Understanding Credit Reports: Examples and Importance

Credit reports play a crucial role in our financial lives. In this article, we’ll explore the importance of credit reports and provide examples of different types of credit reports.

Credit reports are documents that contain information about an individual’s credit history. They are compiled by credit bureaus and used by lenders, landlords, and other institutions to assess an individual’s creditworthiness. Understanding credit reports is important for anyone looking to apply for credit, rent an apartment, or even apply for a job.

In this article, we’ll explore the different types of credit reports and why they are important.

Types of Credit Reports:

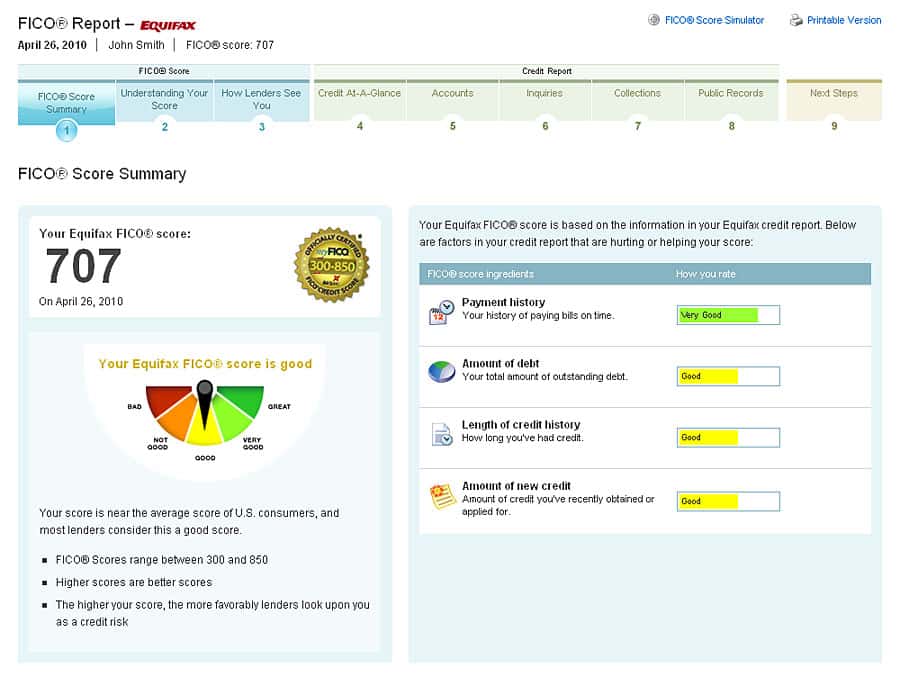

Credit Score Reports:

A credit score report is a document that contains an individual’s credit score. Credit scores are calculated based on information in a person’s credit report, including their payment history, credit utilization, and length of credit history. Lenders use credit scores to determine the likelihood that a person will repay a loan on time.

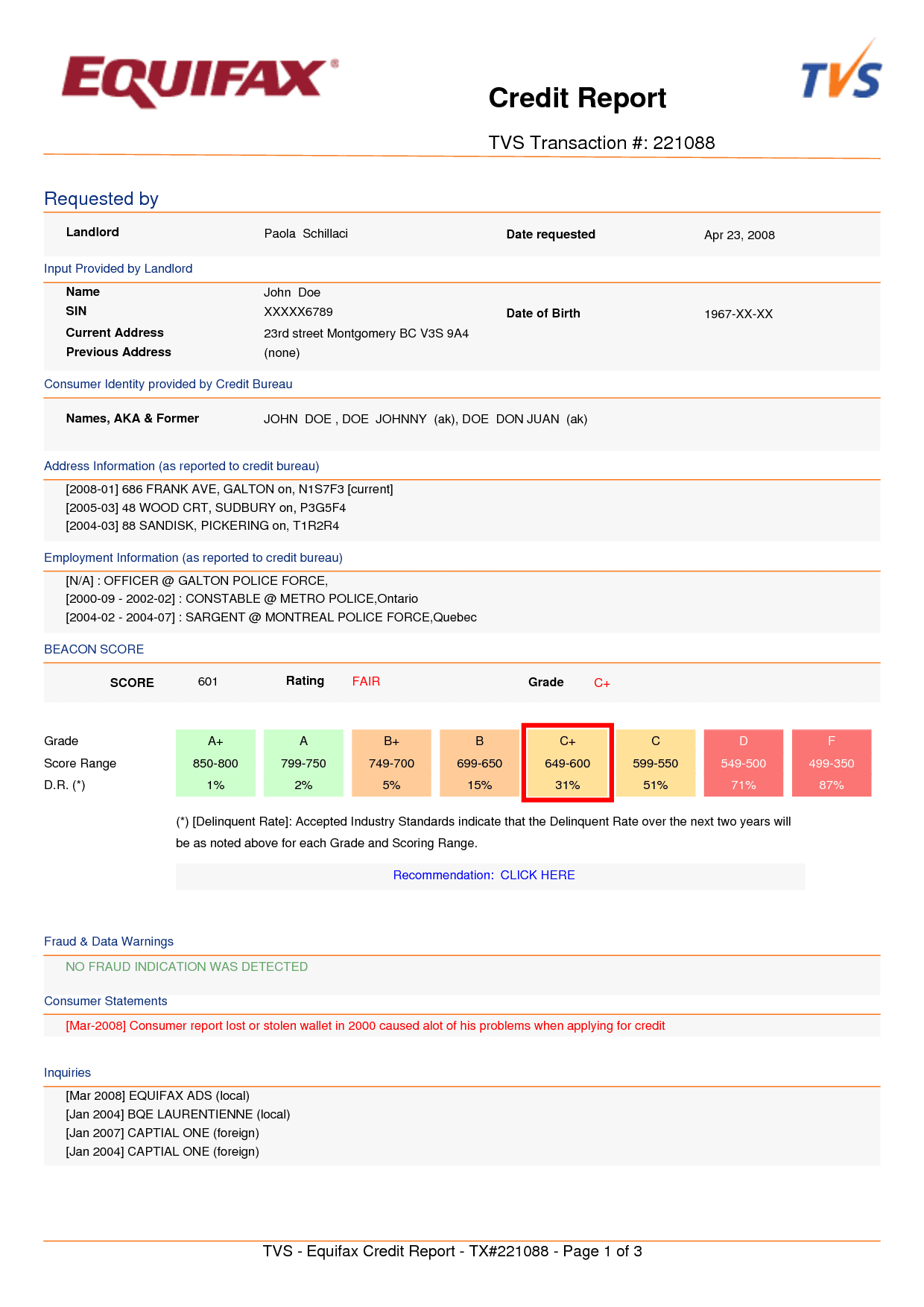

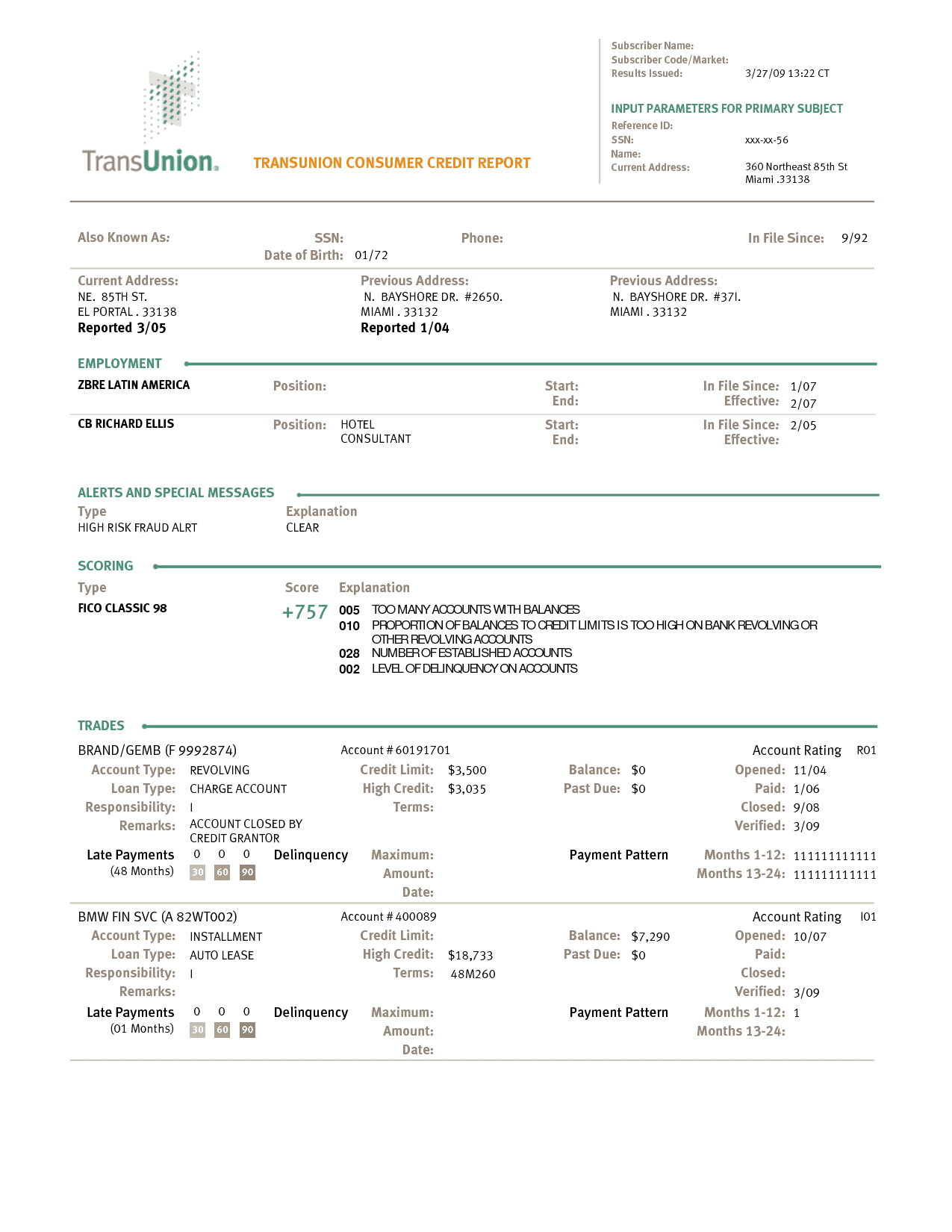

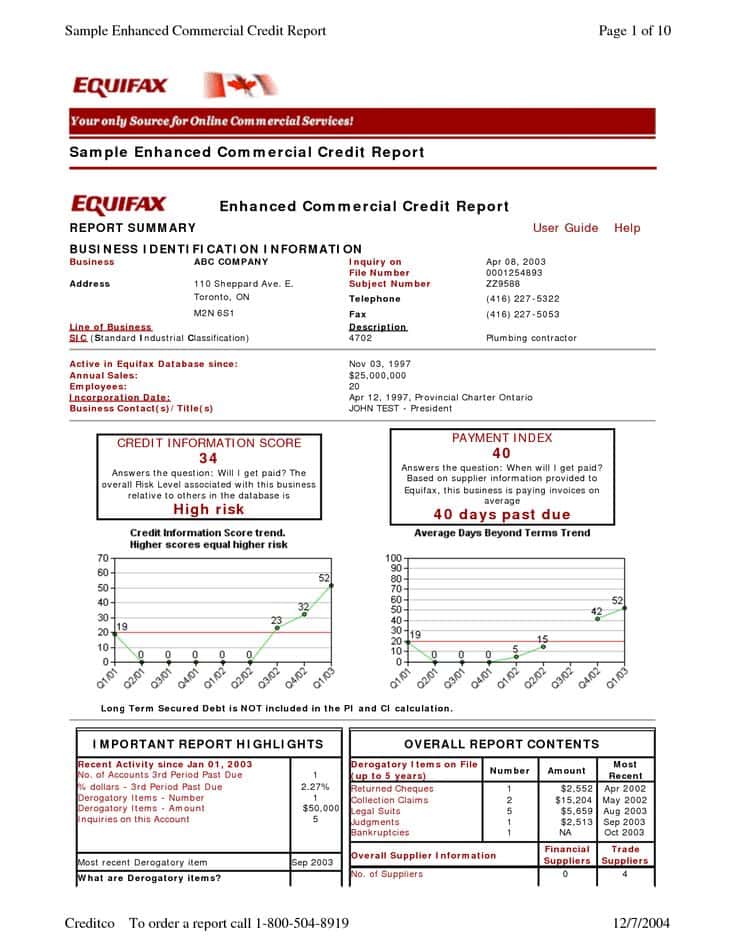

Consumer Credit Reports:

Consumer credit reports contain information about an individual’s credit history, including their credit accounts, payment history, and outstanding debts. This type of credit report is often used by lenders to assess an individual’s creditworthiness.

Employment Credit Reports:

Employment credit reports are used by employers to evaluate an individual’s credit history as part of the hiring process. These reports are similar to consumer credit reports but typically do not contain as much detail.

Importance of Credit Reports:

Assessing Creditworthiness:

Credit reports are used by lenders to assess an individual’s creditworthiness. A person’s credit score and credit history are often the primary factors used to determine whether they qualify for a loan and what interest rate they will receive.

Identifying Errors:

Credit reports can help individuals identify errors in their credit history. If there is incorrect information on a credit report, it can negatively impact a person’s credit score and make it more difficult to obtain credit in the future.

Monitoring Credit Activity:

Regularly checking a credit report can help individuals monitor their credit activity and identify potential instances of fraud or identity theft. If there is suspicious activity on a credit report, it can be reported to the credit bureau and investigated further.

Conclusion:

Understanding credit reports and their importance is crucial for anyone looking to apply for credit or rent an apartment. By regularly checking credit reports and understanding what they contain, individuals can ensure that their credit history is accurate and take steps to improve their credit score.

Additionally, it is important to note that credit reports are not only used by lenders and landlords, but also by insurance companies and utility providers. A person’s credit history can impact their ability to obtain affordable insurance rates or even qualify for certain utility services.

In order to maintain a healthy credit history, it is recommended to make on-time payments, keep credit utilization low, and regularly check credit reports for errors or suspicious activity. It is also important to limit the number of credit inquiries as too many inquiries can negatively impact a credit score.

In conclusion, credit reports play a critical role in our financial lives and understanding their importance can help individuals make informed decisions when it comes to their credit and financial well-being. By regularly monitoring credit reports and taking steps to maintain a healthy credit history, individuals can improve their chances of obtaining credit and achieving their financial goals. Remember, a strong credit history can open doors to new opportunities and financial stability.