In the dynamic realm of business, understanding and managing your finances is crucial for sustainable success. One indispensable tool for effective financial planning is the Projected Cash Flow Statement. In this guide, we’ll explore the significance of projecting cash flow and provide you with a comprehensive Projected Cash Flow Statement Sample to empower your financial journey.

Why Projected Cash Flow Matters

A Projected Cash Flow Statement is a forward-looking financial document that outlines how cash is expected to flow in and out of your business over a specific period. It serves as a roadmap for managing your financial resources, making informed decisions, and ensuring your business’s financial health.

The Components of Projected Cash Flow Statement

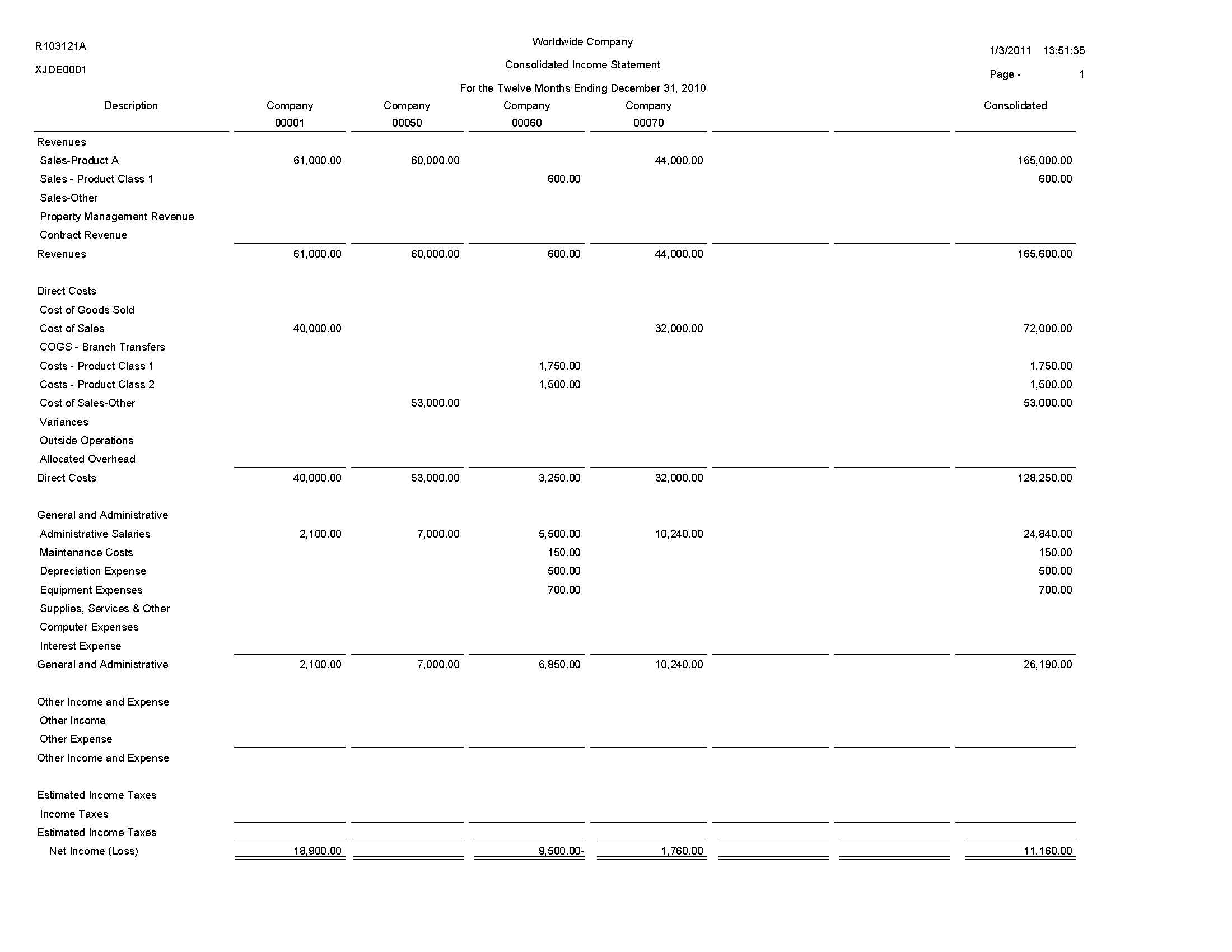

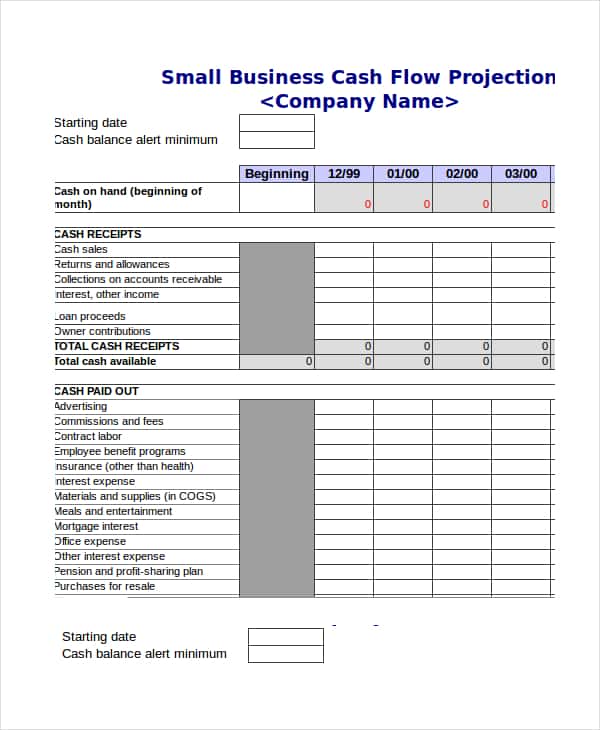

- Operating Activities

This section includes cash transactions related to the core operations of your business. It covers revenue, expenses, and net income. - Investing Activities

Here, you detail cash transactions related to investments, such as purchasing or selling assets. It helps in assessing the return on investment. - Financing Activities

This section outlines cash transactions with your investors and creditors, including loans and equity. It provides insights into how your business is funded.

Crafting Your Projected Cash Flow Statement

- Start with Accurate Sales Projections

Projecting your future sales is the cornerstone of your cash flow statement. Use historical data, market trends, and realistic assumptions to estimate future sales accurately. - Factor in Variable and Fixed Costs

Identify and categorize your costs as either variable or fixed. Variable costs fluctuate with sales, while fixed costs remain constant. This distinction is vital for precise forecasting. - Account for Seasonal Trends

If your business experiences seasonal fluctuations, incorporate this into your projection. Understanding the seasonal nature of your business helps in planning for lean periods. - Consider Contingencies

Unexpected events can impact your cash flow. Factor in contingencies and create a buffer for unforeseen circumstances. This proactive approach ensures resilience in the face of uncertainties.

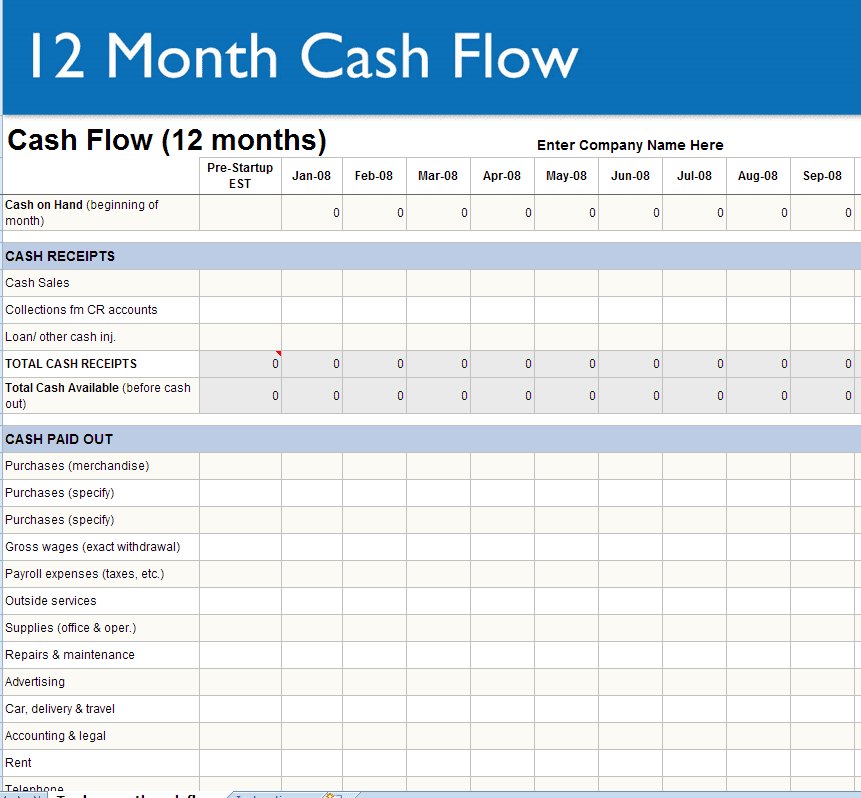

Sample Projected Cash Flow Statement

| Categories | Month 1 | Month 2 | Month 3 | … | Month n | Total |

|---|---|---|---|---|---|---|

| Operating Activities | $XXX | $XXX | $XXX | … | $XXX | $XXXX |

| Investing Activities | -$XXX | -$XXX | -$XXX | … | -$XXX | -$XXXX |

| Financing Activities | $XXX | -$XXX | $XXX | … | -$XXX | $XXXX |

| Net Cash Flow | $XXX | $XXX | $XXX | … | $XXX | $XXXX |

Tips for Effectively Using the Projected Cash Flow Statement Sample

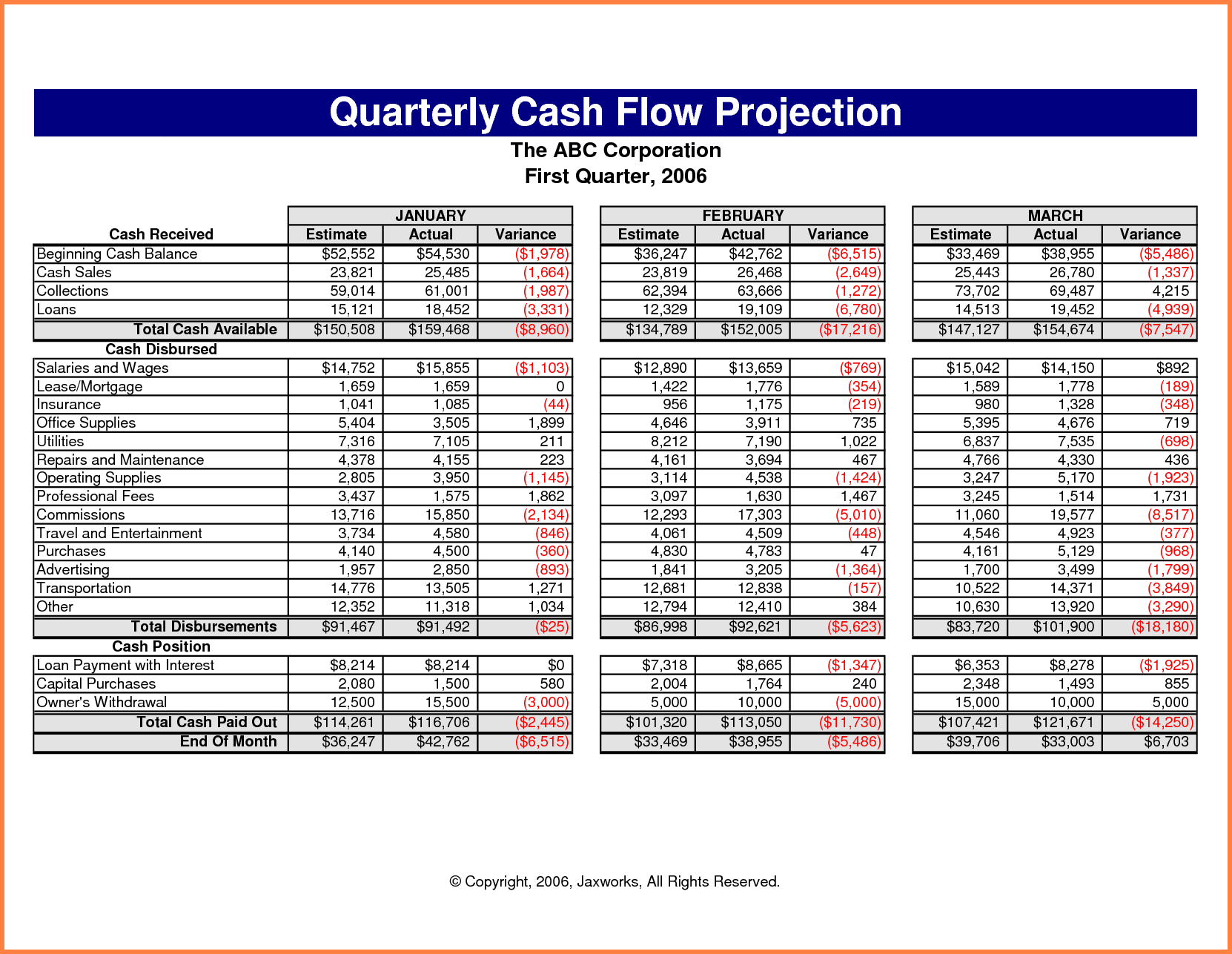

- Regularly Update Your Projections

The business landscape is dynamic, and factors influencing cash flow can change. Regularly update your projections to reflect the latest information, market trends, and any shifts in your business environment. - Monitor Variances

Actively compare your actual cash flow with the projections. Variances can provide valuable insights into the accuracy of your forecasts and help identify areas that may need adjustment in future projections. - Scenario Planning

Consider creating multiple scenarios based on different assumptions. This helps in preparing for various outcomes, making your business more resilient to uncertainties. - Seek Professional Guidance

If financial forecasting seems daunting, don’t hesitate to seek advice from financial experts or consult with your accountant. They can provide valuable insights and ensure the accuracy of your projections.

Realizing the Power of Financial Forecasting

A well-crafted Projected Cash Flow Statement is not just a financial document; it’s a strategic tool that empowers you to make informed decisions, manage risks, and seize opportunities. It serves as a compass, guiding your business through the complex currents of the market.

Our Commitment to Your Financial Success

At PruneyardInn.com, we understand the importance of financial literacy and planning for the success of your endeavors. That’s why we provide resources like this Projected Cash Flow Statement Sample to assist you on your journey. Whether you’re a seasoned entrepreneur or just starting, our commitment is to be your partner in achieving financial success.

Embrace the Future with Confidence

Now armed with a comprehensive Projected Cash Flow Statement Sample and the knowledge to navigate its intricacies, you can confidently steer your business towards a prosperous future. Financial planning is not just about numbers; it’s about empowering your vision and ensuring its sustainability.

As you embark on this financial journey, remember that the ability to project cash flow is a skill that evolves with experience. Embrace each challenge as an opportunity to refine your projections and enhance your financial acumen.

Conclusion

In conclusion, mastering the art of projecting cash flow is a pivotal step towards financial stability and growth. Utilize our Projected Cash Flow Statement Sample as a guiding tool to navigate the complexities of financial planning. By understanding and implementing these principles, you empower your business to thrive in the ever-evolving landscape of commerce. Take charge of your financial future today!

Take the first step towards financial empowerment with our Projected Cash Flow Statement Sample. Your success story begins with informed financial decisions. Let’s build a resilient future together!