A non profit balance sheet template is a crucial tool for tracking the financial health of your organization. In this guide, we’ll provide you with everything you need to know about creating and using a balance sheet template for your non profit.

Non profit organizations have a unique set of financial challenges to manage. They must ensure that their expenses are covered while also making sure that they are operating in a financially responsible manner. A balance sheet is an essential tool for tracking the financial health of your non profit, and creating a non profit balance sheet template can help make the process more manageable.

In this guide, we’ll explore the importance of a non profit balance sheet template, how to create one, and how to use it effectively to manage your organization’s finances.

Why a Non Profit Balance Sheet Template is Important

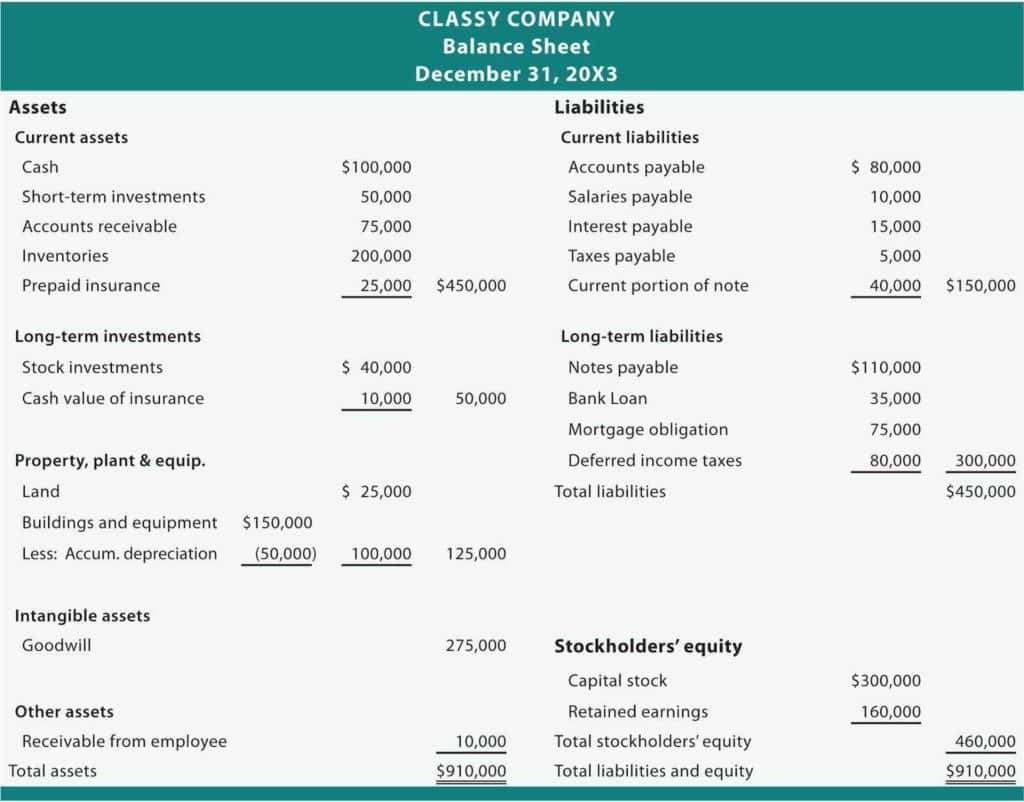

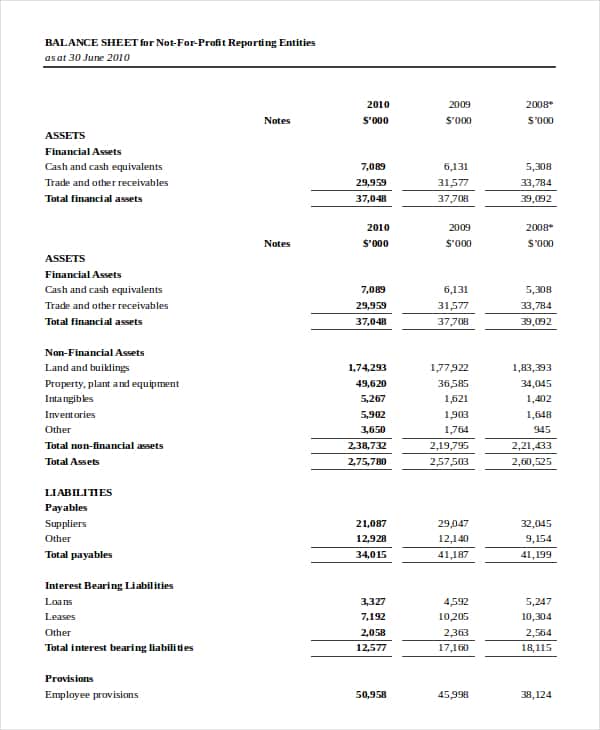

A balance sheet is a financial statement that provides a snapshot of your organization’s financial health. It shows your organization’s assets, liabilities, and equity at a specific point in time. A non profit balance sheet template can help you track the financial performance of your organization over time, making it easier to identify trends and make informed decisions about your finances.

Using a Non Profit Balance Sheet Template

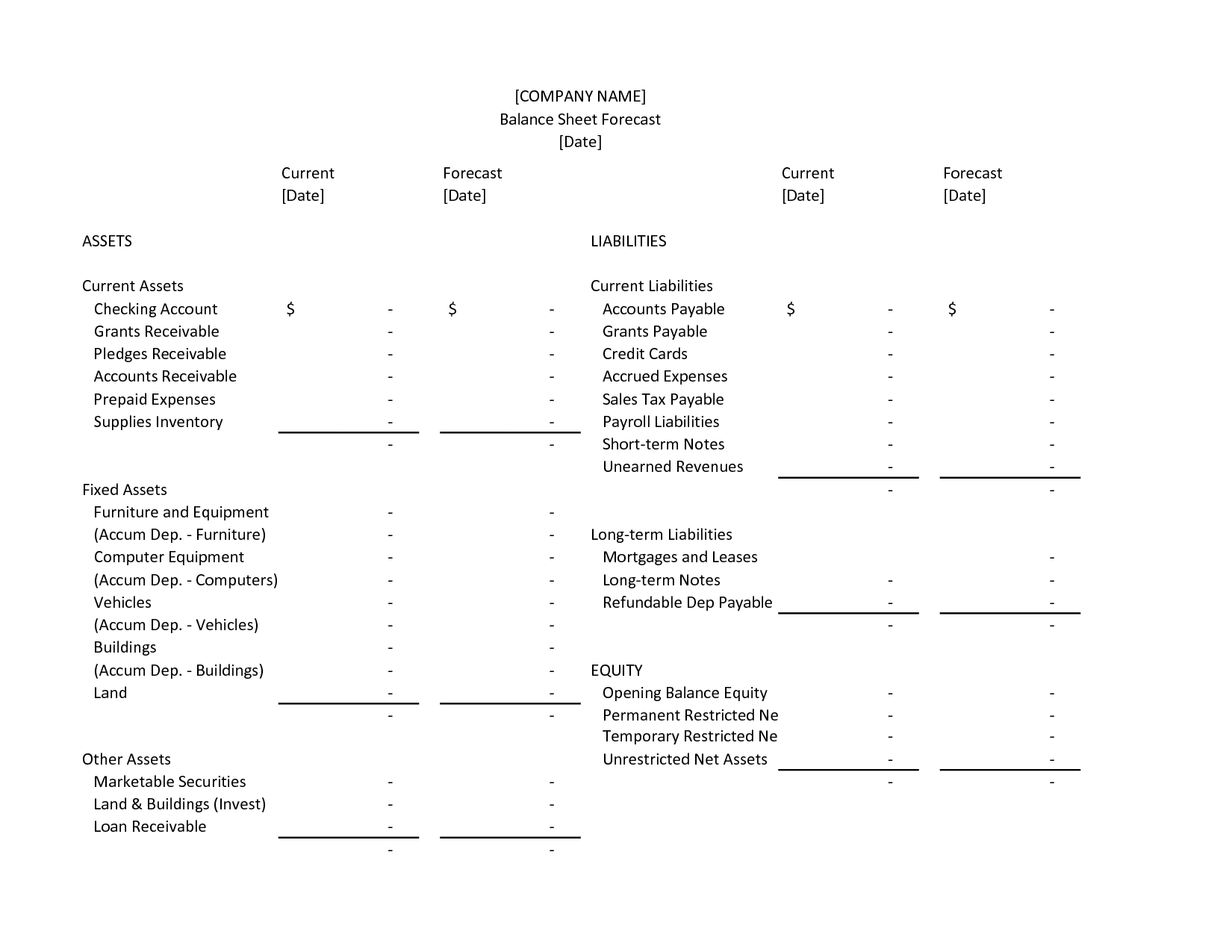

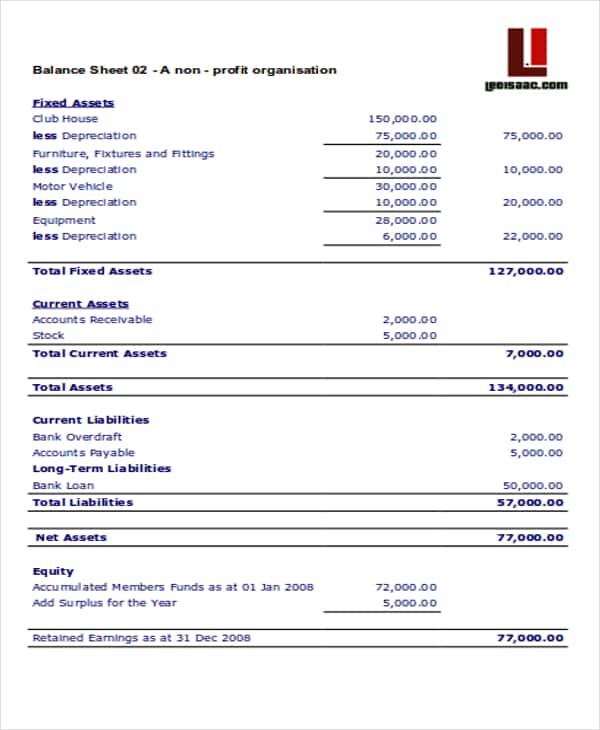

Creating a non profit balance sheet template is relatively straightforward. First, you’ll need to list all of your organization’s assets, including cash, investments, and any property or equipment you own. Next, you’ll need to list your liabilities, including any outstanding debts, loans, or other financial obligations. Finally, you’ll need to calculate your equity, which is the difference between your assets and liabilities.

Once you’ve created your non profit balance sheet template, you can use it to track your organization’s financial performance over time. By comparing your balance sheet from one period to the next, you can identify trends and make informed decisions about your finances.

Tips for Using a Non Profit Balance Sheet Template

Here are a few tips to help you get the most out of your non profit balance sheet template:

- Keep it updated

Make sure you update your balance sheet regularly to ensure that you have an accurate picture of your organization’s financial health. - Use it to identify trends

By comparing your balance sheet from one period to the next, you can identify trends in your organization’s financial performance. - Use it to make informed decisions

Your balance sheet can provide valuable insights into your organization’s financial health, which can help you make informed decisions about your finances. - Get help if you need it

If you’re unsure about how to create or use a non profit balance sheet template, don’t hesitate to seek help from a financial expert or accountant.

Additional Tips for Creating a Non Profit Balance Sheet Template

When creating your non profit balance sheet template, here are a few additional tips to keep in mind:

- Be organized

Keep your balance sheet template organized and easy to read. Use clear headings and separate your assets, liabilities, and equity into distinct sections. - Be accurate

Double-check your figures to ensure that your balance sheet is accurate. Any errors or omissions can throw off your entire financial analysis. - Use standardized formats

Use standardized formats and financial terminology to ensure that your balance sheet is easily understandable to others in your organization, as well as to potential donors or grantors. - Consider using software

If you have limited experience with financial analysis, consider using software that can help you create and analyze your balance sheet. This can save you time and ensure that your financial analysis is accurate and reliable.

Conclusion

A non profit balance sheet template is a crucial tool for tracking the financial health of your organization. By creating and using a balance sheet template, you can ensure that your organization is operating in a financially responsible manner while also making informed decisions about your finances. Remember to keep your balance sheet updated, use it to identify trends, and seek help if you need it. With these tips, you’ll be well on your way to managing your organization’s finances like a pro.