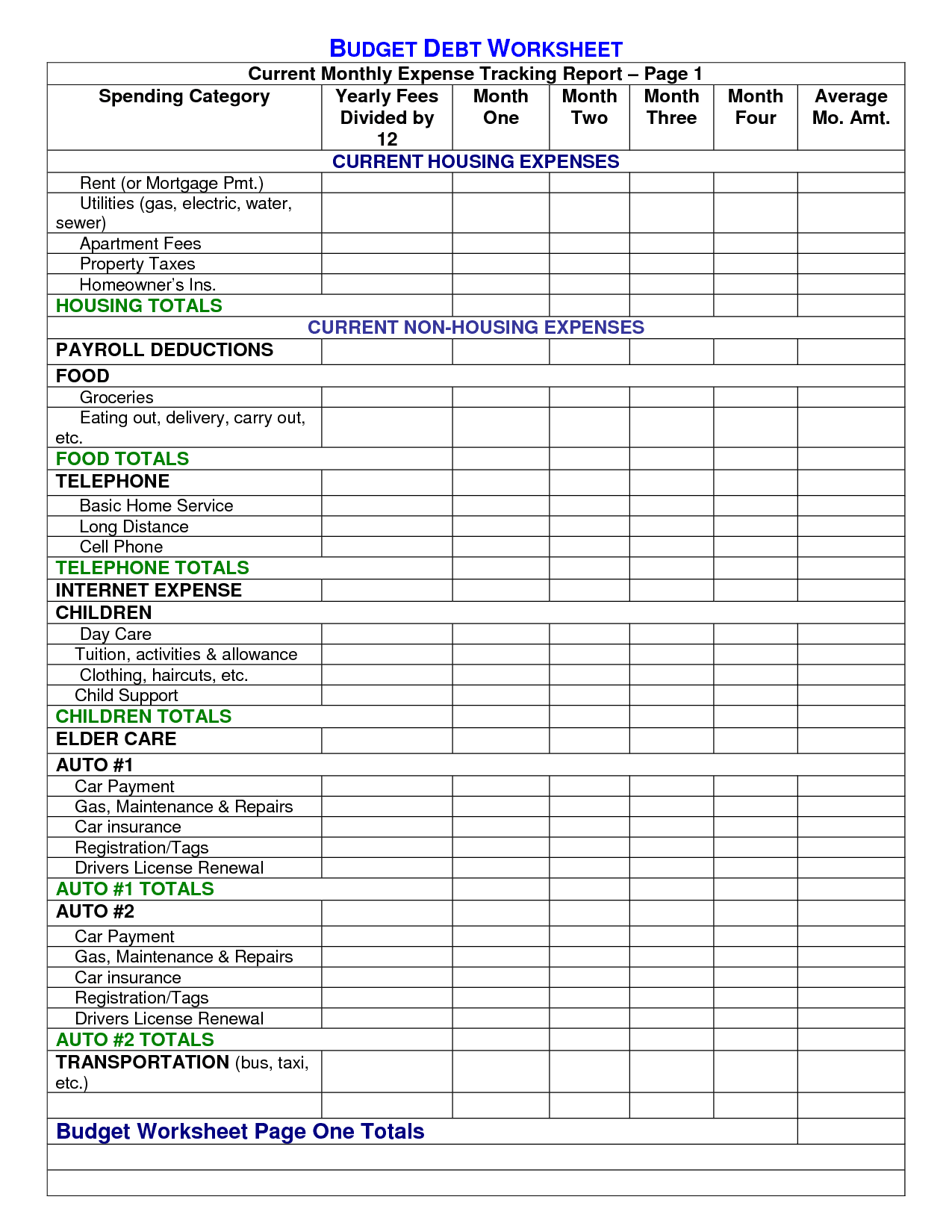

Step 2: Categorize Your Expenses

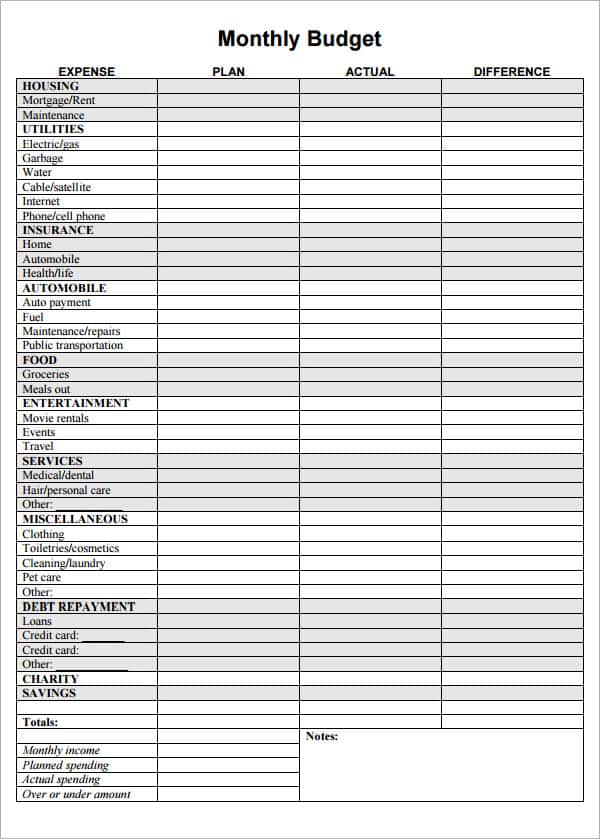

Once you have listed all your business expenses, the next step is to categorize them. You can organize your expenses by type, such as rent, utilities, and supplies, or by function, such as marketing, operations, and administration. Categorizing your expenses will help you better understand where your money is going and identify areas where you may need to cut costs.

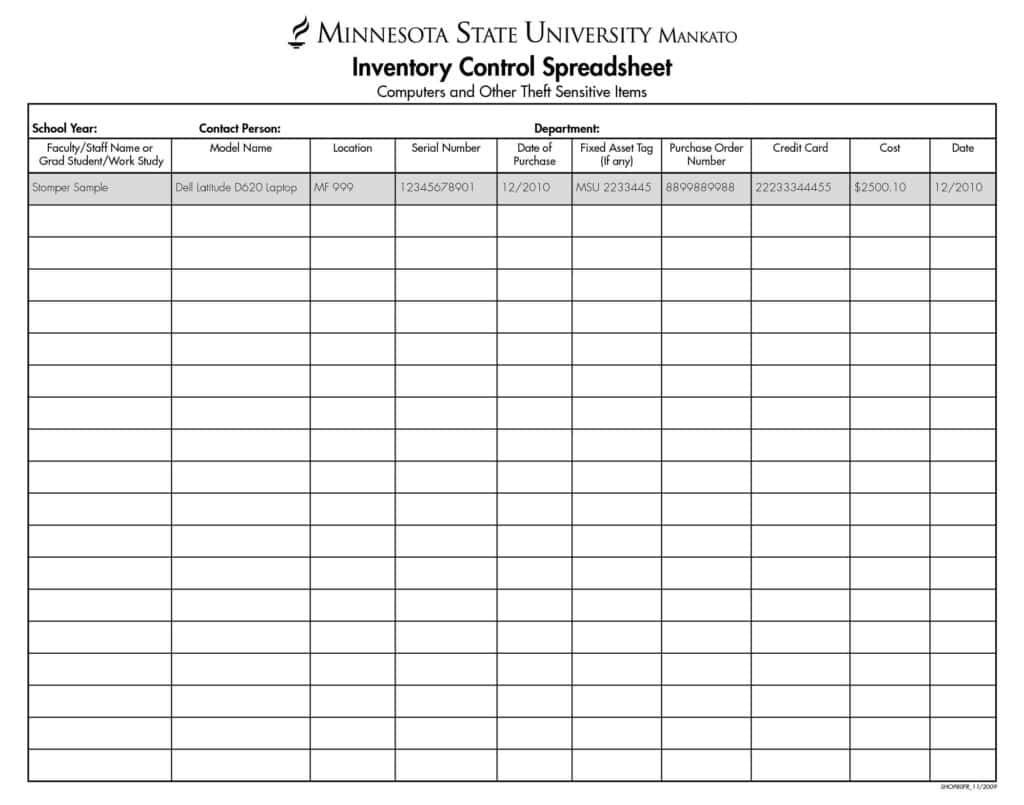

Step 3: Choose a Template

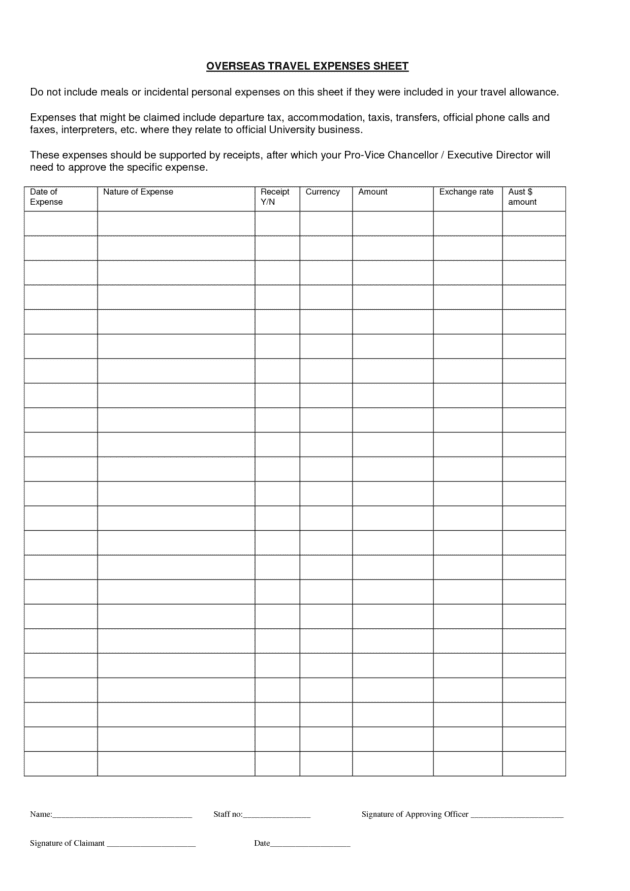

There are many different types of sample of expenses sheet templates available online. Choose one that is easy to use and customizable to your specific business needs. Some popular templates include spreadsheets, software applications, and online tools.

Step 4: Record Your Expenses

Now that you have your expenses categorized and a template in place, it’s time to start recording your expenses. Be sure to record each expense accurately and include all the relevant details, such as the date, description, and amount. You should also assign each expense to its appropriate category, as this will help you track your spending and budget more effectively.

Step 5: Review and Analyze Your Expenses

Reviewing and analyzing your expenses regularly is critical to keeping your business finances on track. By looking at your sample of expenses sheet regularly, you can identify any patterns or trends in your spending, such as areas where you may be overspending or opportunities to save money. You can also use your expenses sheet to track your progress towards your financial goals, such as increasing profits or reducing costs.

Tips for Effective Expense Tracking

Here are some tips to help you track your business expenses effectively:

- Keep Receipts and Invoices

Keep all your receipts and invoices organized and in one place. This will make it easier to record your expenses accurately and to keep track of your spending. - Use a Separate Business Account

It’s a good idea to have a separate bank account for your business expenses. This will help you keep your personal and business finances separate and make it easier to track your expenses. - Use Software or Apps

There are many software applications and apps available that can help you track your expenses more efficiently. Look for one that is easy to use and compatible with your accounting system. - Regularly Review and Update Your Expenses Sheet

It’s essential to review and update your expenses sheet regularly to ensure that it remains accurate and up-to-date. Set a regular time each week or month to review your expenses and make any necessary updates. - Set Realistic Budgets

Setting realistic budgets for each category of expenses can help you avoid overspending and ensure that you are staying within your means. Use your expenses sheet to track your progress towards your budget goals.

Final Thoughts

A sample of expenses sheet is a valuable tool for any business owner who wants to keep track of their finances effectively. By following these tips and creating a comprehensive and accurate expenses sheet, you can ensure that your business is financially healthy and sustainable. Remember to review and update your expenses sheet regularly and adjust your spending as needed to achieve your financial goals. With a little effort and attention, you can take control of your business finances and set yourself up for long-term success.