A Comprehensive Guide to Portfolio Management Reporting Templates

Looking for a way to streamline your portfolio management reporting process? Check out this comprehensive guide on portfolio management reporting templates and learn how they can help you save time and improve your reporting accuracy.

As a portfolio manager, you know how important it is to stay on top of your investments and monitor their performance regularly. However, the reporting process can be time-consuming and prone to errors, especially if you’re using manual methods. This is where portfolio management reporting templates come in handy.

In this article, we’ll take a closer look at portfolio management reporting templates, including what they are, how they work, and why they’re beneficial for portfolio managers.

What are Portfolio Management Reporting Templates?

Portfolio management reporting templates are pre-designed documents that allow portfolio managers to present and report on their investment portfolios in a standardized format. These templates can be customized to meet the specific needs of the manager and the investment strategy.

How do Portfolio Management Reporting Templates work?

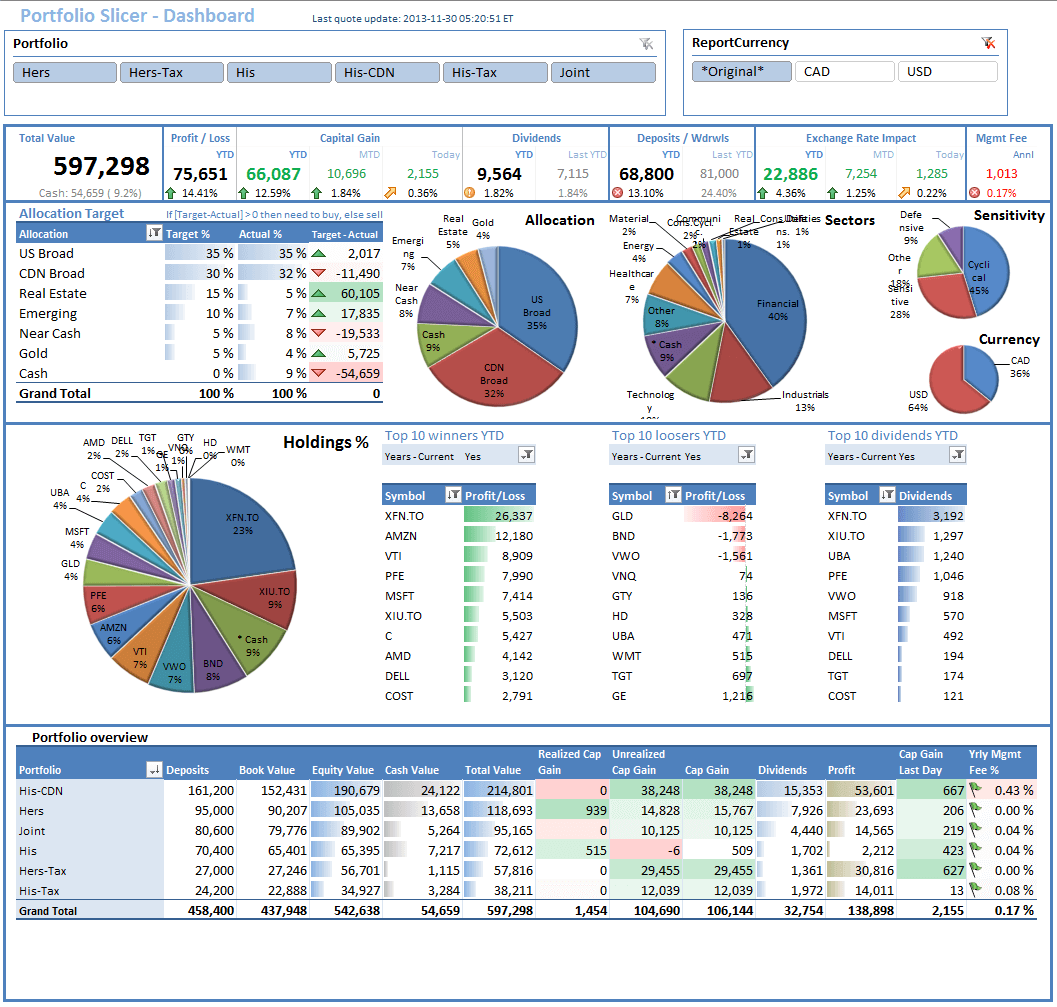

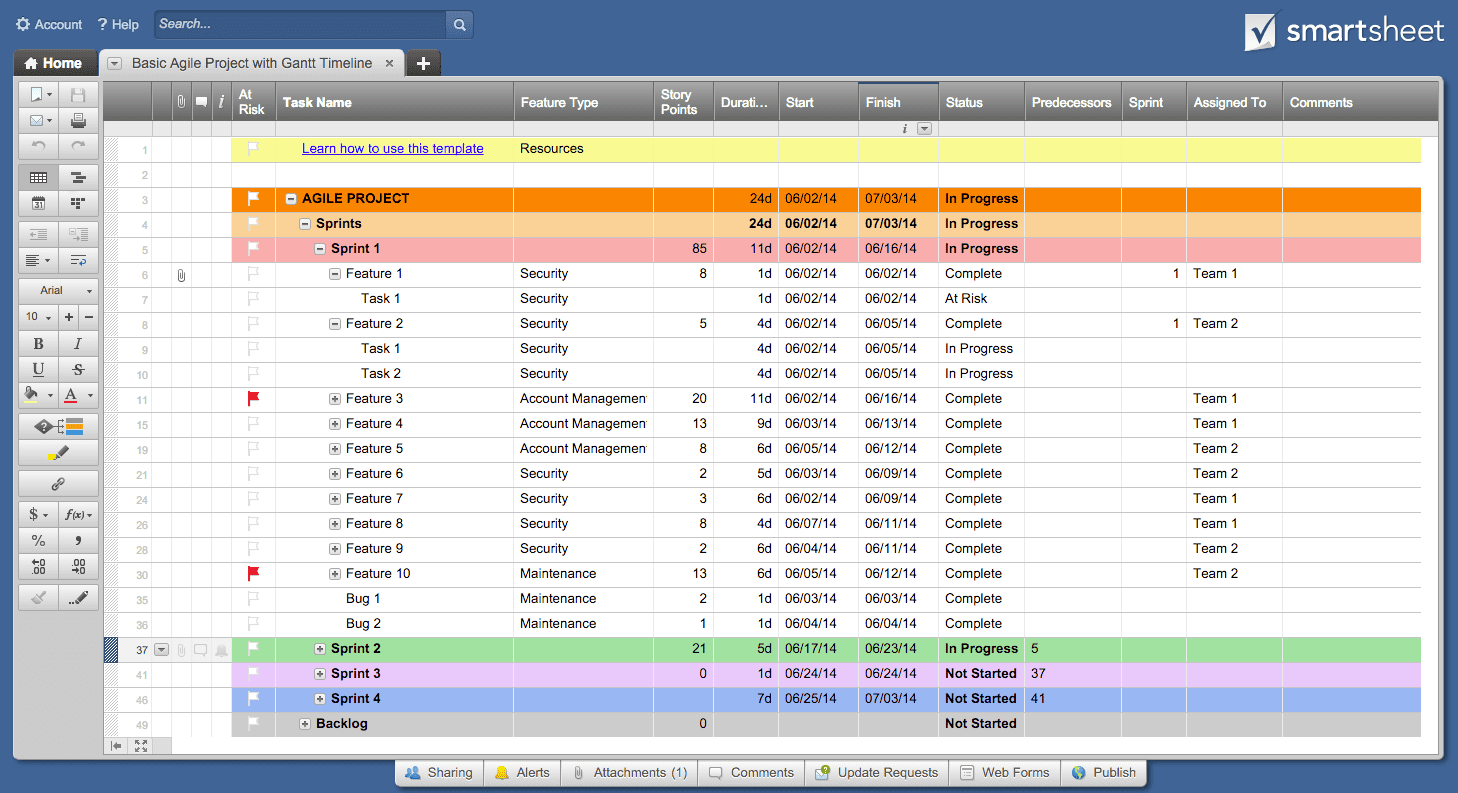

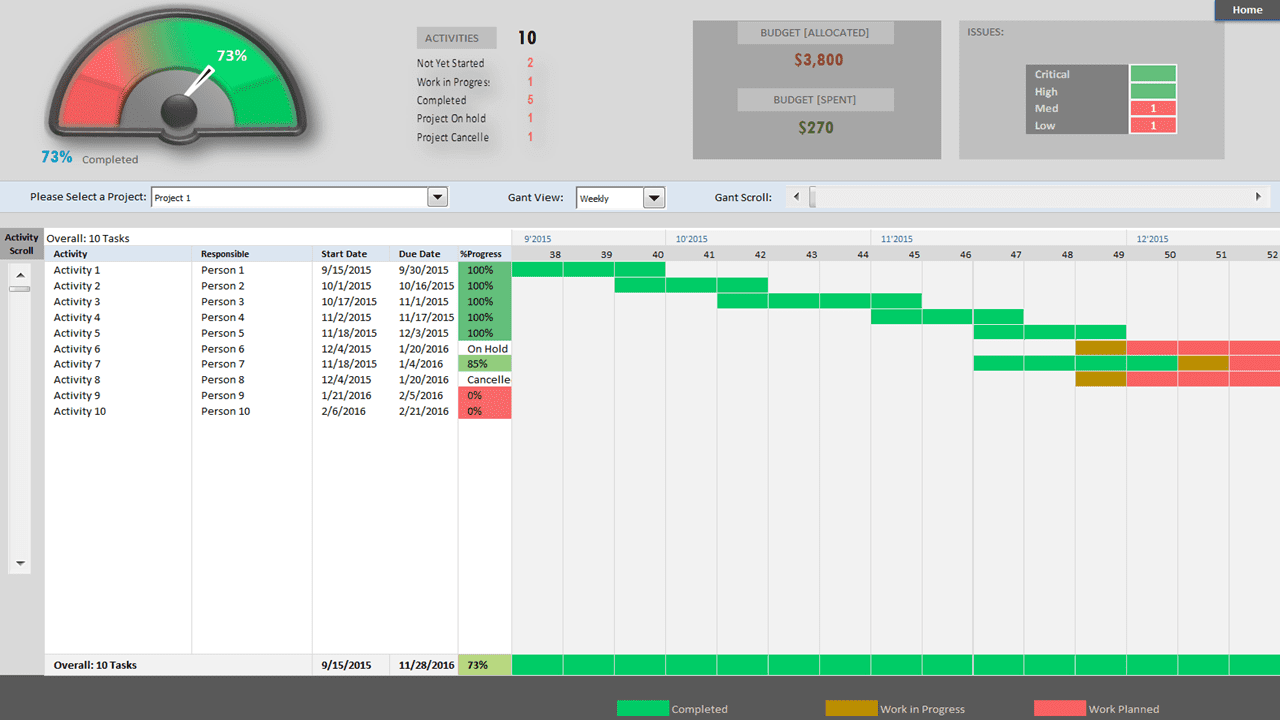

Portfolio management reporting templates work by providing a framework for presenting investment performance data in a consistent manner. The templates typically include sections for asset allocation, performance metrics, risk metrics, and other important data points.

By using a template, portfolio managers can easily input their data and generate reports quickly and accurately. This can save them time and reduce the risk of errors.

Why are Portfolio Management Reporting Templates beneficial for portfolio managers?

There are several benefits to using portfolio management reporting templates, including:

- Consistency: By using a standardized format, portfolio managers can ensure that their reports are consistent and easy to understand.

- Efficiency: With a template, portfolio managers can quickly generate reports without having to spend hours formatting and organizing data.

- Accuracy: Templates can help reduce the risk of errors by providing a clear structure for data presentation.

- Customization: Templates can be customized to meet the specific needs of the portfolio manager and the investment strategy.

- Professionalism: Using a professional-looking template can help enhance the image of the portfolio manager and the investment firm.

Types of Portfolio Management Reporting Templates

There are various types of portfolio management reporting templates available, each designed to meet the unique needs of different investment strategies. Let’s take a look at some of the most common types:

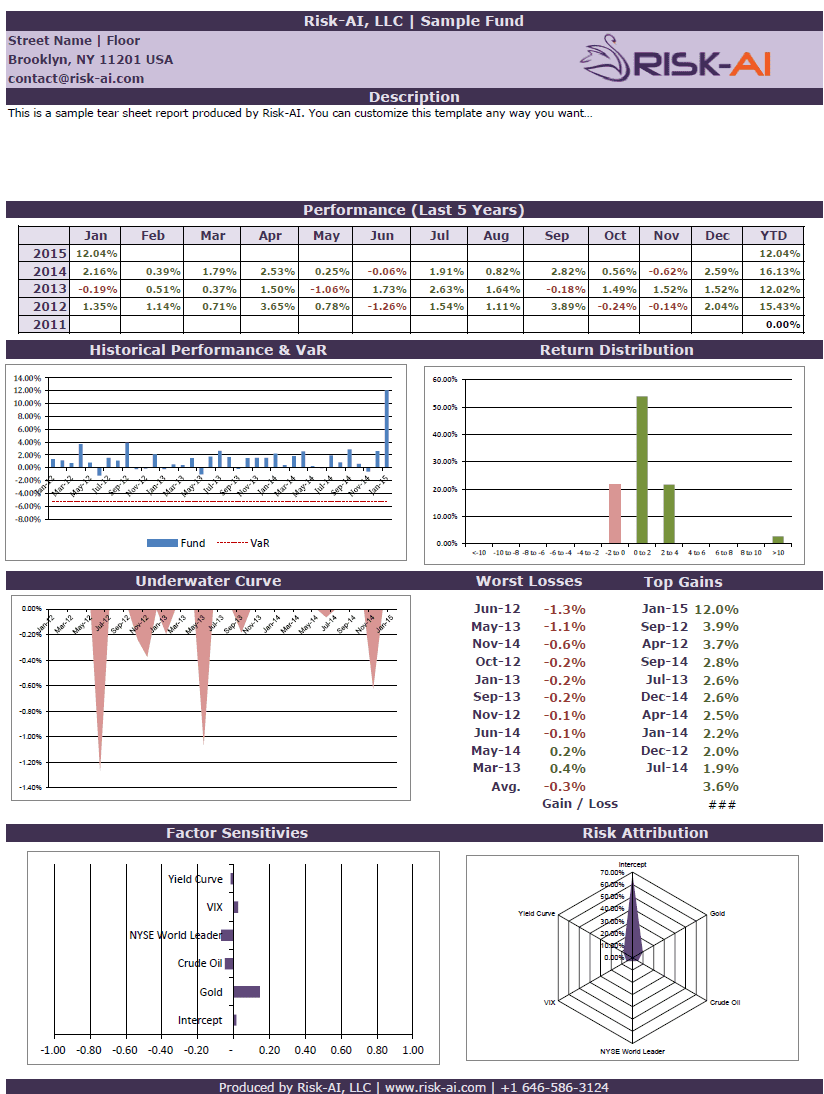

- Performance Reporting Templates: These templates focus on presenting investment performance metrics, such as returns, risk, and other key indicators. They typically include tables, graphs, and charts to help visualize the data.

- Risk Reporting Templates: These templates focus on presenting risk-related metrics, such as standard deviation, beta, and other risk measurements. They can help portfolio managers identify potential risks and adjust their investment strategies accordingly.

- Asset Allocation Reporting Templates: These templates focus on presenting asset allocation data, including the percentage of assets allocated to each asset class. They can help portfolio managers determine whether their investment portfolios are well-diversified.

- Investment Committee Reporting Templates: These templates are designed for presenting investment performance data to investment committees. They typically include a summary of portfolio performance, risk management strategies, and investment recommendations.

- Client Reporting Templates: These templates are designed for presenting investment performance data to clients. They typically include a summary of portfolio performance, investment strategy, and future investment plans.

Choosing the Right Portfolio Management Reporting Template

Choosing the right portfolio management reporting template depends on the specific needs of the portfolio manager and the investment strategy. Here are some factors to consider when choosing a template:

- Investment strategy: Choose a template that aligns with the investment strategy, whether it’s focused on growth, income, or a combination of both.

- Reporting frequency: Choose a template that’s appropriate for the reporting frequency, whether it’s monthly, quarterly, or annually.

- Data sources: Choose a template that can easily integrate with the data sources used to track investment performance.

- Customization: Choose a template that can be customized to meet the unique needs of the portfolio manager and the investment strategy.

- Ease of use: Choose a template that’s easy to use and doesn’t require extensive technical knowledge.

Conclusion

Portfolio management reporting templates are a valuable tool for portfolio managers looking to streamline their reporting process and improve the accuracy of their reports. By providing a consistent and efficient way to present investment performance data, templates can save time and reduce errors. When choosing a template, consider the investment strategy, reporting frequency, data sources, customization options, and ease of use. With the right template, portfolio managers can present their investment portfolios in a professional and meaningful way.