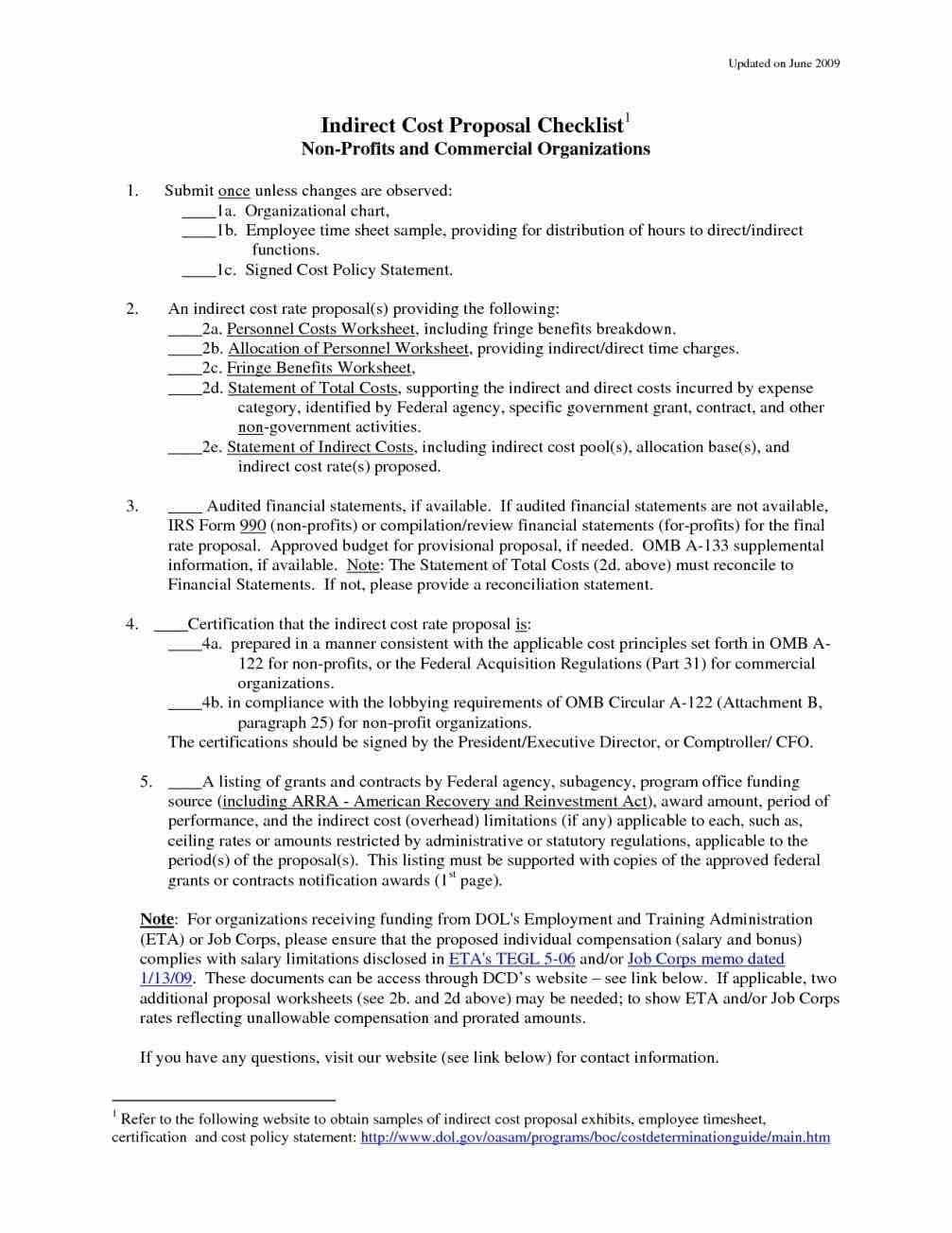

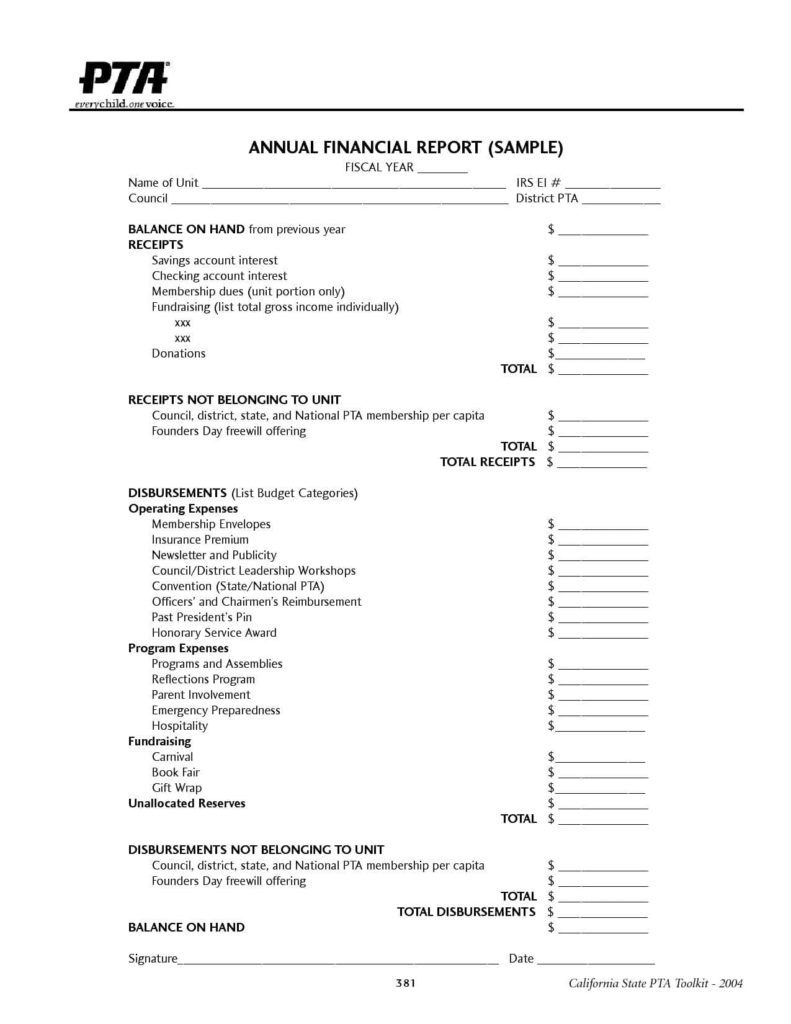

You can find a sample financial report for non-profit organizations online. These types of reports are used to solicit funds for the purpose of furthering an organization’s mission. The money comes in the form of grants, loans, and other forms of non-monetary contributions that are given out by government or private foundations. These types of organizations are called non-profit foundations.

The report is used to show how the organization’s mission will be fulfilled when funds are given out. It also helps a lot in deciding if there is money available to help with the organization’s needs. These reports usually include the amount of money required to conduct specific projects. They also contain the cost of acquiring a specific equipment, such as computers, printing presses or even software and other technical resources. Other things included in the financial reports are the number of volunteers needed for the job, expenses for a specific service or item, and the amount of time that it takes for the project to be completed.

There are many reasons why a person would want to look for these reports. The most popular of which is to find out how the organization is doing financially. This can be helpful if they are looking to buy into a certain organization, or if the organization itself needs money. Another reason that a person might be interested in getting a financial report for a non-profit organization is to make sure that their money is well spent. By finding out how the organization is doing, it can give them more information on what to do to improve the business.

A financial report is also important for those who are trying to get loans from banks. The reports can help the borrower to decide if they want to take the loan. They can also help them decide if the organization needs additional funds. Sometimes, it is also helpful to know how much money is going into the project at a time. It can also be useful for banks to find out if there are any loans that they may be able to give out to the organization.

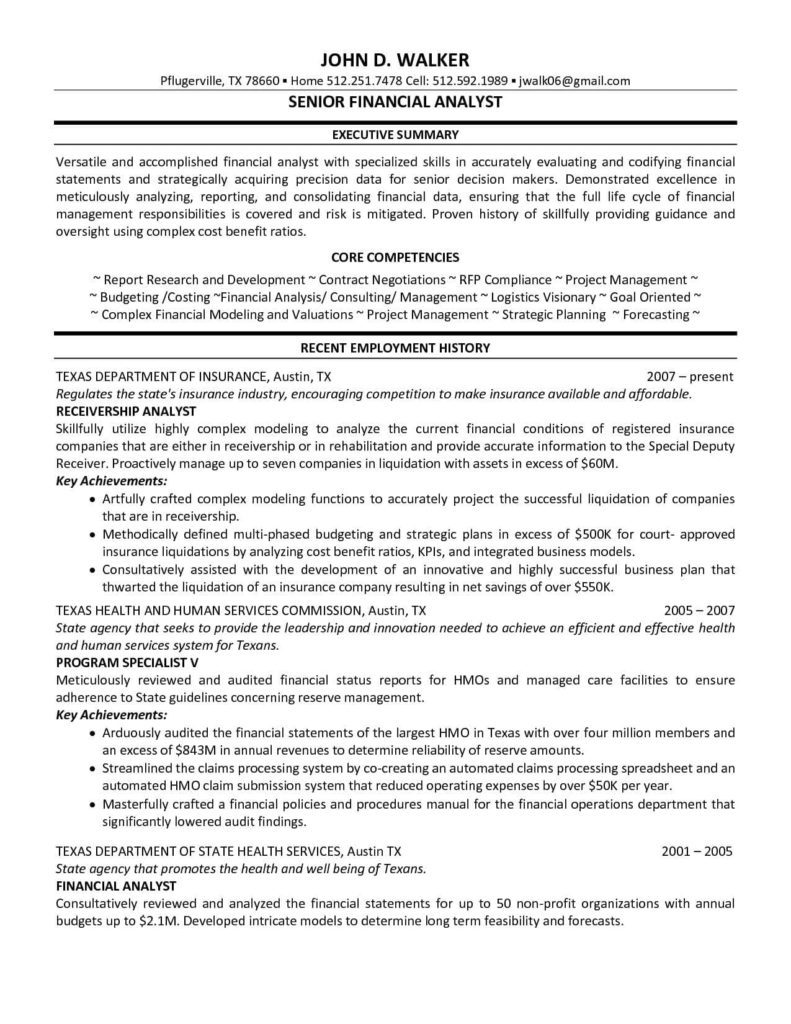

The financial reports for non-profit foundation may also include data about the finances of different levels of staff in the organization. These financial reports may show expenses and revenues of different levels of staff. Staff salaries, allowances, expense accounts, and other data that would otherwise not be easily found in other financial reports.

Non-profit organizations must be transparent in how they spend their money. For this reason, it is important to find out how these organizations spend their money and where the money goes. For example, there are some organizations that give their grant money away for purposes other than to pay for their activities.

Some non-profit organizations may have multiple locations. They can pay for their expenses by collecting money at each location and then disbursing it to one location at a later date. It is also possible for non-profit organizations to get loans to buy equipment and pay for volunteers or services that are provided in their various locations.

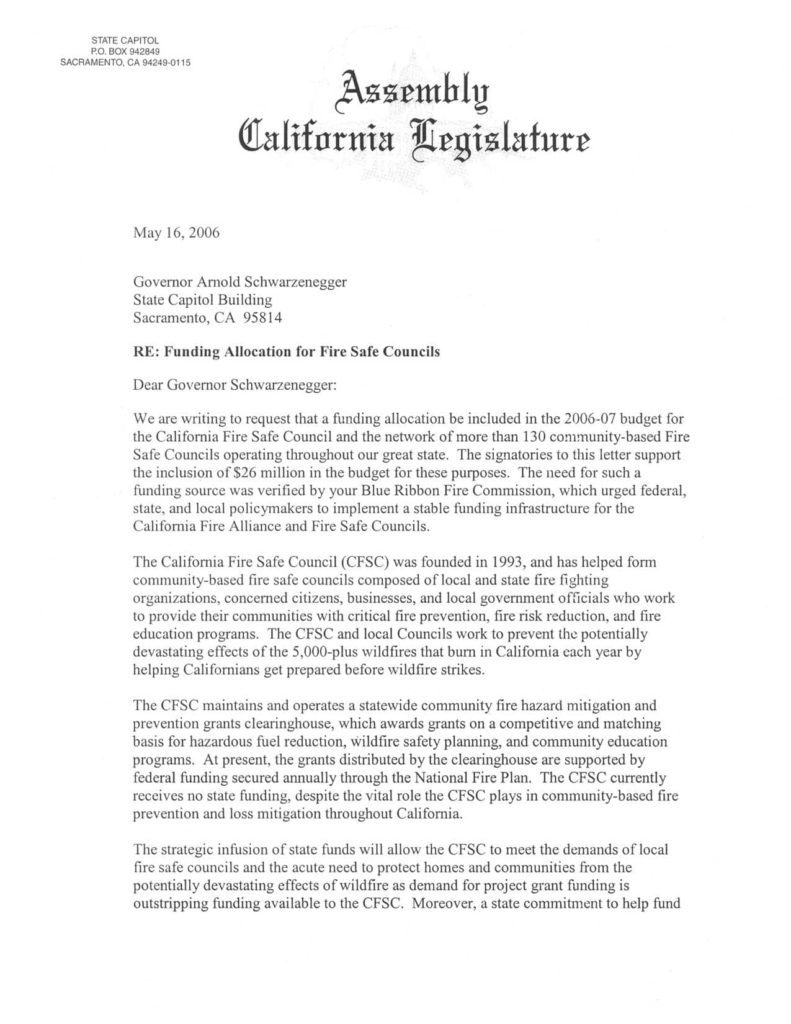

Financial reports for non-profit organizations can also include information about other types of donations. These include grants and donations that are given to individuals, organizations, institutions, or groups. Some of these can be used for the same purpose of acquiring equipment and other expenses. There is no reason why people or other groups cannot become a member of an organization and then use the donations to cover the expenses.

If financial reports for non-profit organizations do not provide enough information for the organization to make a sound decision about accepting donations and grants, they may be able to find more information about it online. The Internet can be a great source for financial reports. There are a number of nonprofit organizations that provide financial reports for non-profit foundation members. The website will be able to provide members with information on the organizations that they can donate their money to and the amount they can donate.

It may be a good idea to join a nonprofit organization that is willing to work with the community. These organizations can work to raise money through a variety of methods. This may include raising funds through grants and donations or participating in events such as fundraising.

The financial reports for non-profit organization are a valuable resource when it comes to collecting information about the organization. It may also be helpful in helping to determine the organization’s needs and how much money it needs to pay its bills. The information gathered can help the organization to decide how to plan the way it uses the money that it raises.