In the realm of managing a church, financial transparency is not just a good practice; it’s a testament to the trust and accountability that underpin a thriving congregation. One of the key tools in achieving this transparency is the Church Balance Sheet Sample. In this comprehensive guide, we’ll navigate through the intricacies of this financial document, shedding light on its importance and how to decipher its components.

Understanding the Basics

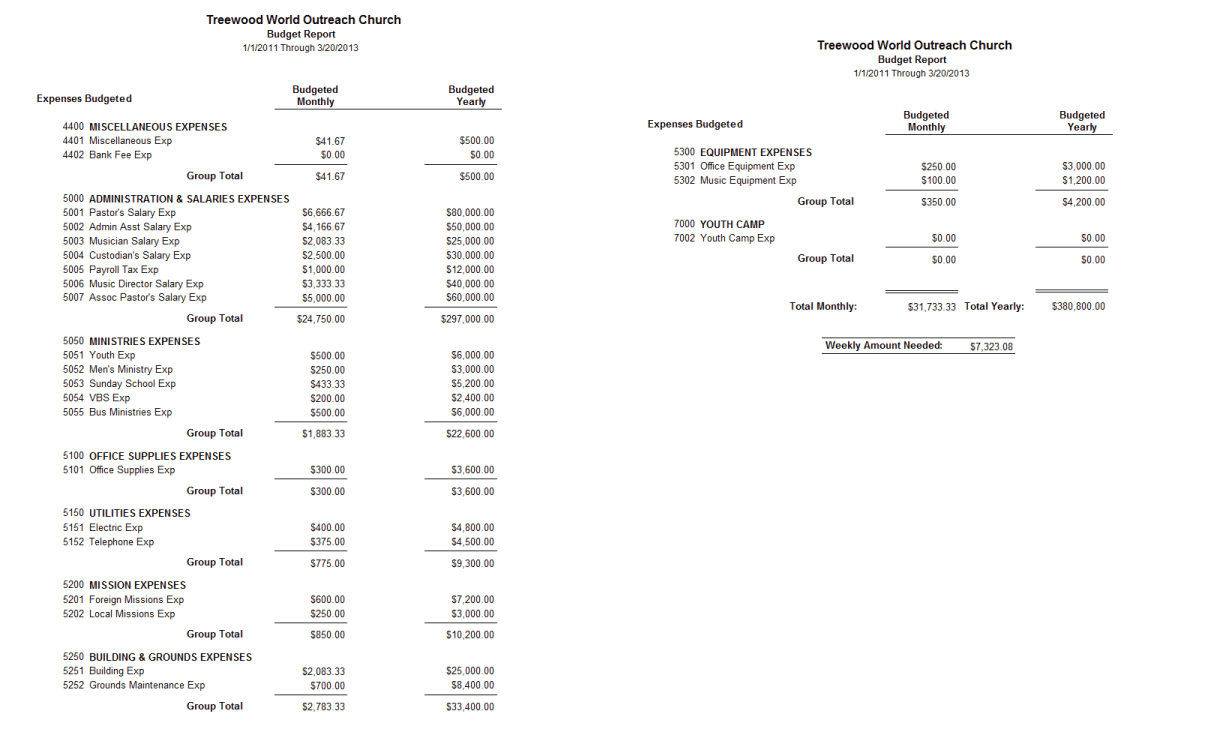

A Church Balance Sheet Sample serves as a snapshot of your church’s financial position at a specific point in time. It comprises two main sections: Assets and Liabilities. The balance between these two elements reflects the church’s equity or net assets.

Assets: Building the Foundation

Assets encompass everything the church owns. From physical assets like property and equipment to intangible assets like investments and cash, each entry plays a crucial role in the financial well-being of the church. Our guide will walk you through the process of categorizing and valuing these assets, ensuring a clear and accurate representation.

Liabilities: Navigating Financial Obligations

Liabilities, on the other hand, represent the church’s financial obligations. This includes debts, mortgages, and any outstanding payments. Understanding and managing these liabilities is imperative for making informed financial decisions. Our guide will provide insights on how to organize and comprehend these obligations.

Equity: The Heart of Transparency

Equity, often referred to as the church’s net assets, is the remainder after subtracting liabilities from assets. This section reflects the overall financial health and sustainability of the church. We’ll guide you on interpreting this crucial metric and making strategic financial decisions to ensure the long-term stability of your congregation.

Best Practices in Financial Reporting

Beyond understanding the components, effective communication of financial information is vital. Our guide delves into best practices for presenting a Church Balance Sheet Sample, ensuring that it becomes a powerful tool for building trust among your congregation and stakeholders.

Leveraging Technology for Simplicity

In an era of advanced technology, managing financial records has never been easier. We’ll explore how leveraging accounting software can simplify the process of creating, maintaining, and interpreting your Church Balance Sheet Sample.

Empowering Your Leadership

A transparent financial system is not just about compliance; it’s about empowering your church leadership with the insights needed for effective decision-making. Our guide will equip you with the knowledge to utilize the Church Balance Sheet Sample as a strategic tool in steering your church towards financial prosperity.

Navigating Challenges and Ensuring Accuracy

While the Church Balance Sheet Sample is a powerful tool, challenges may arise, such as the complexity of financial transactions or changes in accounting standards. Our guide addresses these potential hurdles, offering tips on maintaining accuracy and staying abreast of regulatory updates to ensure your financial statements are not just transparent but also compliant.

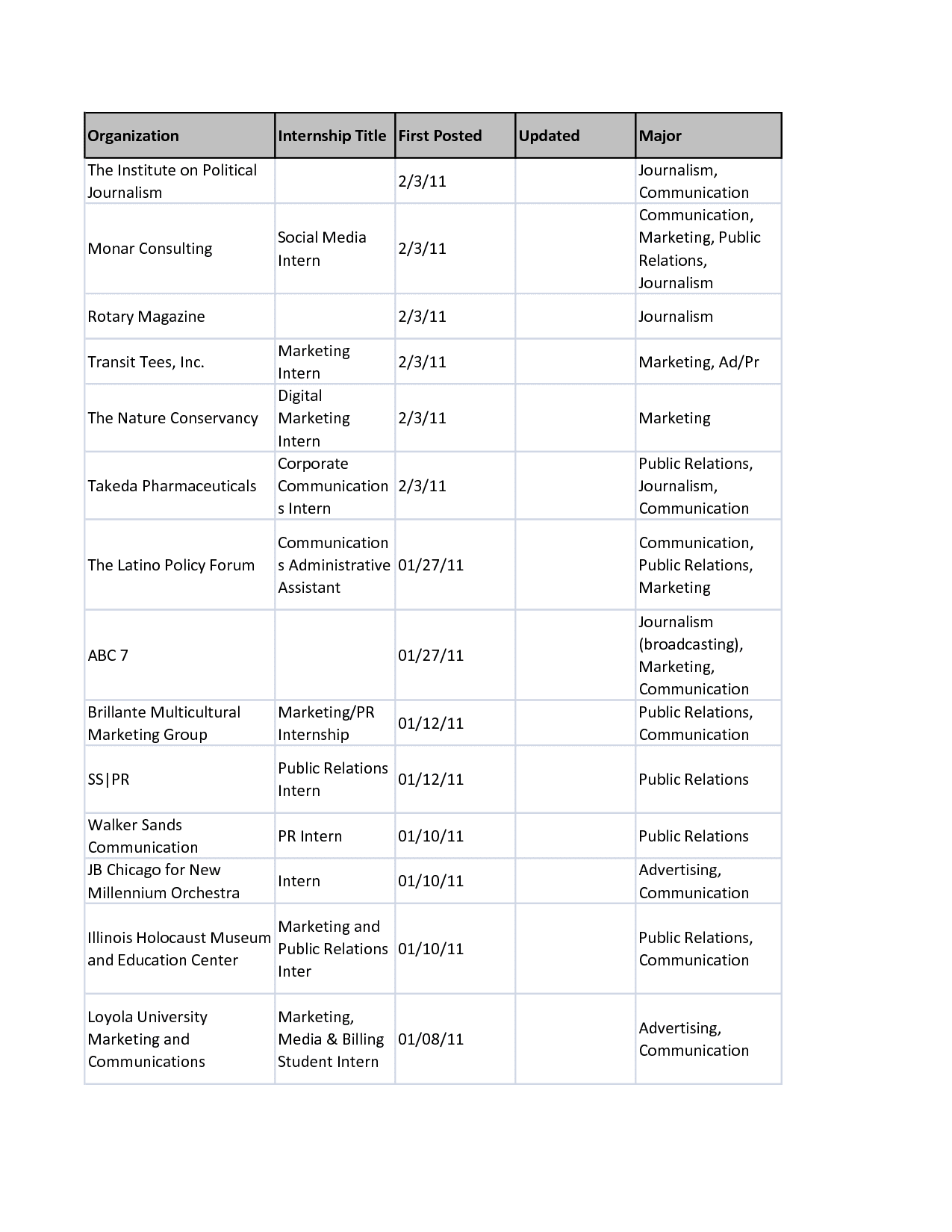

Educating Your Congregation

Transparency extends beyond the church’s leadership. We explore effective ways to communicate financial information to your congregation, fostering a sense of trust and involvement. By breaking down complex financial jargon into easily understandable language, you empower your members to actively participate in the financial well-being of the church.

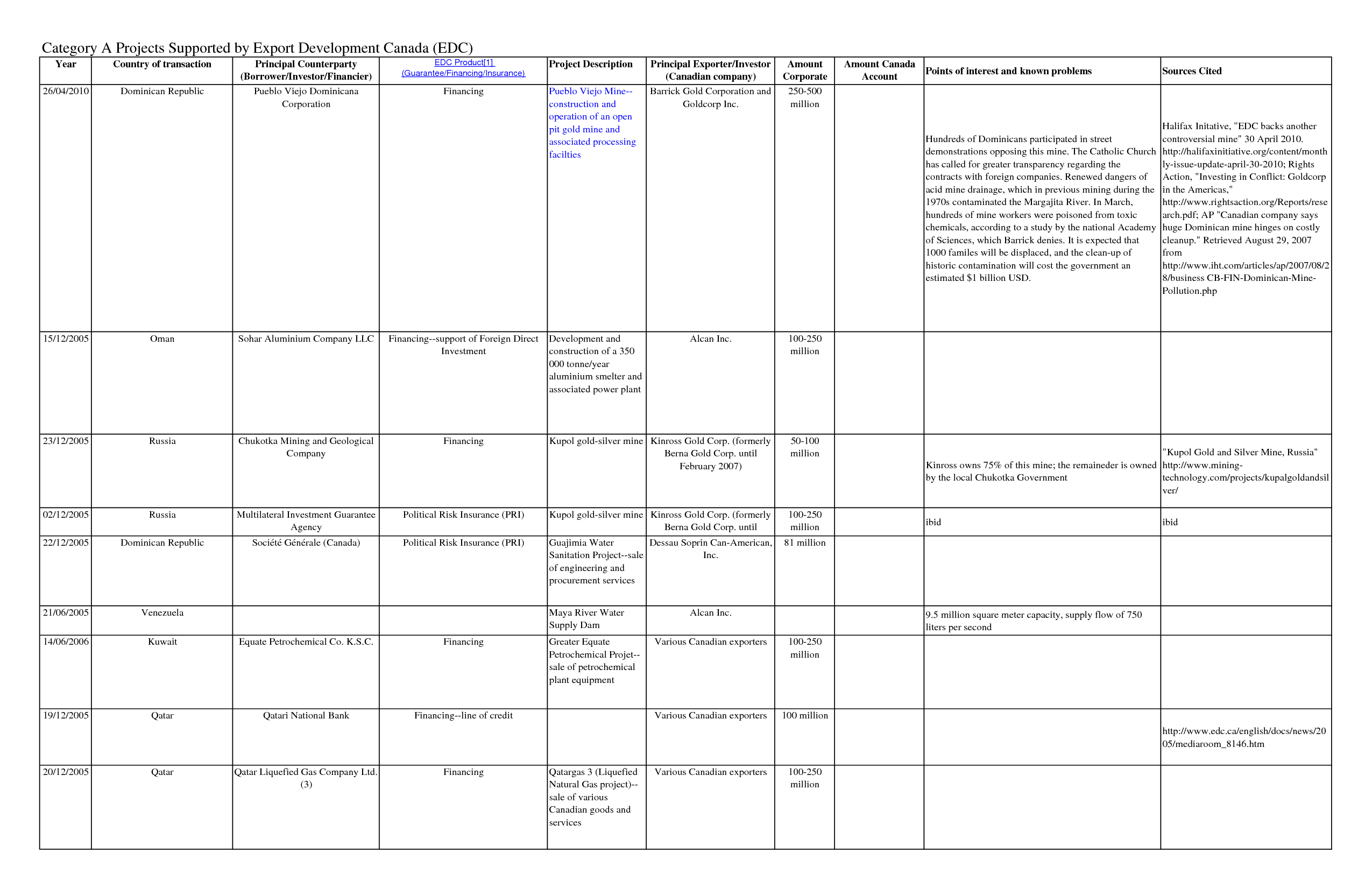

Case Studies and Real-world Examples

To provide practical insights, our guide incorporates real-world examples and case studies from successful churches that have effectively utilized their balance sheets for informed decision-making. By learning from the experiences of others, you can gain valuable perspectives on adapting financial strategies to suit your congregation’s unique needs.

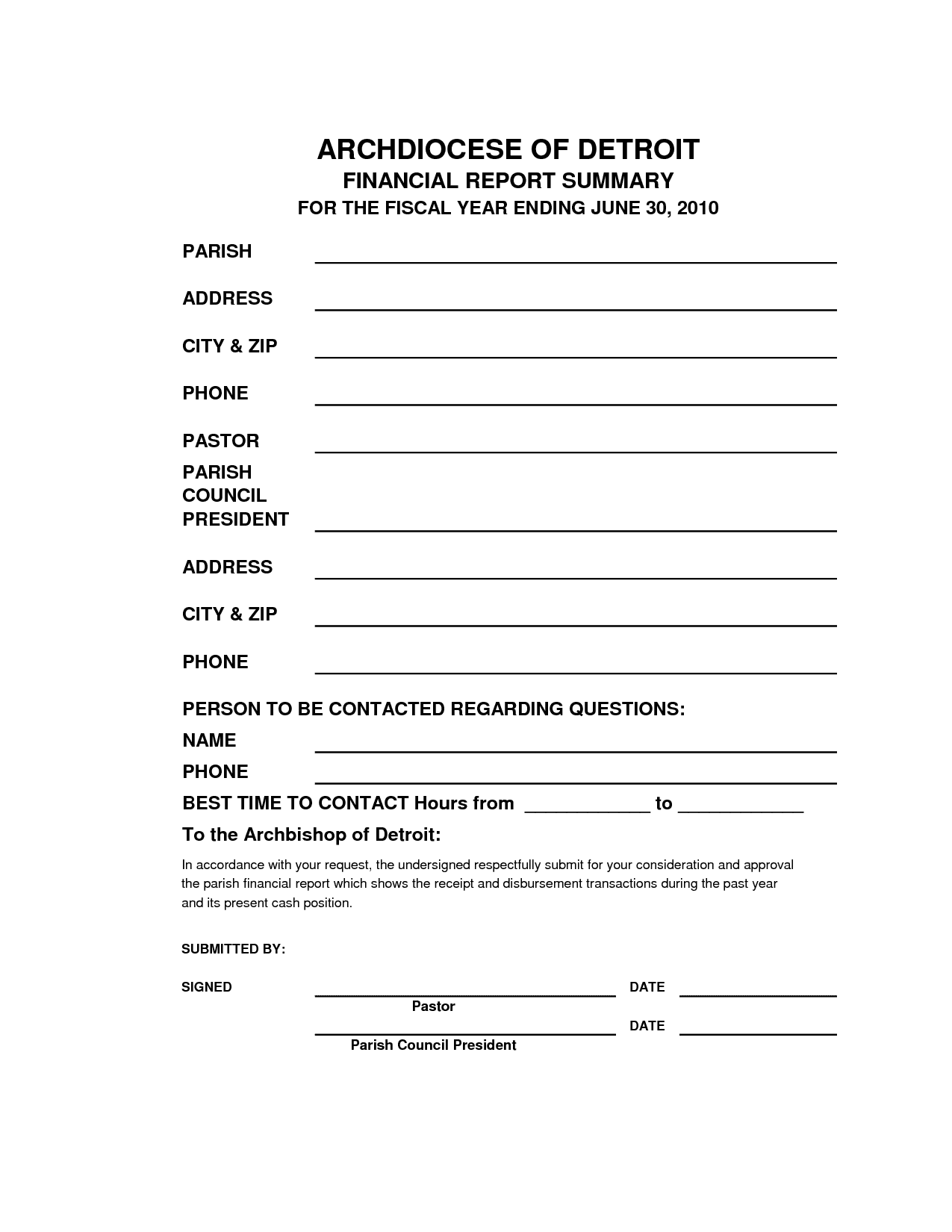

Preparing for Audits and External Scrutiny

Whether it’s an internal review or external audit, your Church Balance Sheet Sample should withstand scrutiny. Our guide offers tips on preparing for audits, ensuring that your financial records are organized, accurate, and comply with regulatory standards, instilling confidence in both your congregation and external stakeholders.

Continual Improvement and Adaptation

The financial landscape is ever-evolving, and your church’s financial practices should be dynamic as well. Our guide emphasizes the importance of continual improvement, encouraging regular reviews and adjustments to your financial reporting processes to align with changing circumstances and goals.

Engaging with Financial Advisors

For churches navigating complex financial terrain, seeking professional advice can be invaluable. We provide guidance on when and how to engage with financial advisors who specialize in nonprofit and religious organizations, ensuring that your Church Balance Sheet Sample reflects not only transparency but also financial wisdom.

Community Feedback and Q&A Section

To enhance the user experience, our guide incorporates a community feedback section where readers can share their insights, questions, and experiences. Additionally, a dedicated Q&A portion addresses common queries, fostering a sense of community and collaboration among church leaders striving for financial transparency.

Final Thoughts

As stewards of your church’s financial health, embracing transparency through a well-crafted Church Balance Sheet Sample is both a responsibility and an opportunity. Our guide serves as a comprehensive resource, empowering you to not only understand the nuances of financial reporting but also leverage it for the greater good of your congregation. May your journey towards financial transparency be smooth, enlightening, and ultimately, a catalyst for the continued growth and prosperity of your church community.